AUDUSD – DAILY FORECAST Q3 | W31 | D30 | Y25📊 AUDUSD – DAILY FORECAST

Q3 | W31 | D30 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FX:AUDUSD

Audusdlongsetup

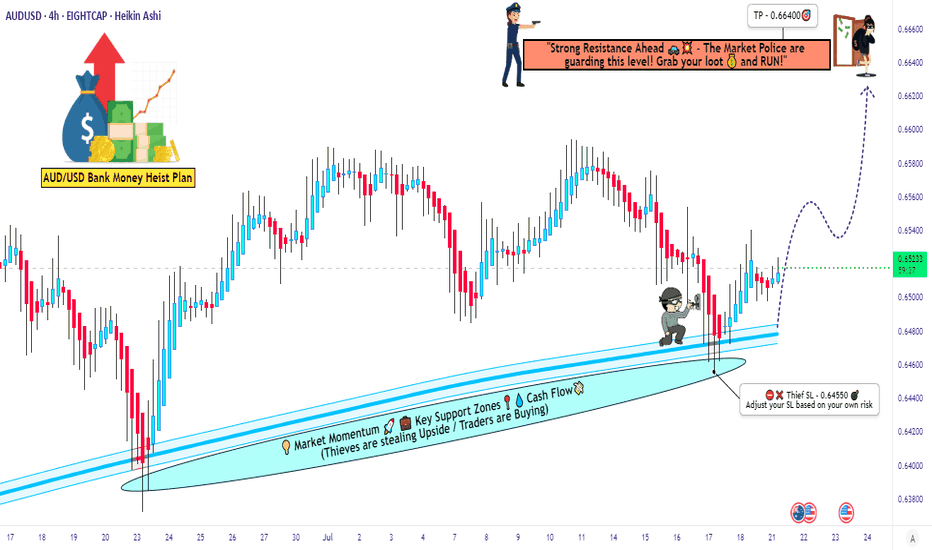

Ready for the Aussie Heist? Is This the Perfect Entry?🚨💰 - "The Aussie Vault Raid: Bullish Robbery in Progress!" 💰🚨

AUD/USD Forex Trade Idea (Thief Style Swing/Day Plan)

📈🔥 Designed for Thief Traders, Market Robbers & Money Makers Worldwide 🤑🐱👤💸

🌍 Hello Global Robbers!

🌟 Hola! Ola! Bonjour! Hallo! Salaam! Konnichiwa! 🌟

Welcome to another bold heist plan from the Thief Trading Crew. This one’s a high-stakes raid on the AUD/USD — "The Aussie" — using our signature Thief Trading Style, combining raw technical setups with real macro/fundamental edge. We're eyeing the Bullish Vault Breakout, so tighten up your gloves — it’s time to rob smart, not hard.

🔓💸 ENTRY PLAN – “The Vault is Unlocked!”

Grab the bullish loot at any valid price zone — but here’s how real thieves move:

📍 Recommended Entry Style:

Use Buy Limit Orders near local swing lows, demand zones, or key pullback entries on the 15m to 30m chart.

Execute DCA (Dollar Cost Averaging) / Layered Orders for more precision.

Align with your MA lines & candle structures for max confirmation.

🛑 STOP LOSS – “Escape Route Secured”

📍 SL hidden beneath recent swing lows below MA (on 4H):

🎯 Suggested Level: 0.64550

💡 Custom-fit your SL based on:

Trade size

Number of active positions

Account risk strategy

🎯 PROFIT TARGET – “Cash Out Before the Cops Show!”

🏴☠️ Take-Profit Zone: 0.66400

This is our bullish breakout reward zone — a high-value zone where profit meets safety.

🔍 MARKET OUTLOOK – "Cops Are Watching, but We're Ahead..."

📈 The AUD/USD market is flashing bullish momentum, supported by:

✅ Risk sentiment flow

✅ US Dollar weakness and rate expectations

✅ Intermarket signals from commodities (Gold/Iron)

✅ Positive macro positioning from smart money (via COT)

✅ Technical demand forming reversal patterns from oversold zones

📎 For a deeper breakdown —

📰 Fundamentals | COT Reports | Sentiment | Intermarket Analysis — Check Klick 🔗

⚠️ THIEF ALERT – “Avoid Sirens. Watch the News.”

