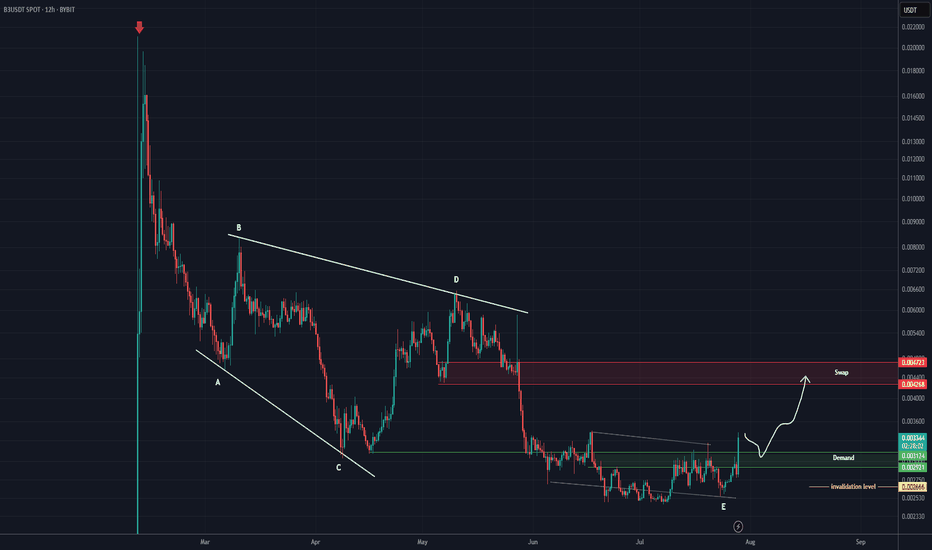

B3 Analysis (12H)From the point where the red arrow is placed on the chart, the B3 correction has started. It appears we have an expanding/diagonal/symmetrical triangle, and wave E now seems to be complete.

As long as the green zone holds, the price could move toward the red box, which is a swap zone.

A daily candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

B3

B3 Aanalysis (12H)The strong bullish move on B3 is turning into a 3D. It could move from the supply zone towards the SWAP zone and then get rejected upwards.

We are looking for buy/long positions in the green zone. Targets are marked on the chart.

A daily candle close below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

Symmetrical Triangle Breakout Attempt! 📈 OMXSTO:B3 - Symmetrical Triangle Breakout Attempt! 📐

✅ OMXSTO:B3 has broken out of a symmetrical triangle pattern.

🔴 Next hurdle: Needs to break and close above the red resistance zone for further upside.

🎯 Potential target: Green line level if the red resistance is broken! 🚀

The Brightest Metal Right NowGold isn’t just shining, it’s on fire, burning through resistance levels as investors seek shelter from global chaos.

Figure 1: Gold Prices Climbing to New Highs

Gold surged past $3,000 per ounce this March, setting 16 record highs this year alone. While it took more than a decade for gold to gain 1,000 points previously, this time it took less than two years.

Figure 2: Correction in the Equities and Cryptocurrencies

In stark contrast, the S&P 500 has dropped 10% since its February peak, marking its first correction since 2023. Bitcoin has also plunged to $81,000, a 25% decline since U.S. President Donald Trump’s inauguration. The AI-driven momentum that propelled tech stocks and the broader equity market higher in 2024 appears to have faded.

Figure 3: Historical Reactions to Crisis

The correction in equities and crypto stands in sharp contrast to gold’s rally—an outcome that should come as no surprise given gold’s reputation as a safe-haven asset. Historically, financial crises and major market pullbacks have consistently triggered capital flows into gold as investors seek refuge from economic uncertainty.

This time, gold’s outperformance is driven by a “perfect storm” of prolonged geopolitical tensions, escalating trade disputes, political uncertainty under Trump’s second term, and a weakening U.S. dollar.

The CNN Business Fear & Greed Index, a widely used measure of market sentiment, has remained in the “fear” and “extreme fear” zones. This stems largely from Trump’s protectionist policies, which have sparked swift retaliation from U.S. trading partners. With new tariff headlines surfacing almost daily, the future of economic policy and inflation has become increasingly uncertain, injecting heightened volatility into global markets. This has, in turn, strengthened gold’s appeal as a hedge against instability.

Figure 4: Gold’s Demand is not Limited to Investors

According to the World Gold Council, investment demand for gold doubled year-over-year in 2024. However, central banks have been the real drivers of demand, purchasing over 1,000 tons of gold for three consecutive years; accounting for 21% of global demand in 2024.

