The key is whether it can find support at 24.59 and rise

Hello, traders.

If you "Follow", you can always get new information quickly.

Have a nice day today.

-------------------------------------

(AVAXUSDT 1M chart)

The key is whether the price can be maintained by rising above the M-Signal indicator on the 1M chart.

Accordingly, we need to see whether the price can be maintained by rising above 27.47.

-

(1W chart)

The important support and resistance range is the 38.93-51.54 range.

Therefore, even if the price is maintained by rising above the M-Signal indicator on the 1M chart, the uptrend can begin only if it rises above the 38.93-51.54 range.

If it falls, we need to see whether it can be supported near the volume profile range of 6.54-13.47.

-

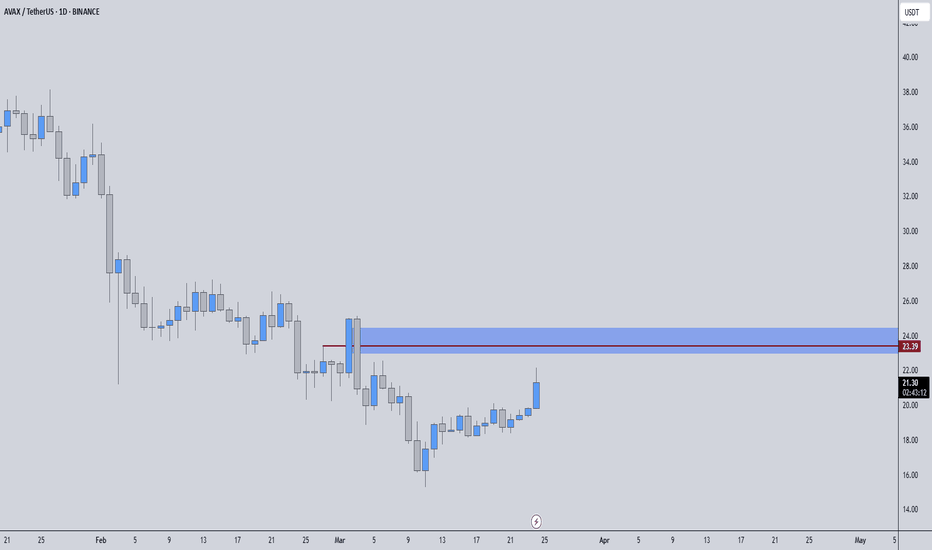

(1D chart)

When it breaks upward around 28.67, it is expected that a breakout trade will be possible.

However, since an important support and resistance section is formed over the 38.93-51.54 section, a response is needed depending on whether there is support in this section.

Therefore, the key is whether it can be supported and rise around 24.59.

If not, it is necessary to check whether it is supported around 17.54-19.79.

-

The basic trading strategy is to buy when supported by the HA-Low indicator and sell when it meets the HA-High indicator.

However, if it is supported and rises near the HA-High indicator, it is likely to show a stepwise upward trend.

On the other hand, if it is resisted and falls near the HA-Low indicator, it is likely to show a stepwise downward trend.

Therefore, since it is currently located near the HA-High indicator, it can be seen that trading is possible depending on whether there is support.

However, since the probability of falling is higher than the probability of rising in the HA-High indicator, you should be careful about the investment ratio.

Otherwise, you may end up buying at the high point.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- Here is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

(3-year bull market, 1-year bear market pattern)

I will explain the details again when the bear market starts.

