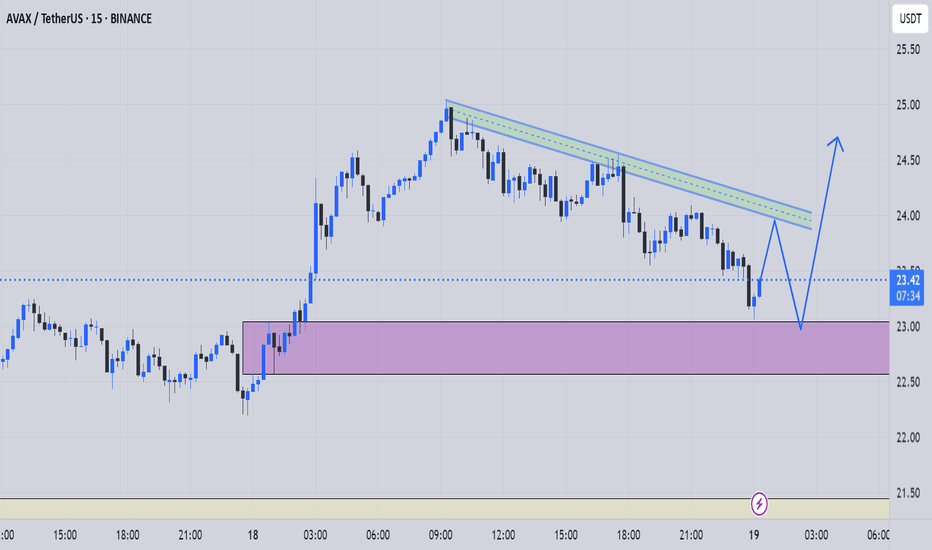

AVAX Long Swing Setup – Waiting for Support RetestAVAX has been rallying for two straight weeks, showing strong momentum. We’re watching for a healthy pullback into the $22.50–$24.00 support zone to position for continuation. If this zone holds, the risk/reward setup favors bulls with clear upside targets.

📌 Trade Setup:

• Entry Zone: $22.50 – $24.00

• Take Profit Targets:

o 🥇 $27 – $29

o 🥈 $33 – $35

o 🥉 $40 – $44

• Stop Loss: Daily close below $20.50

AVAXUSDT

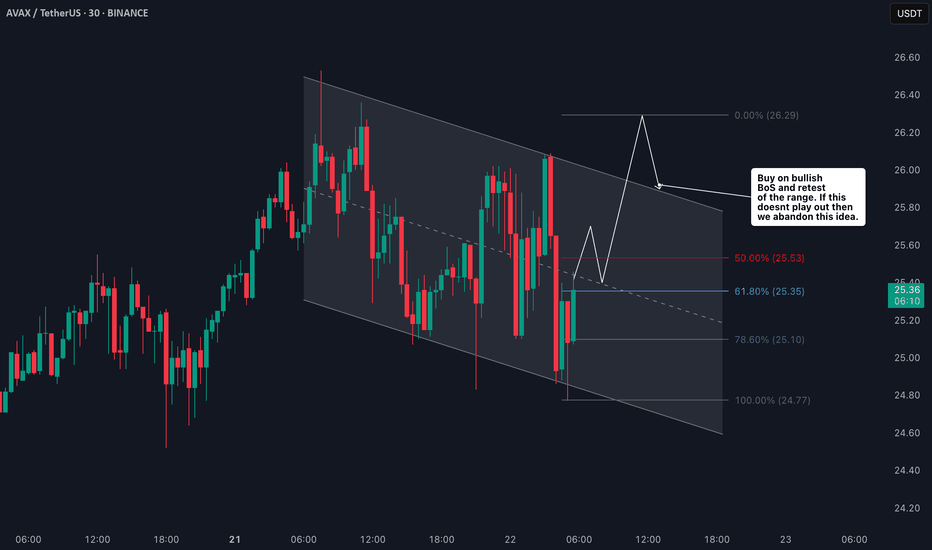

AVAX/USDT Trade Setup: Bullish Bias with Fibonacci Targets🚀 AVAX/USDT Avalanche is currently in a strong bullish trend 🔼. On the 4H chart, price is pulling back slightly 📉, and I’m watching for momentum to pick up and break above the current range high 📊—that’s where I’ll be looking for the next entry.

🎯 My bias remains long, and in the video I break everything down in detail:

🔍 Price action

🧱 Market structure

📈 Overall trend

📍 Stop loss placement (below the previous swing low)

🎯 Targeting key Fibonacci levels

I also go over my exact Fibonacci settings and how I use them to frame the trade.

