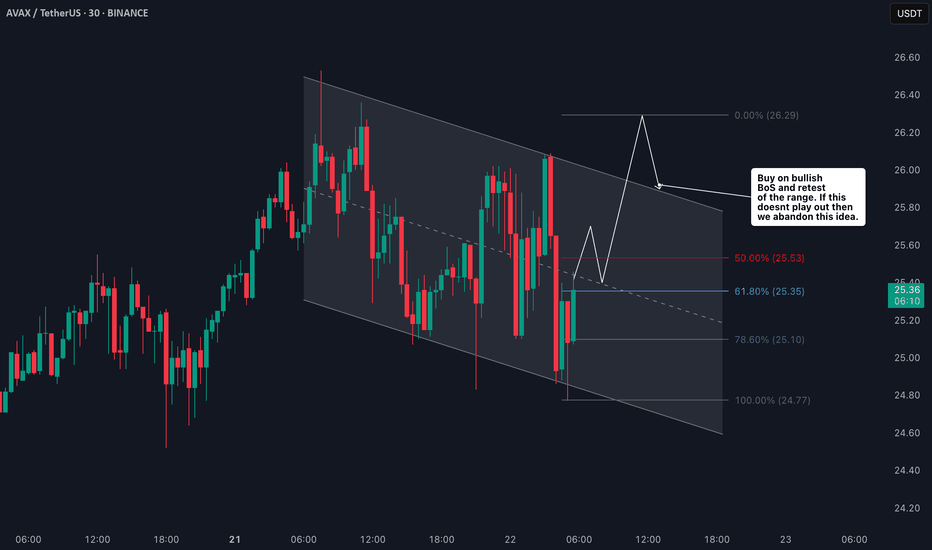

AVAX/USDT Trade Setup: Bullish Bias with Fibonacci Targets🚀 AVAX/USDT Avalanche is currently in a strong bullish trend 🔼. On the 4H chart, price is pulling back slightly 📉, and I’m watching for momentum to pick up and break above the current range high 📊—that’s where I’ll be looking for the next entry.

🎯 My bias remains long, and in the video I break everything down in detail:

🔍 Price action

🧱 Market structure

📈 Overall trend

📍 Stop loss placement (below the previous swing low)

🎯 Targeting key Fibonacci levels

I also go over my exact Fibonacci settings and how I use them to frame the trade.

This is not financial advice ❌💼

Avalanchelong

AVAX Bulls Walking into a Trap? Yello Paradisers, are we on the edge of a clean breakout or is AVAX setting up the perfect trap before flushing the late bulls?

💎#AVAXUSDT has recently broken above a critical resistance zone and is now attempting a retest. This move appears strong on the surface, but it sits at a dangerous pivot—one that could determine the short-term direction in the days ahead. The structure is unfolding within a clean ascending channel, with both resistance and support levels well respected. These rising boundaries give the breakout credibility, but they also highlight how vulnerable the setup is if key support levels fail.

💎Right now, the level that previously acted as resistance is being tested as support. This is the moment of truth. If the price continues to hold above this level with strength and volume, we’re likely in for a continuation toward the next resistance level around $22.40. But the real test for bulls will come at the $23.00 region, where heavy profit-taking and increased selling pressure are highly likely. That’s where the larger players will look to trap over-leveraged longs and reposition.

💎But this bullish outlook comes with a clear condition and it’s non-negotiable. If #AVAX fails to hold $21.00 and begins closing candles back inside the previous range, the move instantly loses its legitimacy. In that case, our focus turns to the strong demand zone between $20.20 and $20.40. A reaction from this area could still save the structure, offering a potential reload for a bounce. But if this level gives way, the entire bullish setup is invalidated and what was once a breakout turns into a confirmed bull trap.

Trade smart, Paradisers. This setup will reward only the disciplined.

MyCryptoParadise

iFeel the success🌴

Avalanche (AVAX) Price Technical AnalysisAvalanche AVAX ⬆($42.90) broke above the resistance line of the ascending channel pattern on Nov. 22, indicating that the bulls have overpowered the bears.

If the price sustains above the resistance line, the AVAX/USDT pair could surge to $48 and futhermore past $50.

This positive view will depend in the near term if the price turns down and breaks below ($40.00). Such a move will signal that the breakout may have been a bull trap. The price may then dip to the ($35.00), extending the consolidation inside the channel for some more time.

Are we going to see lower low?I entered a long position as I mentioned in the last idea on $AVAXUSDT. What BINANCE:AVAXUSDT doing is most likely to go down to the 19.5 area first, because there is no big impulse and CRYPTOCAP:BTC.D is not giving a chance to alt-coins. The yellow line is very crucial which is holding the last lowest point since the last higher high. But if the yellow line breaks in the 4H and 1D timeframe we are likely to see the 15.5-14.5 range before the big impulse.

