Alibaba - This chart is pretty bullish!🎁Alibaba ( NYSE:BABA ) will head much higher:

🔎Analysis summary:

After we saw the perfect creation of the rounding bottom on Alibaba, the trend finally shifted back to bullish. Especially with the recent bullish break and retest, Alibaba is now preparing for another major move higher. All we need now is simple bullish confirmation.

📝Levels to watch:

$140

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

Babalong

Alibaba - A remarkable reversal!🛒Alibaba ( NYSE:BABA ) reversed exactly here:

🔎Analysis summary:

Recently Alibaba has perfectly been respecting market structure. With the current bullish break and retest playing out, there is a very high chance that Alibaba will rally at least another +20%. But all of this chart behaviour just looks like we will witness a major bottom formation soon.

📝Levels to watch:

$110, $135

🙏🏻#LONGTERMVISION

Philip - Swing Trader

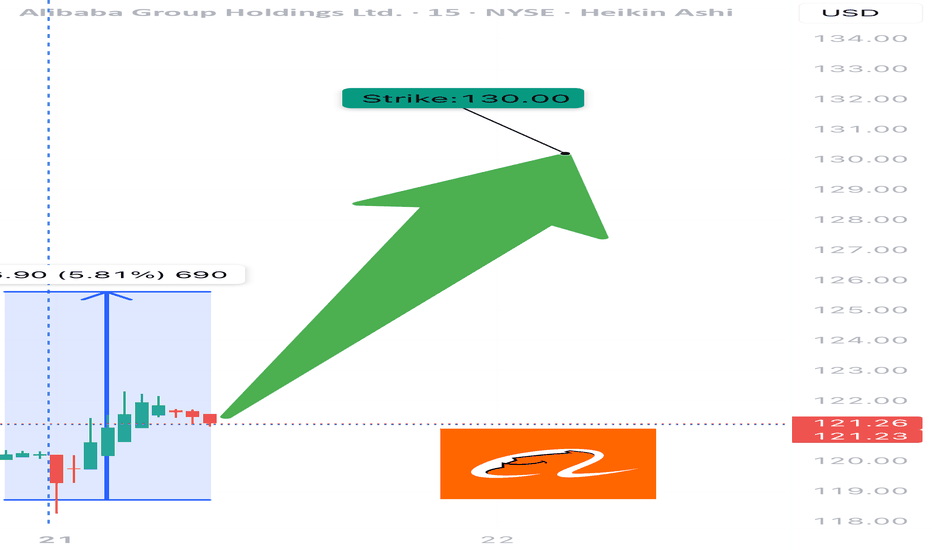

BABA WEEKLY TRADE IDEA – JULY 21, 2025

🐉 NYSE:BABA WEEKLY TRADE IDEA – JULY 21, 2025 🐉

📈 Strong RSI. Institutional Accumulation. Gamma-juiced upside.

Momentum is building — timing is key.

⸻

📊 Trade Setup

🔹 Type: Long Call

🎯 Strike: $130.00

📆 Expiry: July 25, 2025 (4 DTE)

💰 Entry Price: $0.52

🎯 Profit Target: $0.74 (📈 +42%)

🛑 Stop Loss: $0.30 (~40% Risk)

📈 Confidence: 70%

🕰️ Timing: Enter at Monday Open

📦 Size: 1 Contract (or scale accordingly)

⸻

🔍 Why This Trade?

✅ Daily RSI = 68.3 → Bullish momentum building

✅ Volume = 1.3x week-over-week → Institutional buying confirmed

📊 Neutral Call/Put Flow → Sentiment not overheated = better entry

🧠 Multiple models agree on MODERATE BULLISH bias

🌬️ VIX stable = ideal for controlled option premium entries

💎 Gamma risk manageable, but monitor price spikes at resistance near $130–132

⸻

⚠️ Risk Management Notes

🔸 RSI near breakout zone → monitor for fakeouts

⏳ Only 4 days to expiry → time decay risk accelerates

📉 Watch for rejection near key levels ($130.50–132.00)

🛑 Respect the stop: If momentum stalls early, exit fast

⸻

📌 Execution Strategy

🔹 Enter clean, single-leg naked call

🔹 Exit partial at 30% profit, full by Thursday unless breakout is strong

🔹 Avoid spreads: delta exposure preferred for upside spike capture

⸻

🏁 Verdict:

All models point to upside, but not full conviction.

This is a momentum + positioning trade, not a breakout gamble.

NYSE:BABA 130C – Risk $0.30 to Target $0.74 📈

Tight structure. Moderate aggression. Execute with precision.

