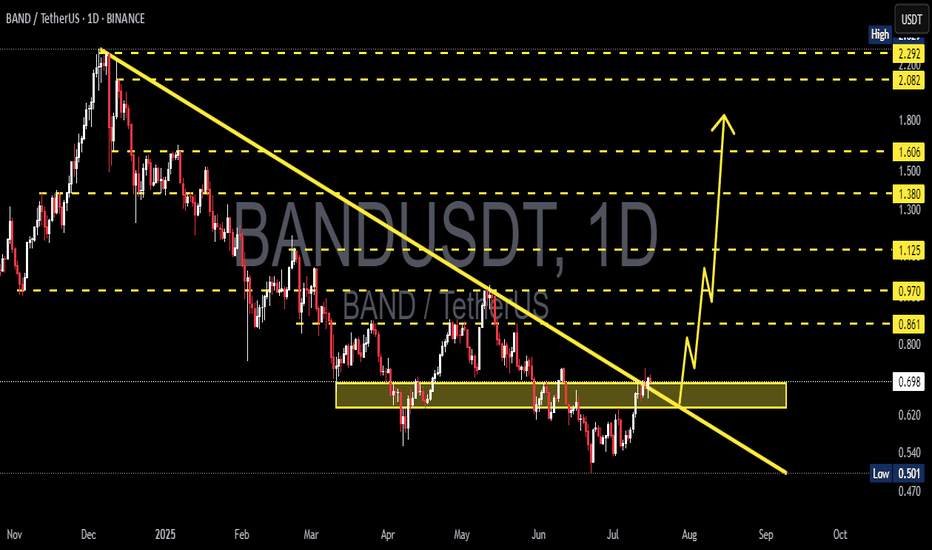

BAND/USDT – Massive Trendline Breakout! Reversal Play!📌 Chart Overview:

BAND/USDT has officially broken out from a long-term descending trendline that has suppressed price action for over 7 months. This breakout, confirmed with a bullish daily close above a key horizontal resistance zone ($0.68–$0.70), opens the door for a powerful trend reversal.

The structure signals the end of accumulation and the beginning of a potential markup phase, where volatility and volume often expand rapidly.

🔍 Technical Pattern Breakdown:

Falling Wedge Formation: A classic bullish reversal pattern formed after a prolonged downtrend. The wedge narrowed price volatility and concluded with a clean breakout to the upside.

Descending Trendline Breakout: The break of the major trendline marks a shift in control from bears to bulls. Historically, this is one of the strongest technical signals for a trend reversal.

Demand Zone Validation: The $0.60–$0.70 range has acted as a multi-month accumulation zone, with repeated rejections from the downside showing strong buyer presence.

✅ Bullish Scenario:

If BAND holds above the $0.68–$0.70 breakout zone, a strong bullish rally could unfold with the following upside targets:

1. TP1: $0.861 – Minor resistance, potential retest level.

2. TP2: $0.970 – Psychological resistance and historical flip zone.

3. TP3: $1.125 – Major horizontal resistance; a breakout from here could trigger FOMO buying.

4. TP4: $1.380–$1.606 – High-confluence zone from previous consolidation.

5. TP5: $2.08–$2.29 – Ultimate extension target aligned with macro resistance from November 2024 highs.

Each breakout above the target levels could lead to a short squeeze scenario, accelerating momentum.

⚠️ Bearish Scenario:

A failure to sustain above the $0.68–$0.70 level would invalidate the breakout and trap late buyers.

Breakdown back below the yellow zone could push price towards:

$0.60 – Key mid-support

$0.501 – The lowest support on chart; a break here would resume the downtrend.

Watch for volume divergence or fake-out signals on lower timeframes.

🧠 Market Psychology Insight:

This setup reflects a shift in sentiment. After a prolonged phase of apathy and seller exhaustion, smart money appears to be stepping in. The strong rejection from lows and breakout suggests early-stage bullish accumulation transitioning into public participation.

If volume increases along with upward price movement, it may confirm Phase C-D of a Wyckoff Accumulation, suggesting much higher upside.

📆 Timing Note:

Historically, July–September has offered volatility surges across mid-cap altcoins. With BAND breaking structure at this critical timing, early positioning could offer asymmetrical risk-reward.

#BANDUSDT #CryptoBreakout #AltcoinSeason #TrendlineBreak #BullishReversal #TechnicalAnalysis #FallingWedge #CryptoSignals #BANDToken #CryptoTA

BANDUSD

Can #BAND Bulls Maintain this Momentum or Will Bears Win? Yello, Paradisers! Is #BANDProtocol breakout from the falling wedge legit—or are bulls walking straight into a trap? Let's dig into the latest setup of #BANDUSDT:

💎After trading for weeks inside a falling wedge, #BAND has finally broken out with solid momentum. The breakout above the resistance trendline at around $0.66 has already occurred, and the price is currently hovering near the $0.72 zone. While this move is promising, it’s now all about whether this breakout can hold or fake out.

💎The structure here is clear: #BANDUSD reclaimed the demand zone between $0.60–$0.66 after bouncing off strong support at $0.504. This zone now becomes the most important area to watch in the short term. A retest of this level would offer a high-probability continuation setup, especially since the 50EMA is now acting as dynamic support beneath the price.

💎If bulls can maintain control, we have a clear path toward the moderate resistance at $0.992. That’s where the next wave of selling pressure is expected. But the real prize is the strong resistance zone near $1.180. That’s the level where major distribution could occur, and it's where we’ll be watching closely for profit-taking signs.

