SPY/QQQ Plan Your Trade For 3-28-25 : Carryover in Counter TrendToday's pattern suggests the SPY/QQQ will attempt to move downward in early trading. The SPY may possibly target the 564-565 level before finding support. The QQQ may possibly attempt to target the 475-476 level before finding support.

Overall, the downward trend is still dominant.

I believe the SPY/QQQ may find some support before the end of trading today and attempt to BOUNCE (squeeze) into the close of trading.

Gold and Silver are RIPPING higher. Here we go.

Remember, I've been telling you of the opportunities in Gold/Silver and other market for more than 5+ months (actually more than 3+ years). This is the BIG MOVE starting - the BIG PARABOLIC price rally.

BTCUSD has rolled downward off the FWB:88K level - just like I predicted. Now we start the move down to the $78k level, then break downward into the $58-62k level looking for support.

Love hearing all of your success stories/comments.

GET SOME.

Happy Friday.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

Ações

SPY/QQQ Plan Your Trade For 3-27-25 : Breakaway PatternToday's Breakaway pattern suggests the markets will continue to melt downward (possibly attempting to fill the Gap from March 24).

I strongly believe the SPY/QQQ are completing the "rolling top" pattern I suggested would happen near or after the March 21-24 TOP pattern my deeper cycle research suggested was likely.

At this point, things are just starting to line up for a broader market decline while the current EPP pattern plays out as a Breakdown of the EPP Flagging formation (moving into consolidation).

Gold and Silver are RIPPING higher. Yes, I do expect a little bit of volatility near these recent highs. But, I also expect metals to continue to rally higher from these levels over the next 10-15+ days. Watch the video.

Bitcoin is stalling/topping - just as I suggested it would months ago.

Now we see how the market move into this new trending phase and how far this current trend will drive price trends. I believe the SPY/QQQ/Bitcoin will all continue to move downward while Gold/Silver move (RIP) higher on this breakaway move.

This is a PERFECT trader's market.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SPY/QQQ Plan Your Trade for 3-26-25 : Flat-Down PatternToday's Flat-Down pattern for the SPY/QQQ suggests the markets will consolidate in a sideways channel, generally drifting downward.

As I've been warning all of you for the past month+, the market will likely roll over into a topping formation over the next few days, then start an aggressive downward trend targeting $525-535 on the SPY.

Today's video covers some details related to my expectations and how traders can prepare for the bigger moves I see pending.

Gold and Silver are poised for a potentially BIG BREAKOUT move to the upside. And I still believe Gold/Silver are going to rally another 15-20% within the next 30-45 days.

Bitcoin should follow the SPY/QQQ into a "rollover top" type of pattern then shift into a downward price trend over the next few days.

Everything is following my predictions/expectations almost perfectly.

Now, we try to profit from some of these big moves.

Go get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SPY/QQQ Plan Your Trade For 3-25-25 : Top PatternToday's Top Pattern suggests the SPY/QQQ will find resistance slightly above yesterday's closing price level and attempt to roll over into a bearish price trend.

Watch today's video to see which levels I believe will be the top for the SPY & QQQ.

I do expect metals to rally over the next 3+ weeks and I'm watching for this morning's bounce to carry onward and upward.

Bitcoin should be rolling downward off that FWB:88K top level I predicted months ago.

We are moving into a topping phase - so get ready for the markets to attempt to ROLL DOWNWARD over the next 5+ trading days into a deeper low price level.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

