AVAX/USDT Trade Setup: Bullish Bias with Fibonacci Targets🚀 AVAX/USDT Avalanche is currently in a strong bullish trend 🔼. On the 4H chart, price is pulling back slightly 📉, and I’m watching for momentum to pick up and break above the current range high 📊—that’s where I’ll be looking for the next entry.

🎯 My bias remains long, and in the video I break everything down in detail:

🔍 Price action

🧱 Market structure

📈 Overall trend

📍 Stop loss placement (below the previous swing low)

🎯 Targeting key Fibonacci levels

I also go over my exact Fibonacci settings and how I use them to frame the trade.

This is not financial advice ❌💼

Avalanchesignals

AVAX (Avalanche) Breakout? Here’s My Trade Plan.📊 Market Breakdown: AVAX/USDT (Avalanche)

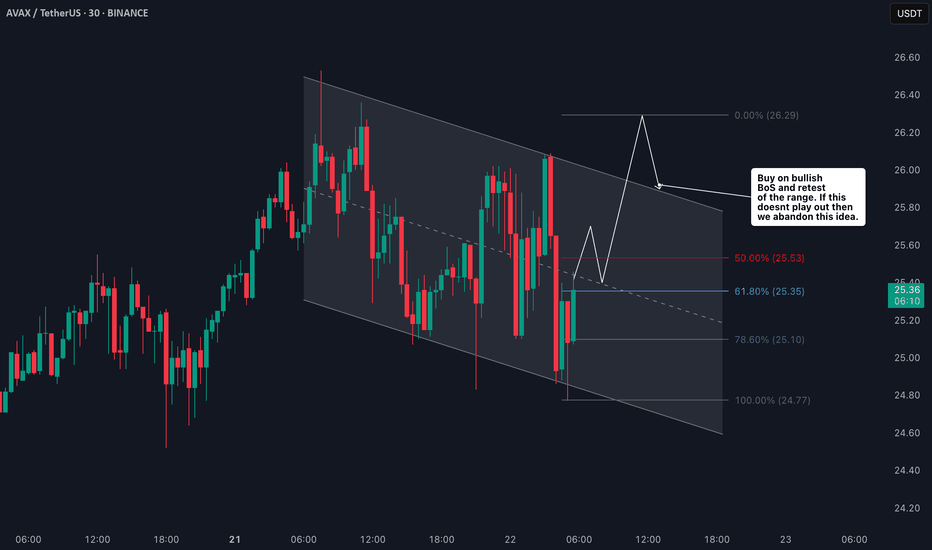

Currently monitoring AVAX/USDT, and both the daily and 4-hour timeframes are showing a clear bullish break in market structure — a key signal that the momentum may be shifting to the upside.

That said, I’m not jumping in just yet. I’m only looking for long opportunities if specific criteria are met:

✅ A clean break above a key resistance level

✅ A retest of that level, followed by a failed attempt to move lower

If these conditions are confirmed, I’ll be watching for a high-probability entry from that zone.

🎥 In the video, I also walk through how to use several powerful TradingView indicators, including:

Volume Profile

VWAP

These tools help sharpen the edge and support decision-making in live market conditions. If the setup doesn’t materialize as expected, we simply stand aside — discipline is key.

📌 Disclaimer: This is not financial advice, just a breakdown of how I approach this potential opportunity.

Avalanche (AVA): Overextended! Is This Ready for a Bullish Move?Avalanche (AVAX) is currently presenting an intriguing setup, with price action showing signs of being overextended on the daily and 4-hour timeframes. The cryptocurrency has recently traded into a critical support zone, defined by previous swing lows on the daily chart. This area has historically acted as a strong demand zone, attracting buyers. However, AVAX has now dipped below these lows, triggering sell-side liquidity in the form of stop-loss orders placed beneath this level. This liquidity grab could be a precursor to a potential bullish reversal. 🚀

On the 15-minute timeframe, AVAX is consolidating within a tight range, reflecting indecision among market participants. A break above this range, coupled with a bullish market structure shift, could signal the start of a reversal and provide a high-probability buy opportunity. This setup aligns with the concept of a "liquidity sweep," where price manipulates stop orders before reversing direction.

Key Observations:

Daily Timeframe: Price has dipped below key swing lows, eating into sell-side liquidity.

4-Hour Timeframe: Overextension is evident, with price trading into a significant support zone.

15-Minute Timeframe: Consolidation within a range, awaiting a breakout.

