BAJAJ HOUSING FINANCE LTD GOOD TIME TO PICK IT Bajaj Housing Finance Ltd. (BHFL) is a prominent non-banking financial company (NBFC) in India, specializing in housing-related finance. It's a subsidiary of Bajaj Finance Ltd., and has been classified as an Upper-Layer NBFC by the RBI under its Scale-Based Regulations.

📊 Latest Financial Highlights (Q1 FY26 Preview)

- Assets Under Management (AUM): 1.2 lakh crore, up 24% YoY and 5% QoQ

- Loan Assets: 1.05 lakh crore, up 24.2% YoY

- Disbursements: 14,640 crore, up 22% YoY

- Net Profit (PAT): Expected to rise 19–21% YoY to 574–584 crore

- Net Interest Income (NII): Estimated to grow 24–28% YoY to 827–851 crore

- Net Interest Margin (NIM): Projected at ~3.2%, slightly compressed due to rate cuts

The company is well-positioned to benefit from the rising demand for housing loans, as more people seek to buy homes. With a focus on technology and customer service, BHFL is likely to enhance its operational efficiency, attracting more clients and growing its market share. As a result, the stock price of BHFL could rise, with steady growth by its expanding loan portfolio and strong brand recognition. In 2026, its share price target would be 253, as per our analysis.

SHORT TERM VIEW

entry - 119.50-123

stop loss - 117.60

target - 135-140

BAJAJHFL

Review and plan for 24th April 2025 Nifty future and banknifty future analysis and intraday plan in kannada.

Quarterly results.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

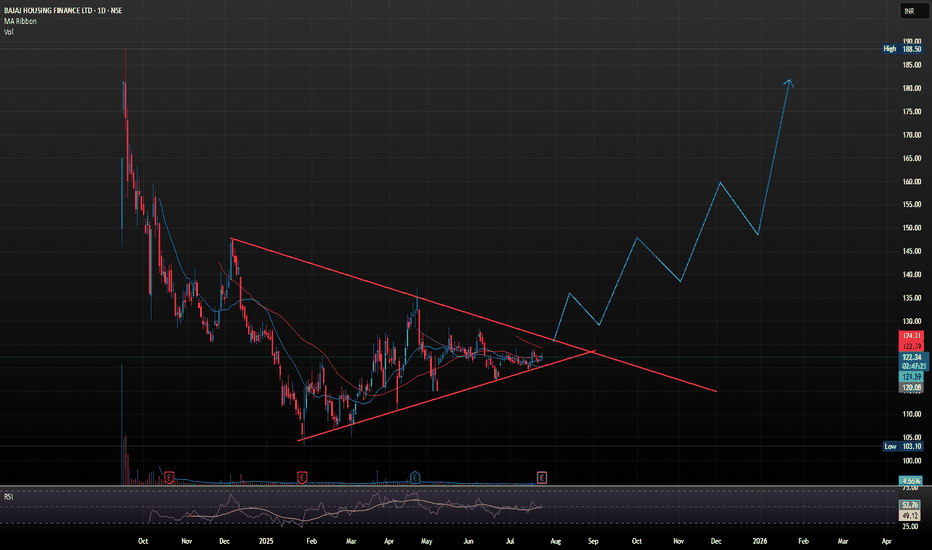

BAJAJHFL Short term IdeaBAJAJHFL is at breakout level. It has tested the TL 2 times and now the swing broke.

People who are looking for low risk and High reward can look this.

This is not a call, please analyze and consult your financial advisor before investing.

Entry can be at Spot(115.29) or safe players can enter above 120, your Risk will be 110(Stoploss) and Targets T1 - 145, T2 - 180.

Estimated Holding time - 3 to 6 months, maximum - 1 year

Bajaj Housing Finance AnalysisNSE:BAJAJHFL

Technical Analysis : You can get an Idea about the potential move from the given chart if the price follows the price action and market sentiment remain bullish.

Fundamental Analysis :

Key Financial Data:

1. **Share Price**: ₹129.56.

2. **Market Capitalization**: ₹1,07,899 crore.

3. **Earnings Per Share (EPS)**: ₹2.65.

4. **Revenue (FY2023-24)**: ₹7,617 crore (34% growth YoY).

5. **Profit After Tax (FY2023-24)**: ₹1,731 crore (38% growth YoY).

6. **Total Assets**: ₹81,827 crore.

7. **ROE (Return on Equity)**: 3.78%.

### Analytical Valuation Models:

Using a combination of financial models to estimate the fair value:

1. **Discounted Cash Flow (DCF) Analysis**:

Assuming moderate growth in free cash flows and using an estimated discount rate (WACC), the DCF valuation suggests a fair value of **₹140 per share**.

2. **Comparable Company Analysis (CCA)**:

Analyzing peers like LIC Housing Finance and Housing Development Corporation, Bajaj Housing Finance appears fairly priced in the **₹125–₹135 range** based on its P/E and P/B ratios.

3. **Precedent Transactions Analysis**:

Benchmarking against recent acquisitions in the housing finance sector, a fair value of **₹135 per share** is plausible.

4. **Dividend Discount Model (DDM)**:

Given the company’s limited dividends, this model is less applicable as it skews conservative with a valuation below **₹100**.

5. **Gordon Growth Model (GGM)**:

Factoring the modest dividend growth, the GGM valuation estimates **₹120 per share**.

6. **Financial Ratios**:

- **P/E Ratio**: Trading at 7.11x earnings.

- **Fair Value**: ₹130 per share based on earnings growth.

7. **Price/Earnings to Growth (PEG) Ratio**:

Considering robust profit growth (38% YoY), the PEG method supports a valuation of **₹140 per share**.

8. **Residual Income Model**:

Using the ROE and cost of equity, the fair value aligns near **₹135 per share**.

9. **Economic Value Added (EVA)**:

Assessing the company’s ability to generate returns over its cost of capital, EVA-based valuation gives **₹138 per share**.

Summary Table:

| **Model** | **Fair Value (₹)** |

|----------------------------------------------|---------------------|

| Discounted Cash Flow (DCF) | 140 |

| Comparable Company Analysis (CCA) | 125–135 |

| Precedent Transactions | 135 |

| Dividend Discount Model (DDM) | 100 |

| Gordon Growth Model (GGM) | 120 |

| Financial Ratios | 130 |

| PEG Ratio | 140 |

| Residual Income Model | 135 |

| Economic Value Added (EVA) | 138 |

**Average Fair Value**: ₹133 per share

**Current Price**: ₹129.56

**Upside Potential**: ~2.66%

Conclusion:

Bajaj Housing Finance Ltd. is currently trading close to its estimated fair value. While not significantly undervalued, it offers stability and modest growth potential, suitable for long-term holding in portfolios focused on housing finance or related sectors.

Disclaimer: This analysis is for informational purposes only. Please consult a financial advisor before making investment decisions.