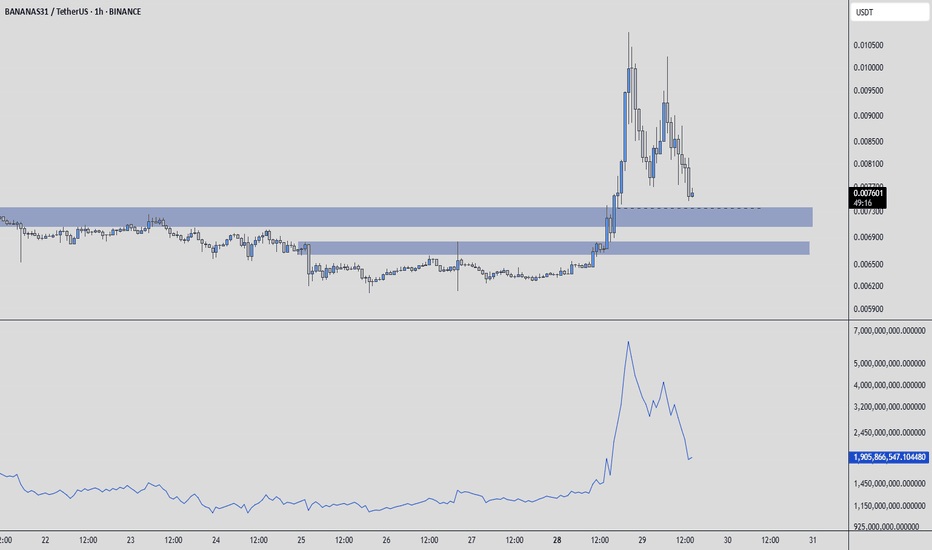

BANANAS31USDT – Smart Entries, Not Chasing Pumps🍌 BANANAS31USDT – Smart Entries, Not Chasing Pumps

Although price has seen a remarkable rise, I believe the uptrend could still have fuel left in the tank.

I’ve marked two blue boxes as potential entry zones. These are not magic reversal levels — they’re simply areas where I’m willing to observe and possibly take action.

🎯 My Strategy

When price reaches a blue box:

I switch to the 5-minute chart

I watch for an upward breakout

I confirm with a rising CDV (Cumulative Delta Volume)

If it all aligns, I spend one bullet — just one, not the whole magazine. Risk is managed, emotion stays out.

These entries might not flip the market, but they can deliver solid, smart profits if executed with discipline.

“You don’t win by predicting the market — you win by preparing for it.”

As always, don’t chase, don’t rush.

Wait for the plan to meet the price.

— UmutTrades 💙

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

📊 Simple Red Box, Extraordinary Results

📊 TIAUSDT | Still No Buyers—Maintaining a Bearish Outlook

📊 OGNUSDT | One of Today’s Highest Volume Gainers – +32.44%

📊 TRXUSDT - I Do My Thing Again

📊 FLOKIUSDT - +%100 From Blue Box!

📊 SFP/USDT - Perfect Entry %80 Profit!

📊 AAVEUSDT - WE DID IT AGAIN!

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

Bananas

Time to Peel Some Gains — BananaUSDT Ripening at the Midline

📈 Technical Overview:

BananaUSDT is currently testing the midline of the descending channel. A confirmed breakout above this level could trigger a bullish move toward the top of the channel, which aligns with our secondary target. Until the breakout is validated, the price may continue to range within the current structure.

🔸 Watchlist Status:

Setup is not confirmed yet — keep this on your watchlist and wait for a clear breakout above the midline.

📍 Next resistance: Top of the channel

📍 Invalidation: Rejection at midline or breakdown below recent support

📉 Risk Management:

Enter only after confirmation, and risk no more than 1% of your capital. Always define your stop-loss.

Bitcoin to 125,000After 9 months of downtrend/sideways price action, bitcoin has finally broke out of this trend.

If we zoom out to weekly time frame, the 9 months of downtrend/sideways price action, serves as "handle" for "cup and handle" pattern which goes back to Nov 2021. Finally, after 3 years, this pattern is completed and bitcoin is set to get to it's next target which is ~125,000.

On it's way up, bitcoin will probably face some resistance at 100K, since people have been waiting for bitcoin to hit this price target from all the way back in 2019-2020. Moreover, 100K is Fibonacci famous 1.6 extension level, so we might see some sell off at this price. However, we believe that FOMO can break this resistance level with ease and bring up the price to 125,000 USD.

From this point, we probably see more sharp upward trend toward 155K and 200K but this is the danger zone where we might see sharp pullbacks to 100-125K range.

gala on berserker mode 1 usdtDisclaimer : It is not a financial advice am not a professional I don't take responsibility for your loss

Just for educational purposes.......

Here we are back on Gala Next axie infinity........

The Devin bull hammer is here,

Congratulation to those who bought the dip .................

This is your host k9100............................ back at your service

Hi there gala gang how you're doing I know it was rough time for gala and us what we hold it we support it

It bull's hammer . Bulls are taking over nasty bears

Please do your own research before investing ...............................................

Take it or regret it bulls are back in game

zoom in and zoom out to see the targets and watch for yellow trench

gala braking falling wedge

Hit like and comment, support the work

Thanks for love and support, I hope we will reach our destination this season

Always remember to take profits

and don't sell til 0.3, 0.5, 1 USD 3 profit targets be patient and keep pushing

................................................................................................................................... har har mahadev

what a beauty XTZ goes bananas till the end of this bull run It is not a financial advice am not a professional I don't take responsibility for your loss

Just for educational purposes.......