💎However, the bullish thesis breaks down completely if the price drops back below the $0.60–$0.66 demand zone. In that case, our invalidation point sits firmly at $0.504. A close below that support would indicate bears are back in control, and we’d shift to a defensive stance, targeting lower re-entry zones.

Stay patient, Paradisers. Let the breakout confirm, and only then do we strike with conviction.

MyCryptoParadise

iFeel the success🌴

#BAND/USDT#BAND

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower limit of the channel at 0.04400, which acts as strong support from which the price can rebound.

Entry price: 0.810

First target: 0.827

Second target: 0.860

Third target: 0.893

#BAND/USDT#BAND

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.926

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.940

First target 0.970

Second target 0.997

Third target 1.038

BANDUSDT Explosive 600% Profit SetupA strong long trade setup has been identified using the Risological Swing Trading Indicator , with a massive 600% profit potential at 10x leverage.

Trade Details:

Entry: $1.541

Stop Loss (SL): $1.389

Targets:

TP1: $1.729

TP2: $2.033

TP3: $2.337

TP4: $2.525

Analysis:

The trade setup shows a breakout signal with clear entry and defined risk. The indicator aligns with a bullish momentum, suggesting potential to reach all target levels efficiently. This setup offers an excellent risk-to-reward ratio, making it a lucrative opportunity for traders.

#BAND/USDT#BAND

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 1.80

Entry price 1.95

First target 1.95

Second target 2.08

Third target 2.23

#BAND (SPOT) IN ( 1.000- 1.320) T. (15) SL(.951)BINANCE:BANDUSDT

entry range (1.000- 1.320)

Target1 (1.730) - Target2 (2.100)- Target3 (5.000)- Target4 (7.300)- Target5 (13.000)- Target6 (15.000)

1 Extra Targets(optional) in chart, if you like to continue in the trade with making stoploss very high.

SL .1D close below (0.951)

***This coin on weekly chart is going to give 10X but it may take time to achieve all targets***

______________________________________________________________

Golden Advices.

********************

* collect the coin slowly in the entry range.

* Please calculate your losses before the entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

Useful Tags.

****************

My total posts

www.tradingview.com

1Million Journey

www.tradingview.com

www.tradingview.com

********************************************************************************************************************** #Manta ,#OMNI, #DYM, #AI, #IO, #XAI , #ACE #NFP #RAD #WLD #ORDI #BLUR #SUI #Voxel #AEVO #VITE #APE #RDNT #FLUX #NMR #VANRY #TRB #HBAR #DGB #XEC #ERN #ALT #IO #ACA #HIVE #ASTR #ARDR #PIXEL #LTO #AERGO #SCRT #ATA #HOOK #FLOW #KSM #HFT #MINA #DATA #SC #JOE #RDNT #IQ #CFX #BICO #CTSI #KMD #FXS #DEGO #FORTH # AST #PORTAL #CYBER #RIF #ENJ #ZIL #APT #GALA #STEEM #ONE #LINK #NTRN #COTI #RENDER #ICX #IMX #ALICE #PYR #PORTAL #GRT #GMT # IDEX #NEAR #ICP #ETH #QTUM #VET #QNT #API3 #BURGER #MOVR #SKL #BAND .

BANDUSDT 300% Potential!BANDUSDT Technical analysis update

BAND's price is bouncing from its major support zone after repeatedly testing the $1.00 support level. It has been trading in the $1.00-$2.50 range for the past 820 days, and a strong bullish move from the current level is anticipated.

Buy zone : Below $1.07

Stop loss : $0.87

Regards

Hexa

BAND looks bearishFrom where we placed the red arrow on the chart, it looks like a BAND correction has started.

BAND seems to be forming a complex diametric which is now in the middle of wave E.

We are looking for sell/short positions in the supply range.

Closing a daily candle above the invalidation level will violate the analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

Opportunity to buy in BANDWe have a bullish iCH on the chart and the trigger line has also broken out.

On the demand range, we can look for buy/long positions

The targets are clear on the chart.

Closing a candle below the invalidation level will violate the analysis

Note that the financial market is risky, so:

Do not enter any position without confirmation and trigger.

Do not enter a position without setting a stop.

Do not enter a position without capital management.

When we reach the first TP, save some profit and try to move the stop continuously in the direction of your profit.

If you have any comments please post them, comments will help us improve our performance

Thanks

#BAND\USDT#BAND

'The price is moving in a downward trend on a 1-hour frame.

The price is moving within it and adhering to it to a large extent,

and it has just been breached. We have a tendency to stabilize above Moving Average 100.

We have a downtrend on the RSI indicator that supports the rise and has been broken to the upside

Entry price is 1.45

The first goal is 1.64

Second goal 1.88

Third goal 2.13

BANDUSDT - Triangle Breakout and Heading towards next ResistanceBINANCE:BANDUSDT (4H CHART) Technical Analysis Update

BANDUSDT is currently trading at 1.80 $ and and successfully breakout from the triangle pattern, its heading towards the next resistance around 2.0

We can expect the trend to continue and out final target is around 2.3

Long Entry level: $ 1.8

Stop loss: below $ 1.621

Target 1: $ 1.9

Target 2: $ 2.0

Target 3: $ 2.1

Target 4: $ 2.3

Max Leverage: 2x

Don't forget to keep stop loss.

Follow Our TradingView Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts.

Cheers

GreenCrypto

BAND will pump soonBefore anything else, you should note that the time frame is large and time-consuming (it is 2D).

BAND seems to be consolidating a triangle pattern, we are now in wave D of this triangle.

Wave D is a diamond diametric, which now seems to be in the bullish wave E of this diametric.

The target indicated on the chart (2.723) is expected to be hit in the coming days

Closing a daily candle below the green range will violate the analysis

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You