EURUSD intraday gains expected above 1.1410The euro currency remains well supported against the US dollar in early Monday trade, following a dovish speech from Federal Reserve Chair Powell on Friday. The EURUSD is expected to advance higher on an intraday basis while the pair trades above the 1.1410 level. A daily price close above the pairs 100-day moving average is essential for further technical buying in the EURUSD.

The EURUSD pair is intraday bullish while trading above the 1.1410 level, key technical resistance is found at 1.1470 and 1.1500 levels.

If the EURUSD pair moves under the 1.1410 level, further losses towards the 1.1360 and 1.1330 levels remain possible.

Average

Finding support on the 200 week moving averagethe BLX chart has the cryptomarket charted since 2011 and during that charts entire existence we have always held support above the 200 week moving average (in blue) We have now touched it again and are seeing a relief bounce....judging by the weekly stochrsi we will likely see a nice bounce here. However I think t his rally may be temporary I think we may ultimately maintain support on the 200 weekly moving average but we may revisit and throw a wick well below it for our capitulation candle (around february) although we may still close that capitulation candle above the 200ma as well. A good time to be long temporarily but remember we likely haven't seen our capitulation candle just yet.

BTC: Averaging short in 5300. Averaging short in 5300. Very risky operation.

Investors entering with short positions should be careful with the possibility that these last day moves are a false bearish break.

In the last few days we have opened short positions in several futures of the blockchain sphere for the next 2 months. Our target for Bitcoin -5.65% in January/February is 3,000 to 2,000 dollars.

The triangular pattern that BTC -5.65% crossed bearishly had a volatility of 2300 points, so the first bearish trend that Bitcoin -5.65% should have is 6000 minus 2300. The result is 3700, and if the price falls from its 3400 support level , 1 BTC -5.65% could cost around $2,000 in January-February 2019.

The most likely scenario is that Bitcoin -5.65% will fall to its support lows, with the MM210 on the weekly chart being its strongest resistance. We will not be in an uptrend until the price is > MM70 which is > MM210, with both MM being bullish . For that situation, we could easily wait until 2020.

MA200 resistance, will BTC manage to break through?It looks as if BTC could make it this time, however there are still mixed signals.

Daily has been overbought for a while now, like the last two tops, when BTC price hit exactly the MA200 line.

Shorts are coming down fast, longs rising, so if BTC doesn't break through fast enough, it could go down again.

I have to admit that I am undecided right now.

I will just wait and see if BTC makes it through the MA200, if yes, I am getting more bullish again short and mid-term (longterm I am as always ultra bullish hehe).

HOW does a Moving Average work? #EZ-Learning by EXPLANATIONHey tradomaniacs and becoming traders,

here some more education for you and especially for those who started trading and heared about that weird thing called Moving Average.

I hope you enjoy it and learn something.

If you need more education just check my videos and posts tagged as education.

Peace and happy learning

Irasor

Trading2ez

Wanna see more? Don`t forget to follow me.

Any questions? Need more? PM me. :-)

USOIL-Weekly... Check it outOff pitchfork in an ending diagonal, 800MA on weekly. Equal length to the first 3 wave move... Just did a flat correction and broke out bottom, Oil news coming. Safest to time entries on the pullbacks. It is technically possible for it to come down A LOT. Check your fundamentals.

Bitshares on sale today!There's a lesson to be learned every day! For me the lesson is: always "cost average" into a position. I was too lazy to ladder in, so I bought at the .618 retracement, and unfortunately we dipped deeper.

Putting it more correctly: unfortunately for me, because for those who didn't buy Bitshares is on sale today! We've briefly dipped below the long-term support trendline, most likely to go to the .886 retracement. Given the low low low RSI's we're seeing on multiple timeframes today.

I think you need to be blind not to scale into BTSBTC at the moment so if you ask me: start accumulating, and set your stop loss right at the 100% retracement, then move up the stop loss as soon as price goes up for a free trade.

why bitcoin isn't dead and will go up soonI drew the original trend line back in mid 2017, as you can see, we had exponential growth, and of course the winter crash.