The rising U.S. budget deficit and Trump’s "America First" policies have created additional risks for central banks holding large reserves of U.S. Treasuries. The ongoing tariff war not only undermines confidence in the U.S. as a reliable trade partner but also raises concerns about the U.S. dollar’s long-term stability as a safe-haven asset. This has accelerated the de-dollarization process, prompting many central banks to stockpile gold as a hedge against dollar exposure.

Unlike investors who may hesitate to buy gold at record highs, central banks operate based on mandates, making them less price-sensitive. They are willing to continue accumulating gold at elevated levels, reinforcing sustained demand for the precious metal.

Figure 5: A Weakening Dollar

Since most gold futures contracts are denominated in U.S. dollars, a weaker dollar makes gold relatively cheaper for non-U.S. buyers, supporting its price. This negative correlation between the two assets has been a key driver of gold’s recent surge.

The Trump administration has long argued that the U.S. dollar’s global dominance has kept it too strong for too long, hurting American manufacturers and contributing to deindustrialization. Further, a strong dollar reduces the price competitiveness of U.S. exports and has widened the trade deficit, leading the administration to pressure the Federal Reserve to cut interest rates.

While the Fed maintains its independence and data-driven approach, inflation trends continue to justify further easing. The market has already priced in three quarter-point rate cuts for this year, with expectations that the first cut could come as early as June.

Gaining Access to Gold

Historically, the London over-the-counter (OTC) market, operated by the London Bullion Market Association (LBMA), has been the largest gold trading center. Traders use the LBMA gold price as the global benchmark for gold transactions, including central bank purchases.

On the other hand, the futures market is the preferred choice for hedge funds, bullion dealers, refineries, and mints to hedge against price fluctuations. Retail investors also typically gain exposure to gold through futures contracts, most commonly via the COMEX gold futures market.

However, executing arbitrage strategies between the OTC and futures markets is capital-intensive and logistically challenging. Traditional arbitrage requires buying physical gold in the LBMA market at a lower price while simultaneously selling COMEX futures at a higher price. This involves storing, insuring, and shipping gold to COMEX-approved vaults, making it difficult to determine the fair value of the spread.

Figure 6: B3 Gold Futures Contract

A more accessible alternative is emerging: Brazil’s B3 Exchange will soon list a new gold futures contract referencing the LBMA gold price.

This new contract offers several advantages:

Easier arbitrage execution: Traders can capitalize on price discrepancies between the B3 contract and COMEX futures.

Lower capital requirements: The contract size is just one troy ounce, 1/100th of the standard COMEX contract, allowing for greater flexibility in position sizing and risk management.

Financial settlement: Both the B3 and COMEX one-ounce contracts are cash-settled, eliminating the logistical challenges of physical delivery.

Putting into Practice

Case Study 1: Arbitrage Strategy

Figure 7: Current Available Gold Futures

A comparison of the existing gold futures contracts highlights key differences in specifications, including fineness, contract size, and settlement methods. While these variations cater to the diverse needs of hedgers managing different gold inventories, they pose challenges for traders looking to establish arbitrage strategies due to mismatches in contract structures.

The introduction of B3’s new gold futures contract addresses these limitations by aligning closely with the COMEX 1-ounce gold contract. This structural similarity simplifies the process of determining fair value in spread pricing, making arbitrage strategies more feasible. The primary distinction between the two lies in their price settlement methods, which, interestingly, also forms the basis of arbitrage opportunities between futures and spot prices.

Additionally, traders can now take advantage of price discrepancies between the two LBMA daily fixing prices by utilizing the B3 Gold and TFEX Gold Online futures contracts. This expands the range of arbitrage opportunities and enhances market efficiency for gold traders.

Case Study 2: Directional Strategy

By considering all the factors – gold’s safe-haven appeal, geopolitical tensions, central banks accumulation, and a weakening dollar – we believe that this is not the end of the gold rally. An investor looking to express a bullish view on gold could do so by buying the B3 one-ounce futures contract, gaining exposure to gold’s price movements in a more accessible and cost-effective manner.

Conclusion

As global uncertainties mount, gold’s resilience remains undeniable. Whether as a hedge against inflation, a refuge from geopolitical turmoil, or a tool for strategic trading, gold continues to prove its value in times of crisis. With central banks stockpiling at record levels, the metal’s rally may still have room to run. For investors navigating today’s volatile landscape, gold is not just a safe-haven, it’s a strategic asset poised for continued strength. It is extremely timely to have new trading instruments like B3’s gold futures providing more accessible opportunities for investors.

For traders looking to enhance liquidity and capitalize on bid-ask spread, B3 also offers a market-making program. Interested participants can reach out to the exchange for further details.

