AUS200/ASX200 - ANOTHER OPPORTUNITY TO SHORT AUS200Team, today, good data came out from the AUS200

The market has given some steroids

Time to put an end to this

SHORTING AUS200 at 8761 toward 8772 with stop loss at 8810

Target 1 at 8732-8726 - take 50% volume and bring stop loss to BE

TARGET 2 at 8712-8696

ENJOY YOUR DAY!

Aus200sell

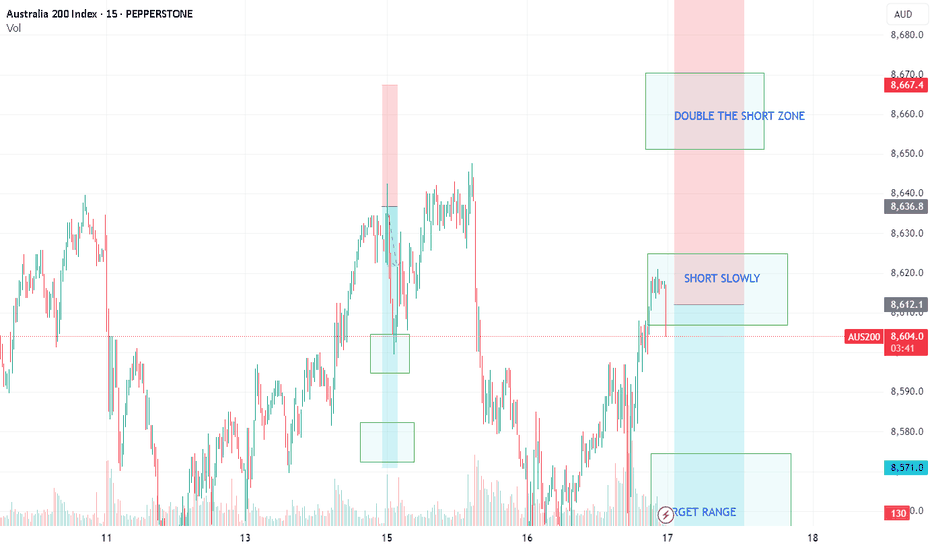

AUS200/ASX200 - ANOTHER DAY TO MAKE THEM PAYTeam, we have successfully SHORT AUS200 last week and kill them with our ACTIVE TRADER COMMUNITY.

Time to have another short at this current price level 8609-8626 ranges

DO NOT FEAR - DOUBLE THE SHORT AT 8642-56 - KILL them

Our first target range at 8586-72 - take 60% profit and bring stop loss to BE

2nd target at 8562-45

NOTE: Next week, we expect the market to be volatile, so be careful with your trade.

SHORT AUS200/ASX200 - TIME TO SHORT THE AUSSIETeam, over the last few days, we have been successfully SHORT BOTH UK100/AUS200, but I did not post the chart

Today is a good time to post.

Ensure you understand your RISK - can always discuss with us in the room

Let's SHORT UK100/FTSE100, I still expect the market to be volatile even though the US expect a rate cut. on the 9th JULY, there will be a tariff announcement, and it could also extend towards September

We are SHORTING AUS200 at 8586 toward 8616 - SLOWLY

with target at 8562-47

DOUBLE THE SHORT AT 8632-56

Target at 8608-8592

AUS200/ASX200 - MASTERMIND FOR SUCCESS STRATEGY Team, last night we did another successful trade on DOW/US30 AND NAS30

If you have time, watch my video how i made 1.5k turn into 20k per month and expect 6 months to hit 100k

so far 2 and half month reached 80k

We are shorting slowly at 8572-8586 range

With target at 8545-36

Now, this is another READY set up order if AUS200 hit above 8618-36 - This is where we kill them with DOUBLE UP the volume as per chart

With the target at 8586 -67

LET'S GO.

AUS200 "Australia 200" Indices Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the AUS200 "Australia 200" Indices market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at 8530 (swing Trade) Using the 1H period, the recent / nearest low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 8750 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

AUS200 "Australia 200" Indices Market market is currently experiencing a bullish trend,., driven by several key factors.

🔆Fundamental Analysis

Australia's GDP Growth Rate: 2.2% in Q4 2024, with a forecast of 2.5% in Q1 2025

Inflation Rate: Australia's inflation rate is expected to rise to 2.8% in 2025, from 2.5% in 2024

Interest Rates: The Reserve Bank of Australia (RBA) has kept interest rates on hold at 0.10%

🔆Technical Analysis

Trend Line: The index is holding above the ascending trend line

Moving Averages: The 200-period and 100-period Simple Moving Averages (SMA) are indicating a bullish bias

Relative Strength Index (RSI): The RSI indicator on the 4-hour chart stays above 50, indicating a bullish trend

🔆Economic Indicators

Unemployment Rate: Australia's unemployment rate is expected to remain steady at 4.2% in 2025

Retail Sales: Australia's retail sales are forecast to rise 3.5% in 2025, driven by consumer spending

Housing Market: Australia's housing market is expected to remain stable, with a forecast growth rate of 2.5% in 2025

🔆Macroeconomic Analysis

Global Economic Trends: The global economy is expected to grow at a moderate pace in 2025, driven by a recovery in trade and investment

Commodity Prices: Commodity prices are expected to remain stable in 2025, with some upside potential due to supply chain disruptions

Australia's Trade Balance: Australia's trade balance is expected to remain in surplus in 2025, driven by strong exports of commodities

🔆COT Data Analysis

Net Long Positions: Institutional traders have increased their net long positions in AUS200 to 60%

