Autosector

Stellantis | STLA | Long at $9.59Stellantis NYSE:STLA is the maker of the auto brands Fiat, Peugeot, Jeep, Citroën, Opel/Vauxhall, Ram Trucks, Dodge, Chrysler, Alfa Romeo, Maserati, DS Automobiles, Lancia, Abarth, and Vauxhall. The stock has fallen sharply due to a 70% profit drop in 2024, weak U.S. sales, high inventory, and tariff uncertainties. The turnaround for NYSE:STLA beyond 2025 hinges on new CEO Antonio Filosa’s focus on U.S. market recovery, new product launches (e.g., Ram 1500 Ramcharger, Jeep hybrids), pricing adjustments, aggressive marketing, $5B U.S. manufacturing investment, and mending dealer relations. The stock is trading at a P/E of 5.1x, debt-to-equity of 0.8x (not bad), a book value of $29 (undervalued), a tangible book value of $9.82, and earnings and revenue are forecasted to grow into 2028. Economic weakening and tariffs may hamper these predictions, but the new CEO and future interest rate drops may get this stock rolling again.

However, if NYSE:STLA shows zero sign of near-term recovery or other fundamental issues arise, I truly think this stock could enter the high $5-$6 range before a true reversal begins.

From a technical analysis perspective, the stock price is currently with my selected "crash" simple moving average. This area often signifies a near-term bottom, but like mentioned above, watchout out for the "major crash" simple moving average area currently between $5.83 and $7.09.

Regardless of bottom predictions, NYSE:STLA is in a personal buy zone at $9.59 with a greater position likely if it enters my "major crash" zone, as mentioned above.

Targets into 2027:

$12 (+25.1%)

$14 (+46.0%)

Equity Research Report – TVS Motor Company Ltd.📌 Timeframes Analyzed: 15-Minute and 1-Hour

📅 Date: May 5, 2025

📍 CMP: ₹2,774.40

📈 Setup: Bullish breakout from falling channel with EMA crossover

🔹 Technical Highlights

Pattern: Descending channel breakout (1H)

Moving Averages: Price is trading above the 20-EMA and 50-EMA with bullish crossover

Volume: Breakout confirmed by increasing volume

RSI (Momentum): RSI is trending up above 50 with positive divergence

🟢 Trade Plan – Intraday to Short-Term Swing

✅ Buy Levels (Confirmation Entry)

Buy Above: ₹2,780 (breakout confirmation level)

🎯 Targets

Timeframe Target 1 Target 2 Target 3

15-min ₹2,810 ₹2,835 ₹2,860

1-hour ₹2,850 ₹2,880 ₹2,920

🔻 Stop Loss

Intraday SL: ₹2,745 (below channel support and 50-EMA)

Swing SL: ₹2,720

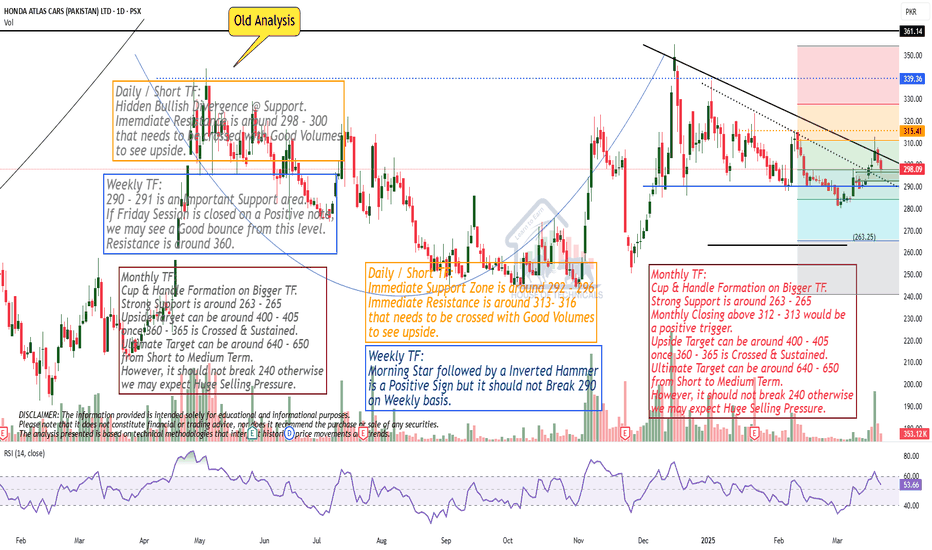

Bearish Divergence on Weekly TF but..Bearish Divergence on Weekly TF.

