Quantum's BA Weekly Outlook 7/19/25🚀 G.O.D. Flow Certified Trade Blueprint – Boeing (BA)

1. 🧩 Summary Overview

Ticker: BA

Current Price: $229.34

Trade Type: Day Trade / 0–2 Day Swing

System: G.O.D. Flow (Gamma, Orderflow, Dealer Positioning)

2. 🔬 Flow Breakdown

🔵 GEX (Gamma Exposure):

Highest negative GEX at $230 = possible resistance or sticky zone.

However, +GEX2 at $235 and +GEX3 at $240 outweigh $230 → suggests dealer hedging will push price upward through gamma bands.

🟡 DEX (Delta Exposure):

+DEX peaks at $230 then fades toward $240 and reappears at $250 → bullish flow decay confirms momentum needs volume through $235–240 to continue upward push.

🟣 Vanna:

Flip zone at $232.50 → if IV rises and price pushes upward, dealers must buy, adding tailwind.

Major positive clusters at $240 & $250 = major squeeze potential if IV increases intraday.

🔴 Charm:

Flip zone at $227.50 = above this level, morning decay benefits bulls.

Negative charm at $240 & $250 = expect afternoon fade into these zones — ideal trim targets.

⚪ Volatility:

Volatility decreasing weekly = less explosive risk, more structured/predictable flow.

Dealers will likely have cleaner hedging paths without IV shocks.

🟢 Open Interest:

Stacked calls at $230, $235, $240, $250.

Aligns with GEX/Vanna targets → confirms upside skew.

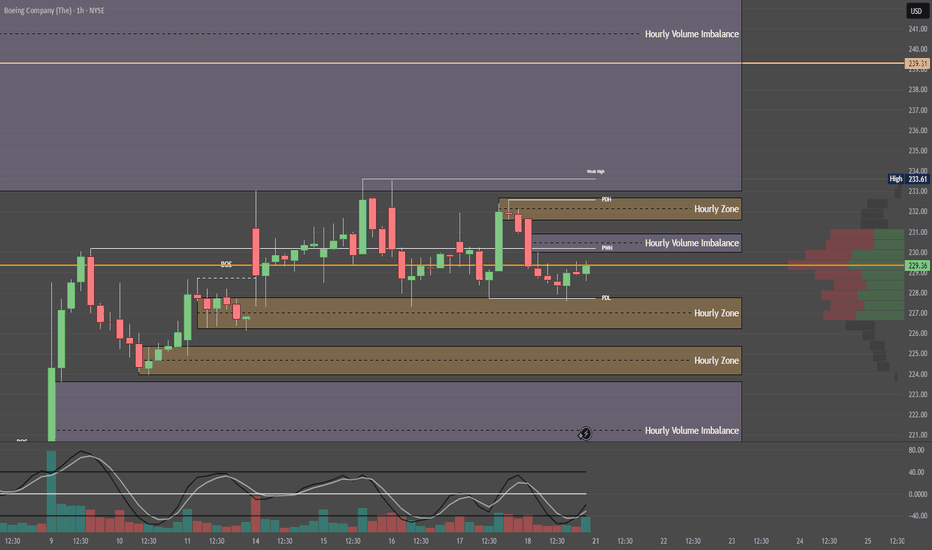

3. 🧭 Chart Structure Setup

Daily: Consolidation breakout attempt.

Hourly: Bounce off support with bullish stochastics crossover.

10M OR: Mark OR High/Low — use reclaim of OR High + VWAP as entry signal.

Resistance: $235–240 (flow + OI + chart confluence) = ideal trim zone.

4. 🎯 Trade Plan

Bias: Bullish

Trigger Entry: Break and reclaim of $232.50 (Vanna Flip)

Contract Suggestion:

235c or 240c, 0–2 DTE (Friday expiry if early week)

Stop-Loss:

VWAP loss or break below $230

Target Zones:

🎯 T1: $235 (GEX2 + OI cluster)

🎯 T2: $240 (GEX3 + Vanna/Charm confluence)

5. 🔁 Intraday Adjustment Triggers

If This Happens: Then Do This:

GEX flips positive above $232.50 Strengthen conviction

Vanna clusters weaken + IV drops Trim / De-risk

Charm flips heavily negative by 12pm Expect fade into highs

Large sweeps hit 235c/240c strikes Ride momentum with size confidence

BA

Boeing (BA, 1W) Falling Wedge + H-Projection TargetOn the weekly chart, Boeing has formed a classic falling wedge — a bullish reversal pattern that typically signals the end of a correction phase. After a sharp decline from $267.97 to $138, price action began to compress within a wedge, forming lower highs and higher lows on declining volume — a textbook setup for a breakout.