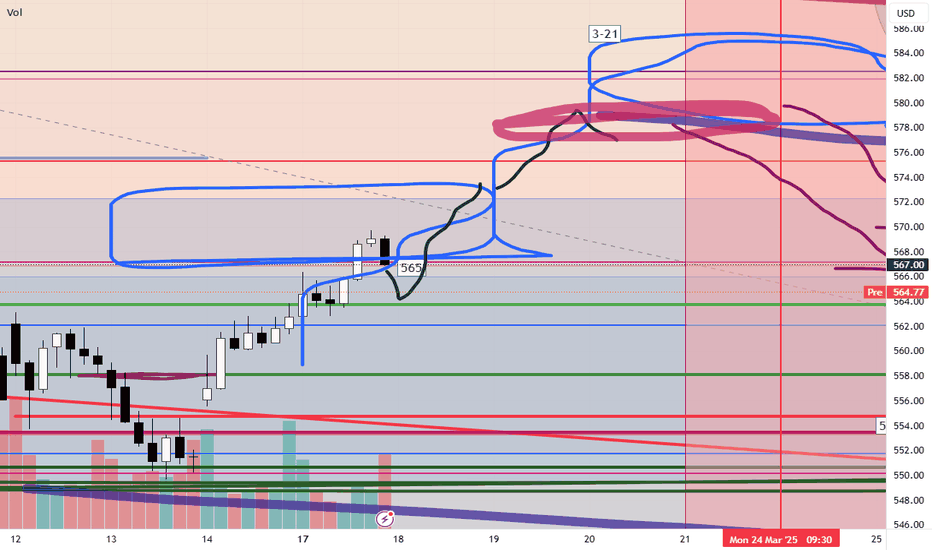

SPY/QQQ Plan Your Trade for 3-24-25 : Bozu Trending PatternToday's Bozu Trending pattern suggests a very aggressive price move is likely. I believe this move will be to the upside after my weekend research suggested we are moving into a "blow-off" topping pattern that will act as a Bull Trap.

Overall, I belive the SPY/QQQ have about 2-3 days up upward price trending early this week, then the markets will suddenly roll into a topping pattern and start to aggressively move downward.

The next base/bottom of the continued downward price trend sets up in early/mid April. The March 21-24 base/bottom is likely the minor base/bottom we have seen over the past 3-5+ days.

I believe the breakdown in the SPY/QQQ late this week and into next week will result in a new lower low - causing the Consolidation phase of this downturn to extend down to the 520-525 level on the SPY.

Bitcoin is very close to my $88,000 upper target level (only about $250 off that level). Get ready, BTCUSD should make an aggressive move downward after stalling near the FWB:88K level peak.

Gold and Silver are moving into a trending mode. I believe both Gold and Silver will rally this week and into the next few weeks as we expand into the Expansion phase.

Buckle up. If my research is correct, we are going to see a BIG ROLLOVER this week.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

Looking for a minimum of ES 5850In the days to come our initial pattern off the recent has the high probability to get into the 5850 area.

Here I will be looking for a pullback.

If this pullback can be viewed as corrective in it's structure then I expect the subdivisions and pathway on my ES4Hr chart should follow suit. However, if the pullback turns out to be impulsive, I will be looking for follow through for either Minor B having completed early, or the alternate wave (iv). If that sort of price action were to materialize, it's Friday's low of 5651.25 that must support any drop if we're to continue to subdivide higher and have this minor B take more time.

Trading Is Not Gambling: Become A Better Trader Part III'm so thankful the admins at Tradingview selected my first Trading Is Not Gambling video for their Editor's Pick section. What an honor.

I put together this video to try to teach all the new followers how to use analysis to try to plan trade actions and to attempt to minimize risks.

Within this video, I try to teach you to explore the best opportunities based on strong research/analysis skills and to learn to wait for the best opportunities for profits.

Trading is very similar to hunting or trying to hit a baseball... you have to WAIT for the best opportunity, then make a decision on how to execute for the best results.

Trust me, if trading was easy, everyone would be making millions and no one would be trying to find the best trade solutions.

In my opinion, the best solution is to learn the skills to try to develop the best consistent outcomes. And that is what I'm trying to teach you in this video.

I look forward to your comments and suggestions.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SPY/QQQ Plan Your Trade for 3-21-25 : BreakAway PatternToday's Breakaway pattern may show up in the form of an Island Top or break-away to the upside if my analysis is correct.

I see the markets stalling over the past few days, potentially setting up a "last breakaway" type of pattern today.

I've highlighted how these "last" patterns work where price sets up a peak or trough (in this case a peak) as a last/exhaustion move and how this move can sometimes be very aggressive.

I urge traders to stay cautious today as we are moving into a MAJOR REVERSAL weekend.

I believe the markets will suddenly change direction next week (early) and will move back into downward trending by March 25-26.

Gold and Silver may rally today if the markets move into that Exhaustion Peak pattern. Keep an eye out for Gold/Silver/Bitcoin to potentially rally today and into early next week.

Overall, traders should stay very cautious as we move into next week's peak/top/rollover.

