Avalanche (AVA): Overextended! Is This Ready for a Bullish Move?Avalanche (AVAX) is currently presenting an intriguing setup, with price action showing signs of being overextended on the daily and 4-hour timeframes. The cryptocurrency has recently traded into a critical support zone, defined by previous swing lows on the daily chart. This area has historically acted as a strong demand zone, attracting buyers. However, AVAX has now dipped below these lows, triggering sell-side liquidity in the form of stop-loss orders placed beneath this level. This liquidity grab could be a precursor to a potential bullish reversal. 🚀

On the 15-minute timeframe, AVAX is consolidating within a tight range, reflecting indecision among market participants. A break above this range, coupled with a bullish market structure shift, could signal the start of a reversal and provide a high-probability buy opportunity. This setup aligns with the concept of a "liquidity sweep," where price manipulates stop orders before reversing direction.

Key Observations:

Daily Timeframe: Price has dipped below key swing lows, eating into sell-side liquidity.

4-Hour Timeframe: Overextension is evident, with price trading into a significant support zone.

15-Minute Timeframe: Consolidation within a range, awaiting a breakout.

Trading Plan:

Wait for Confirmation: Monitor the 15-minute timeframe for a bullish breakout above the current range. 📈

Market Structure Shift: Look for higher highs and higher lows to confirm bullish intent. 🔍

Entry Strategy: Enter long positions after a confirmed breakout, with a stop-loss placed below the range low. 🛡️

Target Levels: Aim for resistance zones on the 4-hour and daily timeframes as potential take-profit areas. 🎯

Key Levels to Watch:

Support Zone: Previous daily swing lows (now acting as a liquidity zone).

Resistance Zone: The upper boundary of the 15-minute range and key levels on the 4-hour chart.

This setup highlights the importance of patience and discipline in trading. While the liquidity grab below support is a promising signal, confirmation of a bullish breakout is essential to avoid false moves. As always, this is not financial advice, and traders should conduct their own research before making any decisions. ⚠️

AVAXUSD

Avax long term.This is my opinion on Avax.

I think the downward waves are good buying opportunities, while the upward waves after that can be good selling opportunities.

* What i share here is not an investment advice. Please do your own research before investing in any digital asset.

* Never take my personal opinions as investment advice, you may lose all your money.

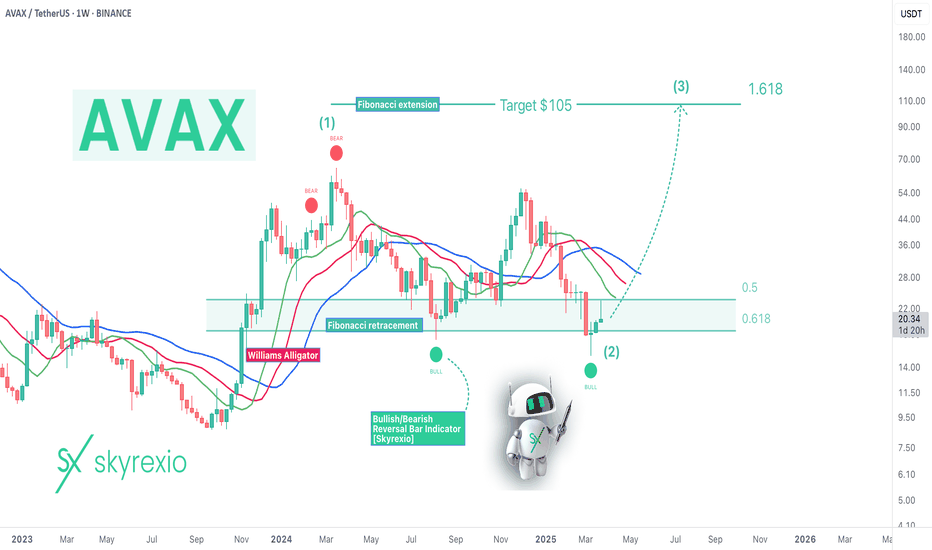

Avalanche AVAX Will Reach $100+ In 2025!Hello, Skyrexians!

Let's make an update on BINANCE:AVAXUSDT the coin with the most clear Elliott waves structure. We have some changes since our last update.