Trading Plan:

Wait for Confirmation: Monitor the 15-minute timeframe for a bullish breakout above the current range. 📈

Market Structure Shift: Look for higher highs and higher lows to confirm bullish intent. 🔍

Entry Strategy: Enter long positions after a confirmed breakout, with a stop-loss placed below the range low. 🛡️

Target Levels: Aim for resistance zones on the 4-hour and daily timeframes as potential take-profit areas. 🎯

Key Levels to Watch:

Support Zone: Previous daily swing lows (now acting as a liquidity zone).

Resistance Zone: The upper boundary of the 15-minute range and key levels on the 4-hour chart.

This setup highlights the importance of patience and discipline in trading. While the liquidity grab below support is a promising signal, confirmation of a bullish breakout is essential to avoid false moves. As always, this is not financial advice, and traders should conduct their own research before making any decisions. ⚠️

AVAXUSD Channel Down bottomed. Bullish Leg to target $45.Avalanche (AVAXUSD) has been trading within a Channel Down for the past 12 months and on March 11 it priced the latest Lower Low. At the same time, the 1D RSI is on an uptrend, a technical Bullish Divergence.

It is the same kind of Bullish Divergence we also saw on the August 05 2024 Lower Low bottom. That bottom produced a Bullish Leg that almost reached the 0.9 Fibonacci retracement level. As a result, we can turn bullish here, targeting a $45.00.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

AVAXUSD Will the 1W MA50 hold and push the Cup & Handle higher?Avalanche (AVAXUSD) is about to complete a Cup and Handle (C&H) pattern on the 1W time-frame and currently the Handle part has found Support for 3 straight weeks on both the 1W MA50 (blue trend-line) and the 1W MA200 (orange trend-line).

This is also on the 0.5 Fibonacci retracement level of the Cycle. Technically we should see in the coming weeks the start of the 2nd Bullish Leg of the Bull Cycle and if it follows the C&H dynamics, we can expect it to target the 2.0 Fibonacci (blue) extension at $240.00.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

From $46 to Glory or Gloom – Avalanche AVAX JourneyAvalanche is trading at a crucial juncture near $49.08, with price action consolidating in range zone where we will continue to see slow and choppy price action.

1. A bounce from the support level at $46.09 and a subsequent push above $51.62 could signal bullish momentum for AVAX, paving the way for a rally toward the next resistance level at $59.39 (Dashed Green Projections).

2. A breakout beyond this zone would confirm strong buyer interest, potentially targeting higher levels near $66.63 as the next key milestone (Green Projections).

3. A failure to maintain the $46.09 support could open the door to further declines, with the price likely retesting the next major support at $38.32 (Red Projections).

Avalanche (AVAX) Price Technical AnalysisAvalanche AVAX ⬆($42.90) broke above the resistance line of the ascending channel pattern on Nov. 22, indicating that the bulls have overpowered the bears.

If the price sustains above the resistance line, the AVAX/USDT pair could surge to $48 and futhermore past $50.

This positive view will depend in the near term if the price turns down and breaks below ($40.00). Such a move will signal that the breakout may have been a bull trap. The price may then dip to the ($35.00), extending the consolidation inside the channel for some more time.

AVAXUSD Bottom formed & going for the ultimate bullish breakout.Avalanche (AVAXUSD) has just touched this week the top of the 6-month Channel Down. In cyclical terms, this is just a big Bull Flag half-way through the Bull Cycle, similar to those of the previous one, in August - November 2020 and March - June 2021.

The Cycle's 2nd bottom is in being doubt as the RSI held and rebounded on the 40.00 Symmetrical Support, which held and kick started the post June 2021 bottom rally. The only confirmation left to give us is to break above the 1W MA50 (blue trend-line) for the first time since late July.

As you can see both of 2020 - 2021 Bull Flags rebounded aggressively reaching the 2.0 Fibonacci extension. As a result once the 1W MA50 breaks, we expect a similar rally on AVAX, whether more aggressive like 2020 or marginally less like 2021, but our Target is at $250.00 (Fib 2.0 and above the All Time High).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

AVAX 2024- Fast Update.

- Everything in Graphic.

- Buy Breakout 50$++. ( always wait Weekly candle on Monday to have confirmation ).

or

- Buy Retracement : 18$ ish ( 25% invest ).

- Buy Bottom : 10$ ish ( 75% invest ).

- TP1 : 150$ ish( old ATH )

- TP2 : before 380 to 500$ ish ( Just don't be greedy ).

Play S4fe

Happy Tr4Ding !

AVAXUSD Bottom formation in process. Target $105.007 months ago we published the following analysis (December 14 2023, see chart below), expecting Avalanche (AVAXUSD), to correct back to the 1.0 Fibonacci level after a potential $55.00 hit:

As you can see the price action didn't fail to deliver our projection, in fact it followed very tightly the February - July 2021 pre-rally pattern of the previous Bull Cycle. Right now it has found Support on the 1W MA100 (green trend-line), while the 1W RSI is on the exact Support level it was on the June 21 2021 bottom.