Stay out of trouble by following these protocols during major news events:

🚫 Don’t enter trades blindly before/after big news

📍 Use trailing stops to protect gains

🔄 Adjust SL/TP if price nears breakout points during volatility

💥 SUPPORT THE CREW – “Smash That Boost Button!”

Love the plan? Then Boost this chart to show love for the Thief Trading Movement.

Every like, comment, and boost adds power to our robbery network across the globe. 🌍❤️💰

⚖️ DISCLAIMER – “Not Financial Advice, Just Thief Vibes”

📌 This analysis is for educational and entertainment purposes only.

📌 Trade at your own risk and always do your own analysis.

📌 Market moves fast — stay sharp, stay stealthy.

**🎭 See you at the next heist.

Until then, trade rich. Rob wise.

Thief Trader out. 🐱👤💰📉📈**

AUD/USD "The Aussie" Forex Bank Money Heist (Bullish)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the AUD/USD "The Aussie" Forex Bank Heist. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk Red Zone. It's a Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA Pullback at Institutional Buy zone (0.63700) & (0.62800) then make your move - Bullish profits await!"

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the nearest/swing low level Using the 2H timeframe "Big Money buy" SL at (0.64000) & "Institutional Buy" SL at (0.62000) Swing trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 0.67000

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸AUD/USD "The Aussie" Forex Bank Money Heist is currently experiencing a bullishness,., driven by several key factors. .☝☝☝

⚠️Trading Alert : News Releases and Position Management 📰🗞️🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits.

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Setup #006 - AUDUSD - Long (Not the cleanest)Trade entered. I used the 5 min for entry but Tradingview doesn't let me post it on a small time frame.

We should find out if this is a winner or loser during the rest of US/UK overlap. I personally think price wants to drop more, but my strategy says to buy, so I'm listening to the strategy, plus there is a nice risk to reward for this trade.

Confluences:

✅ Bullish overall bias

✅ Bulllish demand zone

✅ Bullish ABCD on 15 min chart, bullish impulse crab on H4

✅ Bullish divergence in price reversal zone

✅ Buillish break of structure

✅ Entering NY open

✅ Break of structure confirmed

✅ Required risk:reward met

AUD/USD "The Aussie" Forex Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the AUD/USD "The Aussie" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the recent / swing low level Using the 4H timeframe (0.62000) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

Primary Target - 0.64500 (or) Escape Before the Target

Secondary Target - 0.66000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Read the Fundamental, Macro, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook before start the plan.

AUD/USD "The Aussie" Forex Market market is currently experiencing a bullish trend,., driven by several key factors.

🟠Fundamental Analysis

Australian Economic Growth: Australia's economic growth is expected to remain steady, driven by the country's strong mining sector.

US Economic Growth: The US economic growth is expected to slow down, due to the ongoing trade tensions and weak domestic demand.

Interest Rate Differential: The interest rate differential between Australia and the US is expected to narrow, with Australia's interest rate at 3.1% and the US interest rate at 5.25%.

🟣Macro Economics

Inflation Rate: Australia's inflation rate is expected to remain steady at 2.5%, while the US inflation rate is expected to decrease to 2.2%.

Unemployment Rate: Australia's unemployment rate is expected to remain steady at 3.7%, while the US unemployment rate is expected to increase to 3.7%.

Global Trade: The ongoing trade tensions between the US and China are expected to have a minimal impact on the AUD/USD market.

🟡Global Market Analysis

Forex Market: The global forex market is experiencing a moderate increase in volatility, with the AUD/USD pair experiencing a 0.5% increase in the last 24 hours.

Commodity Market: The global commodity market is experiencing a moderate increase, with iron ore prices increasing by 1.2% in the last 24 hours.

Stock Market: The global stock market is experiencing a moderate decrease, with the S&P 500 index decreasing by 0.3% in the last 24 hours.

🔵COT Data

Speculators (Non-Commercials): 60,000 long positions and 40,000 short positions.