This is not financial advice ❌💼

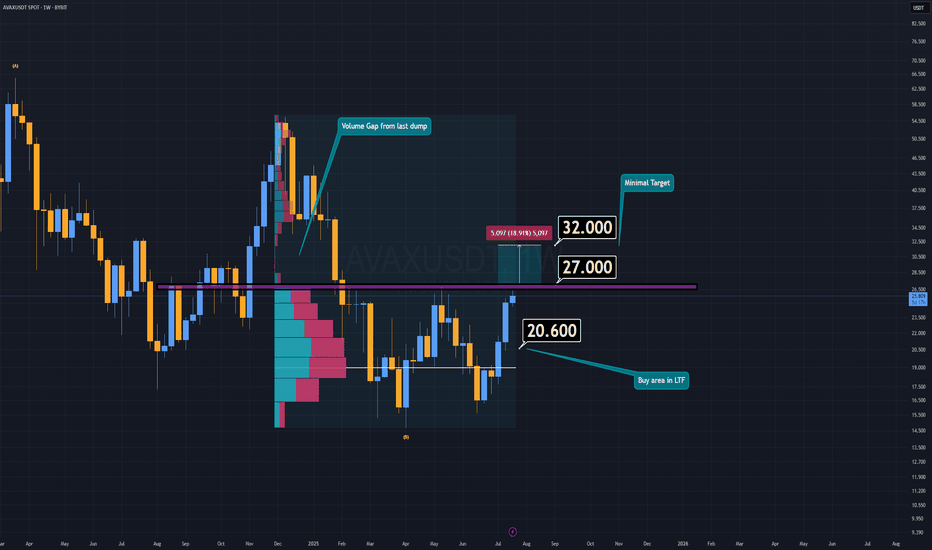

AVAX Analysis (1W)AVAX is currently attempting to form a double bottom pattern, which could signal a strong bullish reversal if confirmed. Earlier this week, AVAX made an effort to break down the key support/resistance zone, but it lacked the necessary volume to succeed.

If AVAX manages to reclaim the resistance area around $27 or higher, and confirms the breakout with a daily candle retest, the minimum target sits at $32.

However, if AVAX fails to break through resistance, there’s potentially an even better buying opportunity in the lower timeframes—a demand zone between $20 and $20.6.

I believe altcoins will offer another chance to catch up while prices are still far below their future valuations.

-S Wishes you the best in luck.

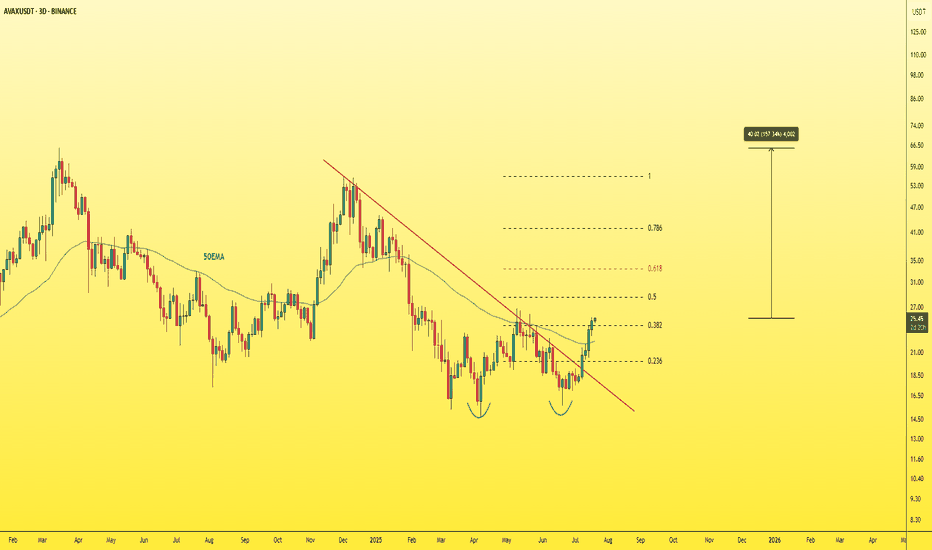

AVAXUSDT - THE real treasure must be hunted!Let's not forget about CRYPTOCAP:AVAX — it's one of the must-have assets in any crypto portfolio.

Currently trading at a discounted price after dropping from its previous top at $55, AVAX now shows strong bullish potential with plenty of upside ahead.

🚀 Key bullish signs:

-Successfully broke through multiple resistance levels, including the 0.382 Fibonacci retracement, 50 EMA, and the main descending trendline.

