Smart Liquidity in TradingIntroduction: What Is Smart Liquidity in Trading?

Liquidity is the backbone of financial markets—it refers to how easily assets can be bought or sold without causing drastic price changes. But as markets have evolved with the rise of algorithmic trading, decentralized finance (DeFi), and AI, a more sophisticated concept has emerged: Smart Liquidity.

Smart Liquidity isn’t just about having buyers and sellers in a market. It’s about efficient, dynamic, and intelligent liquidity—where technology, data, and algorithms converge to improve how trades are executed, how markets function, and how risks are managed. Whether in traditional stock markets, forex, or blockchain-based platforms, smart liquidity is now central to modern trading strategies.

Chapter 1: Understanding Traditional Liquidity

Before diving into smart liquidity, let's revisit the basics of traditional liquidity:

Bid-Ask Spread: A narrow spread indicates high liquidity; a wide one shows low liquidity.

Market Depth: The volume of orders at different price levels.

Turnover Volume: How frequently assets are traded.

Price Impact: How much a large order moves the price.

In traditional finance, liquidity providers (LPs) include:

Market makers

Banks and financial institutions

High-frequency trading firms

Exchanges

Liquidity ensures:

Stable pricing

Smooth trade execution

Lower transaction costs

Chapter 2: The Evolution Toward Smart Liquidity

What Changed?

Algorithmic Trading: Algorithms can detect, provide, or withdraw liquidity in milliseconds.

Decentralized Finance (DeFi): Smart contracts offer on-chain liquidity pools without intermediaries.

AI & Machine Learning: Predictive models can identify where liquidity is needed or likely to shift.

Smart Order Routing (SOR): Optimizes trade execution by splitting orders across multiple venues.

These technologies gave rise to “smart liquidity,” where liquidity is not static but adaptive, context-aware, and real-time optimized.

Chapter 3: Components of Smart Liquidity

1. Liquidity Intelligence

Advanced analytics track:

Market depth across exchanges

Order flow trends

Latency and slippage statistics

Arbitrage opportunities

This helps institutions dynamically manage their liquidity strategies.

2. Smart Order Routing (SOR)

SOR systems:

Automatically split large orders across venues

Route based on fees, liquidity, latency, and execution quality

Reduce market impact and slippage

SOR is key in both equity and crypto markets.

3. Algorithmic Liquidity Providers

Market-making bots adjust quotes in real-time based on:

Volatility

News sentiment

Volume spikes

Risk exposure

They enhance liquidity without manual intervention.

4. Automated Market Makers (AMMs)

Used in DeFi:

No traditional order book

Prices determined algorithmically via a liquidity pool

Traders interact with pools, not people

Popular AMMs: Uniswap, Curve, Balancer.

Chapter 4: Use Cases of Smart Liquidity

1. HFT Firms and Institutions

Use predictive liquidity models

Deploy SOR to reduce costs and slippage

Balance exposure across markets

2. Retail Traders

Benefit from tighter spreads and faster execution

Use platforms with AI-driven order matching

3. Decentralized Finance (DeFi)

Anyone can provide liquidity and earn fees

Smart liquidity enables 24/7 trading with no intermediaries

New protocols optimize capital allocation via auto-rebalancing

4. Stablecoin & Forex Markets

Smart liquidity ensures 1:1 peg stability

Algorithms prevent arbitrage imbalances

Chapter 5: Key Metrics to Measure Smart Liquidity

Metric Description

Slippage Difference between expected and actual execution price

Spread Efficiency How close bid-ask spreads are to theoretical minimum

Fill Rate How much of an order is filled without delay or rerouting

Market Impact Price movement caused by a trade

Liquidity Utilization How efficiently capital is allocated across pairs/assets

Latency Time taken from order input to execution

These metrics help evaluate the quality of liquidity provided.

Chapter 6: Risks and Challenges of Smart Liquidity

Despite its benefits, smart liquidity isn’t perfect.

1. Flash Crashes

Caused by sudden withdrawal of liquidity bots

Example: 2010 Flash Crash in U.S. equities

2. Manipulation Risks

Predatory algorithms can spoof or bait other traders

"Liquidity mirages" trick algorithms

3. Smart Contract Failures (DeFi)

Vulnerabilities in AMMs can drain entire liquidity pools

Hacks like those on Curve and Poly Network show smart liquidity can be fragile

4. Impermanent Loss (DeFi)

LPs may lose value if asset prices diverge significantly

Complex math and simulations needed to manage it

5. Regulatory Uncertainty

Especially in crypto, regulators still debating on decentralized liquidity protocols

Conclusion

Smart liquidity represents the next evolution of market infrastructure. It's not just about having capital in the market—it's about how that capital moves, adapts, and executes.

From hedge funds deploying intelligent routing systems to DeFi users earning yields through AMMs, smart liquidity touches every corner of modern finance. As technology continues to mature, expect liquidity to become even more predictive, responsive, and intelligent—unlocking a new level of speed, precision, and access for traders around the world.