Let's take a look at the weekly chart. We can count the growth from the bottom to the March 2024 top as the wave 1. After that we can see the flat correction ABC in the wave 2. The great sign that price has printed even 2 green dots on the Bullish/Bearish Reversal Bar Indicator inside the Fibonacci 0.61 zone. We expect that for this asset correction is over and the next target is 1.61 extension for the wave 3. Now it's located at $105.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

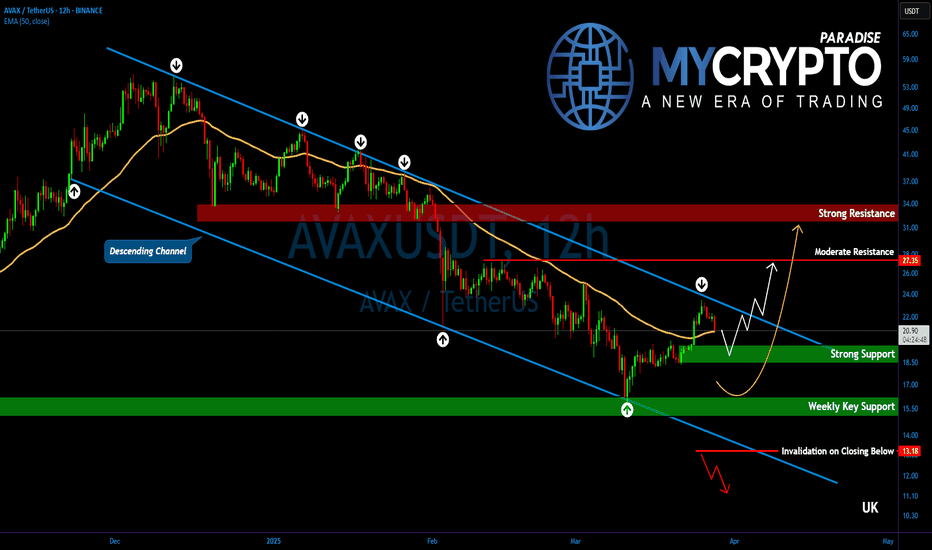

AVAX Is Approaching a Make-or-Break Level — What Comes Next?Yello, Paradisers! Is #AVAX finally waking up after months of bearish slumber, or is this just another bull trap? After moving within a well-defined descending channel for weeks, we are now seeing the first real shift in structure: AVAXUSDT has just broken above its 12-hour EMA convincingly for the first time since November 2024. This development may be a strong early signal of a potential corrective move to the upside.

💎At the moment, #AVAXUSDT is testing a critical resistance at the $23.50 level, which lines up with the descending trendline that has capped price since December 2024. A breakout above this zone would significantly increase bullish momentum, with the next target likely at $27.35 — a key area of moderate resistance that could temporarily halt upward movement.

💎However, $27.35 is not expected to be an easy level to break. Sellers will likely defend this zone, potentially causing short-term volatility. But if bulls manage to flip it into support, the path opens toward the $31.20 to $34.00 region. This higher resistance area is even more significant as it aligns with the 50% Fibonacci retracement level — a major technical barrier where many traders will be looking to take profits or fade the rally.

💎On the downside, AVAX has established a strong support range between $19.50 and $18.80. If this short-term support fails, we then look to the weekly support zone between $16.20 and $15.00, which continues to serve as a long-term base structure. As long as AVAX holds above this broader support, the larger bullish outlook remains intact.

Paradisers, strive for consistency, not quick profits. Treat the market as a businessman, not as a gambler.

MyCryptoParadise

iFeel the success🌴

AVAX/USDTHello friends

As you can see, the price has been well supported by buyers from the specified support area...

Now you can buy in steps with capital and risk management and move to the specified targets.

The red resistance area can also cause a price correction, so be careful and take profit.

*Trade safely with us*

#AVAX/USDT#AVAX

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 18.22.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 19.12

First target: 19.55

Second target: 20.14

Third target: 20.74

Is #AVAX Making Much Needed Comeback or Another Bull Trap Ahead?Yello, Paradisers! Is #AVAX on the verge of a major breakout, or is this just another bull trap? Let's look at the latest setup of #Avalanche:

💎#AVAXUSDT has been stuck inside a falling wedge for weeks, respecting both the descending resistance and descending support levels. However, bulls have finally pushed through the upper trendline, signaling a potential shift in market sentiment. The question now is: will it sustain the momentum, or will we see a sharp rejection at key resistance levels? AVAX has been stuck inside a falling wedge for weeks, the breakout shows a high probability of an impulsive move toward the highlighted zones.