(B3) Base3 "NFT opensea challenge"Something to consider when developing an NFT project to be offered on Opensea; Even though Base is offered as an alternative to Ethereum, the highest cost blockchain, B3 is tradable. With NFT projects an aspect of their profitability comes from the tradability history of Ethereum NFT information, as we know. If you consider developing and offering an NFT on Opensea you may want to consider a tradable layer-1 that you can hold in value along with offering NFTs for trade/sale, such as; B3, Avalanche, Polygon, Sei, Arbitrum, Berachain, Blast, Ethereum, Flow, and Optimism. And if you use Binance you could also consider Klaytn--not traded on Coinbase or Kraken. BASE is the new cutting edge offering trending so much based on PEPE coin yet what it does not have is the ability to see the growth of the chain improve the price of the NFT. This is something to consider when you decide to offer an NFT on Opensea, or elsewhere. I'm not trying to hate on Brian or BASE so much as I'm seeing the concept behind why I would actually choose B3 over using BASE, and so on. Berachain is sort of new and I would not swear by it, plus, who wnats to see a bear market right now, not me. Lots of people talked about Arbitrum and the fact is for as much hype as was placed on Arbitrum the outcome was not great enough to counter the more popular Solana.

Live Trade Unfiltered: Real-Time Breakout, Strategy & Market PsyWatch me execute a live trade in COINBASE:B3USD breaking down price action, trend lines, and market psychology in real time. I also guide a fellow trader through the trade via text. Whether you're new to day trading or a seasoned pro, this is a raw look at how I navigate fast-moving markets. No financial advice—just live insights!

Key Takeaways

Trade Type: Bull flag breakout, intraday scalping, ahead of huge multi day rally.

Indicators Used: Trend lines, Bollinger Bands, price action.

Exit Strategy: Momentum signals, clearly defined criteria for price behavior.

Psychological Tip: Don’t chase trades—wait for price to come to you.

Live Trading Lesson: Limit vs. market orders for optimal exits.

I'll update this post with the trade outcome and lessons learned. Let me know in the comments if you’d like to see more live trading breakdowns!

CRYPTO:B3USD CRYPTO:BTCUSD CRYPTO:XRPUSD

As always this is not investment advice, I would never place myself in such a liable situation, and you shouldn't take advice from a stranger on the Internet, do your own research and CY your own A and trade at your own risk.

A Silver Lining in BrazilThe USDBRL recently broke above a descending channel, signaling further BRL weakness; an unusual occurrence given the ongoing shift to easing cycles by major global central banks.

Figure 1: Major Central Banks Begun Rate Cuts; USDBRL Rises Instead

On September 18th, the Federal Reserve (Fed) cut rates by 50 basis points, marking its first reduction since the pandemic. Several other central banks, such as Bank of Canada (BOC), European Central Bank (ECB), have continued their ongoing rate cut cycle in the past few months. While uncertainties remain about the pace and extent of these cuts, there is a clear consensus among major central banks to adopt a dovish stance.

Historically, monetary decisions by major central banks, especially the U.S. Federal Reserve (Fed), have directly influenced the USDBRL exchange rate. Higher U.S. rates attract capital inflows, strengthening the USD and weakening the BRL. Consequently, one would expect USDBRL to continue trending lower in line with anticipated rate cuts. Instead, USDBRL recently surged to levels reminiscent of the pandemic era, defying conventional expectations.

Figure 2: Brazil’s Central Bank Acts Swiftly on Inflation

The Brazilian Monetary Committee (COPOM) was one of the earliest to react to rising inflation, initiating aggressive rate hikes as early as 2021. This preemptive stance set COPOM apart from other major central banks, which only began tightening in 2022. The much more aggressive hikes helped stabilize the BRL, leading to a sustained downtrend in USDBRL.

The COPOM has also been quick to address the recent reversal in inflation trends. A 25-basis-point rate hike in September and November signals the start of a monetary tightening cycle aimed at countering inflationary pressures, especially in food and energy prices.

Figure 3: COPOM Leads Global Rate Hike and Rate Cut Cycles

Although COPOM began cutting rates in the second half of 2023, global narratives remained focused on the U.S.'s potential for a soft landing. Amid the lack of confidence in post-pandemic recovery and lack of direction in major central banks’ stance on rate hikes, capital stayed in developed markets. However, the latest cuts from major central banks suggest a shift toward more accommodative policies, potentially sparking renewed interest in riskier emerging market assets. Brazil stands to benefit from this shift, particularly following COPOM’s decision to raise rates. Yet, the recent USDBRL breakout suggests a market sentiment that is incongruent with these developments.