Congratulation to those who bought the dip ..................

This is your host k9100............................ back at your service

what a beauty XTZ chart if I can date a chart I probably date sol and xtz chart

if bull run continues and btc hit 100k then xtz will be in range of like 50usd

sleep and enjoy the day and hold and for newbies buy the dip or wait for conform brake at the red levels buy along yellow trend line

Hit like and comment, support the work it will keep me motivating to do more ......................................k9100 out

............................................................................................................................................................................ Har Har Mahadev

Looks like Gary had lots of bananas this weekThere was not much movement in s&p this week as I anticipated it was a very tight accumulation.

The reason I drew the blue accumulation lines was based on Cem Karsan (Croissant) support/resistance levels from the previous week.

This chart I tried to put Croissant levels onto a SPY chart.

The weekly / daily levels are scary accurate as you can see the regression trend I set in this chart is only for Monday Open -> Tuesday Open.

The median for Monday-Tuesday open is almost pinned exactly to close of markets Friday.

To understand why the markets are behaving the way they are, Sergei Perfiliev released a video this week www.youtube.com that helps the less technical understand what Cem Karsan levels and his S&P modeling really mean.

What Karsan means that Gary has his bananas is that thier is plenty of options liquidity (delta hedging) providing gary (the market makers options dealer). It basically means we're going to slowly grind higher until prince charming returns.

The reason why volume is so low is that there is plenty of liquidity in options that market makers don't need to move (sell or buy) as much of the underlying to remain delta neutral.

Who is Prince Charming?

Charm is the change in Delta with respect to the passage of time. The thing with options markets is that as options near expiration this rate of change increases quickly.

Aug 6 tweet thread from Karsan was a cryptic poem that he later re-tweeted this past Wednesday.

My interpretation of his prince charming thread is simple. We're stuck in what he calls the after gamma. Never ending call squeezes.

Which means big money is buying the dip with call options into a sell off that will eventually whipsaw back the other direction as market makers hedge (buy underlying) the call delta.

This chart I did 2 weeks ago is a perfect example of the call squeeze whipsaw we saw the last Buy the Dip 19th.

It was right before Karsan tweeted about never ending call squeezes.

He retweeted the same tweet thread Sept 1st, so my expectation is that we'll have another similar buy the dip this next Vix / Opex.

4/16, 4/20; Orangutanian OnitheorimancyI intentionally neglected to label the obvious patterns (the Big Banana Breakfast, Gravity's Rainbow, the Baby & the Bongwater, One Hundred Years of Solid 'tude, Bonobo's no-nos, Havana Banana Boat Float GOAT, etc., etc..) in favor of the crisp contourage of the raw Orangutanian Onitheorimancy unobstructed.

In a state of denial, the June rally that never should've been.Despite such promising (sorry I mean "beautiful") past rhetoric from Trump on the trade war, he finally admits to the public there is no end in sight. I suspect the trade war will be with us for the foreseeable future, a deal might never materialize. A hard and painful reconfiguration of US supply chains away from China will likely intensify. Despite clearing a point of control that went untested for days, I'm not sure we have a clear signal to short yet since this rally extension (the best June in years) past 3000 was based on the expectations of rate cuts from the fed. Econ data today continues to show a net positive here in the US, an impressive beat on retail sales the highlight of the lot. This seems to compliment last week's inflation data finally ticking up. I find it personally absurd we're talking about cuts at ATH's but with the trade war still looming I think the slowdown in global growth will continue to play a major role on weather we get rate cuts at the end of the month. I'm expecting market participants to be disappointed no matter what happens at the fed meeting. The equity and bond market are pricing in over 50bs of cuts, but the dot plot suggests a majority vote on cuts that big will be hard to get. A cut below 50bps will likely not be enough to satisfy "investors" and I predict a sell off would occur. If we get 50bps I still think it would be a sell the news event. If the dot plot shifted that hard it would suggest the fed is very nervous about market conditions. Fears of a slowdown or recession in the US would likely grow. If we get no cuts at all the rate cut bulls (oxymoron of the year) will obviously throw a tantrum and a sell off would ensue. Because the market is bullish on cuts I think the negative commentary on the trade war could move us back into the 3012-3020 range by the EOW, potentially staying near ATH's until the Fed announcement. Bad news is good news, good news is bad news (pre market we dropped on positive data dump) Bonds have been moving in parallel with equities for weeks now, or is it the other way around? At this point I couldn't tell you what was up and what was down. This market is fucking bananas. nanas!

Agree? Disagree? Let me know what you are thinking!

time to chart some epic bananasSo for DXY I've been watching this pattern I spotted long before brexit. I can't rationalize why the dollar would fall in the coming years in such an epic fashion but on a technical cycle shown in my chart it certainly works... especially if you look at what I can chart in oil, gold and SPX which suggest the timing of a major market correction around jan/ feb 2016. Feel free to laugh !! ;)

new long term ideaMessed up today. had a look again at chart and spotted what I think is beginning of major break of pattern at end of year after a trip down to mid 30s which would be bounce at long term fib.. so a decent chance. prob need some wacky fundamental BS from OPEC or something to give it that kick up to 60s though.