-A daily close above the 26$ level is a very positive signal.

With a solid project, reliable fundamentals, and low risk compared to potential reward, this could be a highly profitable opportunity.

Don’t sleep on it.🎯

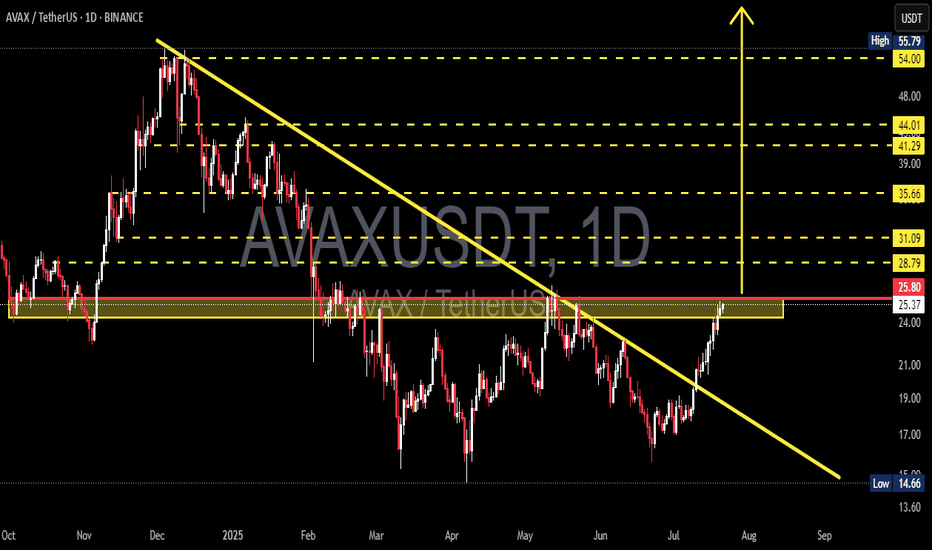

AVAX/USDT Massive Trend Reversal: Breakout from 8-Month DowntrenAVAX has just delivered one of its most technically significant moves in recent months. After spending over 8 months trapped under a descending resistance line, price action has finally broken free — suggesting a potential trend reversal and the beginning of a much larger bullish phase.

🧠 Pattern & Structure Breakdown:

📌 Descending Trendline Breakout

AVAX had been forming a descending triangle pattern, characterized by consistent lower highs and a horizontal support zone between $14.66 – $22. The recent bullish breakout from this structure, accompanied by strong volume, is a highly encouraging sign for bulls.

📌 Accumulation Zone Identified

The yellow zone on the chart ($14.66 – $22) has proven to be a strong demand zone where buyers consistently stepped in. The recent rally originates from this base, indicating possible institutional accumulation.

📌 Critical Horizontal Resistance at $25.80

Price is now testing the $25.80 resistance zone, which historically acted as a supply area. A successful daily close and confirmation above this level would officially flip the structure bullish.

📈 Bullish Scenario – Multi-Level Upside Targets:

If AVAX confirms the breakout above $25.80, these are the key bullish targets ahead:

🎯 Target 1: $28.79 – minor resistance & potential short-term TP zone

🎯 Target 2: $31.09 – previous price equilibrium

🎯 Target 3: $35.66 – key pivot from past market structure

🎯 Target 4: $41.29 and $44.01 – heavy historical supply zones

🎯 Target 5 (measured move): $54.00 to $55.79 – the projected breakout target from the descending triangle pattern

This move would represent a full technical recovery if AVAX aligns with broader market sentiment and Bitcoin remains stable or bullish.

📉 Bearish Scenario – Pullback Risks:

On the flip side, if price fails to sustain above $25.80 and gets rejected:

⚠️ A retest of $24.00 – $22.00 is likely

⚠️ If that zone breaks down, next support lies at $19.00 – $17.00

⚠️ A loss of the $17 level may trigger a return to the critical low near $14.66

This would invalidate the bullish breakout and return AVAX into a sideways or downward consolidation phase.

🔍 Additional Technical Insights:

✅ Volume is steadily increasing — showing renewed buying pressure

✅ Indicators like RSI and MACD (if applied) are likely showing bullish divergence

✅ Overall altcoin sentiment is improving, providing a tailwind for AVAX's potential breakout continuation

🧩 Final Thoughts:

AVAX is at a pivotal moment in its medium-term price structure. The breakout above the long-term downtrend line is a strong technical shift. A confirmed breakout and hold above $25.80 could trigger a multi-week or multi-month rally targeting $40 – $55+.