After the major crash, it touched the original trend, with only a shadow, and then tested it 2 more times, both bottoming out at the bottom of that trend line. We can see this is an extremely strong trend line, dating all the way back from March of last year.

I believe after the rest of the mt gox funds are dumped, and if any remaining governments decide to ban crypto, we will finally break out of this trend again.

With bitcoin becoming more of a store of value, and safe haven from trading alts, it acts more like a long term investment, or the stock market average.

GBPUSD CABLE Fundamental Analysis - Fibonacci & Moving Averages- See thumbs up, 5 day MA moves upwards cutting across the 10 day MA. (1st Bull Signal)

- If the 5 & 10 day MA's continue upwards and cross the red 50 day MA (Buy Signal)

- See fib level 0.7 & 0.3 for key price action areas

- Use other fib levels for Stop/Loss & T/P

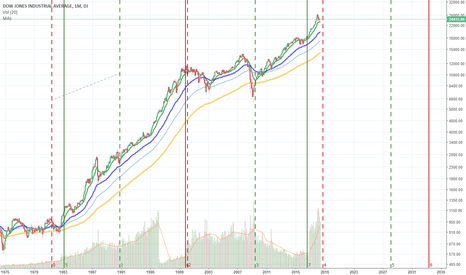

DJIA Dow Jones - Market Cycles LESSON TWO - Studying 2 cyclesLesson Two

The market is more predictable that we have been led to believe.

We will now study the effects of both the 17 year half-cycle and the 9 year half-cycle which are occurring at the same time.

There are many other cycles or sine-waves occurring in DJIA and in other markets as well, but for now we will just focus on these two cycles.

Please see the Lesson One link below for an introduction to how market cycles work.

As I said in the other ideas, the Green line occurs at the trough (low-point) of the cycle and the Red Line occurs at the peak of the cycle. The GREEN ZONE is the period starting at the GREEN LINE to the red line. The RED ZONE starts at the RED LINE and goes to the GREEN LiNE. Growth is strongest in the GREEN ZONE, especially at the end of the green zone. Growth is weakest during the RED ZONE, especially at the end of the RED ZONE.

With TWO CYCLES, there are Green zones and Red Zones. When it is a time period where both cycles are GREEN ZONES, GROWTH is the strongest. When one is red and one is Green, the forces counteract each other. When both zones are RED, growth is the weakest and corrections are stronger.

All of the cycles are still part of a very long term growing economic cycle. It's hard to calculate when this long-term cycle began due to lack of data in the 1700s and 1800s. So due to that, it is hard to know when this long-term cycle will end. But this long-term growth cycle is what keeps the markets overall moving up, despite various corrections.

In this chart the SOLID GREEN Lines are the green lines from the 17 year cycle. The 17 year cycle is stronger, but it takes longer to complete. The DOTTED Lines are the 9 year (approx) cycle which I showed you on the Nasdaq. This 9 year cycle also fits the DOW, I suppose because they are both US Stock market indexes.

You can see how these cycles interact with each other. Growth is stronger when both cycles are green. The DOT.COM Bubble burst after both the 17 year GREEN cycle and the 9 Year Green cycle ended around the same time. They both went into a RED cycle until 2009 where the 9 year cycle became GREEN. The 17 year cycle did not become green until 2016, and afterwards the market growth really picked up. Now we are approaching the end of the GREEN 9 year cycle which ends around November 2018. Stay with my ideas and will will try to calculate shorter cycles to determine where the current market peak is going to end.

I think it points to a recession coming, maybe 2019. But due to the 17 year green cycle, it probably won't be end-of-the-world type market crashes. The 9 year cycle will be red until 2028 where it turns green. The 17 year cycle is green until 2033. There is still the possibility of doing something like the predepression bubble after 2028 when both cycles are green at the same time. Even if not like that, it is likely to have a bubble of some sort after 2028 due to both cycles being green.

Please click like if like the idea. Give comments or questions for clarifications how two cycles interact together. I hope I have explained this well enough.

Stay tuned, we will try to focus on a closer cycle to see if we can get a more accurate time period for a market top in 2018.