Even though a marginal decline is possible to satisfy the past condition of slightly breaking below the 0.5 Fib, the current levels are good enough to buy again for the long-term.

As in November 2021, our Target is again the 1.236 Fibonacci extension, which is currently just above the $105.00 Resistance.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

AVAX → Avalanche Reached Resistance! Reverse to $25? or $75?AVAX has met a major 2021 lifetime resistance area and rendered a strong sell signal in response. Is this the time to short?

How do we trade this? 🤔

We have three pushes up in a bull trend; the third push has made contact with a major 2021 resistance area, followed by two strong bear candles closing on their lows below the Daily 30EMA. What we need now is a test of the 30EMA as resistance followed by a strong bear bar closing on or near its low. This will be our confirmation bar and our queue to enter a short. Take half profits at 1:1 Risk/Reward then move the stop loss up to the entry price to secure profits. Swing the latter half of the position to 1:3 Risk/Reward just above the previous major support, or until a reversal pattern appears.

💡 Trade Idea 💡

Short Entry: $46.50

🟥 Stop Loss: $53.00

✅ Take Profit #1: $39.85

✅ Take Profit #2: $27.00

⚖️ Risk/Reward Ratio: 1:3

🔑 Key Takeaways 🔑

1. Three pushes up into a bull trend.

2. Price has made contact with a 2021 resistance area.

3. Strong sell signal pushing below the Daily 30EMA

4. Wait for confirmation candle just below the Daily 30EMA to enter a short.

5. RSI at 48.00 and below the Moving Average, supports short bias.

💰 Trading Tip 💰

It's reasonable to take half profits at the first resistance target in a long trade, or the first support target in a short trade. Using a 1:1 Risk/Reward Ratio for your first target, you can move your stop loss up to your entry price, locking in profits. This allows you to watch the rest of the trade execute without worry of losing money. This helps improve trading psychology and the equity in your account.

⚠️ Risk Warning! ⚠️

Past performance is not necessarily indicative of future results. You are solely responsible for your trades. Trade at your own risk!

Like 👍 and Follow to learn more about:

1. Reading Price Action

2. Chart Analysis

3. Trade Management

4. Trading Psychology

AVAXUSD $104 is the minimum target on this run.Avalanche (AVAXUSD) has been trading within a Channel Up since the October 19 2023 Low and at the moment is halfway through its 2nd Bullish Leg of the sequence. So far it has been replicating to a fair extent the previous Leg, trading above the 1D MA50 (blue trend-line), which shouldn't be touched again before the next peak.

If it continues to repeat the sequence, then we can see $155 as a peak (Higher High), since the previous leg topped at around +470% from the bottom. We take a more conservative target however, aiming for the April 02 2022 High at $104.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Cryptolean Avalanche AVAX Update Avalanche is facing the resistance from $60.

A bullish break-out and the daily candle closure above $60, the key daily resistance, will push AVAX price higher towards $64-$67 and higher to $72 .

A bearish dip to below $54 will result in a decline to re-test $47-$49, the key daily support.

Intraday Chart

Unable to sustain the price action above $59.40, the AVAXUSDT 4-Hour chart is having a bearish intraday pullback.

A bearish dip to below $54.30 or, even better, to $47.63-$49.61 and a bullish rejection of one of these levels could offer a long trade towards $59 and higher.

A bullish move from its current price location and a break-out of $59.40 resistance will push #Avalanche to the next target of $63.89-$66.

Support once read!

Thank you.

AVAXUSD $55.00 is on the cards but then expect correction.Avalanche (AVAXUSD) hit all of our targets during November's run (see chart below) and even broke above the 1W MA100 (green trend-line) for the first time ever:

This resembles the incredible rally of January 2021, even though it has been executed during a different time period of the global Cycle. Nonetheless, one last spike to the 1.786 Fibonacci to make a February 08 2021 type High, is expected (target = $55.00) but then most likely the market will correct back to the 1W MA50 (blue trend-line). After that, our long-term target will be 105.00 (Resistance 1).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Avalanche to tumble southward as the downtrend persistsThe daily and 4-hour price charts of Avalanche showed the bears were highly likely to drive prices lower, especially after the move below $13.88 on 5 June.

The higher timeframe charts showed that the mid-April rally failed to break key highs.

This was followed by a downtrend in May, but the $13.8 area posed some opposition to the sellers.