However, traders should be cautious of possible pullbacks and manage risk accordingly — especially as resistance zones from previous structures are being tested.

#AVAX #AVAXUSDT #CryptoBreakout #TechnicalAnalysis #Altcoins #BullishCrypto #DescendingTriangle #ReversalPattern #AVAXAnalysis

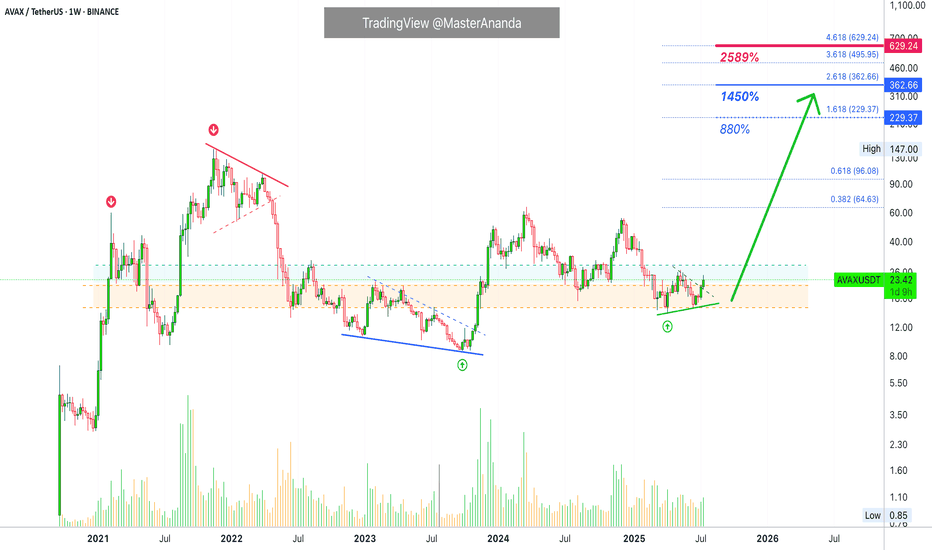

Avalanche's (AVAX) $229 & $363 Bull Market Potential ExposedStarting from the December 2020 low, Avalanche (AVAX) grew a total of 5,245% to its November 2021 all-time high. Now, if we take the true market bottom, when trading started back in September 2020 with a low of $0.85, total growth by the end of the bull market amounts to 17,152%.

It doesn't matter how you slice it, both are incredibly strong numbers.

Do you really think Avalanche will consolidate for years only to grow 500%, 600% in its bull market? I don't think so. This prolonged consolidation period was a test. Those that remained true to the market; those that continued to hold; those that continued to develop, to build and to grow within the market; all those people will be rewarded, big time.

Let's consider the true potential for AVAXUSDT in early 2026 or late 2025.

The main target is $229. I think missing a new all-time high is out of the question. We are going for the top as the market has been growing behind the scenes for so long. So much hard work has gone into making Cryptocurrency accessible to everybody and this hard work is about to pay off.

This $229 target opens up 880%. Keep in mind that this coming from current prices. If we were to consider the bear market bottom, this number would be much higher, something around 2,564%.

The next target, a "strong all-time high," is open at $363. This would give us a total profits potential of 1,450%.

As you can see, Avalanche is trading at bottom prices with plenty of room left available for growth. It is still very early if you focus on the long-term.

Thank you for reading.

Your support is appreciated.

Namaste.