Figure 4: Divergence Between Brazil’s Ibovespa and S&P 500 Continues

This odd occurrence extends to the equity market as well. Back in March 2024, we noted the divergence between the S&P500 and Ibovespa. While the divergence narrowed slightly after, the S&P500 benefited from the subsequent AI-driven gains, and Brazil’s Ibovespa futures lagged. This reflects a broader uncertainty surrounding Brazil’s financial outlook.

Figure 5: Brazil’s Overall Flow Remains Positive

The trade balance measures the difference between exports and imports of goods and services whereas the capital flows measure the ownership of Brazilian assets by foreigners against foreign assets owned by Brazilians. This can include foreign direct investment, portfolio investment and other investments.

Despite episodes of capital outflow in 2024, Brazil’s trade surplus has been relatively stable, which has effectively provided a buffer. Throughout the first half of 2024, the net positive combined inflow signals an overall greater demand for the BRL and ought to provide additional support for the currency.

Moreover, China’s recent stimulus measures are likely to have a positive impact on Brazil. As a major commodity exporter, Brazil’s trade figures are closely tied to China’s economic performance. The announcement of China’s 2025 investment budget for construction projects is expected to further boost Brazil’s trade numbers.

Though there is different dynamics in international trade and investment, market sentiment still weighs heavily on bearish expectations on Brazil’s financial market over her strong trade capabilities.

Figure 6: Brazil’s GDP Shows Robust Growth

Brazil’s central bank recently revised its 2024 growth forecast upwards, citing stronger-than-expected data. Brazil’s GDP grew by 1.4%, while real GDP expanded by 2.68%, rebounding after two quarters of stagnation. With annual GDP growth projected to hit 3% by the fourth quarter, Brazil’s economy is proving to be more resilient than market sentiment suggests.

Figure 7: Brazil’s Labor Market Remains Robust

While the market panicked over U.S. unemployment rate spike in July, Brazil’s unemployment rate has been consistently declining, a clear indication in a significant improvement in labor participation rate. Furthermore, wages, benchmarked using real earnings, have shown significant recovery post-pandemic, reaching new highs. This labor market strength further supports the fundamentals of the Brazilian economy.

Figure 8: Brazil’s Fiscal Concerns Weigh on Sentiment

Brazil’s rising government debt and debt-to-GDP ratio have raised concerns among investors, highlighting a significant fiscal challenge. While the debt-to-GDP ratio had improved in recent years, 2023 marked a reversal suggesting a possible upward trend that alarmed markets. This is compounded by the government’s recent decision to relax budget targets for 2025 and 2026, extending the timeline to achieve fiscal surplus. Such moves signal a longer period needed to stabilize Brazil’s growing public debt, prompting fears of higher future inflation and questions about the government’s commitment to fiscal discipline. Investors worry that these factors could lead to elevated inflation expectations and erode the perceived value of Brazilian assets, demanding higher risk premiums to compensate for fiscal uncertainty.

Every Cloud has a Silver Lining

Despite these fiscal challenges, Brazil’s economy continues to demonstrate resilience. Trade surpluses remain robust, GDP growth is positive, and the labor market is strong. COPOM’s recent rate hike signals its determination to combat inflationary pressures. Brazil’s Treasury Secretary, Rogerio Ceron, has pledged to outperform fiscal targets, while Moody’s recent credit rating upgrade in October places Brazil just one notch below investment grade. This contrast between solid economic fundamentals and fiscal instability has created a situation where the market appears overly focused on Brazil’s fiscal risks, potentially mispricing the country’s overall economic health. Consequently, this divergence highlights a lopsided risk premium that investors may exploit, particularly by engaging in relative value trades on the yield curve.

Gaining Access to the Yield Curve

Brazil’s main interest rate contract, the DI Futures which is traded on the B3 exchange, reflects the expectations of the market for the average DI Rate over a specified period – starting from the trade day (inclusive) to the contract’s maturity date (exclusive). The DI Rate is the average rate for one-day Interbank Deposit Certificates (CDI) traded between different banks but, nowadays, considering their methodology and the current market dynamic, this rate has the same value of Selic Over Rate (Brazilian interest rate benchmark that will follow the Selic Target Rate). The Selic Target Rate is the interest rate set by the COPOM and used by the Brazil Central Bank in the implementation of the monetary policy. Both local and non-local investors trade the DI Futures to express their views and expectations of the Brazilian yield curve, making DI Futures one of the most liquid interest rate instruments traded globally. Furthermore, B3’s COPOM Option Public Dashboard provides a convenient visualization of such market sentiment – Selic Target Rate probabilities decided at each COPOM meeting. These probabilities are calculated with B3’s COPOM Option contracts.