Avalanche had a bearish bias on the price charts. It is the fifth largest blockchain in terms of TVL but its DeFi activity stagnated in recent months. In other news, SushiSwap announced the launch of their v3 suite of products on Avalanche.

The price action presented short sellers with an opportunity. The structure was bearish, but the volatility has been high over the past 48 hours despite seller dominance. If the prices fall beneath $13.5, it would represent a continuation of the downtrend.

The market structure was bearish on the daily timeframe, and a downtrend was in progress. The 4-hour chart also showed a downtrend in progress. In May, the price formed a series of lower highs and lower lows.

The $13.88 level served as support, but AVAX still formed a low at $13.71 on 25 May. On 5 June, the price fell to $13.48, showing that bears remained dominant. Despite the bounce to $14.6 on 7 June, the market structure remained bearish.

Monday’s move was used to plot a set of Fibonacci retracement levels (pale yellow). It showed the 78.6% retracement level at $14.62, which explained the inability of the bulls to drive prices higher. Having established the bearish character of the market, a short trade can be entered upon a retest of the 50% retracement level at $14.21.

The 23.6% and 61.8% Fibonacci extension levels at $13.14 and $12.58 can be used to book profits. A move by AVAX above $14.93 would invalidate this idea as it represents a key short-term lower high.

It has been noted that the prices bounced to the $14.62 level on Wednesday. Despite that, the spot CVD continued to decline. Over the past 24 hours, the metric was flat, this showed buyers were in the minority and selling pressure was overwhelming.

The Open Interest picked up a little, amounting to close to $10 million. However, when AVAX faced rejection at $14.6, the open interest dropped further. This development hinted at discouraged bulls. Overall, the bearish sentiment was prevalent both on the low and high timeframes.

AVAX looks INTERESTING!KUCOIN:AVAXUSDT

AVAX is approaching an interesting level for a possible long providing a potential of about 40% upside gains.

However, since Bitcoin is sitting in a huge Head & Shoulders pattern, we must let our edge develop on lower time frames 4h to

look at entry triggers.

Should the Head & Shoulders activate, potential downside target to possible pullback zone is an idea.

Future markets open in about 3h 20m

Always having Plan A and Plan B scenarios so we can react once the markets provide an opportunity to execute our edge.

If you liked this idea or if you have your own opinion about it, write in the comments.

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations.

AVAXUSD is the closest to its 1D MA200 it's been since April!Avalanche (AVAXUSD) is about to hit its 1D MA200 (orange trend-line) for the first time since April 11 2022! Needless to say, a break-out there would be a major long-term bullish signal for the coin.

With AVAX trading within a Channel Up since the February 2021 High, we can see that the best Sell entry and (potentially now) best Buy entry have come around its +0.236 and -0.236 Fibonacci extension (extreme) levels respectively. Those extremes have both come after the 1D RSI went deep into a Bearish and Bullish Divergence respectively. On the November 21 2021 High, while AVAX was rising on Higher Highs, the RSI was falling on Lower Highs, hence a Bearish Divergence, indicating loss of strength on the trend. Similarly on the December 30 2022 Low, while AVAX was falling on Lower Lows, the RSI was rising on Higher Lows, hence a Bullish Divergence, indicating a weakening bearish trend.

In both cases, the breaking of the 1D MA200 was the confirmation of trend reversal. And since in late January 2022 after the 1D MA200 bearish break-out, AVAX bounced back on the short-term above the 1D MA50 (blue trend-line) before making the deep collapse, we expect this time also after the 1D MA200 bullish break-out to pull-back on the medium-term before starting to fill the upper Fibonacci levels of the Channel Up one by one in the new Bull Cycle.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

AVAXUSD Re-testing the 1D MA50. Breakout and rejection scenariosAvalanche (AVAXUSD) is recovering from the recent rejection on the 1D MA50 (blue trend-line) last week. That would be the third attempt that close to the MA50 in 3 weeks and with the 1D LMACD on a strong rise, it appears it could be the decisive one to break it.

In fact the same LMACD sequence was last spotted in July 2021, a year ago, when the price eventually broke above the 1D MA50 and initiated an extremely strong rally. Now with the general crypto market attempting to find a bottom on this Bear Cycle, such a rally would be difficult to re-create yet but the Fibonacci retracement levels within this long-term Channel Up can help us set some short/ medium-term targets leading eventually to the 1D MA200 (orange trend-line).

On the downside, if the price gets rejected again and breaks below the Higher Lows trend-line (Fib 0.0), it can go for a Bearish extreme near the -0.236 Fib, similar to the Bullish extreme at 1.236 Fib that shaped the top of the market on November 22 2021.

--------------------------------------------------------------------------------------------------------

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **

--------------------------------------------------------------------------------------------------------