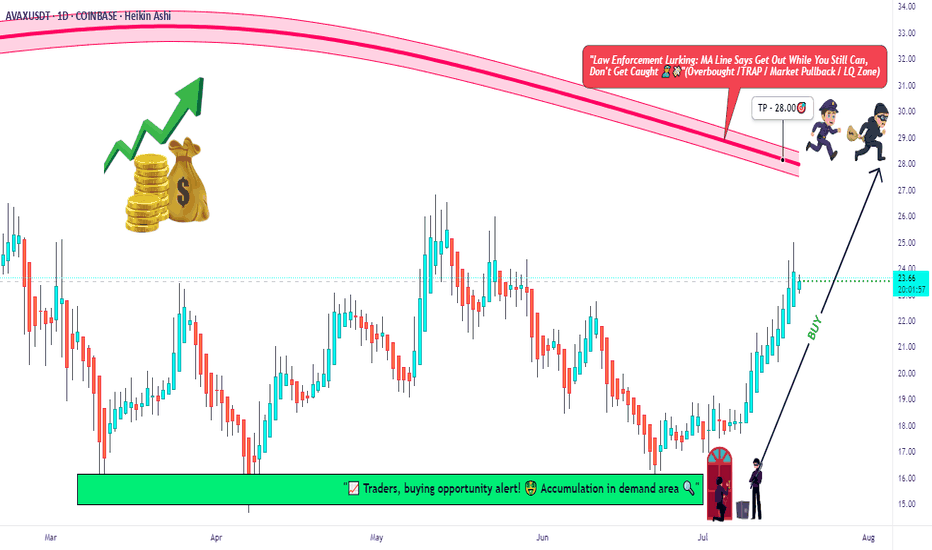

AVAX Long Only | Moving Average Trap Heist in Action🧨“Avalanche Crypto Vault Break-In 💣 | Thief Trader’s Long Playbook”⚔️💸🚀

(AVAX/USDT Crypto Heist Plan – Swing/Day Trade Blueprint)

🌍 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Welcome, Money Makers, Market Pirates, and Chart Snipers! 🤑💰💼✈️

This ain’t just another setup — this is a strategic crypto ambush on AVAX/USDT, cooked up with the 🔥 Thief Trading Playbook 🔥. We're planning a clean, no-fingerprint heist into the Red Moving Average Zone. That’s the liquidity vault, and yes — the police (market makers) are watching 👮♂️🚨... but so are we. Stay sharp. 💼🔦

💥 Mission Objectives:

🎯 Entry Point (The Infiltration Point)

"The vault's wide open! Swipe the Bullish loot at any decent price" 📈

Smart thieves wait for pullbacks on the 15m or 30m chart to plant their limit orders near swing lows/highs. Use layered orders (DCA style) to scale in like a pro. 💣🔁

🛑 Stop Loss (Your Getaway Exit)

Secure your trade. SL at the nearest wick low/high on the 1D timeframe (around 21:00 candle).

Your SL = your personal risk code. Choose it based on lot size & how deep you're inside the vault. 🎭🚫

🏴☠️ Take Profit Target (The Treasure Room)

🎯 Target: 28.00 USDT

...or escape early if the heat (volatility) gets too intense. Protect the bag. 💼💰

⚡ Special Note for Scalpers:

🧲Only operate on the Long Side.

If you’ve got deep pockets, smash in directly. Otherwise, ride with swing bandits. Use trailing SL to secure stolen profits. 🧨📉📈

🔍 Market Heat Map & Rationale:

The AVAX/USDT setup is flashing bullish strength, backed by:

🧠 On-Chain Metrics 📊

💡 Market Sentiment

📰 Macro Catalysts

🌐 Intermarket Synchronicity

📡 Go grab the full breakdown on:

⚠️ Red Alert: News Zones Ahead! 📰🚫

Avoid fresh trades during high-volatility news releases.

Lock in gains with trailing SL. Risk management is not optional — it’s the escape vehicle. 🚗💨

📝 Legal Talk (Don’t Skip):

This isn’t investment advice. Just a well-planned blueprint from a market thief.

You're responsible for your own loot and losses. 🎭📉📈

❤️ Boost the Brotherhood 💥

Smash the 🔥BOOST BUTTON🔥 if you found value.

Every boost powers our Thief Trading Gang’s next big score. 🚀💸

Stay tuned for the next heist plan. I’ll be back with more charts, more loot, and less mercy. 🐱👤📊💥

avaxpump"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

$AVAX Ready to breakout!CRYPTOCAP:AVAX looks ready to pop.

High Volume Node resistance and daily 200EMA is clear and now support. We don't want to see price rejected and moving back below this area.

The R5 daily pivot is my first partial take profit $35-36 followed by the major resistance High Volume Node at $48

Daily RSI is overbought with unconfirmed bearish divergence so watch out for this but should be good to run in the mean time. BTC permitting...