All DI Futures contracts are cash settled and payout 100,000 BRL at the end. The total profit and loss will include all the daily settlement to be carried out until the expiry date. Since the DI Futures contract is quoted in rates, to express the view of a rate cut, an investor can simply short the DI Futures in the respective maturities being studied. Furthermore, by analyzing DI Futures rates across shorter maturities, investors can gauge market sentiment regarding future COPOM actions while rates across longer maturities reflect sentiments on the broader outlook on economic conditions. An example to interpret the DI Futures rates and calculate the daily settlement is provided by B3 under the topic of directional positions.

Figure 9: Setting up the Trade

Evidently in Figure 2, the COPOM has always reacted promptly to address any reversals in inflation trend. As it is incredibly difficult to predict future inflation trends and other economic conditions, it is therefore difficult to predict COPOM’s reaction in the future. As such a directional trade on DI Futures can prove to be relatively risky.

As of 10th Nov 2024, the rates quoted by the DI1F35, expressing a 10-year view, and the DI1F27, expressing a 2-year view, are at 12.49% and 13.09% respectively, resulting in an inverted yield curve.

Considering Brazil’s strong economic fundamentals, the current inverted yield curve appears overly pessimistic. A trade, constructed with DI1F27 and DI1F35, that anticipates a normalization to a positive yield curve could be profitable. To set up the trade, we would have to calculate the sizing ratio from a Basis Point Value (BPV) neutral perspective. The computation is shown in the table below.

We would consider taking a long position on the forward rate strategy by selling 100 DI1F27 futures and buying 55 DI1F35 futures. Each basis point move in the DI1F27 leg is 100 * R$ 14,46 = R$ 1.445 and each basis point move in the DI1F35 leg is 55 * R$ 27,35 = R$ 1.504. Evidently, each basis point move in the DI rate would have roughly the same profit and loss impact on either contract. This is achieved by the BPV neutral calculation.

From Figure 9, we would place the stop-loss at -0,65, a historical support line, for a hypothetical maximum loss of 5 basis points, 5 * R$ 1.504 = R$ 7.520. Likewise, we would place the take-profit at 0,93, a historical resistance line, for a hypothetical gain of 153 basis points, 153 * R$ 1.446 = R$ 221.238.

In conclusion, this relative value trade would be more favorable. As expressed in this trade, the normalization could happen as a result from either a rise in the DI1F35, a fall in the DI1F27, or a concurrent rise and fall in the DI1F35 and DI1F27 respectively. This proves that a relative value trade is likely to be less risky as compared to a directional bet on the Selic Target Rate using one DI Futures contract.

Divergence Unveiled: Ibovespa & S&P500“Emerging markets conclude 2023 on better note than developed markets” – S&P Global Market Intelligence.

How much of this has been reflected in the respective market indices?

Figure 1: Ibovespa and E-mini S&P500 Index Futures

Figure 1 presents a retrospective view of the Ibovespa Index Futures (IND1!) and E-mini S&P500 Index Futures (ES1!) since the onset of the pandemic. While the indices initially traded in tandem, a noticeable deviation emerged since the middle of 2021. The IND Futures to ES Futures ratio testing long-term resistance at 25 raises questions about a potential rebound or breakout to the downside. Let's delve into the methodologies of these two index futures to gain insights into their recent divergence.

Index Methodology and Weightings

Figure 2: Top 10 Constituents of Both Indices

Examining the top 10 constituents of both indices in Figure 2, we observe fundamental differences. Despite their similarities as float-weighted benchmarks for large-cap stocks in their respective countries, the Ibovespa Index comprises 86 stocks compared to the SP500's 500. This fundamental distinction results in a significantly larger total weight for the top 10 constituents of the Ibovespa Index, suggesting that IND future prices are more susceptible to the performance of its leading components.

Ibovespa Driven by Global Commodity Prices

Figure 3: Ibovespa vs Brent Crude Oil, Nickel, and Iron Ore

Dominated by the Energy, Financials and Basic Materials sector, the combined weight of VALE SA and PETROBRAS holds significant influence. While VALE SA is the largest producer of iron ore and nickel in the world, PETROBRAS is heavily involved in the petroleum industry. Their earnings are likely to increase following an increase in the traded prices of iron ore, nickel, and crude oil, respectively.

Positive correlations with Nickel, Iron Ore, and Crude Oil Futures prices indicate periods marked in grey boxes since the pandemic, where fluctuations in commodity futures potentially explain observed patterns in IND prices.