However, Breakout on Daily TF from 452 - 453.

Weekly Closing above this level would

be a positive sign.

Upside Targets can be around 495 - 500

& if this level is Sustained, with Good

Volumes , we may witness 540 - 550.

Should not break 400, otherwise, we may see

heavy Selling pressure.

Monthly TF:

Cup & Handle Formation on Bigger TF.

Strong Support is around 263 - 265

Monthly Closing above 312 - 313 would be

a positive trigger.

Upside Target can be around 400 - 405

once 360 - 365 is Crossed & Sustained.

Ultimate Target can be around 640 - 650

from Short to Medium Term.

However, it should not break 240 otherwise

we may expect Huge Selling Pressure.

Case Study based on Elliott Waves on exampled chart Tata MotorsHello Friends,

Today we are plotting Elliott wave counts on Case study chart of "Tata Motors Ltd".

In this study we used Elliott Wave Theory & Structures, it involves multiple possibilities, and the analysis presented focuses on one potential scenario. The provided information is for educational purposes only, not trading advice. There's a risk of being completely wrong, and users are warned not to trade or invest solely based on this study. The content is not an advisory and does not guarantee profits, We are not responsible for any kind of profits and losses; individuals should consult a financial advisor before making any trading or investment decisions.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Charts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Charts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

MULTIBAGGER Series - Stock 1Hello guys!

I am starting a new series this Diwali, where I will post stocks which may achieve multibagger growth. Investing in such companies bring a high risk factor so please do your own analysis before investing.

The first stock is SHREE OSFM E-Mobility Ltd.

SOEML offers employee transportation services to large multinational corporations (MNCs) in India, serving sectors such as IT/ITES, aviation, and more. The company operates with a primarily asset-light model, where services are typically offered through monthly leases, per kilometre rates, per passenger trip, or package models. It has a significant presence across major Indian cities, catering to the transportation needs of various corporate clients.

REVENUE: In FY24, company generated revenue from Vehicle Hire Charges Received,

which was ~43% higher than FY23.

In big cities such types of business are a success due to urbanisation and MNC work culture.

The company has not taken any funding and are expanding with the help of the profits made.

Do some more research and write any important points in the comments section below.

Visit the website and read the financial documents.

Hope you learned something new from my ideas.

Do like, share and follow me. Thank you!

RECESSION ALERT | Total Vehicle Sales Data Print DelayedWith last months revision of 818,000 jobs, it is probably safe to conclude that other data points have also been incorrectly reported (manipulated for political purposes).

Total Vehicle Sales for the month of August 2024 were supposed to be published today. As of 8:45 PM EST, the data STILL has not been released.. HUH??

Total vehicle sales are a leading economic indicator. I’m guessing the numbers are bad.. really bad.

In Germany, the economic powerhouse of Europe, vehicle sales collapsed in August (in August 2024).

The absence of today's scheduled print is a choice. Someone decided that Total Vehicle Sales (for the month of August 2024) would not be released as scheduled.

In addition to illustrating the obvious failures of the current US political administration, this is also a strong indicator that Tesla ( the entire green new scam ) is on the verge of bankruptcy. I will explain this in more detail later.

FORD - ICE predominates EV falters LONGFord has scaled back its EV ambitions in consideration of the marketplace while TSLA drops

its price in the Eurozone and falls into less than first place in the China EV market. Ford's

F-150 truck continues to dominate GM and the others in North America.

On the 4H chart, first a price uptrend and then retrace to the 0.5 Fib level and a reverse into

a new trend up. A pair of EMAs shows an impending golden cross also suggested by

the zero lag MACD. The two RSI lines ( 60 minutes and 480 minutes fast and slow) are

rising and about to cross the 50 level.

I see this as a long entry for Ford. Targets based on major pivots in 2023 are 13 and 14.25

#HEROMOTOCO... good in coming session#HEROMOTOCO...

