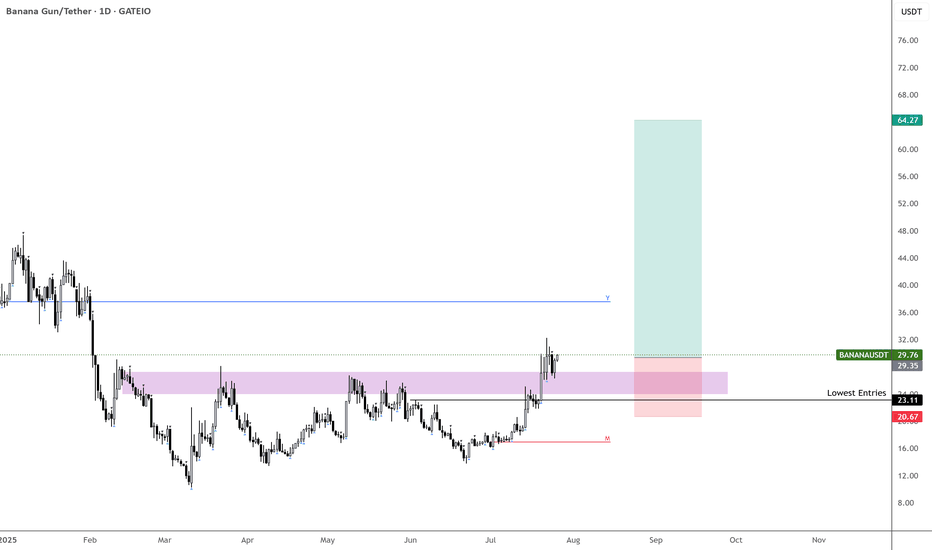

$BANANA – Gift Below $30, Trend Reversal Confirmed

BINANCE:BANANAUSDT under $30 feels like a gift.

Starting to build here, and if price dips back into the purple zone, I’ll keep adding.

Monthly trend is active off the lows—this looks like a clear reversal. If it holds, I expect new highs over the next 5 months.

Not sure if $22 gets retested, but if it does, that’ll be a major area of interest.

Strong coin. Strong setup. Time to act.

BANANAUSDT

Time to Peel Some Gains — BananaUSDT Ripening at the Midline

📈 Technical Overview:

BananaUSDT is currently testing the midline of the descending channel. A confirmed breakout above this level could trigger a bullish move toward the top of the channel, which aligns with our secondary target. Until the breakout is validated, the price may continue to range within the current structure.

🔸 Watchlist Status:

Setup is not confirmed yet — keep this on your watchlist and wait for a clear breakout above the midline.

📍 Next resistance: Top of the channel

📍 Invalidation: Rejection at midline or breakdown below recent support

📉 Risk Management:

Enter only after confirmation, and risk no more than 1% of your capital. Always define your stop-loss.

BANANAS31 Forming Bullish FlagBANANAS31USDT is currently displaying a bullish flag pattern, which is typically a continuation formation that appears after a strong upward movement. This pattern suggests that the market is temporarily consolidating before potentially continuing its bullish trend. The price action has pulled back slightly in a controlled and descending manner, forming a flag structure after a steep rise, indicating that bulls are taking a breather before possibly driving prices higher once again.

Volume remains healthy and consistent, supporting the legitimacy of the pattern. A breakout above the upper resistance of the flag would likely attract additional buyers and could trigger a new wave of momentum. This setup is particularly attractive to technical traders looking for breakout opportunities with clear entry and target zones. Given the current setup, a projected gain of 20% to 30% is reasonable and aligns well with recent resistance levels visible on the higher timeframes.

In addition to the pattern itself, market sentiment around BANANAS31USDT appears to be improving. Social engagement, increased interest from retail traders, and a rise in transaction activity suggest that this project is gaining attention. Short-term traders may find this an ideal opportunity to capitalize on a relatively low-risk/high-reward trade setup, especially if the broader crypto market continues its upward trajectory.

BANANAS31USDT is worth keeping on your radar if you are tracking breakout-ready coins. With solid technical structure and growing investor interest, this coin has the potential to deliver moderate but consistent gains in the coming sessions. Watching for a confirmed breakout with strong volume could be the key to capitalizing on this move.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

BANANA/USDT with a 61.77% potential

BANANA/USDT (6H timeframe)

Current Price: 24.82 USDT

Recent High: 28.19 USDT

Resistance Level Highlighted: 34.28 USDT

Projected Target: Around 34.28 USDT (with a 61.77% potential increase of 13.08 points from current price)

+FVG (Fair Value Gaps):

Two bullish FVG zones are marked, indicating potential areas of interest where price may return for liquidity or support.

Expected Price Movement (Blue Line Path):

A slight retracement is anticipated toward the lower FVG zone (around 20–22 USDT).

After that, a bounce is expected, targeting the major resistance zone around 34.28 USDT.

A heart symbol marks this target area, possibly indicating strong bullish sentiment or a key zone to take profit.

Visual Markers:

Orange box at 34.28: Price target zone.

Vertical purple line: Measures the potential gain (13.08 points or 61.77% rise).

