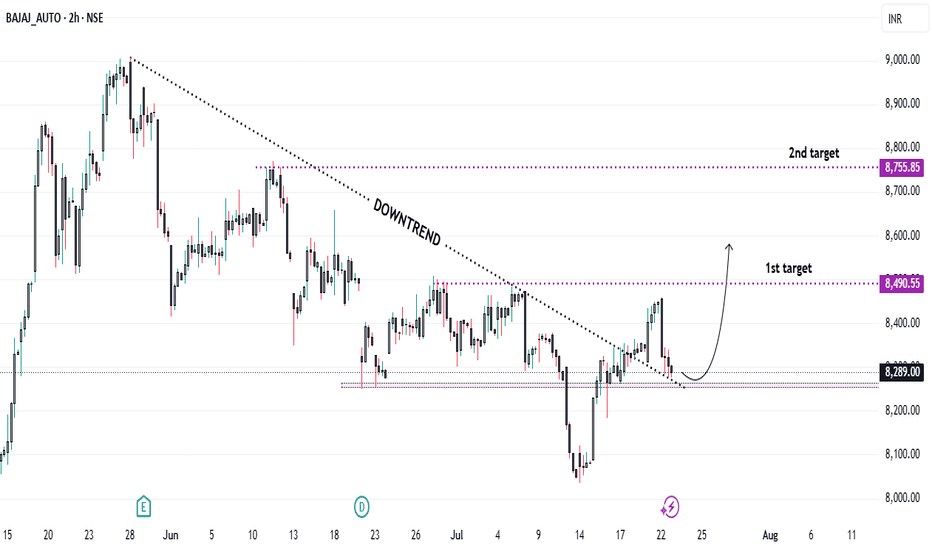

Trendline Breakout in Bajaj Auto: Buy Opportunity...?* Trend Overview:

* The stock has been in a downtrend over the past 2 months.

* Recently, it has broken the downward trendline and successfully retested the breakout, indicating a potential reversal.

* Current Price Action:

* Breakout above trendline confirms bullish momentum.

* The retest held above the trendline, adding further confidence for long positions.

* Support & Stop-Loss:

* Key support level identified at ₹8,250 – has acted as a demand zone in recent sessions.

* A stop-loss should be placed just below ₹8,250 to manage risk effectively.

* Target Levels:

* 🎯 Target 1: ₹8,490

* 🎯 Target 2: ₹8,755

* Important Note:

* ⚠️ Due to ongoing global geopolitical tensions, the overall market may remain volatile.

* Trade with proper risk management and position sizing.

Bajajautolong

BAJAJ AUTO LTD - NSE (BAJAJ-AUTO) ForecastThe stock chart for BAJAJ AUTO LTD - NSE (BAJAJ-AUTO) reveals interesting patterns and potential trading strategies:

1. Symmetrical Triangle Pattern:

- The chart displays a symmetrical triangle formed by converging trend lines.

- This pattern suggests a continuation of the existing trend.

- Traders should wait for a breakout from this triangle before making any moves.

2. Trading Strategies:

- Long Position:

- Consider buying if the price moves above a certain level.

- Target price for a long position: 3900.

- Short Position:

- Sell short if the price falls below a specific level.

- Target price for a short position: 3500.

3. Current Price:

- BAJAJ AUTO LTD is currently trading at 8948.20.

Remember, this analysis is based on technical patterns, and actual market behavior may vary. Always use additional indicators and risk management techniques when trading stocks.

BAJAJ AUTOBajaj auto forming a double bottom and ready to breakout above the trendline as well.

Good to go in this stock for target of previous high (4300 levels).

Trade safe. Manage risk. Be profitable.

Please follow us for more simple trading analysis and setups. Also let me know in the comment in case you have any queries.

Disclaimer :- This is just my view. Please analyze charts yourself and then decide to take any trades.

BUY BAJAJ-AUTO AROUND 3810 TGT 4300/4700 SL BELOW 3699 The only hurdle is 3950 which is 20 week MA. Any break out above that can give atleast 10-12 % return in short term and can stretch much higher if the nifty auto is in support. It is a good trade with almost 3 % of SL as seen on price action on closing basis

Bajaj Auto at SupportBajaj Auto, the trend is good on the monthly timeframe and its weekly price action is suggesting that it trying to form a short-term bottom.

And there is a support zone 3790-3743 that confirms the said price action, now if this support zone holds price might move towards the upper range.

BAJAJ AUTO - Flag Pattern TradeThe stock saw a good up move of approx 500 points i.e from 3450 levels to 3966 levels.

From the Past 8 Trading sessions stock has been moving in a range of approx 200 points.

Now there are two types of trades, that can take place

Support Trade :

Pros - good risk-reward ratio 😀

Cons - might get stuck in sideways move for a while, i.e it can test your patience.😌

Breakout Trade:

Pros: Immediate fast move.😍 i.e means immediate return, no patience-testing.

Cons: Low-risk reward ratio, fakeout can happen🤨

🛵🏍 Bajajauto 🎯NSE:BAJAJ_AUTO whoever holding can hold till PRZ fresh long till PRZ and if one can find reversal then can short from PRZ.

******whatever charts or levels sharing here are just for educational purpose only not a recommendation. please do your own analysis before taking any trade on them. we are not SEBI registered.