------------------------------------------------------

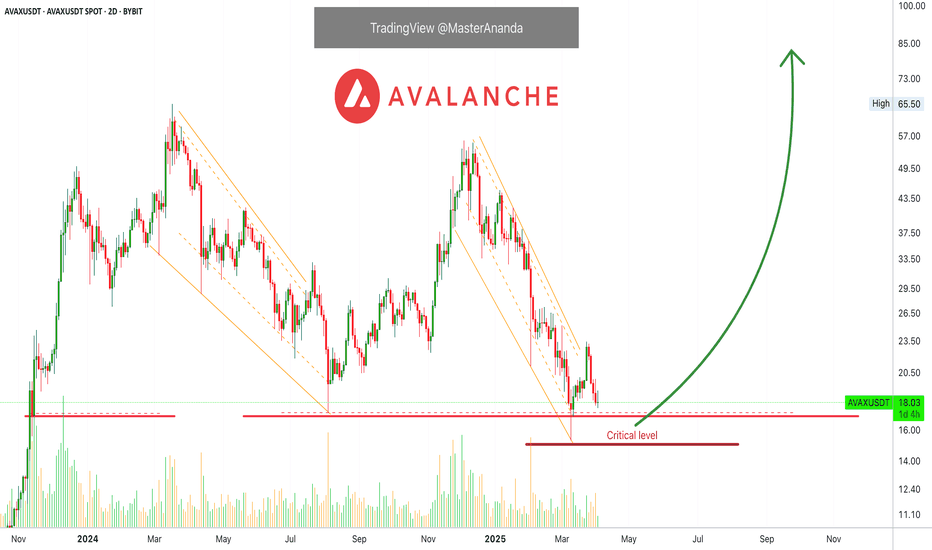

Avalanche

Avalanche With Higher Targets —1,700% Profits PotentialWe've been looking at Avalanche many times but each time only with short-term targets, that is because we were considering a leveraged trade setup. When using leverage, we tend to ignore the higher targets because profits tend to climb pretty high pretty fast even with the short-term ones. But this doesn't mean that these targets won't hit or that you should ignore them. In these types of leveraged trade setup, once the great entry is achieve and the market goes bullish, it is easy to hold long-term. Once the holding is in place, you can wait for whatever target you prefer. Leveraged trading is for experienced traders and you have to develop your own plan, I only share the numbers, the timing and the charts.

Looking at AVAXUSDT, notice the blue line and inverted triangle. The current week recovered the early March drop that led to the correction bottom. The correction produced the lowest prices since November 2023.

Now that the low is in and fully confirmed, we know the market will enter a bullish phase. This means long-term growth, thus we need to map some long-term targets.

The main target that I am mapping for you is $162, this is an easy target. By easy I mean that Avalanche has potential to grow beyond it. Total profits from current price is equal to 560%.

The final target on this chart is 949% at $257. I believe this isn't likely to be the end for this pair and even higher is possible. In fact, if you move the chart upwards a little bit you will find additional targets.

While Avalanche can grow really strong, ~900% is a lot, incredible and perfect. We are happy with such big wins/moves if it happens but we are ready for more.

It will go higher.

Thanks a lot for your continued support.

Namaste.

Avalanche (AVAX) RectangleBINANCE:AVAXUSDT is trading within a well-defined rectangle, after breaking out of a steep falling channel earlier this year.

Key Observations

• The current range has two clear touches on both support ($15.50) and resistance ($23.00), forming a valid rectangle structure.

• This follows a sideways channel breakout, suggesting a consolidation phase which is often a precursor to a larger move.

Range Levels

• Resistance – $23.00: Capped price twice in April, marking the upper bound of the rectangle.

• Support – $15.50: Held firmly on two separate pullbacks.

• Midrange Bias – As long as AVAX remains within this box, directional conviction remains limited.

Breakout/Breakdown Scenarios

• Bullish Breakout: If AVAX closes decisively above $23.00, the measured target would be ~$30, based on the rectangle height projected upward (linear scale).

• Bearish Breakdown: If it loses $15.50 support, the downside target becomes $10.50, calculated using the same rectangle height on log scale (to reflect proportional downside risk).

Until either side breaks, this remains a range-trading environment.

Avalanche Will Grow, You Can Count On It! (460% PP)After a bullish breakout, there is always a retrace. A retrace can be short or long but never deep. If the retrace goes too deep it turns into a correction.

Notice here AVAXUSDT after the 7-April low, it starts to grow. There were two red sessions, total of 4 days (2D candles) followed by additional growth. We have a red session now which is the current active session. AVAXUSDT can continue growing right away or produce a few of these red sessions before additional growth.

The market never moves in a straight line, up or down, it always fluctuates and these fluctuations can seen like a big deal when we are looking up-close. If we zoom-out and consider the bigger picture, we soon realize it is all noise.

After the bottom is in, we get growth. Not only that, always higher highs and higher lows. So AVAXUSDT will continue growing long-term regardless of the short-term. Never worry about what happens today, tomorrow or in a single day. By the end of the week, it turns green; at the end of the month, prices are up. It is only the start, Avalanche is going higher for sure.