Avalanche Buy OpportunitySo far, I have profited 450%, 56% and 223% from Avalanche. I have already shared the profits I made in 2023 in my X report, and my followers have profited with me. I don't have any Avalanche at the moment. I am waiting for this moving average to pick up. If Avalanche falls below the moving average, I will wait for my Dip Finder indicator to turn green to buy. But if it is rejected from the moving average, I will buy and hold it until my indicator lights white. I will update this post again when I buy, so I recommend you to stay tuned.

Avalanche Price Rallies 12% Amid Binance AnnouncementThe cryptocurrency market is abuzz with excitement as Avalanche ( CRYPTOCAP:AVAX ) experiences a remarkable surge of nearly 12%. This surge coincides with a strategic announcement from Binance, the leading crypto exchange, signaling a significant shift in market dynamics.

Binance's Endorsement Fuels Momentum:

The surge in CRYPTOCAP:AVAX price underscores the growing confidence of investors, propelled by Binance's latest move. With the introduction of a USDC-margined AVAX Perpetual Contract offering up to 75x leverage on its Futures platform, Binance aims to enhance trading options and user experience, stimulating trading activity and liquidity for $AVAX.

Expanding Trading Options:

Scheduled for March 20, 2024, Binance's USDC-margined CRYPTOCAP:AVAX Perpetual Contract opens new avenues for traders, enabling them to capitalize on increased leverage options. The 10% promotional trading fee discount until April 3, 2024, further incentivizes trading, while the Multi-Assets Mode feature provides flexibility across multiple margin assets.

Binance's Strategic Commitment:

Binance's endorsement through the introduction of the CRYPTOCAP:AVAX Perpetual Contract underscores its strategic commitment to expanding offerings and meeting user needs. By providing access to CRYPTOCAP:AVAX trading with enhanced leverage options, Binance reinforces its position as a key player in the crypto market.

Impact on Market Sentiment:

Binance's endorsement signals a vote of confidence in Avalanche's potential, driving positive market sentiment and investor interest. With increased access to CRYPTOCAP:AVAX trading and favorable trading conditions, demand for CRYPTOCAP:AVAX is poised for further upticks, potentially driving its price higher.

Avalanche Foundation's Board Expansion:

In addition to Binance's announcement, the recent expansion of the Avalanche Foundation's board has bolstered market sentiment. These developments underscore the growing significance of CRYPTOCAP:AVAX within the cryptocurrency ecosystem, attracting attention from investors and enthusiasts alike.

Current Status and Future Outlook:

As of writing, Avalanche ( CRYPTOCAP:AVAX ) price surged to $62.52, marking a significant gain of 12.73% with a monthly increase of around 50%. With trading volume holding steady and the potential for further upticks, CRYPTOCAP:AVAX continues to capture the attention of investors, positioning itself as a promising asset within the cryptocurrency market.

AVAX on THIN ICEBankrupt exchange Voyager Digital to shut shop after failed deals, details inside

According to Voyager Digital’s lawyers, the crypto lender will self-liquidate its assets after failing to reach an agreement on a sale to either FTX US or Binance.US.

The announcement, shared in a court filing on 5 May, comes just ten days after Binance.US abruptly backed out of a $1 billion deal to buy Voyager Digital’s assets when the US government intervened to prohibit part of it.

Prior to the agreement with Binance.US, the crypto lender made a similar offer to FTX. When FTX went bankrupt alongside Voyager in November, the first contract was cancelled.

Voyager stated in a filing that a number of digital assets on the platform that cannot be removed will be liquidated and returned to its users. These assets include major cryptocurrencies such as Algorand , Celo and Avalanche .

Avalanche’s latest collaboration with Chinese company Alibaba could change the game for AVAX in the cryptocurrency market. At press time, the excitement of the partnership was reflected on the AVAX charts.

Avalanche managed to secure a major partnership that could make it a stronger contender in the metaverse.

AVAX sees low demand despite the hype around a new partnership and supports retest.

Avalanche could be about to spice things up in the metaverse thanks to a major development that might be a game-changer. The development in question is a partnership with Chinese tech giant Alibaba.

According to Avalanche’s official announcement, the two secured a partnership through which Avalanche will be the conduit for Alibaba’s metaverse pursuits.

The partnership will focus on Alibaba’s Cloudverse, the cloud computing segment of the Chinese company which already has millions of customers. Avalanche will provide the decentralized technology to support this metaverse endeavor.

Today, @alibaba_cloud announced that they are entering the metaverse--on Avalanche!

With Cloudverse, Alibaba Cloud's millions of clients can easily deploy custom metaverses and unlock new dimensions for consumers.