💎The immediate support to keep an eye on sits around $18.38, a level that could act as a strong demand zone if retested. Below that, $16.61 serves as a critical invalidation level for the bullish setup. A breakdown here would shift the momentum back in favor of the bears.

💎On the upside, #AVAX faces its first major challenge between $23.00 and $26.00, where sellers are likely to step in. A clean breakthrough of this zone would open the door for a more aggressive rally. RSI & Volume Confirmation – The RSI is showing early signs of strength, but volume confirmation is still needed. A strong push above the resistance zone on high volume would solidify the bullish breakout.

💎If #AVAXUSD can flip $18.38 into strong support, we could see an impulsive move toward the $23-$26 range. However, a failure to hold support could result in a bearish breakdown toward the $14 region.

The market rewards discipline and patience—trade smart, Paradisers!

MyCryptoParadise

iFeel the success 🌴

AVAXUSD Channel Down bottomed. Bullish Leg to target $45.Avalanche (AVAXUSD) has been trading within a Channel Down for the past 12 months and on March 11 it priced the latest Lower Low. At the same time, the 1D RSI is on an uptrend, a technical Bullish Divergence.

It is the same kind of Bullish Divergence we also saw on the August 05 2024 Lower Low bottom. That bottom produced a Bullish Leg that almost reached the 0.9 Fibonacci retracement level. As a result, we can turn bullish here, targeting a $45.00.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

AVAXUSD: Could target $125 by the end of this CycleAvalanche is bearish on its 1D technical outlook (RSI = 38.910, MACD = -2.280, ADX = 35.079) but the bullish dynamics should start accelerating now as the price hit the HL trendline of December 2020. This is the bottom of the multi year Triangle pattern and with the 1W RSI as low as the August 5th 2024 bottom, we expect the final rally of this Bull Cycle to start. Technically it should break above the LH trendline as all Bull Cycle rallies hit (or came close to) their 2.0 Fibonacci extension. Buy and aim for slightly below it (TP = 125.000).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Avalanche: Pending LowWith the recent sharp pullback, AVAX has entered the lower third of our magenta long Target Zone between $24.42 and $13.30. The low of the turquoise wave 2 is approaching and should form well above the $8.64 support. From the bottom of wave 2, we expect a rally in the turquoise impulse wave 3, which should aim for the current all-time highs of the last bull run.

Avalanche (avax)Avax usdt Daily analysis

Time frame daily

As you see on the chart , if decrease of avax stops on 17.5 $ the pattern (double bottom)will create.

So we will see the end of decreasing and avax will reach to 25$

On the other hand , if price breaks down and reach 15 EURONEXT:OR less , this pattern will failed

AVAX/USDT: BIG CHANCEHello friends

As the price reached a resistance area, we witnessed a double top pattern that caused the price to fall.

Now the price has been able to recover by reaching a strong support area and with the continued power of buyers, you can buy within the specified ranges and we have also specified targets for you.

*Trade safely with us*

Avalanche AVAX price analysis It's been a long time since we've had an analysis of CRYPTOCAP:AVAX

Well, we're sorry.... but inform you that OKX:AVAXUSDT price is now in a potential buying zone.

The main thing is that the price of the #Avalanche token does not fall much below $20

And the growth potential is the same as six months ago - at least up to $45-50

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

AVAX MID TERM IDEASummary:

Support Zone: $22.7 - $15.7 USDT (Demand Area).

Resistance Levels: $30, $35, and $45 USDT.

Short-Term: Downtrend continues, but signs of recovery can be monitored within the demand zone.

Mid-Term: A breakout above $30 USDT signals a potential trend shift.

Long-Term: If it recovers from the demand zone, the target range could extend to $45-$65 USDT.

Strategy:

Entry: Buy within the $22.7 - $15.7 USDT demand zone, with a stop loss below $15.5 USDT.

Targets: $30, $35, and $45 USDT.