Intraday as well as swing trade

All levels given in charts ...

IF good potential seen then we work in options also

if activate then possible a good movement Keep eye on this ...

We take trade only when it activates...

Possible to give good target

TRADING FACTS

HEROMOTOCORP- Daily/Hourly Timeframe-Tringle PatternNSE:HEROMOTOCO

Entire auto sector has outperformed in past few weeks, However HEROMOTOCO is looking a bit weak as per as per the daily chart, it has broke its previous daily swing low.

Stock is consolidating in tringle in hourly chart. In hourly chart buyers are trying to push price higher (Higher lows) however sellers are defending level 2840-2855.

If it breaks either side we may see a momentum, keep eye.

This idea is only for educational purpose, please manage your risk accordingly.

MAZDA BUY PRICE AT CMP 647 Mazda Limited is an engineering company,engaged in the manufacture of Engineering Goods and the manufacturing of food products, such as food color, and various fruit jams and fruit mix powders

THIS IS BUY PRICE AT CMP 647 WILL GET IN DISCOUNT TOMORROW BECAUSE SAES NO.. SOME WEAK

TAKE LONG TARGET 777 AFTER QUARTER RESULT

WSUP ME FOR MORE ANALYSIS 84 59 22 0202

#HEROMOTOCO... Looking good 18.05.23#HEROMOTOCO.. ✅▶️

Intraday as well as swing trade

All levels given in charts ...

IF good potential seen then we work in options also

if activate then possible a huge movement Keep eye on this ...

We take trade only when it activates...

Possible to give good target

TRADING FACTS

ASHOK LEYLAND BULLISH CUP & HANDLE BREAKOUT | 1:2.5 RR | SWINGAs Nifty is trading above its resistance area, it looks like the growth is being pushed by AUTO and FMCG Sector.

AUTO Sector has recently broken out of its resistance area and it seems it will continue to go higher in upcoming weeks.

Checking out AUTO STOCKS, Ashok Leyland looks a good pick.

The price has broken out of its resistance area and is trading above Daily 200 EMA.

Also, the price has broken out a Cup and Handle Pattern, which is a bullish pattern.

Entry- 147.5

TARGETS

1- 154

2-160

STOP LOSS

For aggressive traders- 144

For conservative traders- 142

This is a SWING TRADE

Let me know in the comments section if you want me to analyse any other financial instrument.

WARNING:-

ALWAYS FOLLOW RISK MANAGEMENT AND POSITION SIZING WHILE TAKING ANY TRADE.

NIFTYAUTO Consolidation Nr. Resistance Breakout Potential?🚗 #NIFTYAUTO is currently trading in a consolidation zone, with the price hovering near the upper boundary. This level has proven to be a tough resistance for the price in the past, with the range of 13455--13544 being a major obstacle to overcome.

📈 However, if the price manages to break out of this resistance area and closes above it on the weekly chart, we could potentially see a strong upward momentum in the near future. This is especially significant considering the prolonged period of consolidation that the price has been experiencing.

📉 On the other hand, if the price fails to break through the resistance zone, we may see it retreat back into the consolidation phase once again.

🔍 Traders should keep a close eye on #NIFTYAUTO and monitor its movement around the key resistance level. A successful breakout could present lucrative trading opportunities, while a failure to do so may indicate a continued period of consolidation. Happy trading!

TSLA vs Ford - Market Cap Shifts may reflect Investor SentimentOn this weekly chart I have set up the running ratio of shares of TSLA to shares of Ford over

a time span dating back to pre-covid times. Added to the chart are a set of EMAs as well

as zero-lag MACD and Directional Index indicators. TLSA dominated early and the ratio steadily

increased. Given a choice between TSLA and F the longterm investor would buy the former.

However, at the beginning of 2021, things changed as can be seen on the chart and the

indicators. At this point, the ratio is over and under the weekly EMA200 and trending down.

Now an investor might liquidate the TSLA shares and buy Ford instead. Hard to say what the

the longer-term picture might be. TSLA is selling a hypergrowth narrative that may not come

to fruition. Ford is slowly steadily hanging in there with its broad product line including the

F-150 both Classic and Lightning. Time will tell........ So is it TSLA long or short ?