Don't get too aggressive trying to prepare for the rollover or any potential upside move over the next 3-5+ days.

Let the markets show us what and when we need to be aggressive.

Get Some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SPY/QQQ Plan Your Trade For 3-20-25 : Flat-Down PatternToday's SPY Cycle pattern suggests the SPY/QQQ will stay somewhat muted in trading range today.

I still believe the SPY/QQQ are in a moderate melt-up type of trend - attempting to reach a peak near the end of this week or early next week (see the patterns for March 24, 25, 26).

Even though I believe we are struggling to try to move higher, I do believe any failure of the SPY to move above the 0.382 Fibonacci retracement level would be a technical failure related to the breadth of this pullback.

Thus, I believe the markets have at least one more attempt to try to move higher over the next 5+ days before topping and rolling over into a broader downtrend.

Gold and Silver moved solidly lower this morning - almost like a Panic type of selling. I believe this is related to the Flat-Down pattern and I believe Gold/Silver will recover fairly quickly. I do believe this is a huge opportunity for Gold/Silver over the next 30+ days. I believe Gold will attempt to move above $3500-3600 before the end of April.

BTCUSD rolled higher yesterday by more than $4000 - just like I predicted.

Incredible.

And, that is another reason why I believe the SPY/QQQ have more room to the upside than we are seeing right now.

Remember this is a trader's market.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

Trading Is Not Gambling : Become A Better Trade Part IOver the last few weeks/months, I've tried to help hundreds of traders learn the difference between trading and gambling.

Trading is where you take measured (risk-restricted) attempts to profit from market moves.

Gambling is where you let your emotions and GREED overtake your risk management decisions - going to BIG WINS on every trade.

I think of gambling in the stock market as a person who continually looks for the big 50% to 150%++ gains on options every day. Someone who will pass up the 20%, 30%, and 40% profits and "let it ride to HERO or ZERO" on most trades.

That's not trading. That's flat-out GAMBLING.

I'm going to start a new series of training videos to try to help you understand how trading operates and how you need to learn to protect capital while taking strategic opportunities for profits and growth.

This is not going to be some dumbed-down example of how to trade. I'm going to try to explain the DOs and DO N'Ts of trading vs. gambling.

If you want to be a gambler - then get used to being broke most of the time.

I'll work on this video's subsequent parts later today and this week.

I hope this helps. At least it is a starting point for what I want to teach all of you.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SPY/QQQ Plan Your Trade For 3-19-25 : Top PatternToday's Top pattern suggests the SPY/QQQ will attempt to rally up to resistance, then form a peak/top in price, and then roll over a bit.

After yesterday's fairly consolidated price range, I believe the SPY/QQQ may rally through most of the day and move into the topping pattern near the end of today's trading day.

Overall, I believe the markets are still rolling into the Excess Phase Peak consolidation phase and that means traders need to prepare for extreme price volatility.

What is interesting is how BTCUSD is trying to rally a bit, but not finding upward momentum.

As I stated in today's video, I believe a fairly big move upward, possibly $3000 or more, in BTCUSD could happen between now and the end of this week.

This would be a perfect upward price advance into resistance that could correlate with a move h higher in the SPY/QQQ - targeting the upper level of the Consolidation Phase.

Gold and Silver have reached a "pause" level. I believe Gold and Silver will only pause for 48 to 96 hours before attempting to break higher. So, metals will still attempt to break higher into late March 2025.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SPY/QQQ Plan Your Trade For 3-18-25 : Gap Reversal Counter-TrendFirst off, thank you for all the great comments and feedback. I really love hearing from TradingView subscribers and how my research is helping everyone find success.

Just recently, I received some DMs from viewers saying my research has been "dead on" - which is great.

One thing is for sure, the big move in Gold/Silver is just getting started.

Today's SPY Cycle Pattern is a Gap-Reversal in a Counter Trend mode. The long-term & short-term bias is currently BEARISH - so I believe the GAP Reversal will be to the upside.

Meaning, I suggest we start the day with a mild lower GAP - followed by a moderate price reversal in early trading, leading to a continued melt-up type of trend for the SPY/QQQ

Gold and Silver are likely to attempt to melt a bit higher into the TOP pattern for today. I believe this is just a temporary resistance level for metals.