GOLD - Fundamental / Decision-Making AnalysisFibonacci Ratios

- 0.786 / Price level: 1310 - 1315

- 0.382 / Price level: 1290 - 1292

See these as key areas for price action, so buy or sell orders could be placed here if the below indicators are fulfilled. Could also use 0.236 & 1 ratios as positions for stops etc

Moving Average 5 Day (GREEN)

- 5 day moving average has cut across the 10 day moving average towards the downside (Bearish indicator NOT A SELL SIGNAL)

Moving Average 10 Day (YELLOW)

- If the 10 day moving average, along with the 5 day moving average, breaks through the 50 day moving average towards the downside (Bearish indicator POTENTIAL SELL SIGNAL)

- If the 5 day moving average cuts back across the 10 day moving average towards the upside (Bullish Indicator POTENTIAL BUY SIGNAL)

Moving Average 50 Day (RED)

- If the price cuts across the 50 day moving average on to the downside (Bearish indicator) (Currently confirmed)

- If the 5 & 10 day moving averages cut across the 50 day moving average on to the downside (Bearish indicator - Look for a break of the blue trend line for further confirmation)

- If the 5 & 10 day moving averages stay above the 50 day moving average (Bullish indicator)

This is not any form of financial advice.

Good Luck

ps. consistency

GBPJPY Fundamentals / Decision-Making Analysis Fibonacci Ratios

- 0.786 / Price level: 148.000

- 0.382 / Price level: 145.000 - 145.750

See these as key areas for price action, so buy or sell orders could be placed here if the below indicators are fulfilled. Could also use 0.236 & 1 ratios (and their accompanying lines) as positions for stops etc

Moving Average 5 Day (GREEN)

- Both 5 & 10 day moving averages have failed to break through on to the upside of the 50 day moving average (Bearish in the short run - see thumbs down)

- However, the 5 day moving average has recently broken through to the upside of the 10 day moving average (see thumbs up) this could be seen as the first indicator showing the need for a future correction (Bullish indicator NOT A BUY SIGNAL THOUGH)

Moving Average 10 Day (YELLOW)

- If the 10 day moving average, along with the 5 day moving average, breaks through the 50 day moving average (Bullish indicator POTENTIAL BUY SIGNAL)

- If the 5 day moving average cuts back across the 10 day moving average towards the downside (Bearish Indicator POTENTIAL SELL SIGNAL)

Moving Average 50 Day (RED)

- The 50 day moving average has consistently been above the price since the 23rd of this month, showing a downward trend.

- The 5 & 10 day moving averages have failed to break through the 50 day moving average on to the upside.

- If the price cuts across the 50 day moving average on to the upside (Bullish indicator)

- If the 5 & 10 day moving averages cut across the 50 day moving average on to the upside (Bullish indicator)

- If the 5 & 10 day moving averages stay below the 50 day moving average (Bearish indicator)

Just some analysis based on moving averages and fibonacci ratios, hopefully this sort of thing will provide an edge during such choppy times. At current, my position is long IF further indicators are met.

This is not any form of financial advice and does not endorse any form of trade.

Good Luck

Ps. cut your losses

Bitcoin BTC - The End is Nigh or To The SkyOverall view of Market direction using the weekly to foresee possible exit/rise positions.

Break of Weekly 50MA is worrying as has been years since this was the case.

Rapid rise during Nov/Dec gave little chance for supports to be established under $5800 and would worry most investors if the possibility arose.

1st July (which may see action early, due to 20th June Cboe Ftuures expiry/27th June CME Futures Expiry) will be decisive as Trend Line (dashed blue line) which has been a resilient support during entire crash, its actually been the saving grace & would be concerned if broken, meets the Ichimoku cloud (years since been broken). Direction is dependent on current fight between bulls/bears @ $7900 & where the markets heads leading into this timespan.

Manipulation on speculation of Futures at the end of the 2017, I believe rose the price from $2000 - $20000 so it would be feasible that if funds are removed in range under $5800 due to risk would add pressure downwards (would exchanges "allow" BTC to get to these prices?) ....cause I worry Volume not setting mean reversions as we are back on low 24HR BTC - 4Bln

Sharp price action rose BTC to $10000 at the start of April from $6600, so again this should be taken as possible support bottom which seems again would need manipulation to impede further downward pressure.