The structure remains active: a confirmed breakout above the upper wedge boundary, with a retest near $181.60 (0.618 Fibonacci retracement), would validate the pattern and trigger the next upward phase.

The projected move (H) equals the height of the previous impulse — $130.02. Adding this to the base of the wedge (~$138) yields a technical target of $268.00, aligning with the previous high and completing the structural recovery.

Technical summary:

– Multiple confirmations of wedge support

– Volume declining into the apex (bullish)

– Entry zone: breakout + retest at $181.60

– Mid-level resistance: $198.09 (0.5 Fibo)

– Final target: $267.97–$268.00 (H-projection complete)

Fundamentals:

Despite operational setbacks, Boeing remains structurally positioned for recovery as demand for commercial aircraft rebounds. Additional support could come from improving supply chains, increased defense contracts, and a more dovish outlook from the Federal Reserve heading into 2025.

A breakout above $181.60 and sustained momentum would confirm the falling wedge pattern and activate the H-measured move toward $268. This is a structurally and fundamentally supported mid-term recovery setup

BA Weekly Options Play – 2025-06-10🧾 BA Weekly Options Play – 2025-06-10

Bias: Moderately Bearish

Timeframe: 5 trading days

Catalysts: Short-term exhaustion signals despite positive news

Trade Type: Single-leg PUT option

🧠 Model Summary Table

Model Direction Strike Entry Price Target Stop Loss Confidence

Grok Bullish 217.50C $0.79 $1.19 $0.40 65%

Claude Bearish 205.00P $0.95 $1.50–2.00 $0.50 72%

Llama Bearish 205.00P $0.95 $1.14 $0.48 70%

Gemini Bearish 202.50P $0.55 $1.00–1.10 $0.25 65%

DeepSeek Bearish 205.00P $0.95 $1.90 $0.47 60%

✅ Consensus: Moderately Bearish

📉 Setup: Tactical mean-reversion play from overbought RSI and MACD divergence

⚠️ Outlier: Grok sees bullish continuation toward $217.50 (minority view)

🔍 Technical & Sentiment Recap

Short-Term: 5-min RSI ~88 (overbought), price hugging upper Bollinger Band

Daily Chart: MACD bearish divergence or slowing momentum

Sentiment: Mixed headlines—China aircraft deliveries positive, but max pain at $207.50 acts as gravitational pull

VIX: Low (≈16.8), suggesting limited volatility but a stable short bias

✅ Final Trade Recommendation

Parameter Value

Instrument BA

Strategy Weekly naked put

Strike $205.00

Entry Price $0.95 (ask)

Profit Target $1.50 (≈58% gain)

Stop-Loss $0.50 (≈47% premium loss)

Size 1 contract (risk ≤2% of account)

Entry Timing At market open

Confidence 70%

🎯 Rationale: Consensus expects BA to retrace from short-term overbought condition back toward max pain zone (~$207.50). Four out of five models favor put option setups.

⚠️ Risk Factors

A strong gap above $211.50 invalidates short thesis → cut immediately

Strong fundamentals (China fleet growth, aviation sector strength) could support further upside

VIX staying low = slow downside → puts may decay rapidly

Use limit order on open to manage slippage risk

📊 TRADE DETAILS SNAPSHOT

🎯 Instrument: BA

🔀 Direction: PUT (SHORT)

🎯 Strike: 205.00

💵 Entry Price: 0.95

🎯 Profit Target: 1.50

🛑 Stop Loss: 0.50

📅 Expiry: 2025-06-13

📏 Size: 1 contract

📈 Confidence: 70%

⏰ Entry Timing: open

🕒 Signal Time: 2025-06-08 16:10:44 EDT

A potential setup on BA soon?OptionsMastery:

🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

BA Weekly Options Trade Plan 2025-04-15NYSE:BA BA Weekly Analysis Summary (2025-04-15)

Below is our synthesis of the various models, followed by our final trade conclusion and details.