Bearish Scenario: A drop below $15.7 USDT may increase selling pressure.

AVAX | ALTS | Possible for BOUNCE HEREAVAX hasn't yet made a glorious ATH, but on the flip side - this means that there is great potential for upside, specifically from this support zone.

If we take a look at the percentage the price has previously bounces from this particular support level, it's quite significant - although it wasn't over night. This support zone is roughly between 20-22 and may be a great place for a swing.

Make sure you check out yesterday's update on LINK; also showing promise for another impulse wave up:

__________________

BINANCE:AVAXUSDT

Avalanche AVAX Is About To Make 10X!Hello, Skyrexians!

Today we have another one gem BINANCE:AVAXUSDT which has confirmed its strength and can make at least 10X in this bull run. Now we will explain why.

You can notice that the previous bull run was really huge, let's count it as an impulsive wave 1. The bear market retraced at 0.61 Fibonacci and found support there. Now this coin is in global wave 3. We thought earlier that wave 2 in this wave 3 has been finished already with the green dot at the Bullish/Bearish Reversal Bar Indicator , but price returned back to this level.

Nothing bad has happened this is still wave 2, but in shape of irregular ABC correction. From the current price we expect the move at least to $250 in 2025.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

Avax analysis: How far will the fall continue...hello friends

Considering the drop we have, now we have to find the best support and check the reaction to the support when the price reaches that level.

We have obtained an important support for you, which can be moved up to the specified targets according to the price reaching there and maintaining the support.

*Trade safely with us*

AVAX in midtermBINANCE:AVAXUSDT

AVAX in midterm will be like this:

Creating a new bottom and a double bottom pattern.

the resistance would be around 60$

if a break out happens, the price shall increase above it.

⚠️ Disclaimer:

This is not financial advice. Always manage your risks and trade responsibly.

👉 Follow me for daily updates,

💬 Comment and like to share your thoughts,

📌 And check the link in my bio for even more resources!

Let’s navigate the markets together—join the journey today! 💹✨

AVAX LongRationale:

Bullish Divergence: 1D MACD shows a classic bullish divergence. Price is making lower lows, while MACD is forming higher lows. This suggests weakening bearish momentum and potential for a bullish reversal.

Demand Zone + Order Block (OB): Current price action is within a previously identified Demand Zone, an area of historical buying pressure. This zone overlaps with an Order Block, further reinforcing the potential for strong support and a bullish bounce.

Trend Change: The CHOCH indicator has recently transitioned from a downtrend to an uptrend. This confirms a shift in market sentiment and increases the probability of further upward price movement.

NOTE: In this position as you can see the RRR is 8:1. You can extend the SL for more safety.

Warning: Don't follow this trade set-up unless you can afford to lose.

AVAX buy/long setup (8H)From the point we marked on the chart, it seems that AVAX has started its correction.

An ABC pattern is nearing completion. The green zone is a fresh support level.

In this area, we can look for buy setups to enter a new pattern or wave D.

A daily candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

AVAXUSDT: Short Opportunities On the Horizon!AVAXUSDT: Short Opportunities On the Horizon! 🔻

Here’s the game plan:

Blue Line: A solid target for short positions.

Red Box: A promising zone to look for new shorts.

Use your confirmation tools—CDV, volume profile, and LTF structure breaks—to ensure precision in your trades.

Let’s capitalize on these setups! Boost, comment, and follow for more winning ideas! 🚀

Let me tell you, this is something special. These insights, these setups—they’re not just good; they’re game-changers. I've spent years refining my approach, and the results speak for themselves. People are always asking, "How do you spot these opportunities?" It’s simple: experience, clarity, and a focus on high-probability moves.

Want to know how I use heatmaps, cumulative volume delta, and volume footprint techniques to find demand zones with precision? I’m happy to share—just send me a message. No cost, no catch. I believe in helping people make smarter decisions.

Here are some of my recent analyses. Each one highlights key opportunities:

🚀 GMTUSDT: %35 FAST REJECTION FROM THE RED BOX

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

This list? It’s just a small piece of what I’ve been working on. There’s so much more. Go check my profile, see the results for yourself. My goal is simple: provide value and help you win. If you’ve got questions, I’ve got answers. Let’s get to work!