BANANAUSDT – 344% Volume Surge at Key Resistance! “Big volume, big levels—but we don’t FOMO, we wait for confirmation!”

🔥 Key Insights:

✅ 344% Volume Spike – Something is brewing, but is it real?

✅ Major Resistance Zone – This level decides the next big move.

✅ Confirmation is Everything – No breakout? No trade.

💡 The Smart Plan:

Wait for a Clean Break & Retest – No confirmation, no entry.

Watch CDV & Volume Profile – If buyers are serious, we see it here.

LTF Breakout = Green Light – Structure > Hype, always.

“Volume is explosive, but resistance is strong. We wait, confirm, and strike smart!” 🔥

A tiny part of my runners;

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

#BANANAUSDT- Golden Opportunity at Trend Support! Hey there, friends! Today, I’m back with another explosive analysis! 🚀🔥

This time, we’re diving into #BANANAUSDT, one of last week’s hottest topics. We’ve caught it right at a beautiful trend support level. I’ve kept the chart as clean and easy to read as possible.

Now, let’s break it down:

📍 Entry Zone: The $17,300-$17,600 range looks like an ideal buying area since it aligns perfectly with strong trend support.

📍 Stop Loss: Set at $17 for risk management.

📍 Targets: First target sits around $19-$19,500. However, if we see two solid hourly candle closures above $19,500 and confirmation from the $19,150-$19,250 region, then $26 comes into play on our radar.

Wishing you all a trade full of green candles! 📊💰 Let’s discuss in the comments!

Manage your risk, stay in the game! 🎯🔥

#AlyAnaliz #TradeSmart #CryptoVision #BANANAUSDT

$BANANA @BananaGunBot ─ Possibly beginning of Accumulation Range🍌 $BANANA @BananaGunBot 🍌

Could this possibly be the beginning of an Accumulation Range?

As usual, my base case is Wyckoff Accumulation Schematic #1.

Time and more data will tell—adding $BANANA to the watchlist.

Clues to Support an Idea:

1️⃣ Prolonged downtrend

2️⃣ Preliminary Support (PS) – Surge in selling volume followed by above-average buying volume

3️⃣ Selling Climax (SC) – Huge increase in selling volume

4️⃣ Automatic Rally (AR) – Short-lived spike in buying volume

BANANA short setup (4H)BANANA is positioned between an SW H and an SW L. Based on the bases that have formed, it seems that this symbol intends to move toward the targets.

Break even at TP 1.

The closure of a daily candle above the invalidation level will invalidate this analysis.

Do not enter the position without capital management and stop setting

Comment if you have any questions

thank you

#BANANAUSDT maintains bearish momentum📉 Short BYBIT:BANANAUSDT.P from $14.905

🛡 Stop loss $15.490

🕒 1H Timeframe

⚡️ Overview:

➡️ The main POC (Point of Control) is at 16.112, indicating the area with the highest trading volume.

➡️ The 15.490 level acts as a local resistance, as the price previously faced selling pressure there.

➡️ The volume and market profile highlight areas of high trader activity, especially in the 14.250 – 15.500 range.

➡️ The chart shows a potential decline after an impulse move and profit-taking.

🎯 TP Targets:

💎 TP 1: $14.580

💎 TP 2: $14.250

💎 TP 3: $13.920

📢 Monitor key levels before entering the trade!

📢 If 15.490 is broken upward, the trade may be invalidated.

📢 If the price continues to decline and breaks through TP 1, the downside potential remains.

BYBIT:BANANAUSDT.P maintains bearish momentum — expecting further downside movement!

BANANAUSDT.P Could the token unlock trigger a price downturn?Hello dear readers,

It’s great to be here again, sharing ideas with you and learning together.

Today, we're looking at **BANANA**, a Telegram bot where you can manually buy and snipe tokens on Ethereum. On **November 8th**, there will be a token unlock—could this event trigger a price drop? We’ll have to wait and see.

For now, let’s analyse the chart for some technical insights. First, we see the **0.5 Fibonacci level** acting as support, with two reversed hammer candles—one from November 3rd and one from November 4th—holding at this level. This could be indicating a developing situation, though it’s still uncertain. Next, we’re monitoring the **50 and 100 MAs**, with price hovering between them, seemingly undecided on a direction. Volume is stable at the moment, neither increasing nor decreasing significantly.

So, what can we extract from all this? Should we decide now, or wait for the daily close to confirm our analysis? Personally, I prefer to wait for the daily close before taking action. However, if you’re more of an intraday trader, feel free to ask me about smaller time frames.

Stay tuned and trade safe!

BANANA/USDT: READY FOR A 80-90% UPSIDE MOVE!!Hey everyone!

If you're enjoying this analysis, a thumbs up and a follow would be greatly appreciated!

BANANA looks good here. It breaks out from the symmetrical triangle and also did a successful retest. Long some now and add more in the dip.

Entry range:- $42-$46

Targets:- $53/$60/$68/$81

SL:- $39.5

Lev:- 2x-4x

What are your thoughts on BANANA's current price action? Do you see a bullish pattern developing? Share your analysis in the comments below!