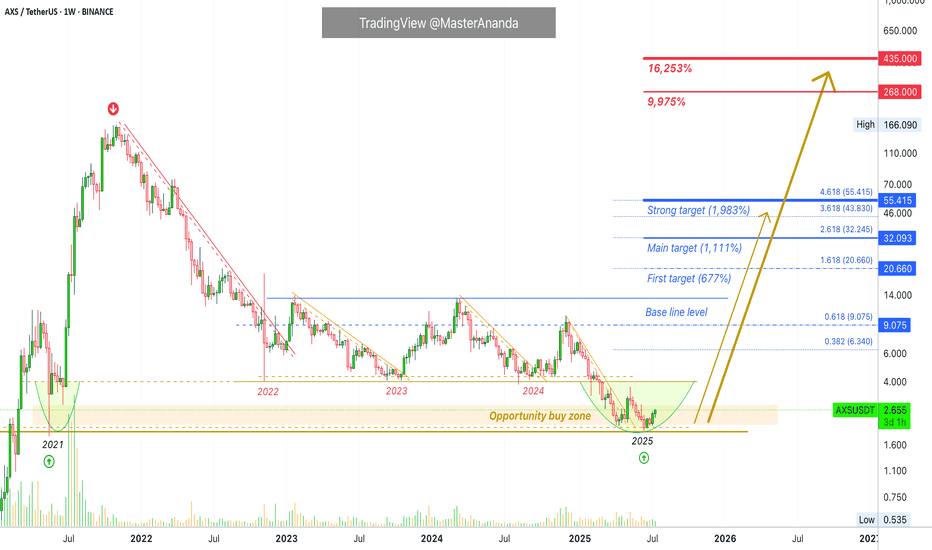

Axie Infinity Trades Within Opportunity Buy Zone · (PP: 16,253%)Right now Axie Infinity is trading within the "opportunity buy zone," this is a level just below the support zone from 2024, 2023 and 2022. It is trading in this zone searching for liquidity. Once this move is over, AXSUSDT will never be available at these prices in the future. The lowest will be the long-term support zone from 2022-2024.

Can Axie Infinity hit a new all-time high in 2025 or 2026? It is possible. But, in this chart setup and analysis we are focusing on high probability conservative targets.

"Back to baseline" is the very easy target. The first target after that sits around $20 for 677%. The main target goes higher, $32 for 1,111%. A strong target is $55 and this one opens up 1,983% profits potential.

A new all-time high can be $268 & $435. Really huge numbers. Just to give you an idea, the second one would be equal to 16,253% profits potential. The first one, $268 would be equal to 9,975%. This is theoretically possible so I don't want to commit to it but is good to keep an open mind with market conditions improving at the speed of light. If we can say there is such a thing.

Technical analysis

The bottom in 2025 matches the mid-way stop of the 2021 bull market. So this is an interesting and valid zone for a reversal.

We don't need to go any deeper in looking for reversal signals because a marketwide bullish bias is already confirmed. We've been bullish since 7-April 2025. Some pairs move first others later though and that's why some are already very high while others are very low. This is good because it gives us time to adapt to the market. If everything were to move together at the same time on the same date, it would be too late to buy anything low. Because the market cycles through different sectors, groups and pairs, we can buy the ones that are low now knowing that they will eventually move ahead. Everything grows. Everything will grow. The 2025 bull market is already confirmed.

Thanks a lot for your continued support.

Namaste.

Axie

#AXSUSDT #4h (Bitget Futures) Falling wedge breakout and retestAxie Infinity just pulled back to 50MA support where it's bouncing, looks ready for recovery towards 200MA resistance and more.

⚡️⚡️ #AXS/USDT ⚡️⚡️

Exchanges: Bitget Futures

Signal Type: Regular (Long)

Leverage: Isolated (4.0X)

Amount: 4.7%

Current Price:

2.509

Entry Zone:

2.489 - 2.407

Take-Profit Targets:

1) 2.758

2) 2.991

3) 3.224

Stop Targets:

1) 2.189

Published By: @Zblaba

NYSE:AXS BITGET:AXSUSDT.P #4h #AxieInfinity #P2E axieinfinity.com

Risk/Reward= 1:1.2 | 1:2.1 | 1:3.0

Expected Profit= +50.7% | +88.7% | +126.8%

Possible Loss= -42.3%

Estimated Gaintime= 1-2 weeks

Axie (AXS) Structure Analysis (1W - Log)After retesting the ~$2.0 demand zone, BINANCE:AXSUSDT broke out of its recent downtrend and could be headed for an attempt to reclaim the ~$4.0 S/R.