Just a friendly update and reminder to let you know that you can sleep easy, there is nothing that can stop this event we've been waiting for. It works like the Sun, it comes out everyday, you can count on it. Crypto goes down and then goes up, you can count on it...

Avalanche will grow!

Namaste.

Avalanche Bullish Confirmed (1,425% Easy Profits With 5X Lev.)Some trade setups are hard, risky, while others are very easy. This one is really easy with relatively low risk.

How are you doing in this wonderful day my fellow Cryptocurrency trader?

» Avalanche is now confirmed green.

While we looked at a pair recently, DOGEUSDT, where trading volume isn't present but the chart signals are still pointing up, here we have a pair that has very strong volume to mark the most recent correction bottom low.

Also, while DOGEUSDT produced a higher low in April 2025 vs August 2024, here Avalanche (AVAXUSDT) produced a lower low. This lower low is good for buyers, it means the bears went beyond 100% and when this happens, there is nothing more to sell, this increases the chances of the next move being strong when it develops. The high buy volume on the drop confirms this statement. This will be a strong bullish wave.

Avalanche is set to grow very strong in the coming months, what I am showing you here is an easy target, very strong potential, mid- to short-term. This can all develop within 1-3 months. So this is perfect. A great opportunity to grow your bank and go beyond any losses the correction produced.

Such strong high volume at "critical level" support indicates that buyers were waiting, ready and present. Now that the low is in, the market reverses from red to green.

» The first target is an easy 90% for spot traders, but leverage traders can extract as much as 450% with just 5X.

» The second and main target, which is also easy because total growth for this newly development bullish cycle will be much higher than what is shown on the chart, goes to $81 for 285%. When we add the reasonable 5X, that's a nice 1,425%. That's it. Timing is of the essence.

The market is good now. The chart looks good now. Once the next bullish wave starts, there is no going back, low prices will be gone forever and the market will be rising until the end of 2025.

Thanks a lot for your continued support, I hope you enjoyed the chart.

Namaste.

Avalanche Potential UpsidesHey Traders, in today's trading session we are monitoring Avalanche for a buying opportunity around 19.20 zone, Avalanche is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 19.20 support and resistance area.

Trade safe, Joe.

Reversal Pattern in Play – Will AVAX Flip Bullish?CRYPTOCAP:AVAX is showing signs of a potential reversal after forming a double bottom near the $17 zone. It’s currently testing a key resistance trendline along with a minor horizontal resistance around $19.50–$20.50.

A successful breakout and close above this zone could trigger bullish momentum toward $22+. However, rejection here may lead to another dip back toward support.

Price action is tightening, so a decisive move is likely soon.

DYOR, NFA

AVAXUSDT – %180 VOLUME SPIKE! Major Resistance Ahead 📊 What’s Happening?

✅ Volume is exploding (+180%) – This means big money is moving, but in which direction?

✅ Blue Box = A HUGE Resistance Zone – This is where sellers may step in aggressively.

✅ Breakout vs. Rejection? – We’re at a critical decision point.

💡 How I’m Trading This:

📌 Scenario 1: Rejection – If price stalls at the blue box, I’ll watch for LTF breakdowns + CDV confirmation for a high-R short.

📌 Scenario 2: Breakout & Retest – If price pushes above with strong volume, I’ll wait for a clean retest before considering a long.

🔑 Pro Trading Mindset:

I don’t marry my bias. If price shifts structure, I shift with it. No guessing. No hoping. Just data-driven execution.

Follow me for real-time, high-probability trade setups. Smart traders adapt, amateurs gamble.🔥

✅I keep my charts clean and simple because I believe clarity leads to better decisions.

✅My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

✅If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

AVAX/USDT:BUYHello friends

Given the good price growth, we see that the price has not managed to reach a higher ceiling and has fallen, so we can buy in stages during the price decline within the specified ranges and move with it to the specified targets.

Observe capital and risk management.