AXISBANK

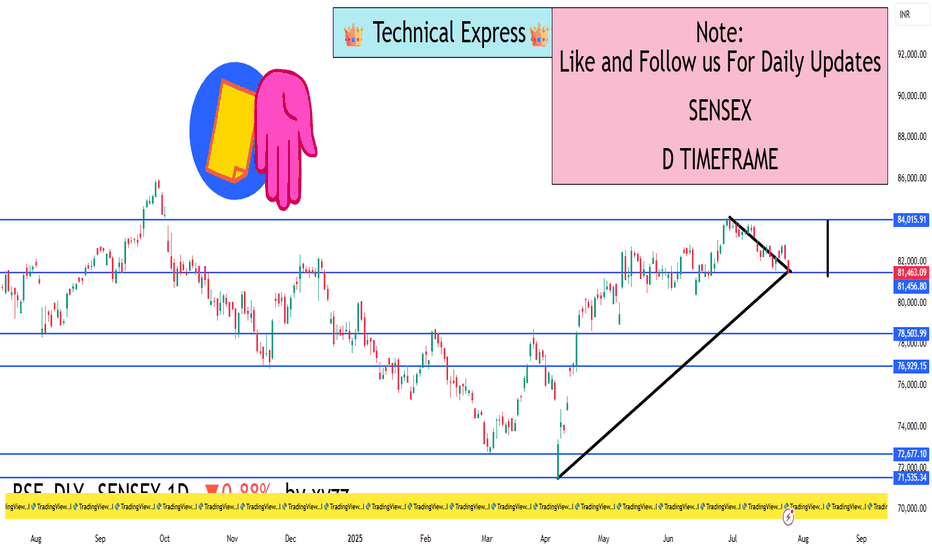

SENSEX 1D Timeframe📉 SENSEX Daily Overview (as of July 25, 2025)

Current Price: Around 81,460

Daily Change: Down by approximately 720 points (–0.9%)

Day’s High: About 82,070

Day’s Low: About 81,400

Previous Close: Around 82,184

📊 1-Day Candlestick Analysis

The candle for today is bearish, indicating strong selling pressure.

The price opened near previous levels but faced resistance at around 82,000.

Sellers dominated most of the day, pushing the index toward the 81,400 support zone.

🔍 Key Support and Resistance Levels

Level Type Price Range

Resistance 82,000 – 82,200

Support 81,400 – 81,000

If Sensex breaks below 81,400, the next target could be around 80,500 or 79,900.

If it holds above support and bounces, it could retest 82,200.

🧠 Technical Trend Analysis

Short-Term Trend: Bearish

Medium-Term Trend: Neutral to mildly bullish (as long as above 80,000)

Market Structure: Lower highs forming, suggesting pressure building on bulls

Indicators (assumed):

RSI may be approaching oversold

MACD likely showing bearish crossover

Volume increasing on red candles—indicating strong sell interest

📌 Sentiment & Market Context

Financial stocks (like banking, NBFCs) are under pressure.

Global cues (such as interest rate uncertainty and geopolitical concerns) are impacting investor confidence.

FII outflows and weak earnings in key sectors are adding to bearish momentum.

The broader trend remains range-bound, but with short-term downside bias.

✅ Strategy Suggestions (For Traders & Investors)

Swing Traders: Wait for a reversal candle (like a bullish engulfing or hammer) before considering long positions.

Breakout Traders: Watch for breakdown below 81,000 for continuation of the fall.

Positional Traders: Can wait to enter near 80,000–79,500 if the market holds that key level.

🔄 Summary

SENSEX is under pressure with a drop of 720+ points.

Technical structure suggests caution, especially if 81,000 breaks.

Support: 81,000 – 80,500

Resistance: 82,000 – 82,200

Review and plan for 18th July 2025Nifty future and banknifty future analysis and intraday plan.

Analysis of quarterly results.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