Key Levels to Watch

• ~$2.0: Demand zone dating back to May 2021, and current support. Any sustained break below it would invalidate any bullish TA.

• ~$4.0: Previous multi-year key support, and likely a strong resistance. Reclaiming it would flip the bias to bullish. It also aligns with the 200-day EMA, which has been very relevant for AXS in the past.

• ~$13.0: Multi-year S/R, and a reasonable target if ~$4.0 is reclaimed.

Still in a No-Trade Zone for me, until ~$4.0 is successfully reclaimed.

Can Axie Infinity Grow 8,000%? Let's Ask The ChartAxie Infinity is recovering from a final flush episode this week. The action just turned green after AXSUSDT hit the lowest price in 4 years, since May 2021.

First, it is still early for buyers and Cryptocurrency traders. Why? Because the action is happening at bottom prices. Just look at the chart, truly low prices as AXSUSDT is still trading below its 3-Feb. low but recovered above its March low already.

The recovery above the 10-March 2025 low within a single candle reveals that the bottom is already in. The final drop, which was a strong shakeout or stop-loss hunt event, not a bearish impulse, is over.

On the left side we can see the bear market wave. It lasted an entire year from November 2021 through November 2022.

This bear market is followed by a neutral-sideways market. This is the transition period.

Now the market is set to turn ultra-bullish but before this bullish cycle there is one final shakeout and that's the drop from December 2024 until April 2025. This move is intended to activate the stop-loss of thousands of traders. Once these people sell lower than what they bought, the market changes course. This is why I do not recommend using a limit stop-loss.

As soon as the multi-year low is hit, the market turns green. This is what is happening now, just watch! Axie Infinity is set to grow long-term.

Buy low to sell high.

Never set a stop-loss limit order on an exchange, it is a recipe for disaster. It is better to wait patiently because the market will recover and will produce strong, sustained, long-term growth.

I have two set of targets, the easy-local targets and the "global" targets.

The easy targets are 560%, 927% and 1,660%. The global targets include the potential for a new All-Time High. We will have to wait and see. I don't know of these purple targets will hit, but is good to be prepared.

Hope for the best and prepare for the best.

Thank you for reading.

Namaste.

AXS-4h- Accumulation RangeAXS-4h- Accumulation Range

REMEMBER that a lot of investors sell stocks or crypto for fiscal conditions in 2024 to close the year.

For that, we have low buy liquidity , and even with that pressure on the price , AXS is trying to remaning in the same range as 1 week ago, so a breakout can restart a new HH , so patience.

Im bullish on AXS if 7.0 will be broken and confirmed as support.

$ AXS | How do I expect to see AXS in coming weeksLet’s dive into another crypto asset analysis from the gaming sector to see if it has any chance to make us more money. This time I picked Axie Infinity with the AXS ticker. Most have heard of this famous project, but for those who have not known about the project, here is the CMC info on BINANCE:AXSUSDT

Axie Infinity is a blockchain-based trading and battling game that is partially owned and operated by its players.

Inspired by popular games like Pokémon and Tamagotchi, Axie Infinity allows players to collect, breed, raise, battle and trade token-based creatures known as Axies.

These Axies can take various forms, and there are more than 500 different body parts available, including aquatic, beast, bird, bug, plant and reptile parts. Parts from each type class come in four different rarity scales: common, rare, ultra rare and legendary — and Axies can have any combination of body parts, making them highly variable and often rare and unique.

Each Axie is a non-fungible token (NFT) with different attributes and strengths and can be entered into 3v3 battles, with the winning team earning more experience (exp) points that are used to level up an Axie's stats or evolve their body parts. These Axies can be bred together to produce new and unique offspring, which can be used or sold on the Axie marketplace.

The Axie Infinity ecosystem also has its own unique governance token, known as Axie Infinity Shards (AXS). These are used to participate in key governance votes and will give holders a say in how funds in the Axie Community Treasury are spent.

BINANCE:AXSUSDT

Market Cap: $ 1.45 B

Market Cap Rank: 95

Market Price: 9.31 $

ATH: $ 165 (-94%)

ATL: $ 0.1234 (+7414%)

Technical highlights:

- W1:

Trend:

Price has been in a parallel channel for 800 days. We had the last LL in Nov.2022 at $ 4. After that price tested that level twice and both times bounced. Price managed to break local resistance level from $ 6.00 to $ 6.6 with sharp candle and good volume. That was a clean break through but price remains in the parallel channel. The point is, price trend from downtrend turned to sideways and many times (not all times) sideways after a long downtrend means accumulation phase. Still we need to check volume and I checked OBV. OBV increased in this sideway phase (769m to 885m) so people bought more in this 800 days.

the next hints.