*Trade safely with us*

AVAXUSDT Ready to Explode? Avalanche ( BINANCE:AVAXUSDT ) has successfully retested its previous support zone, showing strong signs of a potential upward move. This retest confirms the level as a solid base, and the price action is hinting at a shift in momentum. Currently undervalued and flying under the radar, Entering the trade at this level offers a favorable risk-reward ratio, with the previous swing low acting as a logical stop-loss point. Once the market gains momentum, we could see explosive moves from $AVAX. As always, manage your risk wisely and never trade without a stop-loss. This could be the calm before the storm — don’t miss out on the next big wave!

BINANCE:AVAXUSDT Currently trading at $19

Buy level : Above $18.7

Stop loss : Below $17.5

Target : $25

Max leverage 3x

Always keep stop loss

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts

Avalanche Update: Easy 510% Profits TargetThis is a perfect chart setup. Price dynamics are revealing a strong potential for the development of a major bullish wave; let me explain.

There was a low around 10-March, followed by a small bounce. This small bounce I take as an early reversal signal but being early caution is advised. Then we have another support in the critical zone.

The initial bounce produced a lower low but there was strong buying right at the "critical level," this signal is strong. The low session ended as a Doji and is immediately confirmed by two days of green. Volume is high on the buy. Prices are now up.

Touch and go. There was a drop below support but the action recovered right away. A failed signal for the bears, a bullish reversal is in place.

Seeing marketwide action, Bitcoin and everything we already know, Avalanche is preparing for a nice up-thrust. This can be big, many times bigger than anything we've seen in several years. We are going up.

An easy target is mapped on the chart, it goes beyond 300%. 500%+ can be achieved within months. So much more by the time this year ends. It will be great.

Thank you for reading and for your continued support.

Early is best. Keep it simple.

Namaste.

Avalanche is trying to bottom out here. Watch list material. AVAX is holding nicely with the double bottom. However, a CHOCH is needed to have a better confirmation of a reversal. Momentum and trend oscillators are diverging bullishly however without market structure be careful with risk.

Full TA: Link in the BIO

AVAXUSDT - Setting Up For A Move higher...After decoding what I believe is the most accurate interpretation of the larger Bitcoin pattern—and how it mirrors across Altcoins—I can now break down what this means for Avalanche. A setup is forming for Wave (C) of Wave D, and it’s looking promising.

Once Wave (B) wraps up, I’ll be closely tracking and trading this expected move higher. Stay tuned.

TradeCityPro | AVAXUSDT Watch the Altcoins!👋 Welcome to TradeCityPro Channel!

Let’s dive into the analysis of one of my favorite coins, which is likely to make a move this week. Let’s break it down and take a closer look together!

🌐 Overview Bitcoin

Before starting the analysis, I want to remind you again that we moved the Bitcoin analysis section from the analysis section to a separate analysis at your request, so that we can discuss the status of Bitcoin in more detail every day and analyze its charts and dominances together.

This is the general analysis of Bitcoin dominance, which we promised you in the analysis to analyze separately and analyze it for you in longer time frames.

📊 Weekly Timeframe

On the weekly timeframe, the AVAX chart is one of the smoothest and most technical charts I’ve seen—support and resistance levels work like a charm, and price patterns are fairly predictable.

After getting rejected at the key resistance of 53.62—a historically significant level—sellers stepped in, pushing us into a deep correction. The failure to break this level was partly because we didn’t enter overbought territory on the weekly chart.

For buying, the weekly chart is currently very bearish, so jumping in now isn’t logical. However, a break above 53.82 would be our most reliable trigger for an upward move. For exiting, if we drop below 21.02, I’d personally cash out. If we climb back above 21.02, I’d buy again—this time with fewer AVAX but the same USDT amount to manage risk.

📉 Daily Timeframe

In the daily timeframe, after a rejection at 53.96 that led to a correction, it seemed likely we’d test this resistance again. However, after the rejection, we broke below 44.21, forming a price range box.

Right now, we’re not paying much attention to resistance levels. Our trendline is showing lower highs but flat lows, indicating that our movement is driven by the trendline rather than traditional support and resistance.

With that in mind, a break of the trendline could spark a move, but we still need a trigger. The 22.71 level is our breakout trigger—not just a resistance. If we break it, we could enter a buy with a risky stop loss at 16.00. Confirmation would come from a spike in volume. For selling, if we get rejected at the trendline and break below 16.00, I’d personally exit.