──────────────────────────────

Comprehensive Summary of Each Model’s Key Points

• Grok/xAI Report – Technicals on BA show that the price (about $155.52) is below the short‐term (and even daily) moving averages with a 5‑minute RSI well into oversold territory (24.71). – The MACD is negative while Bollinger Bands show price near the lower edge. – Market sentiment (including bearish headlines and high put open interest) supports a view of further downside, despite a touch of potential mean‐reversion. – Recommendation: Buy a naked put at the $150 strike (premium ~$0.88) to play a moderately bearish view.

• Gemini/Google Report – Confirms that on a 5‑minute chart BA is trading below key EMAs and shows strong bearish momentum on MACD. – However, the extremely oversold 5‑minute RSI and the fact that the max pain is at $160 (well above current price) introduce a counter‐signal suggesting a possible bounce. – Conclusion: The directional bias is ambiguous; the risk of entering a short when a bounce may occur makes trade timing uncertain. No clear open‐trade setup is recommended.

• Llama/Meta Report – Also notes that BA’s price is below key short‑term moving averages and that the MACD is on the downside. – But Llama points out that the max pain level at $160 and relatively low call premium (e.g. $162.50 call at $0.54) might offer a speculative play on an upward move. – Recommendation: Buy the $162.50 call as a hedge/speculative play, citing the potential for a rally toward the max pain.

• DeepSeek Report – Reiterates the technical picture: BA is trading below its key MAs, the 5‑minute RSI is oversold, and there is strong bearish open interest in puts (notably at the $150 strike). – Their analysis supports a moderately bearish outlook despite the risk of a short‐term bounce. – Recommendation: Buy the $150 July (weekly) put at $0.88, with exit triggers set if BA regains short‑term resistance.

────────────────────────────── 2. Areas of Agreement and Disagreement

• Agreement: – All models agree that BA is trading below key short‑term moving averages and that the 5‑minute technicals (including an extremely low RSI and negative MACD) point to bearish momentum. – There is consensus that options data (with max pain at $160 and strong put open interest at $150) provides key reference points.

• Disagreement: – While Grok and DeepSeek lean into a bearish trade via the $150 put, Gemini highlights conflicting signals (oversold RSI versus bearish momentum) and recommends caution at the open. – Llama instead sees potential for a bounce upward towards max pain and recommends a call trade. – The conflict centers on whether the oversold condition could force a short-term bounce (favoring calls or no trade) versus the prevailing bearish trend (favoring puts).

────────────────────────────── 3. Clear Conclusion

Overall Market Direction Consensus: The majority of the analyses show that while BA has an oversold 5‑minute RSI hinting at a possible short-term bounce, the price action below key EMAs, the negative MACD, bearish news, and heavy put open interest largely indicate a moderately bearish outlook. The ambiguity in the immediate open (as noted by Gemini) is acknowledged, but overall the consensus leans toward further downside pressure.

Recommended Trade: Since we must trade single‑leg, naked options on weekly expiries and we choose one of the provided strikes/prices, we favor the moderately bearish stance. Hence our recommendation is to buy a naked put option.

Trade Parameters: • Instrument: BA • Trade: Buy weekly puts • Strike: $150.00 • Premium: $0.88 (as shown in the current options data) • Expiration: 2025‑04‑17 • Entry Timing: At open • Rationale: This put offers a bearish play that earns from continued downside momentum, even if there is a brief bounce. Liquidity is supported through high open interest and volume at this strike. • Confidence Level: Approximately 65% • Risk/Reward Guidelines: A target exit is set for a roughly 50% profit on the premium (aiming for an option price near $1.32), while a stop‐loss is triggered if BA recovers and breaches key short‑term resistance (around the $156 range) – roughly limiting losses to 50% of the premium.

Key Risks and Considerations: – There is a risk that the oversold condition (RSI at 24.71) could spark a swift bounce, forcing the trade into near‐term losses. – The max pain level at $160 could create upward pressure as expiration nears. – Volatility as indicated by the VIX (30.12) remains elevated, so sudden price swings are possible. – Traders should carefully size positions (not more than 2–3% of account capital) and defend profit targets and stops to limit risk.

────────────────────────────── 4. TRADE_DETAILS (JSON Format)

{ "instrument": "BA", "direction": "put", "strike": 150.0, "expiry": "2025-04-17", "confidence": 0.65, "profit_target": 1.32, "stop_loss": 0.44, "size": 1, "entry_price": 0.88, "entry_timing": "open" }

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions based on proprietary research which I am sharing publicly as my personal blog. Futures, stocks, and options trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of TradingView. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors' IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.