Hedgers (Commercials): 40,000 long positions and 60,000 short positions.

🟠Intermarket Analysis

Correlation with NZD/USD: AUD/USD has a positive correlation with NZD/USD, indicating that a strong New Zealand dollar could boost AUD/USD prices.

Correlation with Commodities: AUD/USD has a positive correlation with commodities, indicating that an increase in commodity prices could boost AUD/USD prices.

🟣Quantitative Analysis

Moving Averages: The 50-day moving average is at 0.62600, and the 200-day moving average is at 0.61800.

Relative Strength Index (RSI): The RSI is at 54, indicating a neutral market sentiment.

🔴Market Sentiment Analysis

The overall sentiment for AUD/USD is neutral, with a mix of positive and negative predictions.

58% of client accounts are long on this market, indicating a bullish sentiment.

🟢Positioning

The long/short ratio for AUD/USD is currently 1.2.

The open interest for AUD/USD is approximately 150,000 contracts.

🟡Next Trend Move

Bullish Prediction: Some analysts predict a potential bullish move, targeting 0.64000 and 0.64500, due to the interest rate differential and the weak dollar.

Bearish Prediction: Others predict a potential bearish move, targeting 0.62500 and 0.62000, due to the ongoing trade tensions and the strong dollar.

🔵Real-Time Market Feed

As of the current time, AUD/USD is trading at 0.63300, with a 0.5% increase in the last 24 hours.

⚪Future Prediction

Short-Term: Bullish: 0.63800-0.64300, Bearish: 0.62800-0.62300

Medium-Term: Bullish: 0.64800-0.65300, Bearish: 0.61800-0.61300

Long-Term: Bullish: 0.66300-0.66800, Bearish: 0.60300-0.59800

🟤Overall Summary Outlook

The market is expected to experience a moderate fluctuation, with some analysts predicting a potential bullish move targeting 0.64000 and 0.64500.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

AUD/USD "The Aussie Dollar" Forex Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the AUD/USD "The Aussie Dollar" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise placing Buy Stop Orders above the breakout MA or Place Buy limit orders within a 15 or 30 minute timeframe. Entry from the most re cent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at the recent / nearest low level Using the 4H timeframe,

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 0.65100 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

AUD/USD "The Aussie Dollar" Forex Market is currently experiencing a Bullish trend., driven by several key factors.

💨 Fundamental Analysis

The AUD/USD pair is struggling due to dismal Goods Trade Balance data from Australia, a modest US Dollar uptick, February RBA rate cut bets, and US-China trade war fears. Australia's trade surplus has shrunk to a three-month low, and the latest Q4 Consumer Price Index (CPI) figures showed that headline inflation rose by 2.5% YoY, down from 2.8% in the previous quarter.

💨 Macro Economics

The Reserve Bank of Australia (RBA) has kept interest rates at record highs, while the US Federal Reserve (Fed) has trimmed the benchmark interest rate by 100 bps through 2024 and aims to slow the pace of cuts in 2025 . The Australian economy is expected to be affected by the US-China trade war, as China is its biggest export market.

💨 COT Analysis

Large speculators and asset managers remain net-long the US dollar index, although the latter has a more convincing bullish view . The Australian Dollar COT Index represents the positioning of large non-commercial (speculator) net positions minus large commercial (hedger) net positions.

💨 Key Takeaways

The AUD/USD pair is bearish due to weak Australian data, US Dollar strength, and trade war fears.

The RBA is expected to cut interest rates in February, while the Fed is slowing the pace of rate cuts.

Large speculators and asset managers remain net-long the US dollar index.

💨 Bullish Factors

RBA Rate Cut Priced In: Markets have already priced in a 25 basis point rate cut by the RBA, which could limit the downside potential for AUD/USD.

China's Economy Showing Signs of Recovery: China's latest economic data, including the Caixin Services PMI, has shown signs of recovery, which could boost demand for Australian exports and support the AUD.

Iron Ore Prices Rising: Iron ore prices have been rising due to supply disruptions and strong demand from China, which could support the AUD.

AUD/USD Oversold: The AUD/USD pair is currently oversold, with the Relative Strength Index (RSI) below 30, which could lead to a technical bounce.