Bitcoin is struggling to find upward momentum - but I believe BTCUSD still has a $3k-$5k rally left to reach the current Consolidation highs. We'll see if it breaks higher over the next 3-5 days before rolling over into a new downtrend.

Again, I really appreciate all of my followers and viewers. I want all of you to learn to see, read, and understand price action more clearly than ever before.

That's why I don't use any technical indicators on my chart. I want you to understand PRICE is the ultimate indicator.

Get some..

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

Gamma Exposure on SPXToday marks the first day in a long time where we can observe some green, bullish levels on gamma exposure. The daily GexView indicator displays thin green lines, which represent the gamma exposure of zero-days-to-expire contracts. The thick lines, on the other hand, represent the total gamma exposure across all expiration contracts. This is a promising first step, especially if these lines persist over the next few days and continue to develop further.

SPY/QQQ Plan Your Trade Video for 3-17: GAP PotentialAs we start moving into the Excess Phase Peak pattern consolidation phase, I believe the SPY/QQQ will attempt a moderate rally for about 3-5+ days, then roll into a deep selling mode after March 21-24.

I don't believe we have reached a bottom - yet.

I do see a lot of people talking about "the bottom is in" and I urge all of you to THINK.

What do you believe will be the basis of US and GLOBAL economic growth starting RIGHT NOW?

Can you name one thing that will be the driver of economic expansion and activity?

I can't either.

Thus, I suggest traders prepare for more sideways consolidation range trading over the next 60+ days as hedge assets and currencies attempt to balance risks.

BTCUSD, Gold, Silver should all be fairly quiet this week. I'm not expecting any huge price moves this week.

I expect the SPY/QQQ & BTCUSD to move a bit higher while Gold and Silver melt upward a bit further.

Then, after March 21, I expect bigger volatility and a broad rotation in the SPY/QQQ/Bitcoin where Gold/Silver will start a bigger move higher.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

Weekly Market Analysis - 16th March 2025 (DXY, NZD, ES, BTC)This is weekly market analysis of a few pairs (DXY, NZD, ES, BTC).

I haven't done one of these in a while, but here it is!

I would have done more pairs but the video was already 30 minutes long and I went into more teaching rather than pure analysis.

I hope you found it insightful to your own trading, because what I teach is the truth of the market regardless of whatever specific strategy you use for trading.

Anything can make money in the markets, but of course, risk management and discipline rule all.

- R2F Trading

A look at the ES1!What's up traders,

Havent posted in a while.

Heres my take and outlook for next week, using the MES1! (SP500)

Current Outlook

Technical Look:

Momentum Bearish -323.25 (looks weak)

MACD Bearish, possibly inflecting

RSI 36.72, off lows and crossing MA (oversold)

200D SMA at 5775.75 (Below the 50 Day)

50D SMA at 5967.43 (Above the 200 Day) Trending towards a Death Cross

Price Action

Bullish Engulfing Candle on the March 14 bounce.

Price successfully crossed the 5600 Psychological Level

We bounced at ~5500

Experiencing resistance in the 5640-5620 Range (expected)

Sentiment

Canada showed promise as heading towards a (take your best guess at the details) resolution to the tariff fight with the united states.

Tariffs remain a major drag on the stock market pricing.

Government shut down at time of this post, is apparently narrowly avoided.

Gold Set a new high.

Outlook for Next Week

Economic Reports

Monday - Retail Sales 830AM

Tuesday - Building Permits, Housing Starts 830AM

Wednesday - Fed Int Rate Decision 2PM, JPOW Speech 230PM

Thursday - Existing home sales 10AM

Notable Earnings Reports

Micron

Nike

Fed Ex

General Mills

Carinval Cruise

NIO

Tencent

I viewed the Firday bounce as a sort of 'relief rally'. My belief is that we could go higher on the back of it. The market has majorly 'oversold' by the numbers - and the probability of a bounce became increasingly likely. Upside resistance to remain mercurial on the rapidly changing sentiment narrative.

A possible outcome: retest the underside of the 200DMA.

I do not expect a notable price recovery towards ATH's until the tariff effects are known, which means: I expect higher than normal volatility for several months

Earnings projections (in the coming earnings season) will shed the required light on reality.