What Rules the Skies Now?In a landmark decision reshaping the future of aerial warfare, Boeing has secured the U.S. Air Force's Next Generation Air Dominance (NGAD) contract, giving rise to the F-47, a sixth-generation fighter poised to redefine air superiority. This advanced aircraft, succeeding the F-22 Raptor, promises unprecedented capabilities in stealth, speed, maneuverability, and payload, signaling a significant leap in aviation technology. The F-47 is not conceived as a solitary platform but as the core of an integrated "family of systems," working in concert with autonomous drone wingmen known as Collaborative Combat Aircraft (CCAs) to project power and enhance mission effectiveness in contested environments.

The development of the F-47 directly responds to the evolving global threat landscape, particularly the advancements made by near-peer adversaries like China and Russia. Designed with a focus on extended range and superior stealth, the F-47 is specifically tailored to operate effectively in high-threat regions, such as the Indo-Pacific. Years of clandestine experimental flight testing have validated key technologies, positioning the F-47 for a potentially accelerated deployment timeline. This next-generation fighter is expected to surpass its predecessors in critical areas, offering enhanced sustainability, supportability, and a reduced operational footprint, all while potentially costing less than the F-22.

The designation "F-47" itself carries historical and symbolic weight, honoring the legacy of the World War II-era P-47 Thunderbolt and commemorating the founding year of the U.S. Air Force. Furthermore, it acknowledges the pivotal role of the 47th President in supporting its development. Design elements observed in early visualizations hint at a lineage with Boeing's experimental aircraft, suggesting a blend of proven concepts and cutting-edge innovation. As the F-47 program moves forward, it represents not only a strategic investment in national security but also a testament to American ingenuity in maintaining its dominance of the skies.

Breakout to the downside on BA?🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

Can Quantum Leap Us into the Cosmos?Boeing's venture into the quantum realm is not just an exploration; it's a bold leap forward into a universe where technology transcends traditional boundaries. Through its involvement in the Quantum in Space Collaboration and the pioneering Q4S satellite project, Boeing is at the forefront of harnessing quantum mechanics for space applications. This initiative promises to revolutionize how we communicate, navigate, and secure data across the vast expanse of space, potentially unlocking new realms of scientific discovery and commercial opportunity.

Imagine a world where quantum sensors offer unprecedented precision, where quantum computers process data at speeds and volumes previously unimagined, and where communications are secured beyond the reach of conventional decryption. Boeing's efforts are not merely about technological advancement; they are about redefining the very fabric of space exploration and security. By demonstrating quantum entanglement swapping in orbit with the Q4S satellite, Boeing is laying the groundwork for a global quantum internet. This network could connect Earth to the stars with unbreakable security and accuracy.

This journey into quantum space technology challenges our understanding of physics and our expectations for the future. With its history of aerospace innovation, Boeing is now poised to lead in an area where the stakes are as high as the potential rewards. The implications of this work extend far beyond secure communications; they touch on every aspect of space utilization, from manufacturing in microgravity to precise environmental monitoring of our planet and beyond. As we stand on the brink of this new frontier, the question isn't just about what quantum technology can do for space, but how it will transform our very approach to living, exploring, and understanding the cosmos.

Boeing (BA): Is Boeing Finally Breaking the Bearish Trend?Boeing has faced significant challenges since March 2020, and when zoomed out, the stock has been trading in a well-defined range between $265 (range high) and $120 (range low), with the mid-range at $192. These levels have been respected repeatedly. From an Elliott Wave perspective, starting the count from the COVID low, we’ve observed consistently deep wave 2 corrections. Following the recent low of $138 in November 2023, we believe Boeing has broken the bearish trend that began in December 2022, signaling a trend reversal.

Currently, we anticipate the completion of the very minor wave (i) soon, followed by wave (ii) correction between the 61.8% and 88.2% Fibonacci retracement levels. To safeguard against Boeing’s historically deep corrections, we are placing the stop-loss slightly below 100% of wave 2.

Looking ahead, the wave structure suggests that Boeing could eventually break out of this long-standing range. For now, the focus is on reclaiming and holding the mid-range level at $192. Our target in this setup is to reach $265 (range high), but it is crucial to first see the mid-range flipped into support.

