XAO - AU10YR - Australian Stock Market - 10 YR Bond YieldsStarting with this video, I'll begin incorporating insights from AriasWave into each new release.

Here, I dive deep into what I believe to be the true pattern of the Australian Stock Market and discuss what might unfold next.

I also analyze 10-year bond yields, presenting a case for significantly higher rates—potentially reaching at least 16%. This isn't just about making bold predictions; I break down the reasoning behind these conclusions using detailed wave analysis.

Australianstockmarket

AriasWave Market Update - DOW - ASX - BTC - XLM - XRPIn this video, I aim to provide an overview of my observations regarding the approach toward a potential market peak.

I'll offer some perspective by comparing the Dow Jones to the ASX (Australian Stock Market) and discuss the possibility of a significant downturn in global markets, comparable to a collapse. I'll outline various factors contributing to these considerations.

Viewing the markets from this angle, one begins to recognize parallels with the tech stocks of the 90s, many of which peaked and experienced a decline of at least 90%, with some becoming worthless.

I see a similar scenario unfolding with cryptocurrencies, where survival will be selective, and many may not endure.

ASX - Australian Stock Market Also Points To A Top...Studying the Dow Jones extensively over the years has been enlightening, but unraveling the patterns within the ASX has always presented a unique challenge. Despite their differences, I believe the outcome from this juncture will remarkably mirror each other, signifying an imminent peak. Witnessing charts with distinct patterns eventually converge in their own distinctive way is truly captivating. I consider this observation crucial, offering an alternative perspective on the impending significant decline within a larger Wave E, typically preceding substantial bull markets. While the exact depth of this decline remains uncertain, I'm putting forth this idea to gauge its proximity to the actual outcome. The convergence of Dow Jones and the ASX, both hinting at an impending downturn, is likely to trigger more stimulus, potentially fueling inflation and higher rates in the future. More significantly, it should act as the catalyst for the next crypto bull market.

ASX (XEJ) Energy Sector ViewHi All,

Found an interesting article for avid chart users on XEJ Australian energy sector on ASX: Australian Stock Exchange, which I believe we can watch out for in the coming day.

The article is on kalkinemedia

and its title is

WPL to BPT: 4 ASX stocks under the spotlight as Energy index reaches multi-year resistance.

CBA Daily TimeframeSNIPER STRATEGY

This magical strategy works like a clock on almost any charts

Although I have to say it can’t predict pullbacks, so I do not suggest this strategy for leverage trading.

It will not give you the whole wave like any other strategy out there but it will give you huge part of the wave.

The best timeframe for this strategy is Daily, Weekly and Monthly however it can work any timeframe above three minutes.

Start believing in this strategy because it will reward believers with huge profit.

There is a lot more about this strategy.

It can predict and also it can give you almost exact buy or sell time on the spot.

I am developing it even more so stay tuned and start to follow me for more signals and forecasts.

AUS200: NO SLEEP - POPCORN AND PIZZA TONIGHT!No sleep for me tonight - and I'll be feeding on popcorn and beer! 🤣😂 Maybe a pizza or two. 🍕🍕

The set up here looks like a good short coming up. (Note the brutal disclaimers).

1. There is big trouble with Chinatown all over the world. Something about China banning shares on some American exchange - or something like that. The Dragon Index took a nose dive, and that reverberated into the Tech100. (See snapshot below - and check the news).

2. The Aussies are usually delayed in reacting. I don't know why. Maybe they're asleep due to some time zone effect when the action has happened. The current reaction is slow, on one 4H candle but the price action is better seen on 5 to 15 min time frames.

3. What happens with the Aussies - and I've seen it too many times - is that they wake up and go "OMG!" Then they panic buy or sell.

4. Normally the big action starts around 00:30 to 01:00 UK local time. As the Aussies open their exchange fully, there is usually some serious price action on 5 to 15 min time frames. Usually if sudden movement happens in that half-hour that sets the stage for what'll happen next in terms of direction - but expect big whipsaws between 00:30 and 02:00 AM. Whipsaws are nice if you know what you're doing. If you don't stay out!