Figure 4: Global Commodity Index

Hence, given IND1!'s demonstrated sensitivity to commodities, understanding the general trajectory of commodities becomes paramount. The S&P Goldman Sachs Commodity Index (GSCI) provides an overview for commodities. In Figure 4, the GSCI acts as a good proxy for the commodities cycle and direction, here we observe a 30% correction from the peak, erasing some of the gains derived from the post-pandemic recovery and the Russia-Ukraine war. However, since the beginning of 2024 we see signs of a potential trend higher with the index starting to creep higher.

Figure 5: Bullish Trends Observed on Multiple Commodities

Is this just part of the usual price volatility for commodities or is the move higher significant? A detailed scrutiny of recent price movements in Figure 5 reveals a bullish outlook for all three previously examined commodities, relevant especially to the Ibovespa Index. The breakout from an ascending triangle in Brent Crude Oil Futures, the price rebound from historical support in Nickel Futures, and the testing of the upside trendline in Iron Ore Futures collectively indicate a prevailing bullish bias, perhaps suggesting more to the broader move higher for commodities.

Are Lower Rates Better?

Figure 6: Changes in Rates and USDBRL on Ibovespa

The Financial Sector, with significant weight in the index, is examined. While higher interest rates expand profit margins of financial institutions, extended periods of tight monetary policy can expose vulnerabilities and increase loan losses.

Since August 2023, Brazil’s Central Bank Monetary Policy Committee, Copom, has had five consecutive rate cutes up to a cumulative total of 250 basis points while the market continues to alter bets on the Fed’s first rate cut. Intriguingly, while interest rate parity would suggest a strengthening USDBRL, the observed weakening suggests a unique deviation.

Furthermore, as the Fed gains more confidence, evidenced by each data print, the likelihood of impending rate cuts becomes more apparent. Conversely, the outlook for further cuts by Copom is less clear due to persistently high inflation. Interpreting these factors collectively points towards a weaker USDBRL and a correspondingly stronger IND1!; as suggested by the historical inverse relationship between Ibovespa and USDBRL observed in Figure 6.

Additional Support for Ibovespa

Figure 7: Brazil’s Growing Net Exports

The rolling average of the net exports, although exhibiting some degrees of seasonality, seems to be a leading indicator of the IND prices. The reversal and positive trend in the rolling average of net exports since 2015 aligns with the climbing IND prices, indicating substantial support from Brazil's trade balance.

EM Still an Attractive Option

Figure 8: Comparing Both Index Futures’ RSI

Figure 8 brings to light yet another noteworthy point, using the ES1! as a proxy for the Developed Markets (DM) and the IND1! as a proxy for Emerging Markets (EM), we see the DM significantly overbought relatively to the EM. Hence, we argue that there is further room for the EM Index to grow.

Putting into Practice

Figure 9: Setting up the Trade

Looking at a shorter timeline, Figure 9 unfolds a compelling narrative marked by a recent decisive breakout from an inverse head and shoulders pattern. This breakout, coupled with the notable reversal in commodity prices, Brazil’s improving balance of trade, a weaker USDBRL, and the RSI not yet overbought; we lean bullish on the IND1!.

To express this view, we can long the Ibovespa Index April 2024 Futures (INDJ4) at the current price level of 129,070.

• We can set the take profit by adding the difference between the neckline and the bottom of the head (24,695), to the neckline (121,980). This puts our take profit at 146,675 and a hypothetical gain of:

146,675 – 129,070 = 17,605 points.

• Likewise, we can set the stop loss at the neckline (121,980), which brings us a hypothetical maximum loss of:

129,070 – 121,980 = 7,090 points.

• Each point is equivalent to 1 BRL.

Overall

In summary, understanding the intricate dynamics between global commodity prices, monetary policies, and trade balances provides valuable insights for anticipating the trajectory of the Ibovespa Index Futures in the evolving financial landscape.

Have you had your coffee yet?We already know that coffee beans have always been one of the most traded commodities in the world, specifically second, so why the sudden interest again?

Figure 1: Summary of World Coffee

In recent years, global consumption has increased at a higher rate than production due to pent-up demand. This rather large deficit in balance in the past two years puts the coffee market in an interesting spotlight. Nonetheless, arabica beans continue to be the more favored selection, with South America as the central production region, driven mainly by Brazil.

Gaining Access to This Market

Amongst various coffee derivatives, a coffee futures contract is the most common way to trade coffee. The 4/5 Arabica Coffee Futures (ICF) listed by Brasil, Bolsa, Balcão (B3) Exchange is an example of such contracts.

For those unfamiliar with futures contracts, it is a legal agreement to buy or sell a specified asset at a predetermined price for delivery at a specified time in the future. For the ICF contract, the asset is 100 bags of 60 kilograms filled with grade 4-25 or better Arabica coffee bean produced in Brazil that is meant to be delivered in the city of São Paulo, Brazil, or a B3 accredited warehouse.