Key Levels:

Support: $147

Resistance: $192

Levels to break on BA! 🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

$BA 1D Idea🚨 Boeing (BA) Analysis 🚨

🔻 Falling Wedge: BA is in a falling wedge pattern, signaling a potential reversal soon.

📊 Key Levels:

Support: $146

Resistance: $165-$170

Current Price: $152.35 (-25.88%)

🟢 Oscillator: Currently oversold in the green zone, suggesting a possible bounce.

📈 Watch for a breakout above the wedge for a move toward $165. Failure to hold $146 could lead to further downside.

Boeing: Taking Off?Boeing continued its decline recently, moving steadily toward our green Target Zone ($146.35 – $113.35). Just this Tuesday, the price reversed only $0.23 above our Zone. While it’s technically possible that the stock has already established the low for wave (2) in green with this dip, we aren’t convinced. So, we expect another pullback soon, with the stock eventually landing within our Target Zone.

Boeing Faces Major Setback as Workers Vote to StrikeBoeing Co. (NYSE: NYSE:BA ) is once again facing turbulence, but this time, it's not related to its planes or production flaws. Thousands of Boeing factory workers have overwhelmingly voted to strike, rejecting a tentative contract agreement, sending shockwaves through the aerospace sector. The strike could have substantial financial consequences, not only for Boeing but also for airlines, suppliers, and the broader industry. Here’s an in-depth look at the technical and fundamental aspects of Boeing's current situation.

Union Discontent and Financial Repercussions

The decision by Boeing workers to strike, voting 96% in favor, comes after rejecting a contract that offered a 25% wage increase over four years and a commitment to invest in the Puget Sound region. The workers, represented by the International Association of Machinists and Aerospace Workers (IAM), found the deal insufficient, especially against the backdrop of Boeing’s previous issues and ongoing recovery efforts.

Key Factors:

- Financial Strain: Boeing has been struggling with production delays, safety concerns, and a staggering $60 billion debt load. A prolonged strike could worsen these issues, especially if it drags out as the 2008 strike did, costing Boeing $100 million per day.

- Impact on Operations: The strike affects Boeing’s major assembly plants on the West Coast, including Seattle and Portland. This could disrupt the production schedule of key models like the 737 MAX, already under scrutiny by regulators.

- Market Response: Boeing's stock is down 36% year-to-date, reflecting investor concerns over ongoing financial strains and potential production disruptions. With the strike, there is a real risk of further downgrades by rating agencies, putting additional pressure on Boeing’s credit standing.

Technical Outlook

Technically, Boeing’s stock is already on shaky ground, having been in a downward trend for most of the year. The strike news has pushed the stock further down, trading near its lowest levels since November 2022.

Technical Indicators:

Boeing's shares fell around 3% early Friday, breaking below key support levels as the market digested the strike news. The stock is now trading near $180, a critical psychological and historical support zone. A dip below the critical support of $126 will lead to massive sellout as it stands as the major building block holding Boeing (NYSE: NYSE:BA ) stock.

The stock has been trading well below its 50-day and 200-day moving averages, a bearish signal that indicates ongoing downward momentum. A death cross pattern was recently confirmed, suggesting further downside risk.

The Relative Strength Index (RSI) remains oversold, hovering around 40, indicating that while the stock is heavily beaten down, it could still see further selling pressure. The MACD is also trending negative, reinforcing the bearish outlook.

What’s Next for Boeing?

As Boeing (NYSE: NYSE:BA ) navigates these troubled waters, the outcome of the strike negotiations will be crucial. The company has expressed its willingness to return to the table, but workers are holding firm on their demands. For investors, the key will be to monitor any updates regarding the length and impact of the strike, especially on Boeing's production capabilities and financial outlook.

Boeing’s challenges are emblematic of broader issues in the aviation industry—supply chain disruptions, rising costs, and workforce discontent. A prolonged strike could set Boeing back in its recovery efforts, delaying production and hurting its reputation further. For now, the market is on edge, watching closely as Boeing seeks to balance financial prudence with the demands of its workforce.

Investor Takeaway

Boeing (NYSE: NYSE:BA ) remains a high-risk stock in the near term due to the ongoing strike and financial uncertainties. Investors should be cautious and consider the potential for further declines if the strike continues. Key technical support levels and the company’s ability to resolve union disputes will be critical factors influencing Boeing's stock performance in the weeks ahead.