5. The Aussie track both Tech and DJI for sense of direction. Well, as USTech has been clobbered, I expect the Aussies to run scared. Hello - I could always be wrong. This is shared experience - not advice!

The smartest people so far are the Germans. The DAX took a pump south already. Now they're consolidating and thinking what to do next.

Disclaimer: This is not advice or encouragement to trade securities or any asset class. This is not investment advice. Chart positions shown are not suggestions intended to assure you of an advantage. No predictions and no guarantees are supplied or implied. The author trades mostly trend following set ups which have a low win rate of approximately 40%. Heavy losses can be expected if trading live accounts or investing in any asset class. Any previous advantageous performance shown in other scenarios, is not indicative of future performance. If you make decisions based on opinion expressed here or on my profile and you lose your money, kindly sue yourself.

ASX - Wave Revision - Ending Diagonal Wave VMapping out the exact waves in this ending diagonal in the Australian Stock Exchange.

Wave v is breaking back into the AriasWave pitchfork channel and will soon retest in Wave E of Wave (B) of this Expanding Type-2 Zig-Zag.

Once the final high is made just above the purple line and then dips back below it this should indicate a top.

Once it breaks back down and out of the AriasWave pitchfork channel this should confirm a top is in place.

Please LIKE and FOLLOW to get notification of updates and future posts.

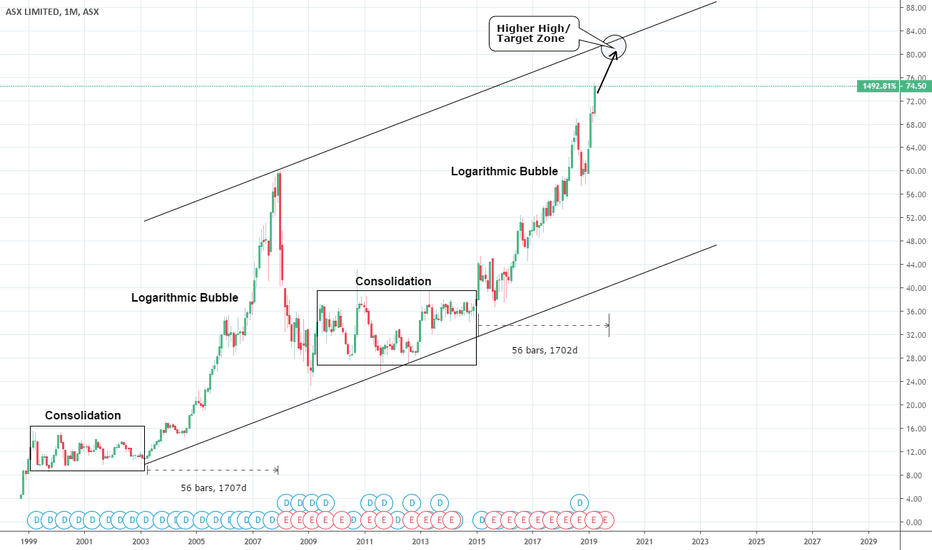

ASX: Australian stocks approaching a peak.The ASX Ltd is on a very strong bullish monthly streak having gained over +25% in 2019 alone. It appears to be trading inside a 20 year Channel Up that displays all phases of a Bubble (aggressive rise, blow-off, consolidation) from Higher Low to Higher.

Currently it is near the end of the bullish leg towards a new Higher High (peak) which is projected within 80.00 - 84.00 towards the end of 2019 (based on a 1702 day Bubble Duration). All charts are overbought (or close to) from 1D (RSI = 72.582) to 1W and 1M (RSI = 76.630 and 73.368 respectively) indicating that the peak of the bubble is indeed near and should be achieved on this final 2019 push.

Our strategy is to buy on every dip until this Target Zone. Then depending on circumstance and mostly global trade dynamics, we will most likely start building up a short base but updates will follow.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.