MA: Price holding above MA20 in monthly time frame. In the weekly time frame, MA20 located below MA50 but with the help and support of MA20, price jumped above MA50 at $ 6.94. MA50 acted as support and been tested successfully last week. On the other hand, in the daily time frame, price hovers above MA20, 50, and 200 and says bulls are in control.

RSI: The value is around 67.9 and is strong in the weekly time frame, which supports the local bullish trend direction. The RSI value in the daily time frame is 68 and it’s almost at the same value of W1. The difference is the RSI in D1 turned into overbought twice and printed a bearish divergence. So, I think there will be a cooldown before any major growth for a healthier growth.

Stoch RSI: The Stochastic RSI in W1 is in the overbought zone. That’s another reason to expect a retracement.

The Darvas Box:

Charts sometimes create patterns with repeating results. That’s why we use them to predict the next move of the trend. In the accumulation phase, there are many patterns that can help us earn profit by following them, but most of them need to be observed and backtested every day to see if they’re still working and reliable. The Dravas box is one of the patterns that can be seen in accumulation periods. Simply put, it’s a sideways (trend must clarify the range high and low) move that eventually breaks above the 52-week high with increased volume. In this chart, the price is still located below the 52-week high ($13.5) and it is still early to call it a box, but if that happens anytime, then the price will most of the time increase for days.

In addition to volume increase, we must observe the absorption of supply at 52 weeks' high. Meaning the price needs to stick right below that level for a few days before the breakout, and it’s better to see OBV increase for more confirmation.

Gaming tokens are still underwater and haven’t moved like other assets like MEME coins, but I believe this is a good time to pick some of the best gaming tokens with real use cases and a well-known team.

In my point of view, channels play an important role in trend direction and targets.

Supports:

$ 8.00 at Ma20 in D1

$ 7.00 at Ma50 in W1

$ 6.00 last known resistance break

Resistances:

$ 10.7 D1 Supply zone

$ 13.50 Range high / 52 weeks high

$ 19.00

$ 23.00 MA200 in W1

$ 45.00

$ 65.00 W1 local high

$ 100 W1 supply

Conclusion:

All these opinions are mine and can be wrong, so please DYOR.

This token is one of the best gaming token with many users and strong community. I will buy partially on the possible pullback. Please always do the risk management.

** In addition to the volume increase, we must observe the absorption of supply at the 52-week high. This means that the price needs to stick right below that level for a few days before I need more energy to carry on, which is provided by your support. Don't forget to hit boost, share, and comment on your point of view with me. **

My strategy goes as below:

🛒 Pair: AXS/ USDT 🛒

👑 Bitcharge 👑

🕰 08/12/2024 🕰

POSITION: 🟢"Buy"🟢

2 % of capital

🛒 Buy: $ 9.3 (10%) – $ 8 (20%) – $ 7 (30%) - $6 (40%)🛒

👉Sell Targets👈

🎯TP1: $ 10.6 🥉

🎯TP2: $ 12 🥈

🎯TP3: $ 13.4 🥇

🎯TP4: $ 15 🚁

🎯TP5: $ 17 ✈️

🎯TP6: $ 19 🚀

🎯TP7: $ 23 🛰

🎯TP8: $ 33 🛰

🎯TP9: $ 45 ✨

🎯TP10: $ 55 ⭐️

🎯TP11: $ 65 💫

🎯TP12: $ 75 🪐

🎯TP13: $ 85 🌞

🎯TP10: $ 98 ⭐️

🎯TP11: $ 110 💫

⛔️ SL: $ 5.10 ⛔️ by closing W1 Below

--Stay rich--

#AXSUSDT #1D (Bybit) Big falling wedge breakoutAxie Infinity regained 50MA support after a long downtrend, looks ready for mid-term recovery towards 200MA resistance.

⚡️⚡️ #AXS/USDT ⚡️⚡️

Exchanges: ByBit USDT

Signal Type: Regular (Long)

Leverage: Isolated (2.0X)

Amount: 4.6%

Current Price:

5.202

Entry Targets:

1) 4.854

Take-Profit Targets:

1) 6.947

Stop Targets:

1) 3.805

Published By: @Zblaba

NYSE:AXS BYBIT:AXSUSDT.P #Axie #NFT #P2E axieinfinity.com

Risk/Reward= 1:2.0

Expected Profit= +86.2%

Possible Loss= -43.2%

Estimated Gaintime= 1-2 months

Axie Infinity (AXS)Axie Infinity is a blockchain-based trading and battling game in which you can collect, breed, raise, battle, and trade NFT token-based creatures known as Axies. Anyway, after the super upward wave of AXS finished, it entered into a correction, a long one. Now, it seems AXS is trying to break the downtrend line. If successful, the next impulse wave might have begun.

