5 Key Advices To Share With Trader Who Is Struggling In TradingHello everyone:

Lately many of you have messaged me about getting FOMO and entering trades without confirmations.

In addition you can't seem to “not” enter trades when the market hasn't shaped up to your strategy and entry criteria.

I am hoping in today’s educational video it can help some of you guys to get back on track.

I want to share 5 main pieces of advice that can help out traders who are currently struggling.

These are experiences and lessons that I accumulate throughout the 8 years of trading and in hope to help some of you who are struggling in your current journey of trading.

1. Do “NOT” think about get rich quick in trading

-Trading is a marathon, not a sprint

-90-95% traders fail due to a combination of: Greed, FOMO, mindset/emotion, risk management, trading psychology.

-Trading is not a get rich quick scheme, but it can produce consistent, sustainable passive income if you can put in the time and effort

-Most try to jump to the result right away, without going through the journey, that is not how life works.

2. No trading strategies, style, method can give you 100% strike rate

-Trading is probability, not right or wrong.

-Understand you can have the best strategy in the world, and still not be profitable.

- Technical, Fundamental, Algo, EA...etc can all not work. This is why risk management is important to not over risk, over trade, over leverage your trading account

3. Backtest and journal

-Backtest your strategy so your brain acknowledges and recognizes it over and over again.

-Slowly build up confidence in your strategy and method. IT will come to you like second nature

-Journal all your wins and losses so you can review them. Work on them, accept your mistakes to grow and improve.

4. Control your EGO

-Human beings have ego to prove others are wrong and they are right

-We refuse to admit we made the error/mistakes, and blame others/external as the cause.

-Acknowledge that in trading, stop blaming the market, the broker, the mentor, the strategy...etc.

-Don't take things personally and be offended by it.

5. Never Give Up

-I blew several accounts in the beginning of trading career, gave up and quit trading multiple times

-I always ended up coming back to trading. After taking time off. Whether that is weeks or months in the beginning journey.

-No one is born into a trader, just like no one is born into a doctor, lawyer.

-If trading was that easy, then everyone would be rich.

-Success is measure by how many times you get back up when you failed

I hope these pointers can help you guys to get more focus and get back on track in trading.

Any questions, comments or feedback welcome to let me know, thank you

Jojo

Below I will share others educational videos that have direct relations to the topics above:

Trading Psychology: How to deal & manage losses/consecutive losses in trading ?

Trading Psychology: Revenge Trading

Trading Psychology: Fear Of Missing Out

Trading Psychology: Over Leveraged Trading

Trading Psychology: Is there Stop Loss Hunting in Trading ? How to deal with it ?

Prevent Blowing an account by backtesting:

Risk Management 101

Backtest

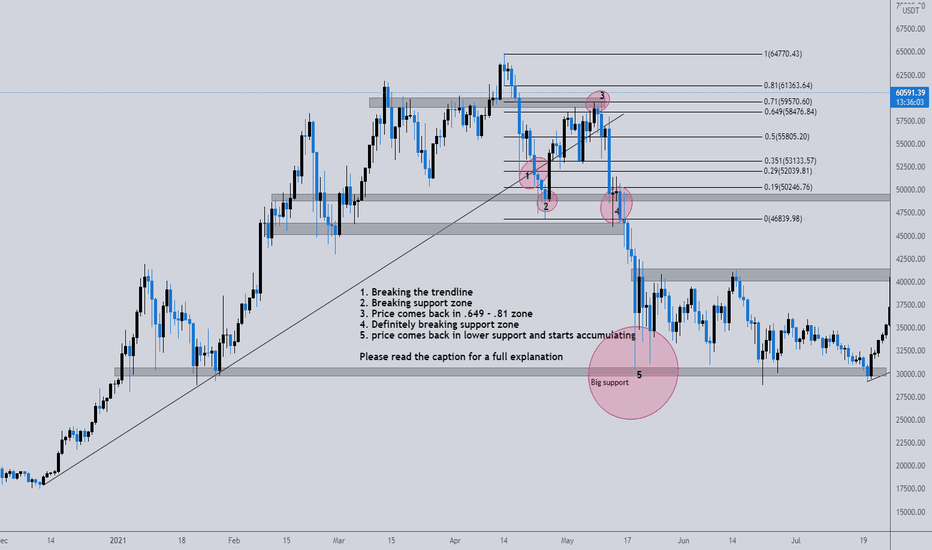

Backtesting Bitcoin: From bullish to bearishHi there,

Personally, I think it's important to backtest prices. In this way, you better understand why a price reacts to events.

Today I backtested bitcoin. I was especially curious about how to recognize the switch from bullish to bearish. I use the daily chart for this because I invest in the long term.

Are you a day trader? Then you can also backtest on lower timeframes. Keep in mind that the uncertainty factor is a lot bigger.

The backtest

Before a bullish period turns into a bearish period, you need several confirmations.

1. We saw the trendline break. This is not yet a reason to become bearish because you can determine a trend in several ways

2. The support zone is broken. Combine this with the broken trend line and the higher low that is no longer valid.

3. Reason enough for me to make a Fibonacci from the highest point to the lower point. On the chart, you can see that I go from spike to spike. The price is looking for a retest before the big drop starts. This to me is the .649, .71 or .81 zone.

4. the price breaks the support zone, retests, and finally drops to the next larger support zone. At that moment a new accumulation starts and it is again waiting for new confirmations.

PMax Explorer Strategy - INDICES & METALS BacktestingThe pair and the time frame you see is the winner in the INDICES & METALS category with profit factor criteria

From 4032 results we have for this strategy :

* 1451 results with Profit Factor > 1

* 270 results with Profit Factor>1 and Sharpe Ratio>0

* 19 results with Profit Factor>1 and Sharpe Ratio>0 and Percent Profitable>50

* Best timeframe : 1m with 18 and 8m with 17 pairs

* Best pair for all categories : OANDA:BTCUSD with 28 / BINANCE:BTCUSDT with 27 timeframes

* My rating for this strategy is : 0.4712%

Check my posts for all instrument categories

1st (FOREX), 2nd(CRYPTOs) and 3rd(INDICES/METALS)

I will split each strategy backtesting in this manner

I'm talking for strategy :

PMax Explorer STRATEGY & SCREENER (by KivancOzbilgic) Oct 10, 2020

I test 29 Forex pairs from FXCM, 51 Crypto Pairs from Binance and 46 CFDs Indices and Metals from OANDA

In total 126 pairs using 32 !!! timeframes

1,2,3,4,5,6,7,8,10,12,15,17,20,24,25,30,45 minutes

1,1-1/2,2,3,4,5,6,7,8,10,12,16,20 hours

1 and 2 Days

In total 4032 results per strategy

I like profit factor and Sharpe ratio as my main guides but also percent profitable does matter

The results of forex were with 1000 contracts, default currency USD and 0.07 USD per order commission

At Cryptos i use 1 contract, default currency USD and no commission because most cryptos are spread based.

At Indices i use the same details as Crypto.

I didn't touch any settings at the strategy for all three ideas (only the backtesting starting day where i maxed out the available data)

I can't post direct links according to house rules, since i love TradingView and i play with their rules.

However my profile links and my signature may help for extensive information.

PMax Explorer Strategy (by KivancOzbilgic) - FOREX BacktestingFrom 4032 results we have for this strategy :

* 1451 results with Profit Factor > 1

* 270 results with Profit Factor>1 and Sharpe Ratio>0

* 19 results with Profit Factor>1 and Sharpe Ratio>0 and Percent Profitable>50

* Best timeframe : 1m with 18 and 8m with 17 pairs

* Best pair for all categories : OANDA:BTCUSD with 28 / BINANCE:BTCUSDT with 27 timeframes

* My rating for this strategy is : 0.4712%

Check my posts for all instrument categories

1st (FOREX), 2nd(CRYPTOs) and 3rd(INDICES/METALS)

I will split each strategy backtesting in this manner

I'm talking for strategy :

PMax Explorer STRATEGY & SCREENER (by KivancOzbilgic) Oct 10, 2020

I test 29 Forex pairs from FXCM, 51 Crypto Pairs from Binance and 46 CFDs Indices and Metals from OANDA

In total 126 pairs using 32 !!! timeframes

1,2,3,4,5,6,7,8,10,12,15,17,20,24,25,30,45 minutes

1,1-1/2,2,3,4,5,6,7,8,10,12,16,20 hours

1 and 2 Days

In total 4032 results per strategy

I like profit factor and Sharpe ratio as my main guides but also percent profitable does matter

The results of forex were with 1000 contracts, default currency USD and 0.07 USD per order commission

At Cryptos i use 1 contract, default currency USD and no commission because most cryptos are spread based.

At Indices i use the same details as Crypto.

I didn't touch any settings at the strategy for all three ideas (only the backtesting starting day where i maxed out the available data)

I can't post direct links according to house rules, since i love TradingView and i play with their rules.

However my profile links and my signature may help for extensive information.

I backtested DeGRAM's Gold Ideas 77 TimesIntroduction

Break of structure is a popular trading strategy.

It is trade along the current direction of structure but cut loss or even reverse when break of structure.

@salehifx_trader and @arashhabibpooor et. al. said they feel disappointed when they receive the trend reverse signal with huge loss.

It is possible the price may pull back or temporarily leave the bound of structure.

Therefore, blindly following the structure may be not profitable in some time.

In this case, I backtest @DeGRAM 's Gold ideas from Apr13 to Jul28, 2021.

Jul29 is the day of closing all positions.

Note this day is the day Fed updated currency policy.

Test Method 1

If DeGRAM said long, close all short positions and open a new long position.

If DeGRAM said short, close all long positions and open a new short position.

Jul29 is the day of closing all positions.

There are 15 data, representing trading in 15 different time stamps of a day. The earliest one is 03:00 and the latest one is 17:00. The time zone is utc+3.

Test Method 2

If DeGRAM said long, close all short positions.

If DeGRAM said long and there are no long positions, open a long position.

If DeGRAM said short, close all long positions.

If DeGRAM said short and there are no short positions, open a short position.

Jul29 is the day of closing all positions.

There are 15 data, representing trading in 15 different time stamps of a day. The earliest one is 03:00 and the latest one is 17:00. The time zone is utc+3.

Result

I compute the numbers with opening price and did not include bid-ask spread, commission and overnight fee.

Method 1 :

03:00 -> -2907.47

04:00 -> -2850.79

05:00 -> -2974.58

06:00 -> -3025.25

07:00 -> -2964.79

08:00 -> -2992.37

09:00 -> -3106.63

10:00 -> -3103.31

11:00 -> -3145.71

12:00 -> -3300.93

13:00 -> -3301.49

14:00 -> -3212.76

15:00 -> -3377.93

16:00 -> -3832.02

17:00 -> -3760.32

average -> -3190.43

Method 2 :

03:00 -> -160.82

04:00 -> -152.48

05:00 -> -162.21

06:00 -> -171.85

07:00 -> -164.90

08:00 -> -163.99

09:00 -> -173.51

10:00 -> -150.52

11:00 -> -174.82

12:00 -> -174.53

13:00 -> -185.05

14:00 -> -180.83

15:00 -> -195.08

16:00 -> -269.06

17:00 -> -289.69

average -> -184.63

Conclusion and Suggestions

* Trading break of structure solely may be too late.

* Repeatly buy and sell in range can lead to more profit.

* We can improve gold trading by predicting the action of Fed.

* Gold is long term bullish unless governments want zero or negative inflation, so we can consider other instruments better than short gold.

MACD ReLoaded Strategy (by KivancOzbilgic) - CRYPTOs BacktestingThe pair and the time frame you see is the winner in the CRYPTO category with profit factor criteria

From 4032 results we have for this strategy :

* 1927 results with Profit Factor > 1

* 168 results with Profit Factor>1 and Sharpe Ratio>0

* 6 results with Profit Factor>1 and Sharpe Ratio>0 and Percent Profitable>50

* Best timeframe : 3m with 10 pairs

* Best pair for all categories : OANDA:BTCUSD with 20 / BINANCE:BTCUSDT with 18 timeframes

* My rating for this strategy is : 0.1488%

Check my posts for all instrument categories

1st (FOREX), 2nd(CRYPTOs) and 3rd(INDICES/METALS)

I will split each strategy backtesting in this manner

I'm talking for strategy

MACD ReLoaded STRATEGY (by KivancOzbilgic) Jul 04, 2021

I test 29 Forex pairs from FXCM, 51 Crypto Pairs from Binance and 46 CFDs Indices and Metals from OANDA

In total 126 pairs using 32 !!! timeframes

1,2,3,4,5,6,7,8,10,12,15,17,20,24,25,30,45 minutes

1,1-1/2,2,3,4,5,6,7,8,10,12,16,20 hours

1 and 2 Days

In total 4032 results per strategy

I like profit factor and Sharpe ratio as my main guides but also percent profitable does matter

The results of forex were with 1000 contracts, default currency USD and 0.07 USD per order commission

At Cryptos i use 1 contract, default currency USD and no commission because most cryptos are spread based.

At Indices i use the same details as Crypto.

I didn't touch any settings at the strategy for all three ideas (only the backtesting starting day where i maxed out the available data)

I can't post direct links according to house rules, since i love TradingView and i play with their rules.

However my profile links and my signature may help for extensive information.

A seasonal sector-switching strategy has beaten the S&P YTDThe Study

I ran an analysis on monthly stock-market returns over the last 20 years or so, to determine which sector delivered the best median dividend-adjusted returns in each month. December 2020 was the last month included in the study.

The sector funds included in the analysis were all equal-weighted, although they don't all use identical methodologies or have identical expense ratios, so keep that in mind. Also, for some funds, there was more data than for others. Some have been around since 2005, some 2007, some 2012. Here are the funds I included: EWRE, RCD, RGI, RTM, RYE, RYF, RHS, RYH, RYU, XAR, XBI, XHB, XME, XTL, XTN, XSW, XSD.

The limitations of the data mean that the results are probably pretty noisy. I've got no real way to determine the statistical significance of these results, because there's just not enough data. A lot of this will be "noise," but probably there's some "signal" here too.

Basically I compared these sector funds' median return in each month and determined which fund gave the best median return. (The median should be a more robust statistical summary than the mean, because the mean will be affected by outliers like meltups and crashes.)

The Results

Here are the best-performing sectors by month:

January: Biotech

February: Aerospace

March: Real Estate

April: Energy

May: Semiconductors

June: Real Estate

July: Semiconductors

August: Semiconductors

September: Materials

October: Transportation

November: Transportation

December: Metals

The Backtest

Since I didn't use data from 2021 to generate these results, we can backtest a sector-switching strategy on 2021. What if, in each month, we switched to the sector with the best median return for that month?

The answer is that the equal-weighted index returned about 18% YTD, whereas the sector-switching strategy returned about 21%. So there's a slight edge here, but not a large one. If you're trading in a tax-deferred IRA, you'd have come out ahead by using the sector-switching strategy. But if your account isn't tax-deferred, then this strategy will have cost you more in capital gains taxes than you're making in excess returns vs. simply holding the index.

The Code

I've put the R code for this analysis on Github, should anyone wish to check my work: github.com

STOP Playing Weekly Options Lottery: Backtest Proven!Since 2020 the retail trading market has exploded with Weekly Options buying. Weekly Options are "cheap" and can, occasionally, give their buyers big exciting wins. Do they make sense over the long run? NO! A backtest of NASDAQ:TSLA proves that over the long run options are PRICED EFFICIENTLY to make traders lose and underperform buying shares!

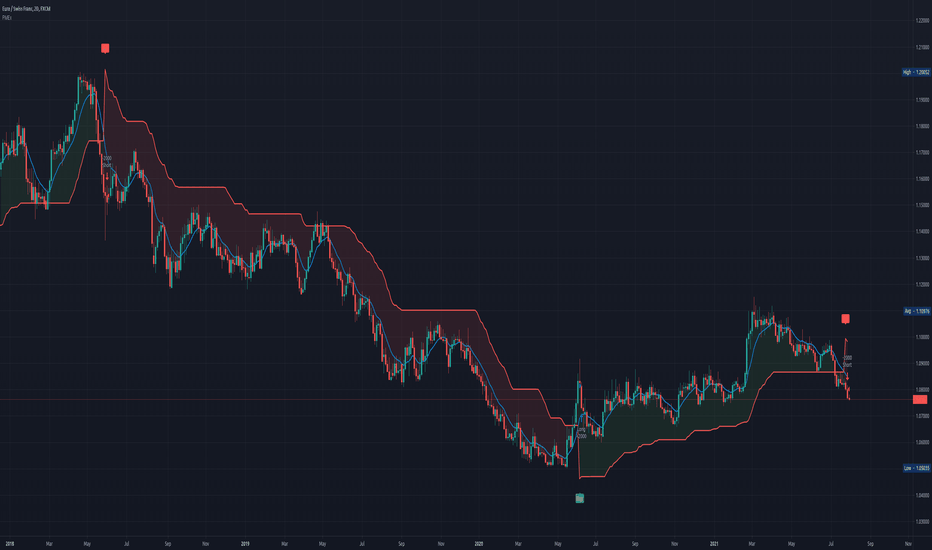

Zigzag Circles Strategy Test 1st April → 6th June@LonesomeTheBlue has recently published an interesting script LTB Zigzag Circles . I got curious about its performance, so I tinkered out a strategy and tested it out on GBPUSD.

I will use ZigZag Circles with a period of 14 on a 30m timeframe. Furthermore, I will utilize round levels to place my entries, exits, and stops.

When there is a bullish signal:

► a limit entry is placed at the nearest-below x000, x200, x500, or x800 level.

► a stop-loss is placed halfway through to another such level below.

► a take-profit will be at the nearest x000, x200, x500, or x800 level to the upside.

When there is a bearish signal:

► a limit entry is placed at the nearest-above x000, x200, x500, or x800 level.

► a stop-loss is placed halfway through to another such level above.

► a take-profit will be at the nearest x00, x200, x500, or x800 level to the downside

(check the first picture for clarification, round levels are shown in gray)

#1 A first entry signal at 17:00

Look at the limit order. A limit is right before 1.38200, the exit before 1.38500, the stop-loss between 1.38000 and 1.38200.

#1 A first order is closed in profit in roughly 12 hours

#2 A second position opened and closed according to rules

#Not All Entries Trigger

Obviously, I didn't leave the entry orders hanging out there forever.

#3 A first loser

This is how a lost trade looked like.

#5, #6 A little problematic area

This is a problem you might encounter with LTB Zigzag Circles. Signals point in both directions... I wouldn't take the long one as the signal is far from my level, but during the backtest, I follow the rules. Hence a win and a loss.

#8, #9, #10, #11 a series of losses in a consolidation area

When the price keeps on contracting, there might be several false signals in a row. Even though you may still see some respect for the x500 zone, the bounces are small and not enough to reach the profits. In real trading, the entries could be identified as unconvincing and avoided.

#14, #15 Two winners in a row

Although the stop-loss was dangerously close to where the price once was for the first one, this is how the winners in a row might look like.

#22 Another problematic situation

Lastly, I wanted to put attention to this imaginary trade. The very point of using limit orders in this test is to make sure I have enough time to get the signal and evaluate its quality. I do believe, there wouldn't be enough time to open a position from a level designated by rules. So I put it on the nearest one below. I know I wouldn't want to take that trade after I was notified at the candle's close. If you would, count it as a loss.

Conclusions

37 trades were open since the beginning of April, out of which 44% were profitable with an accumulated profit of 1141 ticks .

When backtesting, I like to subtract 3 pips from every trade to give it a better feel of the real world. You make mistakes and you also pay spreads and fees. If I subtract 3 pips from every single trade, the strategy will still be profitable, but barely. It's 91 ticks only. Of course, the real spread is smaller than that, so this is a good result also.

Lastly, I saw the price to continue in the direction of the trade far exceeding its original take profit. With advanced trade management (which can not be backtested easily), profits would be higher.

Remember, that 37 trades is a narrow sample size. It is enough to give you an idea of what parts of the strategy to improve. But for accurate statistics, you should test your strategy 180+ times.

NZDCAD up up and up againMy Marketmiracle advisor provided an input signal on the NZDCAD cross forex

at the price 0,883250

with target 0,914329

for a possible profit of 3.52% which on forex is a lot

Analyzing the graph we realize how we are actually at the point of possible rupture in a head shoulders upside down so at the rupture of this the price could start quickly towards the target.

Actually, the LONG interest on NZDCAD is increasing a lot ( see Mmiracle Viewer indicator)

The scenario is possible in my opinion so I decided to take positions on the cross in this regard.

NZDCAD was already climbing and the previous analysis had provided a perfect signal as per related idea

This idea is based on a signal generated by the advisor Marketmiracle, down on this page you will find the link to the page of signals of the advisor that you can see for free without any cost or registration

Below are also the results of the backtest of Miraclemarket on this cross

Trading Ethereum Profitable: Strategy Example (With Backtest)Ethereum made a new all-time high, rising over 20% from its previous ATH. Let's take a look at how you can trade Ethereum and take advantage of these uptrends.

Finding the Trend:

To make a successful strategy, we should start by identifying the trend. We can do this with the help of a trend-following indicator that will act as a filter. The MESA can work well here, this particular setup will keep a buy signal as long as the MAMA is above the FAMA.

In this example, we have changed the MESA's default values to Fast Limit 0.1 and Slow Limit 0.001. This change made the indicator less reactive to the price and better at finding long-term trends.

Entries & Exits

We then need an indicator that can find suitable entry points. For this example, we have chosen the MACD. Thus we will only take trades when the MESA displays bullish momentum and when the MACD gives a buy signal.

For the exit, you can use a strategy or sell settings. We have chosen to use the MACD again to time our exits. This is because Ethereum's trend is irregular; sometimes, it may be less volatile, while other times a lot more. Thus the MACD should be able to take full advantage of this volatility. Therefore our strategy will sell when the MACD gives a sell signal.

Results: In short, our strategy would look like this: enter when both the MACD and modified MESA give a buy signal and exit when the MACD gives a sell signal. We performed a backtest on ETH/USD (Kraken), with all the available equity used on each trade, a 0.1% fee was taken into account. This resulted in a profit of 164,121%, similar to the buy and hold of 179,352%. However, the strategy is less risky than the buy and hold as it doesn't lose much in a downtrend. Remember, this is just an example for you to create a suitable strategy, and not a recommendation.

XRP Short Term Reaccumulation Period Likely Happening So, as we are finally in an orbit with our XRP rocket, we might could expect some reaccumulation happening before continuing our journey to the moon. The pattern that has formed as we broken through our blue resistence line (now support), tels me that we could repeat Nov- Dec 2020 price action, minus the dramatic price fall of course. We have to understand that XRP price would already be between $1 - $2 area if sec lawsuit wouldn't happen in Dec, nevertheless here we are waiting for the tears of joy to come.

No one knows how long this reaccumulation period could take, but a think it will happen quicker than it did in dec. as we've already broken through a 2year old resistence line (blue)

The reaccumulation pattern could happen differently than it is shown on the graph, as there are many new people in the space than there was in 4-5 months ago. Whatever it happens i still think that this blue support line will get backtested, but don't take my word for it.

I am not a financial advisor so and nothing here should be taken as a financial advise. Stay safe with your investments.

BITSTAMP:XRPUSD

Perfect backtest of the previous ATH.The previous high became a support. If we compare the current chart with previous bull runs, we can get very excited.

One thing I have seriously no clue about is how big this move could be. However, I firmly believe that afterwards we would see a nasty correction again.