While the long-term outlook for Boeing (NYSE: NYSE:BA ) remains tied to the broader recovery of the aviation industry, the current scenario presents significant short-term headwinds. Navigating these challenges successfully will require careful negotiation, strategic decision-making, and, most importantly, a commitment to restoring the trust of both its workforce and investors.

Wells Fargo Downgrades Boeing Amid Debt Woes and Delayed GoalsBoeing (NYSE: NYSE:BA ), once a stalwart of American industrial might, faces significant challenges that have cast a shadow over its future prospects. The aerospace giant's financial woes have worsened as Wells Fargo recently downgraded its stock to “underweight,” slashing the target price to $119—a staggering 32% downside from its last closing price. Here's a deep dive into both the fundamental and technical factors that are driving Boeing's troubles.

Mounting Debt and Delayed Cash Flow Goals

Boeing's financial health is under severe strain as the company grapples with a massive net debt of approximately $45 billion. The debt crisis stems from a series of setbacks, including safety scandals, regulatory curbs on its 737 MAX production, and ongoing supply chain disruptions. As Wells Fargo analyst Matthew Akers notes, Boeing's annual free cash flow (FCF) target of $10 billion, initially projected for 2025-26, now looks unachievable until at least 2027-28.

To get back on track, Boeing (NYSE: NYSE:BA ) needs to address its towering debt load before it can consider launching new aircraft development—a critical factor for maintaining market competitiveness against rivals like Airbus (AIR.PA). Wells Fargo estimates that Boeing may need to raise $30 billion in equity to zero out its net debt by 2027, a move that would likely dilute current shareholders. The company's cash flow will remain constrained through 2030 as it prioritizes debt reduction over growth initiatives.

Further complicating matters, Boeing's strategic decision-making is under scrutiny. While deferring the launch of new aircraft could help stabilize cash flow, it risks losing market share to Airbus, which continues to dominate in the commercial aircraft space. A scenario where Boeing focuses solely on debt repayment could lead to stagnation, potentially ceding ground to competitors in the long term.

Technical Analysis: Breaking Below Key Support Levels

From a technical standpoint, Boeing's stock price has been in a downward spiral, exacerbated by the latest downgrade. Shares plunged over 7% on Tuesday, hitting their lowest intraday level since November 2022. The stock is currently trading below all key moving averages, indicating a strong bearish trend. The Relative Strength Index (RSI) stands at 34, signaling that NYSE:BA is oversold but not yet showing signs of a potential reversal.

The current price action suggests that Boeing could be headed for even lower levels, with the next major support zone around $149. A break below this level could trigger further downside, with limited immediate catalysts to inspire a rebound. The stock's downward trajectory has been punctuated by a series of lower highs and lower lows, a classic indicator of a sustained bearish trend.

Investors should be wary of Boeing's chart, which offers little optimism in the near term. The lack of institutional buying interest and consistent downward pressure point to a potential retest of critical support areas. Moreover, recent volumes have been thin, underscoring a lack of confidence among major players in the market.

A Long Road to Recovery

Boeing's path to recovery is fraught with challenges. The combination of staggering debt, delayed cash flow targets, and potential shareholder dilution paints a bleak picture for the company's near-term outlook. Fundamentally, Boeing needs to address its debt woes and regain investor confidence, while technically, the stock faces significant resistance levels that may cap any upward momentum.

For investors, NYSE:BA currently spells caution. The stock's inability to find a firm footing amid a series of bearish headlines suggests that Boeing's turbulence is far from over. Unless there is a substantial shift in the company's strategy or market conditions, the stock may continue to face downward pressure, making it a risky bet in an already volatile market environment.

Boeing Faces Another Setback: Cracks Discovered in 777X JetlinerBoeing's turbulent year continues as the aerospace giant confronts yet another major issue. During initial test flights of its cutting-edge 777X jetliner, Boeing (NYSE: NYSE:BA ) discovered cracks in a critical structural component, adding to a growing list of setbacks for the company.

The Discovery

The cracks were identified during routine inspections following test flights in Hawaii. The affected component is the thrust link, a crucial part that connects the plane’s massive engines to the airframe. This link, made from heavy-duty titanium, is unique to the 777X and integral to the aircraft's overall integrity. The discovery of these cracks has forced Boeing to ground its entire 777X test fleet as engineers work to replace the faulty parts and analyze the root cause.