AXS (Axie Infinity) Falling WedgeTrade setup : Price is in a Downtrend, however, it's trading in a Falling Wedge pattern, which typically resolves in a bullish breakout and a trend reversal. We wait for such a breakout.

Patterns : Falling Wedge Usually results in a bullish breakout . When price breaks the upper trend line the price is expected to trend higher. Emerging patterns (before a breakout occurs) can be traded by swing traders between the convergence lines; however, most traders should wait for a completed pattern with a breakout and then place a BUY order. Learn to trade chart patterns in Lesson 8.

Trend : Short-term trend is Strong Down, Medium-term trend is Strong Down and Long-term trend is Strong Down.

Momentum : Price is Oversold currently, based on RSI-14 levels (RSI < 30).

Support and Resistance : Nearest Support Zone is $4.00. Nearest Resistance Zone is $7.00, then $9.00.

Axie Infinity: Seems extremely bullish!AXS is now down almost 96% from its previous ATH and is about to reach an important support level, which is a strong demand zone at $4. It can recover to its ATH of around $164, and if there is significant hype and AXS performs exceptionally well in the upcoming bull run, hitting targets above $1,000 is not impossible, IMO.

AXSUSDT - 4H Bullish signsThe AXSUSDT 4-hour chart indicates a significant bullish breakout from a descending triangle pattern, typically a continuation pattern but here suggesting a reversal.

The price has breached the upper trendline of the triangle, signaling a potential upward movement.

The target for this breakout is set at approximately $9.40, as depicted by the green highlighted zone.

This target aligns with previous resistance levels observed in early April. The overall bullish momentum is supported by increasing volume, indicating strong buying interest.

AXS: Channel Down PatternTrade setup : Trends are mixed. Price is trading in a Channel Down pattern. With emerging patterns, traders who believe the price is likely to remain within its channel can initiate trades when the price fluctuates within its channel trendlines. With complete patterns (i.e. a breakout) – initiate a trade when the price breaks through the channel’s trendlines, either on the upper or lower side. When this happens, the price can move rapidly in the direction of that breakout.

Trend : Downtrend on Short- and Medium-Term basis and Uptrend on Long-Term basis.

Momentum is Mixed as MACD Line is above MACD Signal Line (Bullish) but RSI < 45 (Bearish).

Support and Resistance : Nearest Support Zone is $7.0, then $5.5. The nearest Resistance Zone is $9.0 (previous support), then $11.0 - $12.0 and $14.0.

AXIE INFINITY #AXS to $11 soon.It's about to break the neckline of an inverse head and shoulders.

You can see the Right shoulder is far shallower

and vastly compressed in time duration in comparison to the Left shoulder

Leading to my assumption that it will breakout soon and move QUICKLY to the target!

AXS: Approaching SupportTrade setup : Trends are mixed. Price had a bearish breakout from a Descending Triangle pattern.

Swing Traders: could enter near $7.00 support and 200-day moving average, which should be a robust support zone, with +25% upside potential back to $9.00. Price is also getting oversold (RSI ~ 30), which means that we could see a brief bounce up near-term. Stop Loss (SL) level at $6.00.

Trend : Downtrend on Short- and Medium-Term basis and Uptrend on Long-Term basis.

Momentum is Bearish but inflecting. MACD Line is below MACD Signal Line and RSI is below 45 but momentum may have bottomed since MACD Histogram bars are rising, which suggests that momentum could be nearing another upswing.

Support and Resistance : Nearest Support Zone is $7.0, then $5.5. The nearest Resistance Zone is $9.0 (previous support), then $11.0 - $12.0 and $14.0.

Axie Infinity - Nice Upside PotentialAXS broke out of the descending triangle with some bullish strength, i really like the pattern on Daily timeframe, but to be perfect it just need to do the retest, but I don't know if that will happen, as the gaming sector in crypto has been performing very well recently and I believe it still is just the beginning.

AXS: Approaching SupportTrade setup : Price is in an Uptrend. Following a bullish breakout from a Descending Triangle pattern, price rallied +20% to $8.50 before pulling back on some profit taking. If it pulls back near $7.00, that could be another attractive swing trade entry in Uptrend. Stop Loss (SL) at $6.70, just below prior swing low.