Safe trading

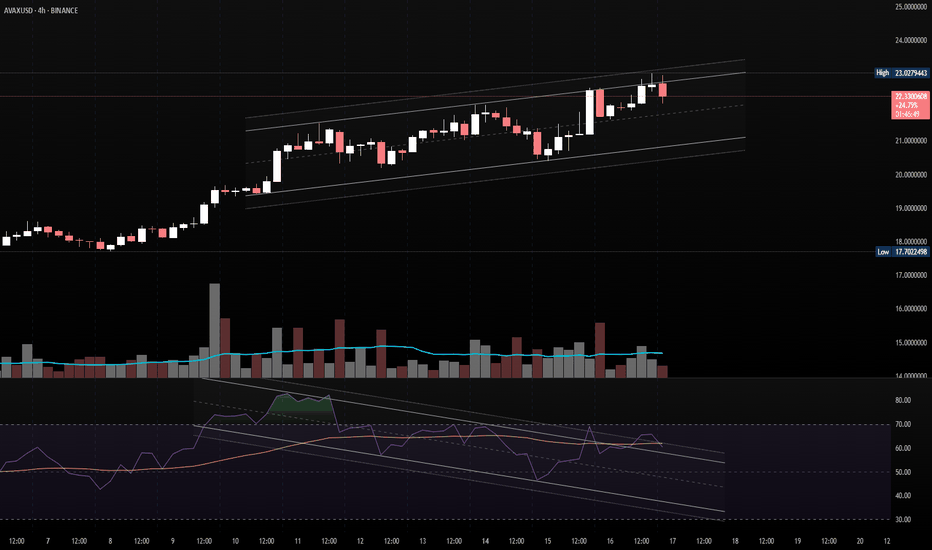

AVAXUSD - Possible Correction from Channel ResistanceStructure: Ascending Channel

Indicators: RSI Overbought, Bearish Divergence Forming

📌 Confirmation:

Look for:

A strong bearish candle or

RSI breaking below 60

Volume divergence

Bias: Short-term bearish correction, bullish structure intact as long as price holds the channel.

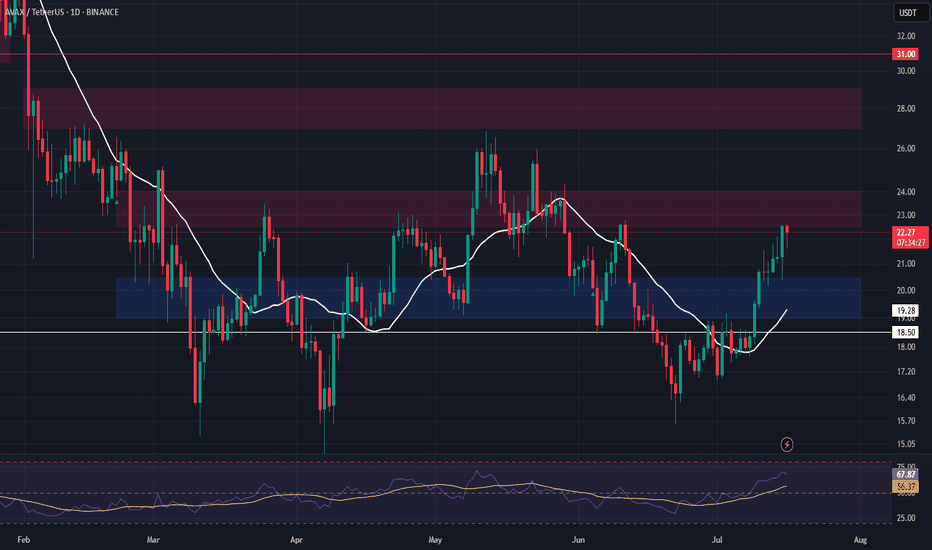

AVAX – Watching for Support Retest After Resistance TestAVAX is currently testing a major resistance level, and we’re anticipating a potential retrace into support. The $19.00–$20.45 zone offers a strong area to enter a long swing position on confirmation of the retest.

📌 Trade Setup:

• Entry Zone: $19.00 – $20.45

• Take Profit Targets:

o 🥇 $22.50 – $24.00

o 🥈 $27.00 – $30.00

• Stop Loss: Daily close below $18.50

AVAX/USDT - H4 - Wedge Breakout (29.06.2025)The AVAX/USDT pair on the H4 timeframe presents a Potential Buying Opportunity due to a recent Formation of a Wedge Breakout Pattern. This suggests a shift in momentum towards the upside and a higher likelihood of further advances in the coming Days.

Possible Long Trade:

Entry: Consider Entering A Long Position around Trendline Of The Pattern.

Target Levels:

1st Resistance – 21.77

2nd Resistance – 24.35

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

Avalanche, Why with Leverage? Exponential Moving AveragesOn the 10th of July AVAXUSDT finally managed to break above EMA55 and EMA89 on a very strong, full green candle. This is the day the market bias turns bullish and is fully confirmed. Bullish of course happens soon with the higher low, 22-June, but confirmation only comes after certain resistance levels are cleared, after the pair in question trades at a certain price.

Notice yesterday's candle, there was a rejection but prices remained above EMA89—blue dotted line on the chart. Today, we have a small candle with the same dynamics: A little lower then higher but still, above EMA89. The action is happening above 0.148 Fib.

These levels, EMA55, EMA89 and 0.148 Fib. extension all expose a strong support zone. As long as AVAXUSDT trades above them, we can expect maximum growth. That's why leverage is possible. With a well defined support range we can set the stop-loss right below and let the market take care of the rest.

Since both days failed to move prices lower, yesterday and today, and we know where the market is headed thanks to Bitcoin and the other altcoins that moved ahead, we can bet that Avalanche will grow and will do so strong. This is a safe bet.

Remember to do your own research and planning. Leveraged trading should be approached by experienced traders only. The same chart setup can be approached spot with minimum risk. Below 5X is also very low risk but higher is possible on this setup. Buy and hold, the market takes care of the rest. Great prices and entry timing.

Your support is appreciated.

Namaste.

$AVA/USDT is Heating Up Are We About to See a Big Move?NYSE:AVA is testing a key descending trendline on the 6H chart.

A breakout above this level could trigger strong upside momentum.

Immediate targets are $0.5605, $0.6237, and $0.6776 with the potential to reach $0.7690.

I'm watching for breakout confirmation.

DYOR, NFA.

TradeCityPro | AVAX Holds Key Support in Sideways Structure👋 Welcome to TradeCity Pro!

In this analysis, I want to review the AVAX coin for you. It’s another Layer1 and RWA project whose coin has a market cap of 7.48 billion dollars and ranks 16th on CoinMarketCap.

📅 Daily Timeframe

On the 1-day timeframe, as you can see, the price is sitting on a very important and strong support at the 16.46 zone, which I’ve marked as a range for you.

🔍 This range is where buyer makers are heavily present, and the price has touched it three times so far and has been supported each time. This shows the high strength of this zone.

✨ Currently, after being supported from this zone, the price has reached the 18.77 level and is fluctuating below this level. Volume is also gradually decreasing, and we have to see what happens next.

📊 If the volume keeps decreasing like this, the price will probably continue ranging between 16.46 and 18.77 until volume enters the market. But if strong buying or selling volume enters, the price can make a move and exit this range.

✔️ If buying volume enters and the price wants to move upward, we can enter a long position with a break of 18.77 and even buy in spot. A confirmation for this position could be the RSI breaking above the 50 level.

🛒 I personally consider this trigger suitable for a long position, but for spot I suggest waiting for a break of 25.78. More important than that is Bitcoin dominance, and in my opinion, as long as the long-term trend of Bitcoin dominance is bullish, buying altcoins is not logical and we have to wait until dominance changes trend.

📉 If the price wants to move downward and selling volume enters the market, the break of this same support range would be the best trigger. With a break of 16.46, we can enter a short position, and if you already bought this coin in spot, you can activate your stop-loss as well.

💥 A momentum confirmation for this position would be the RSI breaking below the 30 level and the oscillator entering the Oversell zone.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

Avalanche 2025 All-Time High, Accumulation & Bullish ZonesI am using $495 as the next bullish cycle top. The 2025/26 bull market all-time high. It can be more but it can also be less. We can only guess at this point because the Cryptocurrency market is just so young that everything becomes possible. We err by being conservative.

Avalanche is trading within a long-term accumulation zone. The best possible prices, literally.

The purple-rounded bottoms on the chart denotes an excess.

This year, 2025, the accumulation zone was activated in February. The action then moved within this orange-zone in March and this is where everything is happening now.

If you wanted to put tens of millions of dollars into this project at the best possible prices pre-2025 bull market wave, then you would need to do it based on the long-term. Back in July-August-November 2024 and February, March, April, June and so on 2025.

If you were to buy too big too fast it would push prices up. So whales wait months in order to accumulate. After years of accumulation at low prices, they send the signal and the market can move. Once the market starts moving, the consolidation/accumulation period is over, there is no going back.

The "neutral zone" here is light blue. This is already bullish but not ultra-bullish because there is no continuation inside this zone. Only when Avalanche (AVAX) moves and stays above it we can get a new bull market cycle. Since it only happens every four years, like clockwork, there is no need to guess.

Pre-2021 we buy as much as we can and sell when prices are high up. Post 2021 bearish, SHORT, SHORT, SHORT. After 2022 comes the transition period, the long-term accumulation and consolidation phase. In 2025 is the next bull market, this is where we are at now.

So now we can buy as much as we can but only with the intention to sell when prices are up.

An investor does not sell, only buys forever more. But still, if you are an investor, you shouldn't buy when prices are high. The time is now to accumulate on everything.

A trader sells every few weeks, every few months. Each wave. Buy support (low) and sell resistance (high). Buy low (red) and sell high (green).

You need to know clearly if you are trading or investing. Getting things confused can result in loses. Getting this topic confused simply means lack of planning.