✍️ Final Thoughts

Stay level-headed, trade with precision, and let’s capitalize on the market’s top opportunities!

This is our analysis, not financial advice—always do your own research.

What do you think? Share your ideas below and pass this along to friends! ❤️

AVAXUSD cooking massive Triangle bullish tradeAvalanche / AVAXUSD is trading inside a massive Triangle pattern for the entirety of its history.

The price just hit its bottom this week and is rebounding with force.

The first target is 45.000, right at the top of the pattern.

If however the 2021 Bull Cycle is confirmed then the price can break massively above the Triangle and exceed $300, but this is arguably an ambitious target.

Follow us, like the idea and leave a comment below!!

Avalanche (AVA): Overextended! Is This Ready for a Bullish Move?Avalanche (AVAX) is currently presenting an intriguing setup, with price action showing signs of being overextended on the daily and 4-hour timeframes. The cryptocurrency has recently traded into a critical support zone, defined by previous swing lows on the daily chart. This area has historically acted as a strong demand zone, attracting buyers. However, AVAX has now dipped below these lows, triggering sell-side liquidity in the form of stop-loss orders placed beneath this level. This liquidity grab could be a precursor to a potential bullish reversal. 🚀

On the 15-minute timeframe, AVAX is consolidating within a tight range, reflecting indecision among market participants. A break above this range, coupled with a bullish market structure shift, could signal the start of a reversal and provide a high-probability buy opportunity. This setup aligns with the concept of a "liquidity sweep," where price manipulates stop orders before reversing direction.

Key Observations:

Daily Timeframe: Price has dipped below key swing lows, eating into sell-side liquidity.

4-Hour Timeframe: Overextension is evident, with price trading into a significant support zone.

15-Minute Timeframe: Consolidation within a range, awaiting a breakout.

Trading Plan:

Wait for Confirmation: Monitor the 15-minute timeframe for a bullish breakout above the current range. 📈

Market Structure Shift: Look for higher highs and higher lows to confirm bullish intent. 🔍

Entry Strategy: Enter long positions after a confirmed breakout, with a stop-loss placed below the range low. 🛡️

Target Levels: Aim for resistance zones on the 4-hour and daily timeframes as potential take-profit areas. 🎯

Key Levels to Watch:

Support Zone: Previous daily swing lows (now acting as a liquidity zone).

Resistance Zone: The upper boundary of the 15-minute range and key levels on the 4-hour chart.

This setup highlights the importance of patience and discipline in trading. While the liquidity grab below support is a promising signal, confirmation of a bullish breakout is essential to avoid false moves. As always, this is not financial advice, and traders should conduct their own research before making any decisions. ⚠️

Avalanche's Higher Low Indicates The Bottom Is InAVAX is currently trading above its August 2024 bottom low price, and this is bullish.

AVAXUSDT produced a major low on the 10-March trading session. The current session is a higher low compared to this date. This is a double bullish signal. The August low and last month. Both are active, valid and hold.

So the August 2024 low was actually tested and pierced but the session close happened above this level. The bottom back then was $17.27. In March, AVAXUSDT went as low as $15.30 but closed at $17.51. The next session went below again and hit $16.95 but closed at $18.5. As you can see, the bulls win.

The current session is green after four sessions closing red. Each session has two candles, 48 hours (2D candles).

Here we have the activation of long-term support. Classic behaviour before a major bullish run.

The dynamic is always this: The correction unravels and gains momentum before reaching its end. When it hits bottom, there is a strong reaction causing a sudden bullish jump. This bullish jump is short-lived and quickly corrected. This short-term correction ends in a higher low. From this higher low, prices start a new wave of growth. We are entering this new growing phase now.

Thanks a lot for your continued support.

This is another time based chart.

The time to enter is now, always focusing on the long-term.

We buy now with the patience and mindset to hold between 6-8 months. If this can be done, easy and big wins will be yours.

The 2025 All-Time High potential and more can be found by visiting my profile.

Thanks a lot for the follow. Your support is appreciated.

Namaste.

Avax long term.This is my opinion on Avax.

I think the downward waves are good buying opportunities, while the upward waves after that can be good selling opportunities.

* What i share here is not an investment advice. Please do your own research before investing in any digital asset.

* Never take my personal opinions as investment advice, you may lose all your money.