The ICO’s Grading and Classification of Green Coffee states that “coffees of the highest altitudes are denser and larger in size than those produced at lower altitudes.” Loosely speaking, larger beans with higher density are better.

The grade indicators refer to the number of defects found in a 300g sample. To achieve a 4-25 grade, the coffee must be classified by B3 in accordance with its rules and regulations. This grading system is more specific to Brazil-produced beans. Other coffee-producing countries have other specifications and classifications.

The Trampoline Effect

Figure 2: Supply & Demand Factors

Historically, the ICF future prices resemble that of a trampoline, with major support lines at the 124.55 and 103.60 levels. Let us explore some of the factors that caused these jumps previously; bear in mind that consumption of Arabica beans has been steadily increasing since the 1990s.

S1: Poor weather conditions in South America in 2010

Brazil suffered from poor weather conditions and faced significant problems in meeting the expected crop yield. Large producers were also considering hoarding their stocks. The problem was further exacerbated by the backdrop of record low arabica stock levels since the 1960s.

S2: Drought in Brazil in 2014

Similarly, poor weather conditions caused uncertainty in crop production for the harvest year and pushed prices up.

S3: Drought and frost in Brazil 2021

The effects of drought followed by a severe wave of frost in Brazil wiped out its coffee production. This was accompanied by increased freight costs and shipment issues caused by Covid-19.

S4: Harvest Conditions

Evidently, weather conditions pose significant downside risks to the coffee supply. Moreover, occasional coffee leaf rust coupled with increasing demand has caused spikes in coffee prices.

USD and Coffee

Figure 3: ICF and DXY (Inverted)

As with many commodities, coffee tends to move inversely with USD. This is especially so since most coffee contracts, like the ICF, are priced in USD. When the dollar rises, coffee becomes more expensive in non-USD terms and can cause international demand to fall, and vice versa.

Figure 4: ICF and BRLUSD

This relationship becomes more apparent when compared to BRLUSD. Our thought process:

Local Brazilian producers and manufacturers traded these ICF contracts as a hedging tool. During the physical delivery of the beans, these market participants would then have to do a currency exchange. Consequently, the impact of BRLUSD rates would have a larger impact on them.

Similar Coffee Futures Contract

Figure 5: ICF and KC

The two contacts’ underlying assets - arabica beans - have similar grading standards. Consequently, macroeconomic factors are likely to have similar impacts on the two contract prices. The prices between the two contracts exhibit a very strong positive correlation. We can then create a spread with ICF – Coffee C (KC) Futures Contract.

Figure 6: ICF - KC

ICF is quoted USD per bag for a contract size of 100 60kg bags, while KC is quoted USD cents per pound for a contract size of 37,500 lbs. We can then create a spread with ICF1!/60-KC1!/0.4536/100, by converting both contracts to the same base units.

The spread setup indicates that KC generally trades at a premium compared to ICF. This could be attributed to several factors, a notable one being the higher liquidity preference investors tend to have for the KC contract, which might reflect a broader international preference. It is also worth noting that ICF requires Brazil-produced arabica beans, while KC comprises beans from other countries. This could explain the uncanny coincidence between the upside bias in spread movements (Figure 6) occurring in periods identified in Figure 2 – supply-side factors driven mainly from the Brazil side.

Putting into Practice

Enough has been said about coffee; you must be wondering how we then use this information to set up trades. Here are some ways for consideration.

Case Study 1: Directional Driven

By considering current macroeconomic factors on coffee, to express a “quieter” outlook on coffee, an investor could sell the ICF future contract (ICFH4).

At the present level of 206.00, with a stop-loss above 219.00 – a conservative resistant line – it brings us a hypothetical maximum loss of 219.00-206.00 = 13.00 points.

As shown in Figure 2, if ICF1! Reverts to major support line 124.55, a hypothetical gain of 206.00-124.55=81.45 points.

Each ICF futures contract represents 100 bags; the value of each point move is USD100.

However, as we approach the main harvest period for Brazil, May to Sep, it is of paramount importance for the investor to keep a watch for any potential hiccups that could negatively affect the harvest yield. Furthermore, this is likely to be a medium-term macro-driven strategy.

Case Study 2: Spread Driven

Regarding the ICF-KC spread currently trading at the upper bound, an investor with a bearish short-term view that the spread will trend downwards could sell ICF futures contract (ICFH4) and buy KC futures contracts (KCH4).