⸻

#BABA #OptionsTrading #CallOption #WeeklyTrade #MomentumPlay #UnusualOptionsActivity #TradingViewIdeas #GammaFlow #FlowBasedSetup #Alibaba

Alibaba | BABA | Long at $108.84Like Amazon, I suspect AI and robotics will enhance Alibaba's NYSE:BABA e-commerce, logistics, and cloud computing operations. There is some risk here, like other Chinese stocks, that they could be delisted from the US market if trade/war tensions rise. But I just don't think that is likely (no matter the threats) due to the importance of worldwide trade and investment. I could be way wrong, though...

NYSE:BABA has a current P/E of 14.2x and a forward P/E of 2x, which indicates strong earnings growth ahead. The company is very healthy, with a debt-to-equity of 0.2x, Altmans Z Score of 3.3, and a Quick Ratio of 1.5. If this were a US stock, investors would have piled in long ago at the current price.

From a technical analysis perspective, the historical simple moving average (SMA) band has started to reverse trend (now upward), indicating a high potential for continued (overall) price movement up. It is possible, however, that the price may reenter the SMA band in the near-term - the $80s aren't out of the question - as tariff threats arise. But that area is another personal entry zone if fundamentals hold.

Thus, while it could be a bumpy ride and the risk is there for delisting, NYSE:BABA is in a personal buy zone at $108.84 (with known risk of drop to the $80s in the near-term).

Targets into 2028:

$125.00 (+14.8%)

$160.00 (+47.0%)

BABA Stock: A Detailed Analysis using Elliott Wave Theory RulesHello Friends,

Welcome to RK_Chaarts,

Let's analyze Ali Baba Group Holdings Limited, also known as BABA, listed on the NYSE. We'll be using the Elliott Waves theory.

Friends, as we can clearly see, after hitting a low of around $95.75 on 9th April 2025, it started an impulse wave. Within this wave, we've completed intermediate degree blue bracketed (1), (2), (3), (4), (5), and primary degree ((1)) in Black. Currently, we're completing primary degree ((2)), with a low around $111.

If it breaks the level of $111, we'll assume we're still in primary degree ((2)), as marked in scenario 2 on the chart. This means wave ((2)) is unfolding, and wave ((3)) might start after wave ((2)) is complete.

If it doesn't break the $111 level, it's likely that wave ((2)) has completed, and we've started a subdivision of wave ((3)) or its further subdivisions. If it moves further up, following scenario 1 (the black line on the chart), this is a possibility.

According to Elliott Wave theory, wave ((2)) cannot retrace more than 100% of wave ((1)). So, our main invalidation level for this count is $95.75. Yes, BABA is turning up against the 95.75 low, and in the near term, we expect the stock to trade higher.

Somewhere, this stock might move towards $150 or $160 if it doesn't break down below $ 95.75.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Chaarts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Chaarts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

BABA in a falling wedge (NEW)BABA stock has been in a long-term downtrend.

We're expecting the price to continue droping as it looks like it got rejected from the downsloping resistance line on the weekly timeframe.

What we can see on the chart is a pattern called a falling wedge.

Most likely the price will revisit $60 or lower but eventually we expect the breakout in Q2 or Q3 2023.

How to trade:

Enter long position if/when we get a breakout with a volume increase.

Final target and the take profit level are shown on the chart.

Good luck

Alibaba Stock Surges 10% as Earnings Beat Expectations Shares of Alibaba Group Holding Ltd. (NYSE: NYSE:BABA ) are soaring after the Chinese tech and e-commerce giant reported quarterly earnings that exceeded Wall Street expectations. Alibaba’s latest financial results reflect strong growth in its cloud computing division, which includes artificial intelligence (AI) initiatives, and the broader market optimism surrounding its strategic moves.

Beating Estimates with Strong Revenue Growth

Alibaba posted revenue of 280.15 billion Chinese yuan ($38.5 billion) for the December quarter, marking a 7.6% increase year-over-year. The company’s earnings per share per ADS came in at $2.93, surpassing analyst expectations tracked by Visible Alpha. CEO Eddie Wu emphasized that Alibaba’s strategic focus on "user-first, AI-driven" operations has contributed significantly to its reaccelerated growth.

One of the standout aspects of Alibaba’s performance is its cloud computing segment, which saw a 13% year-over-year revenue increase. Notably, AI-related product revenue surged at a triple-digit rate for the sixth consecutive quarter, underscoring Alibaba’s position as a dominant player in China’s AI landscape.

Adding to the bullish sentiment is speculation that Alibaba may be collaborating with Apple (AAPL) to integrate AI-powered features into iPhones in China. Moreover, reports suggest that co-founder Jack Ma has re-established ties with Beijing, a development that could ease regulatory pressures and pave the way for smoother business operations.