I have been adding long term holds - such as:

GDX

DAX

META

GOOG

AMZN

BABA

UNH

C

CRWD

IBIT

NVO

CMG

INDA

AVGO

I remain ~90% cash at ~3.7% yield.

Resistance possibly at:

5672 August 2024 Resistance, September 2024 Support

5724 July 2024 Resistance and later Support

5775 (200 Day SMA)

SPY/QQQ Plan Your Trade For 3-14-25: Temp BottomToday's Cycle Pattern is a Temporary Bottom pattern. I suspect the markets may attempt to move a bit lower in early trading before attempting to find a new base/support level.

Yesterday's low may prove to be very important depending on what the markets do today. Initially, I thought yesterday's low was the Temporary Bottom pattern (one day early). But, I do believe the markets will continue to be volatile in early trading today and may move downward to retest lows before trying to move higher - setting up the Temporary Bottom pattern.

Gold and Silver will likely continue to melt upward unless there is some big news that disrupts the US Dollar's downward slide. I see Gold trying to rally above $3200 very quickly over the next 15+ days.

Bitcoin is still consolidating and is currently in a short upward price phase (much like the SPY/QQQ). In fact, the SPY/QQQ and Bitcoin are all in an EPP consolidation phase.

So, that means even though we may see a volatile type of price move over the next 15-30+ days, price is ultimately trapped in a consolidated price range and will/should attempt to break downward into the Ultimate Low.

Therefore, if we get a moderate pullback/rally phase over the next 5+ trading days, be aware that the rally upward will end near March 21-24 and turn downward very sharply before the end of March (based on my research).

You have lots of opportunity if this base sets up for a moderate rally in the SPY/QQQ, but play it cautiously as I don't believe we'll see new ATHs anytime soon.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SPY/QQQ Plan Your Trade EOD Update for 3-13-25What a crazy day. The markets certainly decided to burn the longs almost all day.

I got a few messages from traders who continued trying to pick bottoms in this downtrend. FYI, that can be very dangerous.

If you are a short-term trader and are trying to pick a base/bottom all day today - you have to have a limit in terms of how much you are willing to risk within a single day.

I've seen dozens of traders blow up their accounts in a big, trending market.

Please learn from your actions. Develop a STOP POINT related to your trading decisions.

There is no reason to continue to try to execute "bounce" trades when the markets are trending as strongly as they are today.

This video should help you understand what I see as the potential over the next 5+ days.

We are still trying to hold above critical support near the 50% retracement level on the SPY.

Everything depends on what happens in DC and how the markets perceive risks.

Gold/Silver rallied very strong today. This is FEAR related to risks.

If the US government enters a shutdown, Gold and Silver could skyrocket much higher.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

ES futures trade setup 13/03/'25Hello,

In today's trade analysis, I will review potential setups for this trading day. Since the overall trend is bearish, I favor short positions over long positions.

I have identified two important zones on the 4H timeframe that align well with the 1H timeframe.

4H supply zone: 5,643 - 5,630

4H demand zone: 5,577 - 5,558

We've seen both false breakouts and breakdowns in recent days, indicating choppy market conditions.

My plan is to either go short in the upper 4H supply zone or short a breakdown of the 4H demand zone. For the latter, I'll wait for the candle to close below the zone and set my entry on a retest.

SPY/QQQ Plan Your Trade Update For 3-13-25 - Fear Settling InWith the US government only about 39 hours away from a complete SHUT DOWN, I want to warn everyone that metals are doing exactly what they are supposed to do - hedge risks. While the SPY/QQQ are continuing to melt downard.

I created this video to show you the Fibonacci Trigger levels on the 60 min SPY chart, which I believe are very important. Pause the video when I show you the proprietary Fibonacci price modeling system and pay attention to the fact that any upward price trend must rally above 563.85 in order to qualify as a new Bullish price trend.

That means we need to see a very solid price reversal from recent lows or an intermediate pullback (to the upside) which will set a new lower Bullish Fibonacci trigger level.

Overall, the SPY/QQQ are in a MELT DOWN mode and I expect this to last into early next week unless the US government reaches some agreement to extend funding.

This is not the time to try to load up on Longs/Calls.

The US and global markets are very likely to MELT DOWNWARD over the next 2 to 5+ days if the US government does SHUT DOWN.

FYI.

Gold and Silver may EXPLODE HIGHER.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver