AVAX Bull Run Loading!AVAX is showing signs of a strong bullish setup on the weekly chart, forming a double bottom pattern right at the lower support trendline of a long-term symmetrical triangle. This technical formation often indicates a potential trend reversal when confirmed with breakout and volume support.

Key Points:

-Double Bottom Support around $12–$14 with bullish momentum.

-Symmetrical Triangle structure compressing price for breakout.

-Breakout Zone near $27, a close above this level may trigger strong upside.

-Upside Target: Short-term Target- $45; Long Term Target - $125

Invalidation: A Break below $15 support could negate the setup.

Cheers

Hexa

CRYPTOCAP:AVAX BINANCE:AVAXUSDT

AVAXUSDTPERP

AVAXUSDT Double Bottom Confirmation.AVAX has formed a textbook double bottom pattern on the daily chart, signaling a potential reversal after months of downtrend. The neckline around the $27 zone has been broken decisively, confirming the bullish breakout.

Key Points:

- Double Bottom Structure: A strong bullish reversal pattern with a clean neckline breakout.

- Breakout Level: $27, which was acting as resistance for the past several weeks.

- Volume Surge: Noticeable increase in volume during the breakout, adding strength to the move.

- Target: $48–$50 region. ( Channel resistance)

-Stop-Loss Idea: Below $22.0

AVAX appears ready to trend higher as momentum builds. If bulls hold above the breakout zone, the rally may accelerate in the coming weeks.

Cheers

Hexa

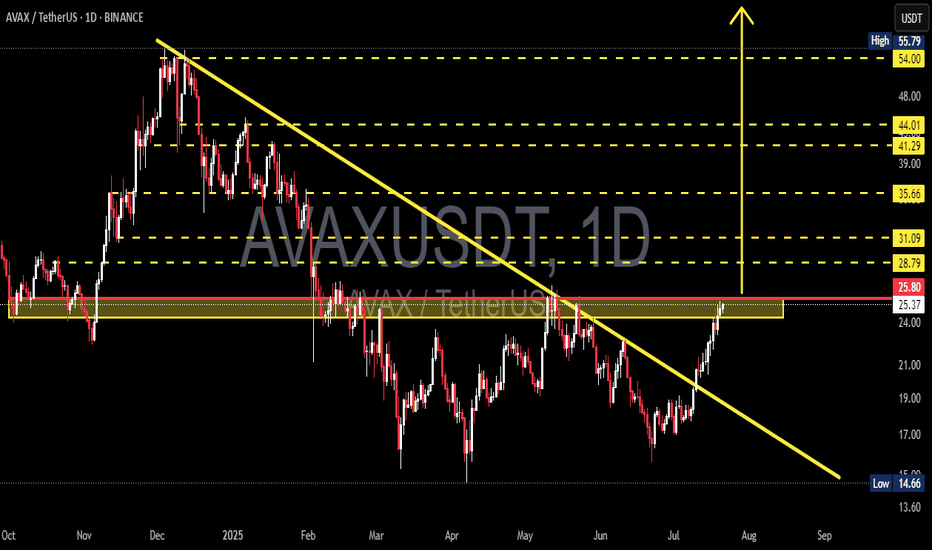

AVAX/USDT Massive Trend Reversal: Breakout from 8-Month DowntrenAVAX has just delivered one of its most technically significant moves in recent months. After spending over 8 months trapped under a descending resistance line, price action has finally broken free — suggesting a potential trend reversal and the beginning of a much larger bullish phase.

🧠 Pattern & Structure Breakdown:

📌 Descending Trendline Breakout

AVAX had been forming a descending triangle pattern, characterized by consistent lower highs and a horizontal support zone between $14.66 – $22. The recent bullish breakout from this structure, accompanied by strong volume, is a highly encouraging sign for bulls.

📌 Accumulation Zone Identified

The yellow zone on the chart ($14.66 – $22) has proven to be a strong demand zone where buyers consistently stepped in. The recent rally originates from this base, indicating possible institutional accumulation.

📌 Critical Horizontal Resistance at $25.80

Price is now testing the $25.80 resistance zone, which historically acted as a supply area. A successful daily close and confirmation above this level would officially flip the structure bullish.

📈 Bullish Scenario – Multi-Level Upside Targets:

If AVAX confirms the breakout above $25.80, these are the key bullish targets ahead:

🎯 Target 1: $28.79 – minor resistance & potential short-term TP zone

🎯 Target 2: $31.09 – previous price equilibrium

🎯 Target 3: $35.66 – key pivot from past market structure

🎯 Target 4: $41.29 and $44.01 – heavy historical supply zones

🎯 Target 5 (measured move): $54.00 to $55.79 – the projected breakout target from the descending triangle pattern

This move would represent a full technical recovery if AVAX aligns with broader market sentiment and Bitcoin remains stable or bullish.

📉 Bearish Scenario – Pullback Risks:

On the flip side, if price fails to sustain above $25.80 and gets rejected:

⚠️ A retest of $24.00 – $22.00 is likely

⚠️ If that zone breaks down, next support lies at $19.00 – $17.00

⚠️ A loss of the $17 level may trigger a return to the critical low near $14.66

This would invalidate the bullish breakout and return AVAX into a sideways or downward consolidation phase.

🔍 Additional Technical Insights:

✅ Volume is steadily increasing — showing renewed buying pressure

✅ Indicators like RSI and MACD (if applied) are likely showing bullish divergence

✅ Overall altcoin sentiment is improving, providing a tailwind for AVAX's potential breakout continuation

🧩 Final Thoughts:

AVAX is at a pivotal moment in its medium-term price structure. The breakout above the long-term downtrend line is a strong technical shift. A confirmed breakout and hold above $25.80 could trigger a multi-week or multi-month rally targeting $40 – $55+.

However, traders should be cautious of possible pullbacks and manage risk accordingly — especially as resistance zones from previous structures are being tested.

#AVAX #AVAXUSDT #CryptoBreakout #TechnicalAnalysis #Altcoins #BullishCrypto #DescendingTriangle #ReversalPattern #AVAXAnalysis

$AVA/USDT is Heating Up Are We About to See a Big Move?NYSE:AVA is testing a key descending trendline on the 6H chart.

A breakout above this level could trigger strong upside momentum.

Immediate targets are $0.5605, $0.6237, and $0.6776 with the potential to reach $0.7690.

I'm watching for breakout confirmation.

DYOR, NFA.

AVAX/USDT Weekly Reversal Zone — Major Support Holding

🟨 CRITICAL ZONE (Key Support Area)

AVAX is currently trading within a major demand zone between $13.5–17.5, a historically strong support area that previously acted as the base for significant upward movements. Multiple weekly candles show rejection from this level, indicating buyer interest.

📊 Pattern Overview:

Double Bottom / Potential Triple Bottom:

The chart illustrates a clear double bottom structure, potentially forming a triple bottom, suggesting accumulation and reversal from the lows.

Bullish Projection Path:

The yellow arrow outlines a projected bullish impulse wave, targeting higher resistance levels if support holds.

📈 Bullish Scenario:

If AVAX maintains support at around $17.1:

1. Price may first test $20.25 (initial resistance).

2. A breakout above $20.25 could open the way to:

$24.98 (strong weekly resistance)

$32.75 (previous distribution zone)

$55.42 (major target/resistance zone)

3. In an extended bullish cycle, price could revisit:

$98.87, $110, and even $128.62 long term (2026+)

A confirmed breakout above $25 with strong volume would further validate the bullish case.

📉 Bearish Scenario:

If the $15–17 support zone breaks down:

1. Price could drop further to:

$11.00 (minor support)

$8.61 (historical low and weekly support)

2. This would indicate strong bearish pressure, potentially leading AVAX into a longer-term accumulation phase.

🔍 Conclusion:

This is a critical decision zone for AVAX. The technical structure shows signs of accumulation and possible trend reversal. However, if support fails, a deeper retracement could occur. Traders should watch this area closely for breakout or breakdown confirmations.

#AVAX #AVAXUSDT #Avalanche #CryptoReversal #TechnicalAnalysis #Altcoins #WeeklyChart #CryptoSupportZone #CryptoBreakout

#AVAX/USDT#AVAX

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower limit of the channel at 17.22, acting as strong support from which the price can rebound.

Entry price: 17.54

First target: 17.92

Second target: 18.22

Third target: 18.62

AVAX About to Nuke Longs Before Pumping to $30?Yello Paradisers — are you prepared for the next major #AVAX move, or will you once again fall into the trap smart money is setting right now? The chart is screaming probable bullish continuation, but not before one final trick to flush out weak hands. We warned you before — and now the game is unfolding exactly as expected.

💎#AVAXUSDT has clearly broken market structure by forming a higher high, confirming a potential trend shift. However, price failed to close above the 25.82–26.93 resistance zone, leaving the bullish breakout unconfirmed. This hesitation right at a critical level increases the probability of a fakeout or liquidity sweep before any continuation.

💎Right now, we are hovering just above the ascending trendline, and based on current structure, the most probable scenario is a sweep of that trendline liquidity, grabbing stops from impatient longs before the market forms a clean higher low and reverses aggressively to the upside.

💎The green zone around 22.00–23.00, which previously acted as resistance, has now flipped to support. As long as price holds above this level, the bullish probability remains dominant. However, if we see a temporary dip below the trendline toward the 19.08 region, where support lies, that would likely be a classic liquidity hunt — designed to trigger fear, force early exits, and then reverse powerfully into the next leg.

💎And while both scenarios favor upside, it is the path of maximum frustration — likely a wick into 19.00 — that has historically proven most probable before larger breakouts.

💎A sustained move above the 26.93 level, especially on a daily candle close, would significantly increase the probability of continuation toward the major resistance between 30.00 and 30.74. This zone remains the main upside target in the short to mid-term.

💎On the other hand, if price closes below 16.67, that would invalidate this bullish outlook and open the door to deeper downside. Until then, structure remains bullish, and the higher-probability outcome still favors upside after a potential short-term shakeout.

This is the point where the weak hands get shaken out and smart money reloads, Paradisers. If you're aiming for long-term success, wait for high-probability setups and protect your capital. Strive for consistency, not quick profits. Treat the market as a businessman, not as a gambler.

MyCryptoParadise

iFeel the success🌴

AVAXUSDT 📊 BINANCE:AVAXUSDT Chart Analysis

AVAX price, after breaking the key resistance at 22.20, is showing a strong upward move 📈 toward the next resistance at the end of the second leg at 30.00 USD. The 22.00 level could act as a pullback and provide strong support 🔄. If it consolidates above 30.00, the uptrend may continue to 37.00 🚀.

Support and Resistance Levels:

Supports:

• 22.20 🛡️

• 20.00 🛡️

• 17.50 🛡️

Resistances :

• 30.00 🚧

• 37.00 🚧

AVAX Weekly Outlook – A Potential 558% Move Ahead?CRYPTOCAP:AVAX is coiling inside a massive multi-year symmetrical triangle on the weekly chart. This is a textbook structure where volatility contracts before an explosive move, and the setup looks nearly complete!

🔹 Entry Zone: Highlighted accumulation zone around CMP- $17

🔹 Breakout Target: If AVAX breaks out, we could see a move toward $147 (a whopping +550%)

🔹 Resistance to Watch: $45-$50 range – historical supply zone

🔹 Support: The Ascending trendline from 2021 continues to act as a strong base

Fundamentals Behind the Chart:

Avalanche (AVAX) is one of the fastest smart contract platforms in terms of time-to-finality. It supports Subnets (custom blockchains), which are gaining traction for scalable enterprise and gaming solutions. With growing DeFi and NFT adoption on Avalanche, fundamentals are aligning with this technical setup.

If this breakout holds, AVAX might become one of the best large-cap performers in the next cycle.

#AVAX/USDT#AVAX

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 21.50, which acts as strong support from which the price can rebound.