Technical Outlook: Bullish Breakout with Strong Momentum

From a technical perspective, NYSE:BABA shares have been on an impressive run, climbing over 80% in the past year. At the time of writing, the stock is up 8.09% in intraday trading, signaling strong bullish momentum.

The breakout from a falling wedge pattern—a classic bullish reversal setup—has been a key catalyst in Alibaba’s upward trajectory. The Relative Strength Index (RSI) currently sits at 84, indicating that the stock is in overbought territory. However, with momentum building, further upside potential remains, particularly if BABA clears its recent one-month high.

In the event of a pullback, the 38.2% Fibonacci retracement level is acting as a solid support zone, providing traders with a potential re-entry point. A decisive breakout above resistance could trigger another leg up, reinforcing the stock’s bullish sentiment.

Conclusion

With cloud computing and AI revenues expanding at a rapid pace, alongside renewed investor confidence, the stock remains in a strong uptrend. While technical indicators suggest caution due to overbought conditions, a breakout above resistance could unlock further gains.

Alibaba Group | BABA | Long at $80.00Alibaba Group NYSE:BABA has the potential for massive growth. From a technical analysis perspective (and using my selected simply moving averages (SMAs)), the price of NYSE:BABA is reconnecting with its primary SMA. It could ride this area for a while as it consolidates further, but this often means a future reversal of the downward trend. Thus, at $80.00, NYSE:BABA is in a personal buy zone.

Target #1 = $89.00

Target #2 = $94.00

Target #3 = $107.00

Target #4 = $116.00

Target #5 = $305.00 (very long-term view...)

I'm GAGA for BABA!NYSE:BABA

🎯134🎯150🎯171

Five weeks of green candles for over 55%!

Road this one higher from the beginning and fully exited. Now that we are pretty extended and broke out of the Inverse H&S Pattern I'd like to see a pullback to retest the breakout at $115-118 for an entry back in.

- Green H5

- Volume GAP

- Wr% Up trending

- Inverse H&S breakout

- China has momentum (look for tariff news or earnings this week to provide a dip buying opp.)

Not financial advice

Alibaba Analysis: Profitable Structure! 2/11/2025One of the most profitable trading structures is currently in progress!

The targets of the uptrend swing (wave C) are displayed on the chart, and it has the potential to exceed the projected levels.

Start point of wave c= $80.06

Targets:

T1=$174

T2=$232

T3=$326

*It's the same structure used in the Netflix price chart!

NYSE:BABA #BABA

Latest news: Apple partners with Alibaba to offer artificial intelligence features for iPhone users in China!

Good Luck!

$BABA Potential Bullish Reversal, (Daily TF)12/25/2024

Alright, I know there's a lot here so let me know if you have any questions and I'll do my best to answer. This is for educational purpose only.

1. Price dropped 18% ($101 -> $82.64) in 15 days.

2. Triple resistance on Tue, Nov 19 & Fri, Nov 29 & Tue, Dec 17 @ ~$87. Resistance zone between $86.70 - $87.75.

3. Bearish Fibonacci (Dec 9 - Dec 20). Anticipate sideways movement around 0.382 ($86.44), 0.5 ($87.91) and 0.618 ($89.38).

4. The light-brown boxes and light-brown line highlight the potential movement of price.

--------------------------------

$85.52: Current price

$85.00: Next bearish price target

Bullish Resistance Points:

$86.44 - 0.382 Bearish Fibonacci (potential daily sideways movement)

$87.00 - Resistance zone

$87.60 - Previous Weekly High

$87.91 - 0.5 Bearish Fibonacci (potential daily sideways movement)

$89.38 - 0.618 Bearish Fibonacci (potential sideways movement or reversal)

$91.44 - 0.786 Bearish Fibonacci (potential reversal)

$90.56 - $91.83: Bullish Gap to be filled

-------------------------------

Currently in a play: NYSE:BABA 21 MAR 25 110c @ $1.24

Currently up 5% (@ $1.31).

Profit Target: $2.24 (contract price)

Stop Loss: n/a (manually monitoring for now)

Alibaba: Will $BABA Bounce Back or Break Key Support (Daily TF)Hey everyone, below is an analysis on NYSE:BABA using MACD, RSI, Fibonacci levels and technical (gap) levels.

Current Price Levels:

NYSE:BABA is trading around $89.35, down significantly (~26%) from its October 7 high of $117.82.

A notable gap between $85 and $86.95 suggests this is a key level of interest for potential support or further downside risk.

Momentum Indicators:

MACD: Shows signs of curling upward, which could indicate momentum shifting toward bullish sentiment.

RSI: Currently not oversold (at 36), but still in a relatively low range, suggesting there is room for price recovery.

Technical Levels:

Gaps and Fibonacci retracements are marked as potential resistance and support zones:

Gap resistance levels: $93.33-$95.05 and $96.80-$99.18.

Higher resistance levels around $104.41 (gap from October 15) and $117.82 (October high).

Previous daily high at $89.50 could act as near-term resistance.

Fibonacci Levels:

The chart includes a retracement from the October high ($117.82) to recent lows, with levels such as 0.236 ($90.29), 0.5 ($102.53), and 0.786 ($111.27) potentially serving as resistance on any upward move.

Feedback and Outlook:

Support and Resistance Analysis:

Support: The gap zone between $85-$86.95 may provide a strong base if selling pressure continues. A break below $85 could indicate further downside.

Resistance: Short-term resistance is seen at $90.29 (0.236 Fib level) and $93.33-$95.05 (gap resistance). These levels will likely be tested if buying pressure builds.

Gaps to Be Filled:

If the price begins to recover, the first upside target would be filling the $93.33-$95.05 gap. This aligns with Fibonacci retracement levels and may act as strong resistance.

Outlook:

Bullish Case: If momentum continues to build, expect a recovery toward the $93-$95 range, with further potential to reach $102 (50% retracement). This would require breaking above immediate resistance at $90.29.

Bearish Case: If the current support at $85 fails, further downside to test levels around $80 or lower is possible.

Final Thoughts:

The chart suggests a cautious bullish outlook in the short term, especially if the $85 support holds. Watch for price action and volume around the resistance zones to confirm whether this is a dead-cat bounce or a true reversal.

Currently in NYSE:BABA 1/17/25 $100c (BOT @ $1.73).

Alibaba - It Is So Predictable!Alibaba ( NYSE:BABA ) just rejected a major resistance:

Click chart above to see the detailed analysis👆🏻

A couple of days ago Alibaba stock perfectly retested a major previous resistance level after rallying +45% just within a couple of weeks. We can first see more bearish movement and maybe even a retest of the trendline breakout level before Alibaba will continue its overall uptrend.

Levels to watch: $80, $110

Keep your long term vision,

Philip (BasicTrading)

$BABA Primed for a Retest and Bounce! 80% Upside Potential!🚀 NYSE:BABA Primed for a Retest and Bounce! 80% Upside Potential! 🚀

🔍 Key Points:

Looking for a bounce after retesting the symmetrical triangle breakout

Awaiting the H5 Indicator to flip green for a bullish signal

Crucial to hold the volume profile shelf for continued upward momentum

Target Prices:

🎯 $107

🎯 $134

MM 🎯 $157

ALIBABA Ready to Explode! Big Gains on the Horizon!Alibaba (BABA) Technical Analysis - 15-Minute Timeframe - Long Position Setup

Entry Price: $99.13

Stop Loss (SL): $97.32

Target Levels:

TP1: $101.36

TP2: $104.96

TP3: $108.57

TP4: $110.80

Market Context and Sentiment: Recent developments indicate strong institutional interest in Alibaba, as evidenced by prominent fund manager Zhang Kun making Alibaba a substantial holding in his portfolio. This investment has bolstered positive sentiment around Alibaba, further supported by strategic economic measures favoring leading tech stocks in China.

Technical Indicators:

Trend Direction: Positive momentum is observed with price action above the Risological Dotted Trendline, signaling a bullish bias.

Volume: Current volume at 16.04M aligns with the recent positive market sentiment, with average 30-day volume standing at 26.70M. This moderate volume increase reinforces the long setup validity.

Analysis and Outlook: This setup presents a well-defined long entry with clear stop loss and target levels. The bullish institutional interest provides a strong fundamental tailwind, which could drive price action towards initial and extended targets. Should the price break through TP1 at $101.36 with sustained volume, a continuation towards TP2 at $104.96 becomes likely, with potential progression to TP3 and TP4.

Conclusion: Alibaba's current price action and market sentiment create a favorable environment for a long position. Close monitoring is advised, particularly as price approaches each target, with adjustments as necessary to secure gains.

Alibaba - Finally The Trendline Breakout!Alibaba ( NYSE:BABA ) finally broke above the bearish trendline:

Click chart above to see the detailed analysis👆🏻

Alibaba is breaking out and the breakout is not unexpected whatsoever. For a long time, Alibaba has been hugging the resistance trendline and finally managed to fulfil its destiny. This could very well be the bottom of the bear market and the start of something big: new all time highs.

Levels to watch: $115, $80

Keep your long term vision,

Philip (BasicTrading)