#Avalanche will provide all blockchain elements for Cloudverse

Today, @alibaba_cloud announced that they are entering the metaverse--on Avalanche!

With Cloudverse, Alibaba Cloud's millions of clients can easily deploy custom metaverses and unlock new dimensions for consumers.

#Avalanche will provide all blockchain elements for Cloudverse

One of the ways to tell if the excitement has been converted into strong demand is to evaluate on-chain volumes. AVAX on-chain volume experienced a slight upside in the last 24 hours, although likely not strong enough to support enough bullish excitement.

Despite the lack of strong demand within the first 24 hours after the announcement, there was one key factor that may still support a strong bounce. AVAX’s price action had been trading within a tight range after finding support near the $16.50 price range. More importantly, the price was recently pushed into an ascending support line.

The same support level may act as a bounce-off zone if AVAX can secure enough bullish demand in the next few days. Its MFI already pivoted after previously registering outflows. Weak bullish demand or a surge in sell pressure may also manifest in the market sentiment shifts in favor of the bears.

Avalanche to tumble southward as the downtrend persistsThe daily and 4-hour price charts of Avalanche showed the bears were highly likely to drive prices lower, especially after the move below $13.88 on 5 June.

The higher timeframe charts showed that the mid-April rally failed to break key highs.

This was followed by a downtrend in May, but the $13.8 area posed some opposition to the sellers.

Avalanche had a bearish bias on the price charts. It is the fifth largest blockchain in terms of TVL but its DeFi activity stagnated in recent months. In other news, SushiSwap announced the launch of their v3 suite of products on Avalanche.

The price action presented short sellers with an opportunity. The structure was bearish, but the volatility has been high over the past 48 hours despite seller dominance. If the prices fall beneath $13.5, it would represent a continuation of the downtrend.

The market structure was bearish on the daily timeframe, and a downtrend was in progress. The 4-hour chart also showed a downtrend in progress. In May, the price formed a series of lower highs and lower lows.

The $13.88 level served as support, but AVAX still formed a low at $13.71 on 25 May. On 5 June, the price fell to $13.48, showing that bears remained dominant. Despite the bounce to $14.6 on 7 June, the market structure remained bearish.

Monday’s move was used to plot a set of Fibonacci retracement levels (pale yellow). It showed the 78.6% retracement level at $14.62, which explained the inability of the bulls to drive prices higher. Having established the bearish character of the market, a short trade can be entered upon a retest of the 50% retracement level at $14.21.

The 23.6% and 61.8% Fibonacci extension levels at $13.14 and $12.58 can be used to book profits. A move by AVAX above $14.93 would invalidate this idea as it represents a key short-term lower high.

It has been noted that the prices bounced to the $14.62 level on Wednesday. Despite that, the spot CVD continued to decline. Over the past 24 hours, the metric was flat, this showed buyers were in the minority and selling pressure was overwhelming.

The Open Interest picked up a little, amounting to close to $10 million. However, when AVAX faced rejection at $14.6, the open interest dropped further. This development hinted at discouraged bulls. Overall, the bearish sentiment was prevalent both on the low and high timeframes.

Avalanche FRVP on WeeklyI think FRVP gives a very good result in identifying support and resistance. In this direction, a FRVP that we will apply to the Avax chart in the weekly timeframe shows us that the 17.50 level is support and AVAX is sitting on this support. I think the return from this level in the weekly timeframe is very positive.

AVAX Daily SupportsIn the daily timeframe, AVAX's continued upward trend seems to have come to an end for now. After reaching the $18.60 level, it sold up to $17. With the continuation of this sale, if the day closes below the level of $ 16.16, it can be entered in the range of $ 16-14. This correction will give investors a buying opportunity. If it does not close below this level, there is a possibility that the rise will continue.

Avalanche (AVAX) formed big Gartley for upto 3770% huge moveHi dear patrons, hope you are well and welcome to the new trade setup of Avalanche (AVAX).

Previously we had a nice trade of AVAX:

Now on a monthly time frame, AVAX has formed bullish Gartley pattern.

Note: Above idea is for educational purpose only. It is advised to diversify and strictly follow the stop loss, and don't get stuck with trade

⭕️BUY Crypto AVAXUSDT ; at the best place 🧐⭕️You see the analysis of the cryptocurrency used in the avalanche blockchain network (AVAX) in four hours(AVAX USDT , H4)🔎

🔰As the analysis shows, the best place to buy low risk is at the intersection of the uptrend line (white) and the support line (orange)❗️

The profit and loss limits are specified in the image👌

⚠️⚠️Please observe capital management and open a low volume transaction❗️❗️

I hope this analysis is useful for you🙏🏻🌹

📌Please introduce the "TRADER STREET" to your friends 🙏🏻

_______________________📈TRADER STREET📉________________________