We are entering a major bullish cycle and wave. This is not the time to be a trader if you've never traded before. This is the time to invest, accumulate; buy and hold. Sell only when prices are astronomically high.

When the bullish cycle is over and if you find a pair trading at support, you can buy to sell again within weeks or months. But not now. Now, after you buy, you hold. Makes sense?

We are in this together.

I love you!

Your continued support is appreciated, truly.

Namaste.

AVAX (Avalanche) Breakout? Here’s My Trade Plan.📊 Market Breakdown: AVAX/USDT (Avalanche)

Currently monitoring AVAX/USDT, and both the daily and 4-hour timeframes are showing a clear bullish break in market structure — a key signal that the momentum may be shifting to the upside.

That said, I’m not jumping in just yet. I’m only looking for long opportunities if specific criteria are met:

✅ A clean break above a key resistance level

✅ A retest of that level, followed by a failed attempt to move lower

If these conditions are confirmed, I’ll be watching for a high-probability entry from that zone.

🎥 In the video, I also walk through how to use several powerful TradingView indicators, including:

Volume Profile

VWAP

These tools help sharpen the edge and support decision-making in live market conditions. If the setup doesn’t materialize as expected, we simply stand aside — discipline is key.

📌 Disclaimer: This is not financial advice, just a breakdown of how I approach this potential opportunity.

AVAX/USDT Weekly Reversal Zone — Major Support Holding

🟨 CRITICAL ZONE (Key Support Area)

AVAX is currently trading within a major demand zone between $13.5–17.5, a historically strong support area that previously acted as the base for significant upward movements. Multiple weekly candles show rejection from this level, indicating buyer interest.

📊 Pattern Overview:

Double Bottom / Potential Triple Bottom:

The chart illustrates a clear double bottom structure, potentially forming a triple bottom, suggesting accumulation and reversal from the lows.

Bullish Projection Path:

The yellow arrow outlines a projected bullish impulse wave, targeting higher resistance levels if support holds.

📈 Bullish Scenario:

If AVAX maintains support at around $17.1:

1. Price may first test $20.25 (initial resistance).

2. A breakout above $20.25 could open the way to:

$24.98 (strong weekly resistance)

$32.75 (previous distribution zone)

$55.42 (major target/resistance zone)

3. In an extended bullish cycle, price could revisit:

$98.87, $110, and even $128.62 long term (2026+)

A confirmed breakout above $25 with strong volume would further validate the bullish case.

📉 Bearish Scenario:

If the $15–17 support zone breaks down:

1. Price could drop further to:

$11.00 (minor support)

$8.61 (historical low and weekly support)

2. This would indicate strong bearish pressure, potentially leading AVAX into a longer-term accumulation phase.

🔍 Conclusion:

This is a critical decision zone for AVAX. The technical structure shows signs of accumulation and possible trend reversal. However, if support fails, a deeper retracement could occur. Traders should watch this area closely for breakout or breakdown confirmations.

#AVAX #AVAXUSDT #Avalanche #CryptoReversal #TechnicalAnalysis #Altcoins #WeeklyChart #CryptoSupportZone #CryptoBreakout

#AVAX/USDT#AVAX

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower limit of the channel at 17.22, acting as strong support from which the price can rebound.

Entry price: 17.54

First target: 17.92

Second target: 18.22

Third target: 18.62

AVAX Analysis (1D)From the point where we placed the red arrow on the chart, it seems a correction has begun.

This correction appears to be a Diametric pattern, and wave E does not seem to be complete yet. It's expected that wave E will finish within the green zone.

The target could be the red box area.

A daily candle closing below the invalidation level would invalidate this analysis.

invalidation level: 10.90$

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

They want AVAX to look weak down here Everyone’s staring at the recent drop like it’s collapse. I see rotation into discount. AVAX is tagging the 0.786 retracement (17.27) — the same level that Smart Money builds into before it reclaims value.

Breakdown of the move:

The range top at 26.86 marked the premium; we’ve now delivered deep into the 0.786

No displacement through the previous swing low — yet

Structure remains intact if 14.66 holds — anything above that is deliberate discount rebalancing, not failure

This is where liquidity collects before decisions are made.

Execution lens:

Accumulation zone: 17.27–14.66

If bulls defend this pocket, 20.76 (0.5 fib) is the first draw, then 22.20

Final delivery window sits between 22.20–23.98 — where late buyers chase

AVAX doesn’t need a narrative. Price is the narrative.

Watch this base. And if it holds — don’t act surprised when it’s 20+.

For more setups that map where, not when — check the profile description.