A Boeing (NYSE: NYSE:BA ) spokesperson commented, "During scheduled maintenance, we identified a component that did not perform as designed. Our team is replacing the part and capturing any learnings from the component and will resume flight testing when ready."

Financial and Reputational Impact

This latest incident comes at a time when Boeing (NYSE: NYSE:BA ) is already struggling with several other crises. The company’s stock has plummeted more than 30% this year, largely due to a series of safety and mechanical failures. Earlier in January, a door plug detached mid-flight from a Boeing 737 MAX 9 operated by Alaska Airlines, prompting the Federal Aviation Administration (FAA) to ground expansion plans for the 737 MAX.

The 777X, Boeing’s most advanced commercial aircraft, was initially slated to enter service in 2020. However, due to increased regulatory scrutiny and ongoing safety concerns, this date has been pushed back multiple times, now tentatively set for 2025. The latest discovery of cracks in a key component could delay the 777X's entry into commercial service even further, exacerbating Boeing’s financial woes.

The Bigger Picture

This incident is the latest in a string of safety concerns that have plagued Boeing in recent years, starting with the tragic crashes of two 737 MAX aircraft in 2018 and 2019. Those crashes, which claimed the lives of 346 people, triggered a global grounding of the 737 MAX fleet and resulted in Boeing agreeing to a $243.6 million fine and a three-year probation period as part of a plea deal with the U.S. Department of Justice.

In light of the new issues with the 777X, Boeing’s reputation is once again under scrutiny. The company, which once held an untarnished reputation for safety and innovation, is now viewed with increasing skepticism by regulators, airlines, and the flying public.

Technical Outlook

Boeing's (NYSE: NYSE:BA ) stock experienced a 4.2% decline at the close of Tuesday's trading session, and its Relative Strength Index (RSI) indicates an oversold condition at 46. Moreover, the stock is currently trading below the 50, 100, and 200 Moving Averages (MA), signaling a strong bearish trend. A bearish harami candlestick pattern is visible on the daily price chart, further indicating downward pressure. It's apparent that Boeing (NYSE: NYSE:BA ) has undergone a series of price corrections and has been confined within a falling wedge pattern for some time now. A potential bullish signal could occur if the stock manages to surpass the 200-day MA, signaling a potential reversal in trend.

Looking Forward

As Boeing (NYSE: NYSE:BA ) works to resolve the cracks in the 777X, the company faces significant challenges ahead. Not only must it address the technical flaws in its latest aircraft, but it also needs to restore confidence in its ability to deliver safe and reliable planes. With the aviation industry closely watching, Boeing’s next steps will be crucial in determining whether it can recover from this series of setbacks or if it will continue to struggle in the years to come.

For investors, the situation remains precarious. Boeing shares (NYSE: NYSE:BA ), which have already suffered steep declines, could face further downward pressure if the 777X’s issues lead to additional delays or safety concerns. The company’s ability to rebound from this latest mishap will depend on its response to the crisis and its capacity to regain the trust of both regulators and the public.

Boeing Stock Climbs on CEO Appointment Despite Earnings MissOverview

Dow Jones aerospace giant Boeing (NYSE: NYSE:BA ) experienced an unexpected stock rise after appointing a new CEO, despite missing estimates for its second-quarter results. Here’s a comprehensive analysis of Boeing’s recent performance, the challenges it faces, and what the future holds under its new leadership.

Q2 Earnings Report: A Disappointing Performance

Boeing's second-quarter financial results revealed a deepening loss, reporting an adjusted loss of $2.90 per share. This was significantly wider than the FactSet analysts' expected loss of $1.90 per share and a marked increase from the $0.82 per share loss in the same period last year. The company's total revenue fell by 15% to $16.87 billion, missing the estimated $17.35 billion.

Commercial Airplane Segment Struggles

The commercial airplane segment faced severe challenges, with revenue plummeting 32% to $6 billion, driven by a corresponding 32% drop in deliveries. Boeing delivered 92 airplanes during the quarter, maintaining a robust backlog of over 5,400 planes valued at $437 billion. Despite the backlog, the immediate decline in deliveries and revenue underscores the operational difficulties Boeing is grappling with.

Efforts to Improve Safety and Quality

In response to a series of mechanical issues earlier this year, Boeing submitted a comprehensive safety and quality plan to the Federal Aviation Administration (FAA). Current CEO Dave Calhoun emphasized the company’s commitment to enhancing its quality management system, stating, "While we have more work ahead, the steps we're taking will help stabilize our operations."