Would love to see Positive news...which should come in the short term, whereas Weekly chart poses that BTC has a decision that will eventually provide forward direction, my previous analysis showed $10000 July so lets hope for little wins up to that point.

BTC is seeing some tough times , so I should write this:

***Education Purposes only***

Multiple Moving Averages (10 Moving Averages In One)Got tired of having multiple moving average indicator on the left side of charts. Wrote this to reduce the long list of indicators on the left of the screen. Allows you to set 4 EMA and 4 Simple Moving Averages with one indicator.

Allows you to have 4 Simple Moving Averages and 4 Exponential Moving Averages with 1 indicator. Also, added a Period High simple moving average and a Period Low simple moving average.

FTSE Moving Average 5,10,50 Fib Analysis H1The Situation H1 :-

- 5 Day MA (Moving Average - Green) crosses 10 Day MA (Yellow) - Bull (see first thumbs up)

- 5 & 10 Day MA cross 50 Day MA (Red) - Bull (see second thumbs up)

- See Top Fib level for swing price action, predictive indicators below;

1) As long as 50 Day MA stays below 5 & 10 Day MAs - Bull/ Level Broken Higher Highs

2) If 5 Day MA & 10 Day MA do not go much higher and the 50 Day MA catches up and pulls higher, around top fib level - Bearish

3) If 5 Day MA crosses back over 10 Day MA and heads further down - Bearish

- Same as above applies to the Bottom Fib level just visa versa.

- See other fib levels as areas of resistance for entries and stops/TP etc

GG

Simple Moving Average Set 20,50,128,200 (Exponential optional)There's similar ones out there to this. I changed the commonly used 100 to 128 since I've found it more in tune with BTCUSD

I also have the colors:

Gray for the 20 MA

Blue for the 50

Lime for the 128

Red for the 200

Stock is SMA, If you prefer to use Exponential you can check the box in the settings

...I more often use the SMA

NCASH Business Model sense cf. other alt coinsNCASH coin has distribution through the worlds retailers in their sights. The model is simple and a potentially attractive investment at this early stage. The idea is retailers reward customers for visiting their store with NCASH direct to their wallet. When a customer makes a purchase they are rewarded with more NCASH. The retailer requests information on the customer, if they accept the customer is rewarded with more NCASH. Retailers get NCASH when they exchange information on in-store customers with other data providers. When a retailer requests information on a customer from another retailer, the customer is asked to authorize. If they accept, the retailer gets NCASH from the other retailer and the customer gets NCASH from the first retailer.

The customer can redeem NCASH through various Nucleus.Vision partners.

Bull Run is taking a breather price action @ 200EMA resistanceThe bulls need a breather after that exciting run and have been stopped at least temporsrily in their tracks when the 200 EMA(in orange) closed the gate on them....Now that the bulls have had a taste, their hunger is probably running wild and they may very well be able to burst through the 200EMA gate and just above it the 200 SMA wall as well when they retest it...won't be easy but I'd say after maybe a minor retrace they could very easily regain a second wind...therefore my advice is to not make any major moves at this time.... but if you're able buy the dips to the support line. If now that the price has both closed yesterday's candle at the 200day EMA and bounced down off of that same 200 day EMA(once again in orange) to start the new candle I'd say the odds are very likely that it could act as temporary resistance as the bulls take a breather. Buy the dips once we figure out where solid support is. (Most likely the T line(in yellow) This is only what I would do anyways, not financial advice of course...you do you and best of fortunes to you in all your trading.

ETC - starting to break out?According to Brandon Kelly's method, ETC seems to be breaking out of last cicle.

As you can see from chard above, we have alredy finished break out and break down, currently in flat line phase. (Red lines on the chart)

Both, MA 7 and MA 77 have alredy crossed MA 231, which is good sign. Even better, MA7 just crossed MA 77 so I think that we can expect long run towards all time highs.

Thoughts?