Entry price: 22.28

First target: 22.87

Second target: 23.44

Third target: 24.00

AVAXUSDT Ready to Explode? Avalanche ( BINANCE:AVAXUSDT ) has successfully retested its previous support zone, showing strong signs of a potential upward move. This retest confirms the level as a solid base, and the price action is hinting at a shift in momentum. Currently undervalued and flying under the radar, Entering the trade at this level offers a favorable risk-reward ratio, with the previous swing low acting as a logical stop-loss point. Once the market gains momentum, we could see explosive moves from $AVAX. As always, manage your risk wisely and never trade without a stop-loss. This could be the calm before the storm — don’t miss out on the next big wave!

BINANCE:AVAXUSDT Currently trading at $19

Buy level : Above $18.7

Stop loss : Below $17.5

Target : $25

Max leverage 3x

Always keep stop loss

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts

#AVAX/USDT#AVAX

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 18.22.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 19.12

First target: 19.55

Second target: 20.14

Third target: 20.74

AVAX/USDT: BIG CHANCEHello friends

As the price reached a resistance area, we witnessed a double top pattern that caused the price to fall.

Now the price has been able to recover by reaching a strong support area and with the continued power of buyers, you can buy within the specified ranges and we have also specified targets for you.

*Trade safely with us*

AVAX MID TERM IDEASummary:

Support Zone: $22.7 - $15.7 USDT (Demand Area).

Resistance Levels: $30, $35, and $45 USDT.

Short-Term: Downtrend continues, but signs of recovery can be monitored within the demand zone.

Mid-Term: A breakout above $30 USDT signals a potential trend shift.

Long-Term: If it recovers from the demand zone, the target range could extend to $45-$65 USDT.

Strategy:

Entry: Buy within the $22.7 - $15.7 USDT demand zone, with a stop loss below $15.5 USDT.

Targets: $30, $35, and $45 USDT.

Bearish Scenario: A drop below $15.7 USDT may increase selling pressure.

LITUSDT: Buyers Are Stepping In – Big Moves on the Horizon!The Chart Is Heating Up – Prepare for a High-Profit Opportunity

"LITUSDT is showing buyer activity, and let me tell you, this could be the start of something big. The market is alive, and smart traders are paying attention!"

What I See:

Blue Box Potential: The chart isn’t fully mature yet, but when CDV aligns, a lower time frame breakout happens, and volume profile confirms, the blue box becomes a golden opportunity for entry. This is how real gains are made.

Perfect Timing Matters: We don’t jump in without confirmation – precision and patience are the keys to success. Wait for the breakout, let the market show its hand, and then strike!

Key Points:

"As always, I’m watching CDV, volume profile, and liquidity heatmap closely to ensure every move is calculated. No guessing, just data-driven decisions."

LITUSDT is shaping up beautifully. This could be a chart for the books, so get ready to make moves with confidence. 🚀

Let me tell you, this is something special. These insights, these setups—they’re not just good; they’re game-changers. I've spent years refining my approach, and the results speak for themselves. People are always asking, "How do you spot these opportunities?" It’s simple: experience, clarity, and a focus on high-probability moves.

Want to know how I use heatmaps, cumulative volume delta, and volume footprint techniques to find demand zones with precision? I’m happy to share—just send me a message. No cost, no catch. I believe in helping people make smarter decisions.

Here are some of my recent analyses. Each one highlights key opportunities:

🚀 RENDERUSDT: Strategic Support Zones at the Blue Boxes +%45 Reaction

🎯 PUNDIXUSDT: Huge Opportunity | 250% Volume Spike - %60 Reaction Sniper Entry

🌐 CryptoMarkets TOTAL2: Support Zone

🚀 GMTUSDT: %35 FAST REJECTION FROM THE RED BOX

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🎯 DEXEUSDT %180 Reaction with %9 Stop

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

This list? It’s just a small piece of what I’ve been working on. There’s so much more. Go check my profile, see the results for yourself. My goal is simple: provide value and help you win. If you’ve got questions, I’ve got answers. Let’s get to work!

AVAX LongAvax bounced at 34.50, where there's strong support= EMA 200 on the daily chart. At the moment, we have broken the trendline and are currently testing prev week mid and monday mid also previous small rezistance.

If we manage to hold, I expect the price to shoot up to 38.96, and from there, I anticipate the price will go back to test the level of 37.68. If it holds, I’ll be opening a trade.

If you want you can buy now: TARGET - 38,90

SL- 37,09