COT Ratio: The COT ratio has risen to 2.1, indicating a bullish trend

Non-Commercial Traders: Non-commercial traders, such as hedge funds and individual traders, have increased their long positions to 62%

🔆Sentimental Analysis

Institutional Sentiment: 58% of institutional traders are bullish on AUS200, while 42% are bearish

Bank Sentiment: 55% of banks are bullish on AUS200, while 45% are bearish

Corporate Sentiment: 56% of corporate traders are bullish on AUS200, while 44% are bearish

Retail Sentiment: 52% of retail traders are bullish on AUS200, while 48% are bearish

🔆Market Positioning

Long Positions: 60% of traders are long on AUS200, while 40% are short

Short Positions: 40% of traders are short on AUS200, while 60% are long

🔆Open Interest and Volume

Open Interest: 251,011 contracts (as of current date)

Volume: 151,201 contracts (as of current date)

🔆Next Move Prediction

Bullish Move: The AUS200 index is expected to continue its bullish trend, with potential upside to 8750

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

AUS200 shortI opened a short position yesterday based on 4H and daily chart.

My reasoning is as follows:

Daily

1) The price broked above the previous high (8525), failed it hold, and dropped and closed below the previous higher high.

2) It moved and closed below the ascending trendline.

3) All momentum indicators are now moving to the downside.

4H

1) The candles consolidated below the ascending treandine and failing to move above the line.

2)The price broked beow Fib 0.238.

3)Both MACD and RSI entered the bear territory.

Entry - 8483

S/L - 8580

Target - 8256

Risk:Reward - 1:2.65

AUS200 - Potential SHORT setupPEPPERSTONE:AUS200 is currently in a critical resistance zone that has consistently acted as a barrier for bullish momentum.

Taking this into account I anticipate a move toward at least 8,250. However, if the resistance fails to hold, it may open the door for further upside.

Proper risk management is essential, given the possibility of price breaking higher.

Feel free to share your opinions in the comments.

AUS200 - CONSUMER PRICE INDEXTeam, we have been very successful trading AUS200. It has been amazing and a blessing.

We are planning to short AUS200 at 8410-18

we also want to short 8442-8460 - this price is prepared for the CPI where the fake pump from the MARKET MAKKETs OR BOT and then likely dumped later)

Our target at 8368-72

target 2 at 8336-44

target 3 at 8308-15

NOTE: if you have a chance short at 8442-8460 then target at 8406-12

Once the target hit, take some partial and bring stop loss to BE.

AUS200/ASX200 - WHAT SHOULD WE DOTeam, yesterday we have successfully short.

Today, we are waiting for the GAP to be filled.

We will be short at 8318-26

ADD more short at 8338-46 (IF MARKET pump)

STOP LOSS at 8356-65

Target 1 at 8292-95 - take some partial and bring stop loss to BE

Target 2 at 8272-83

Target 3 at 8254-61

AUS200 - TIME FOR A GOOD SHORT Team, we have been watching the hold week and trade on the AUS,

This is 5th time, and I hope we get 5/5 results for this week as the same last week

We are shorting AUS at 8284-76, STOP LOSS at 8315

Target 1 at 8258-49 Please take some trail and bring stop loss to BE

Target 2 at 8233-26

Target 3 at 8216-09

AUS200 - SHORTING TIMETeam, yesterday, our AUS200, we hit all the targets last two days

Today it looks like another good short at 8226-8235

STOP LOSS at 8245-65 - depend on your risk level, always have better room for stop loss

TARGET at 8205

TARGET 2 AT 8180-8192

Once the price hit below 8200, BRING STOP LOSS TO BE and remember to take some partial 50-70% volume.

AUS200 WAITNG FOR RETEST AND SHORT - DOUBLE TOPTeam, yesterday we had a beautiful trade with 6/6 all-target hitting.

But every day is another day, let's focus on today.

It looks like AUS200 will be moving in a tight range.

We only trade when the price kicks in our set-up range.

We want to short AUS200 AT 8178-8176.2 - (double top). Yesterday's high may be retested.

Our stop loss would be around 8208

Target 1 at 8159.20 and Target 2 at 8123.20

If it breaks below yesterday's low, will be going into the target 3 at 8105 and 8078 ranges

SHORTAUS200 AT MARKET OPEN – current price at 8225Good morning Team; it is Friday, and I hope you have a fantastic week.

We are preparing a short AUS200 at market opening in 30 minutes

Stop loss at 8266 or 8258

TARGET 1 at 8204.5

Once it reaches the 1st target, take 50% partial and bring stop loss to 8247

We are going to target at 8173.3

PATIENCTLY WAIT FOR THE AUS200 getting to our SHORT TRAPGood morning everyone.

we are waiting for the AUS200 to get into our position to short.

If the trade does not form into our position, we will focus on the US market opening tonight. It is essential.

We await the AUS fall below 8140-38 to enter our short position.

Our stop loss should be above the all-time high 8186. (Let your stop loss be a bit lengthy to accommodate fake outs which happens most of the times in the market.)

Our first target will be 8126; please note once it hits our first target, please take 50% profit

from our second target, 8103.7, and

third target 8055.7

AUS200 - This is what I expect the trend for todayWe have review the market for the AUS200, but we are expecting further downtrend base on the chart which we have set up for AUS200.

PLEASE NOTE: We are not enter this trade today.

We would consider short at 8012.60, with stop loss either at 8030.40 or 8062.7

target would be 7973.60

and target 2 at 7941.50