Production Outlook

Boeing ( NYSE:BA ) plans to increase production of its 737 aircraft to 38 planes per month by the end of the year and boost 787 production to five planes per month. These production increases are crucial for Boeing as it aims to recover from recent setbacks and meet growing market demand.

Performance in Other Segments

Boeing's defense, space, and security revenue saw a slight decline of 2% to $6.02 billion. However, the global services segment reported a 3% increase in revenue to $4.89 billion. Despite these mixed results, Boeing's diversified portfolio provides a buffer against the challenges faced in the commercial airplane segment.

Free Cash Flow and Financial Health

A major concern for investors is Boeing’s free cash flow, which was negative $4.3 billion for the quarter, compared to a positive $2.6 billion in the same quarter last year. Managing cash flow effectively will be critical for Boeing as it balances investment in production and innovation with financial stability.

Strategic Acquisition

In early July, Boeing announced a strategic acquisition, agreeing to buy supplier Spirit AeroSystems (NYSE: NYSE:SPR ) for $4.7 billion. This deal, expected to close in mid-2025, aims to enhance Boeing’s supply chain capabilities and support its long-term growth strategy.

Leadership Change: A New CEO

A significant development for Boeing is the appointment of Robert K. "Kelly" Ortberg as the company’s new president and CEO, effective August 8. Ortberg, 64, brings over 35 years of leadership experience in the aerospace industry. He previously led Rockwell Collins, overseeing its integration with United Technologies and later with RTX Corporation.

Ortberg will succeed Dave Calhoun, who announced his plans to retire earlier this year. Calhoun has been with Boeing since 2009 and has served as CEO since January 2020, navigating the company through significant challenges, including the 737 Max crisis and the impacts of the COVID-19 pandemic.

Market Reaction

Despite the disappointing earnings report, Boeing ( NYSE:BA ) stock climbed 1.5% early Wednesday on the news of Ortberg’s appointment. The stock has rebounded from its late April lows but remains down more than 28% in 2024, making it one of the worst-performing stocks on the Dow Jones Industrial Average.

The stock currently has a Relative Strength Index (RSI) of 55.31, which suggests that there is a significant potential for strong growth in the near future. This particular figure is especially notable given that the stock has recently demonstrated a falling wedge pattern, a formation that is generally recognized as indicative of impending bullish reversals in the price trend.

This pattern is often interpreted as a precursor to an upward movement in stock prices. As a result, market participants are beginning to anticipate a decisive move toward the pivotal $217 point. Such a movement is expected to further reinforce Boeing's existing rising wedge formation, which aligns with the notion of a bullish shift in the stock's trajectory. Consequently, this anticipated behavior is likely to bolster investor confidence and enthusiasm surrounding the stock, as it suggests a positive turnaround and an upward momentum in its future performance.

Challenges Ahead

Ortberg will face several significant challenges as he steps into his new role. Boeing ( NYSE:BA ) is dealing with persistent financial losses, increased regulatory scrutiny, and a crisis of confidence from airline customers facing delivery delays. Additionally, the company is engaged in tense labor negotiations, with the threat of a strike looming.

Conclusion

Boeing’s Q2 earnings report highlighted ongoing operational and financial challenges. However, the appointment of Kelly Ortberg as CEO brings renewed optimism for the company's future. With his extensive experience and proven leadership in the aerospace industry, Ortberg is well-positioned to steer Boeing through its current difficulties and towards a more stable and prosperous future.

As Boeing ( NYSE:BA ) works to enhance its safety and quality systems, ramp up production, and navigate regulatory and financial hurdles, investors will be closely watching to see if these efforts translate into a sustainable recovery and long-term growth. With a strong backlog, strategic acquisitions, and a focus on operational excellence, Boeing aims to regain its footing and reaffirm its position as a leader in the aerospace industry.

Boeing | BA | Long at $180Boeing NYSE:BA is getting bad press (and rightfully so) due to quality/safety assurance issues, but I view this dip as a buying opportunity for future returns. The company expects profitability beyond 2024 and once that happens, I expect this ticker to soar. There may be some pains in the near-term, but long-term, it is in my buy zone at $180.00.

Target #1 = $260

Target #2 = $335

Target #3 = $414