AXY

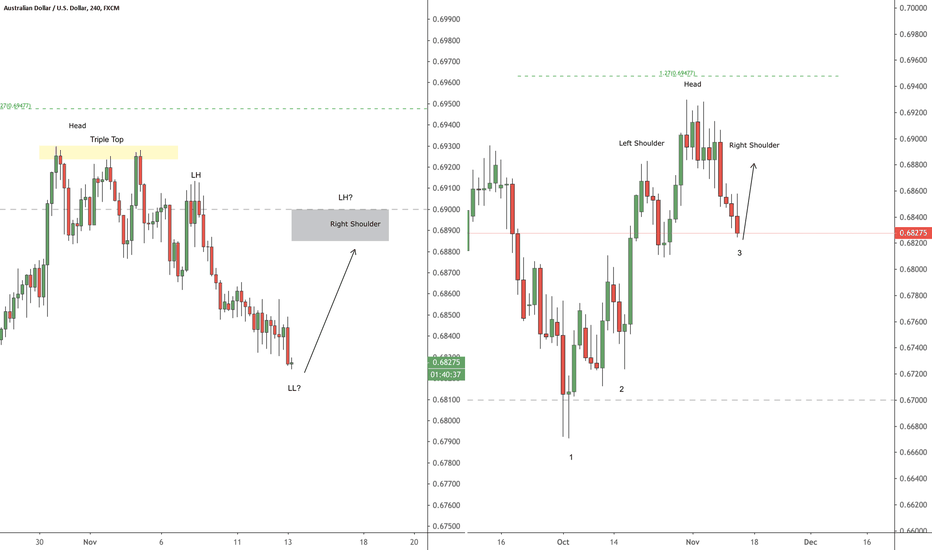

GA: H&S completed, shorts on AUD strengthEarlier this week we posted both the start and finish of the right shoulder for the now compelted head-and-shoulder pattern. We expect with the Aussie-dollar gaining support for this to capitulate GBP/AUD downard following the breaking of the neckline.

See related ideas below,

NU: Update for wkly setupOur bias from Monday remains bullish. Since Monday, we've successfully called both setups for NZD/USD. We'll be looking for long entries at the lowest possible price before retracing higher to the upside target shown to make a new HH in the current llnger-term structure. See linked charts below,

AU: Update ahead of CPIWith this specific setup, there is not only a number of confluences in our favor, but price is at a critical point for us to consider. Taking into consideration our bias and comparing it over different timeframes can help you make more strategic choices on where to place your capital in the market. Confluences for this trade setup include a daily head and shoulder pattern, daily fibs, 4-hrly fibs, 4-hrly trendline (descending), daily trendline (ascending), daily key level, 4-hrly institutional level, daily pivot point suggesting bullish price action to form a new lower high in the current shorter term downtrend; daily pivot suggesting bullish price action

This trade will be published to our Telegram. We won't be entering the market until after the CPI numbers in around 1 hour.