Trend : Uptrend across all time horizons (Short- Medium- and Long-Term).

Momentum is Bullish but inflecting. MACD Line is above MACD Signal Line and RSI is above 55 but momentum may have peaked since MACD Histogram bars are declining, which suggests that momentum is weakening.

Support and Resistance : Nearest Support Zone is $7.00 (previous resistance), then $6.00. The nearest Resistance Zone is $9.50, then $11.00.

AXS: Approaching SupportTrade setup : Price is in an Uptrend. Following a bullish breakout from a Descending Triangle pattern, price rallied +20% to $8.50 before pulling back on some profit taking. If it pulls back near $7.00, that could be another attractive swing trade entry in Uptrend. Stop Loss (SL) at $6.70, just below prior swing low.

Trend : Uptrend across all time horizons (Short- Medium- and Long-Term).

Momentum is Bullish but inflecting. MACD Line is above MACD Signal Line and RSI is above 55 but momentum may have peaked since MACD Histogram bars are declining, which suggests that momentum is weakening.

Support and Resistance : Nearest Support Zone is $7.00 (previous resistance), then $6.00. The nearest Resistance Zone is $9.50, then $11.00.

AXS: Descending Triangle BreakoutTrade setup : Trends are mixed. Bullish breakout from a Descending Triangle pattern could see price revisit $8.00 near-term and $9.50 medium-term. Stop Loss (SL) at $6.70, just below prior swing low.

Trend : Uptrend across all time horizons (Short- Medium- and Long-Term).

Momentum is Bullish (MACD Line is above MACD Signal Line and RSI is above 55).

Support and Resistance : Nearest Support Zone is $7.00 (previous resistance), then $6.00. The nearest Resistance Zone is $9.50, then $11.00.

AXS: Descending Triangle BreakoutTrade setup : Trends are mixed. Bullish breakout from a Descending Triangle pattern could see price revisit $8.00 near-term and $9.50 medium-term. Stop Loss (SL) at $6.70, just below prior swing low.

Trend : Downtrend on Short- and Medium-Term basis and Uptrend on Long-Term basis.

Momentum is Mixed as MACD Line is above MACD Signal Line (Bullish) but RSI ~ 50 (Neutral).

Support and Resistance : Nearest Support Zone is $7.00 (previous resistance), then $6.00. The nearest Resistance Zone is $9.50, then $11.00.

AXS: Descending TriangleTrade setup : Trends are mixed. Trading in a Descending Triangle pattern. We wait for a breakout. Bullish breakout could see price revisit $9.50, while a bearish break below $6.90 support could be followed by a pullback to $6.00 support and 200-day moving average, which could then be a good swing trade entry.

Pattern : Price is trading in a Descending Triangle pattern. Typically, a breakout will occur in the direction of the existing trend. Most traders will take a position once the price action breaks through the bottom line of the triangle with increased volume, which is when the price should decline an amount equivalent to the widest section of the triangle.

Trend : Downtrend on Short-Term basis, Neutral on Medium-Term basis and Uptrend on Long-Term basis.

Momentum is Bearish but inflecting. MACD Line is below MACD Signal Line and RSI is below 45 but momentum may have bottomed since MACD Histogram bars are rising, which suggests that momentum could be nearing another upswing.

Support and Resistance : Nearest Support Zone is $7.00 (previous resistance), then $6.00. The nearest Resistance Zone is $9.50, then $11.00.

AXS: Descending TriangleTrade setup : Trends are mixed. Trading in a Descending Triangle pattern. We wait for a breakout. Bullish breakout could see price revisit $9.50, while a bearish break below $6.90 support could be followed by a pullback to $6.00 support and 200-day moving average, which could then be a good swing trade entry.

Pattern : Price is trading in a Descending Triangle pattern. Typically, a breakout will occur in the direction of the existing trend. Most traders will take a position once the price action breaks through the bottom line of the triangle with increased volume, which is when the price should decline an amount equivalent to the widest section of the triangle.

Trend : Neutral on Short- and Medium-Term basis and Uptrend on Long-Term basis.

Momentum is Bearish but inflecting. MACD Line is below MACD Signal Line and RSI is below 45 but momentum may have bottomed since MACD Histogram bars are rising, which suggests that momentum could be nearing another upswing.

Support and Resistance : Nearest Support Zone is $7.00 (previous resistance), then $6.00. The nearest Resistance Zone is $9.50, then $11.00.