At the present level of 206.00 and 169.95 for ICFH4 and KCH4, respectively. Following the formula above, the spread will be at –0.31336 points.

Setting the resistance at the Fibonacci 50% ratio, we have a stop loss at -0.25, which brings us a hypothetical maximum loss of -0.25-(-0.31336) = 0.06336 points.

Setting the support at the Fibonacci 38.2% ratio, we set our take profit at -0.40, which brings us a hypothetical gain of -0.31336-(-0.40) = 0.08664 points.

The value of each point move in ICFH4 is USD100, while KCH4 is USD375.

Conclusion

There are various methods to create opportunities for investors, depending on how the investor would like to view the market or what other financial assets to pair up with coffee futures contracts. What we have covered in this article merely scrapes the tip of the iceberg, and we hope investors keep a creative mindset and explore other potential options.

Disclaimer:

The contents of this article are intended for information purposes only and do not constitute investment recommendations or advice. Nor are they used to promote any specific products or services. They serve as an integral part of a case study to demonstrate fundamental concepts in risk management under given market scenarios. A full version of the disclaimer is available in our profile description.

Buy LWSA3: Support Rejection, Trendline Break + MACD DivergenceLocaweb is presenting an interesting buy. Having gotten clobbered in the past months due to interest rates on the rise locally and globally, we now have signs that the bearish trend is on its last breaths, or has morphed into very early stages of an uptrend.

DOUBLE BOTTOM

A Double Bottom is likely being formed.

SUPPORT REJECTION

A few days ago, price closed a gap that was made close to the current most recent low. After closing this gap, which was served as a support itself(thin grey horizontal rectangle), price started climbing again.

TREND

We already have a higher high, but confirmation of a higher low will only take place when the last high is surpassed. For now we have a temporary higher low that was made just a few days go, and is a strong candidate to become this first higher low.

MACD

We have triple MACD Divergence which clearly shows waning bearish trend strength.

TRENDLINE

The bearish trendline was broken on this moves first leg up, which had a 50% plus price push upwards.

VOLUME

Said first leg up had record volume.

NUBR33 Price Reversion [next target]After BMFBOVESPA:NUBR33 finally found its bottom at 8.32 points it formed a double bottom pattern last week, then a spike surged pumping the price over 10% breaking an important resistance zone before the market closed for the Christmas holiday.

What we can expect for its reopening tomorrow is the price continuing its run aiming for the second level of the fib retraction at around 9.69 points .

The price action around this area will determine whether the stock keep its run for a higher target or settle in a new resistance zone.

Relative strength and price momentum may indicate a consolidation period confirming the price settlement after the next target.

Cheers.

Measured Support in the up & downs of #ES_FShowing some trendline support along with measured moves hitting on the short side.

Next leg up is a decent bet with the angles of the trendlines still green and the market in oscillation.

It is important to realize that in an oscillating market, measured moves hit all the time.

Should a solid and lengthy trend develop, the MM's will fail with price blowing past them.

Conversely in trendy markets, the MM's would be huge, but when oscillation takes over the MM"s never come close to hitting for a short time.

Programming notes:

My algorithm is finished!

I have 4 scripts off of the idea so far with 2 possibly 3 to go.

I want to get them all done so people can save on access costs through bundling.

Expect late June to early July for access to these amazing new indicators.

Shown:

B3 MEASURED MOVES TRIANGLE (Measures moves then projects them in triangulation)

B3 AUTO-DRAW (Automatically paints valid-only TRENDLINES, FRACTALS or ZIGZAG)

Nasdaq Futures in a falling channelHere we begin the week at the top of a channel, which means it is the best place to go short. Having the channel there tells us quickly the short is incorrect should king price breaks higher - shorts fold. I like trades that are either correct or get right out, but I never like to feel jumpy leaving a trade early (the questioning the exit is the worst part). A channel makes this easier, it either stays in the channel or it doesn't.

Featured are the upcoming releases Measured Move and AutoDraw Trendlines. - Several new features!!

Long/Compra SAPR11: End of ABC Correction/Fim de Correção ABCSAPR11 is almost finishing its Corrective WAVE C down. We should see a thrust upwards marking the start of the next impulse upwards, on it's way to breaks the highs seen on the start of the ABC.

SAPR11 está quase terminando uma onda corretiva C para baixo. Devemos ver um empuxo para cima, marcando o começo do próximo impulso, a caminho de romper o topo feito no topo do ABC.

Good-luck and godspeedSupport at 1.35 with support 20 day moving average

Support at 1.25 and filling one remaining gap

Support at 1.09 and filling two remaining gaps and support of 12 month and 10 year moving averages

Target at 2.17

Target at 2.43

Target at 2.85