US Dollar Overbought: The US Dollar is currently overbought, with the US Dollar Index (DXY) above 98, which could lead to a correction and support the AUD.

Positive Australian Data: Australia's latest economic data, including the Q4 Consumer Price Index (CPI) and the January employment report, has been positive, which could support the AUD.

Technical Support: The AUD/USD pair has technical support at 0.6200, which could limit the downside potential.

💨 Bullish Scenarios

AUD/USD breaks above 0.6300: A break above 0.6300 could lead to a rally towards 0.6400.

RBA surprises with no rate cut: If the RBA surprises markets with no rate cut, the AUD could rally towards 0.6500.

China's economy continues to recover: If China's economy continues to show signs of recovery, the AUD could benefit from increased demand for Australian exports.

💨 Market sentiment for AUD/USD is currently bullish, with 76% of traders holding long positions ¹. This is also reflected in IG's client sentiment data, which shows that 78% of client accounts are long on this market

However, it's essential to note that market sentiment can change rapidly, and it's crucial to consider other factors, such as technical analysis and fundamental data, when making trading decisions.

From a technical perspective, AUD/USD is struggling to capitalize on its recent recovery move from a multi-year low, dropping toward 0.6250 due to dismal Goods Trade Balance data from Australia

Fundamentally, the Australian economy is expected to be affected by the US-China trade war, as China is its biggest export market. The Reserve Bank of Australia (RBA) has kept interest rates at record highs, while the US Federal Reserve (Fed) has trimmed the benchmark interest rate by 100 bps through 2024 and aims to slow the pace of cuts in 2025

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

AUD/USD "The AUSSIE" Forex Market Heist Plan on Bullish🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the AUD/USD "The AUSSIE" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. Be wealthy and safe trade.💪🏆🎉

Entry 📈 : Traders & Thieves with New Entry A bull trade can be initiated at any price level.

However I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Using the 2H period, the recent / nearest low or high level.

Goal 🎯: 0.63800 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Fundamental Outlook 📰🗞️

The AUD/USD pair is looking interesting right now, with some mixed signals from the latest analysis. On one hand, the pair has stabilized at its horizontal support area, which could lead to a bullish continuation, with the price potentially breaking above the range's resistance. On the other hand, some experts are warning of a potential reversal, with the pair showing signs of exhaustion and a possible shift in momentum.

In terms of fundamentals, the Australian Consumer Inflation Expectations for July increased 6.3% annualized, while the Australian Employment Change for June came in at 88.4K and the Unemployment Rate at 3.5% . The US Initial Jobless Claims for the week of July 9th are predicted at 235K, and US Continuing Claims for the week of July 2nd are predicted at 1,383K. The US PPI for June is predicted to increase 0.8% monthly and 10.7% annualized.

The forecast for the AUD/USD turned bullish after the pair stabilized at its horizontal support area, with short-term volatility likely to rise as bulls and bears fight for control. However, the Ichimoku Kinko Hyo Cloud continues to apply downside pressure, suggesting a rocky path higher. Traders should monitor the CCI after it has formed a positive divergence in extreme oversold territory followed by a breakout above -100.

Overall, it's a bit of a mixed bag, but the bullish scenario is gaining traction. The AUD/USD pair could move in a bullish direction.

BULLISH FACTORS:

Strong US Economy: A strong US economy could lead to an increase in demand for the US dollar, which could put upward pressure on the AUD/USD pair.

Interest Rate Differentials: The interest rate differential between the US and Australia is expected to remain positive, which could support the US dollar and put upward pressure on the AUD/USD pair.

Commodity Prices: A rise in commodity prices, particularly iron ore, could put upward pressure on the Australian dollar and support the AUD/USD pair.

Trading Alert⚠️ : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

AUDUSD - LongAUDUSD Analysis - LONG 👆

In this Chart AUDUSD D1 Timeframe: By Nii_Billions.

❤️This Chart is for AUDUSD market analysis.

❤️Entry, SL, and Target is based off our Strategy.

This chart analysis uses multiple timeframes to analyze the market and to help see the bigger picture on the charts.

The strategy uses technical and fundamental factors, and market sentiment to predict a BULLISH trend in AUDUSD, with well-defined entry, stop loss, and take profit levels for risk management.

🟢This idea is purely for educational purposes.🟢

❤️Please, support our work with like & comment!❤️

AUD/ USD ! 10/31 ! Support H4 and recoveryAUD/USD trend forecast October 31, 2024

The Australian Dollar (AUD) dipped slightly after mixed economic data from Australia and China’s PMI release on Thursday. However, hawkish expectations for the Reserve Bank of Australia’s (RBA) policy outlook helped support the AUD/USD pair and limited its downside. In September, Australian Retail Sales rose by 0.1% month-over-month, below the 0.3% forecast and down from 0.7% in August. Quarterly, Retail Sales grew by 0.5% in Q3, recovering from a 0.3% drop in the previous quarter.

in the large frame - gold price will continue to fall back to strong support and have a larger recovery. In the context of not much AUD news at the end of the year, mainly important USD data

/// BUY AUD/USD : zone 0.64800 - 0.64500

SL: 0.64000

TP: 60 - 300 - 500 pips (0.69500)

Safe and profitable trading

AUDUSD - Look for Reversal Long (INTRADAY) 1:4!USD has reached a seven-week high following the NFP news, driving USD pairs downward. A correction could be expected before USD resumes its bullish momentum if conditions hold.

This presents a potential opportunity to capture some pips, especially with DVX reacting to the SBR Zone, similar to the current behavior in AUDUSD.

Disclaimer:

This is simply my personal technical analysis, and you're free to consider it as a reference or disregard it. No obligation! Emphasizing the importance of proper risk management—it can make a significant difference. Wishing you a successful and happy trading experience!

BUY AUDUSD looks to be retesting highs on daily RSI strong 1HR

AUDUSD has broken out of a consolidation zone on the 1HR timeframe with bullish RSI strength & the Daily chart looks bullish to be wanting to retest the highs on Daily.

Stop loss: Under the zone 1hr or a tighter Stop will be a better yielder.

AUD/USD Setup The AUD/USD pair has reached my Point of Interest (POI) and is showing a strong rejection, indicating a potential bullish swing. Gold has found support and is expected to rise, while the US Dollar has encountered resistance and is likely to begin a bearish trend.

1Hr TimeFrame

4Hr Timeframe

Aud/Usd trading setup | bullish bias price is trading near the bullish ob from 1h

where we have a bullish divergence

we are waiting for the confirmation

the condition

if, price form big bar candle over 0.66120 (closed above)

if the price has left bulling fvg where we can place our trade

we can target upto 0.66750

follow for more such ideas

AUDUSD Targeting Double Top ResistanceHi Traders!

AUDUSD looks bullish as it targets the double top resistance on the 4H chart.

Here are the details:

Since breaking and closing above the 20 EMA, the price action has been aggressively bullish, and the market is now in an ascending price channel and is near the double top resistance at 0.65430.

The plan here is to buy market dips at retracement levels to target 0.65430.

Preferred Direction: Buy

Resistance: 0.65430

Support 1: 0.64804

Support 2: 0.64428

Technical Indicators: 20 EMA

Please make sure to click on the like/boost button 🚀 as your support greatly helps.

Trade safely and responsibly.

BluetonaFX

AUDUSD - W1 strong support approaching Analyzing the weekly chart of AUDUSD, our outlook anticipates a price decline toward the lower boundary of the channel, which also coincides with the 88.6% Fibonacci retracement level. We expect the Australian dollar (AUD) to establish strong support at the 0.62750 level.

Following this expected support, our projection foresees a robust upward movement toward the 0.66700 level. Our initial stop-loss will be set at 0.61700, positioned just below the previous low recorded in October 2022. This stop-loss level is approximately 1.5% below our anticipated entry point. Importantly, this trade maintains a favorable risk-to-reward ratio of 1:4.

Please remember that trading carries inherent risks, and market conditions can change swiftly. This analysis is for informational purposes only and should not be considered as financial advice. Always exercise prudent risk management and consider various factors when making trading decisions.