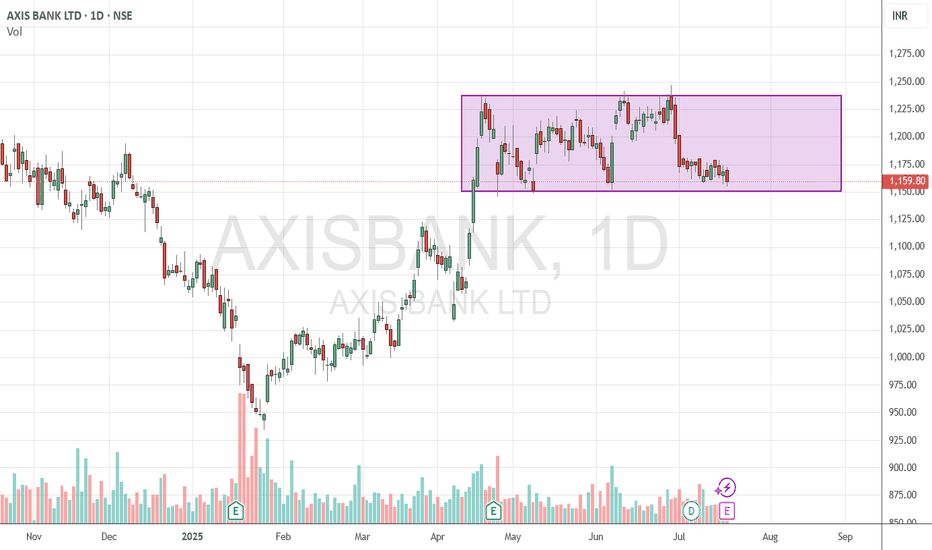

AXIS BANK at Best Support !!Here are two charts of Axis Bank — one in the 4-hour timeframe and the other in the 1-hour timeframe.

4-Hour Timeframe Chart:

In this chart, Axis Bank is moving within a parallel channel, with the support zone lying in the 1150–1160 range.

1-Hour Timeframe Chart:

Axis Bank is forming a descending broadening wedge pattern, with support near the 1150–1155 zone.

If this level is sustain ,then we may see higher prices in Axis Bank.

Thank You !!

AXISBANKNSE:AXISBANK

One Can Enter Now !

Or Wait for Retest of the Trendline (BO) !

Or wait For better R:R ratio !

Note :

1.One Can Go long with a Strict SL below the Trendline or Swing Low.

2. R:R ratio should be 1 :2 minimum

3. Plan as per your RISK appetite and Money Management.

Disclaimer : You are responsible for your Profits and loss, Shared for Educational purpose

AXISBANK--Near Its Demands??This stock is bullish from long term.

we have to look for buying opportunities to continue in the trend.

if we see trendline is acting as support multiple times at bottom side...

on the topside we have dynamic resistance in the form of trendline.

when price takes the support again from the bottom side trendline,

we will go for buying, when price breaks the topside trendline and retest.

we have a lot of liquidity is lies below the trendline on bottom side.

If price takes all the liquidity then an immediate entry is placed at 960 to 920 levels.

Look for buying opportunities in this stock.

Axis Bank: Preparing to Break Resistance – A Rally in the MakingCurrent Price: ₹1,142.40 (+0.29%)

Axis Bank is consolidating near its Golden Retracement Zone (₹1,098 - ₹1,112) after breaking out of its Previous CHoCH Zone (Change of Character). It is also testing a trendline resistance, with potential for a breakout rally toward supply mitigation levels.

Key Levels:

Buy Zone: ₹1,112 - ₹1,143 (Golden Retracement Zone)

Stop Loss: ₹1,098 (on a daily close below the retracement zone)

Target 1: ₹1,280

Target 2: ₹1,303 - ₹1,326 (Supply mitigation zone)

Key Observations:

Golden Retracement Zone: Acts as a strong support for a bounce.

Trendline Breakout: A successful breakout above the resistance line may lead to sustained upward momentum.

Supply Zone: ₹1,303 - ₹1,326 is the next key level to watch for profit booking.

Disclaimer:

This analysis is for educational purposes only and is not financial advice. I am not a SEBI-registered analyst. Please do your own research or consult a financial advisor before making any investment decisions.

Axis Bank Technical Analysis: Cautious Outlook Near Key Support

Axis Bank is currently trading near a crucial support level at approximately ₹1120, significantly below its all-time high of ₹1340. Recent price action within a range of around ₹1133 indicates a period of consolidation.

Bearish Scenario: A decisive break below ₹1120 would be a bearish signal, potentially triggering a further decline towards ₹1080.

Market Context: It's vital to consider the broader market. Both Nifty and Bank Nifty indices are also trading near their support levels, suggesting a potential market-wide rebound. This adds a layer of uncertainty to the Axis Bank outlook.

Bullish Scenario: Conversely, a sustained move above the resistance level of ₹1200 would signal a significant shift in momentum, potentially initiating a rally.

Recommendation: Given the current market dynamics and Axis Bank's proximity to key support, we recommend a cautious approach. Investors should closely monitor price action and volume before making any significant trading decisions. A break above or below the key levels, accompanied by strong volume, would provide greater confirmation of the prevailing trend.

Axis Bank-Bullish Swing- Strong Supply zone!!

12.08.2024

Buy 1163

Target 1260

Stop Loss 1115

Risk Reward- 1:2

1. Inside bar breakout after good consolidation

2. Weekly Doji breakout

3. 200 EMA Rejection

4. Price rejected at 0.618 Fibonacci level

5. Gradual decrease in volumes in downtrend.

6. Strength of bear candles reduced.

7. RSI has reached over sold and now recovered to 40

8. Price rejection at resistance turned to support zone

NSE:AXISBANK