BANK

EURSGD Long BiasWelcome to everyone!

Today is the time of EURSGD.

As we know eursgd just reacted the previous higher timeframe descending trendline and creater new monthly demand imbalance. by using supply and demand method we earn good profit when we follow higher timeframes.

On another side we have monthly supply area up there where market could reach and retrace back for retesting the levels. So right now we are here with long positions.

Enjoy the weekend.

Happy Trading.

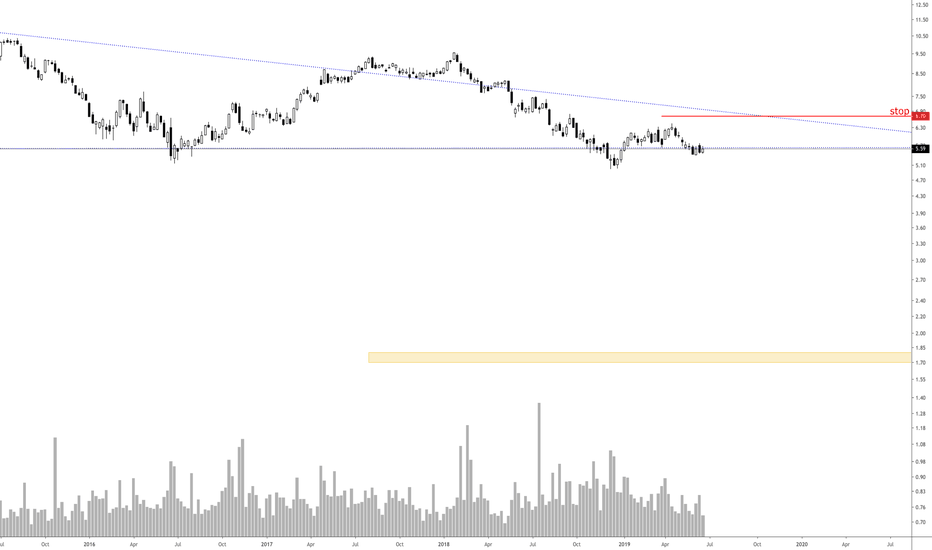

USDSEK Short BiasWelcome to everyone!

Today is the day of USDSEK.

usdsek just reacting the previous strong created supply area and going for short now.

as we know the strength of dollar is getting weaker now.

We always follow our rules and stick with our plan. But no method/plan help us without controling our emotions.

Without proper knowledge forex is just a gambling for the people who try to gain profit from it following by their luck.

So Short Bias right now. This is it. Enjoy

Happy Trading : )

XNGUSD Long BiasWelcome to everyone!

Today is the day of natural gas.

price just reacted the very strong area of monthly demand down there. So when price reacts higher timeframe areas as that happend now then price moves strongly either upward or downward.

well we have projected strong supply weekly zone up there so we can say that is a huge room for earning profit.

Always remember! Just enter in the market zone to zone then you would never be lost anywhere in the forex world.

Happy Trading.

EURGBP Short BiasWelcome to everyone!

Today is the EG time.

Euro is just pushing but price action looks really weak and it is hardest thing to break the previous two strong supply areas.

Due to brexit GBP getting weaker day by day so that causes also that price couldn't make any strong move and went for consolidation. So hope after this small consolidation drops would be happend. So just stick with the plan and Control the emotions.

Happy Trading.

DXY Short Bias Welcome to everyone.

DXY just reacted lower timeframe H1 supply level. If market breaks H1 level then it will go up there to the Daily supply and we will see the strong drop. So we have to wait for that. If market doesn't break H1 level then it will go slightly down as it is happening now. So the Future drops are just there on Dollar yield.

Happy trading

A new decline for Aud/UsdA new decline is expected for Aud/Usd, in fact in the last sessions the price stabilized between 78.6% and 100% of the Fibonacci retracement. Speaking about the price it was between the support at 0.675 and the resistance at 0.705. Throughout the summer it should continue to lateralize in this channel as, fundamentally, both the Australian central bank and the FED will not distort their monetary policies.

At this time, however, investors and analysts are expecting a slight change from Powell. He should cut rates in the July meeting: the market has already discounted this news, causing a retracement of dollar against the other majors. For now we expect a maintenance of this level, with the dollar that should find the necessary strength to reach the main short-term supports against other currencies. Technically, on this pair the price should go back to testing the static support at 0.675. This before the monthly closing in June.

What is going on Eur/Usd ?What is going on Eur/Usd ? So the price is undergoing a very short-term rebound. This allowed the price to return in the 1.12 area. In fact, after entering short about a month ago and reaching the first target in the area of 1,112 (as indicated in the previous analysis), the price returned again near the previous entry point.

Technically, the trend still remains bearish on the main TFs, with the price still below all the main EMA and key static resistances. To reverse the trend in the very short/short period, the price should break the weekly dynamic resistance identified by EMA20 and passer for the 1,126. To reverse it in the short / medium term, the price should even violate upwards the dynamic resistance identified by the EMA200 and passing through the 1.16.

The technical analysis is strongly supported by the fundamental scenario. During the week Draghi will speak, declaring the monetary policy that the ECB will adopt in the short term. Which should not surprise analysts and investors, who still expect a strongly expansive policy. This could devaluing the euro, which should loss against the other majors. We expect that this downtrend will start again.

So because of what is going on Eur/Usd the first target remains the support area at 1.112; the last target we expect the area located at 1.08.

BAC Short ScalpOn this one, I'm going to trade a short scalp on BAC.

A resistance that have showed to be valid is tested again just before the weekend and after that seen some bearish conformation that it is not ready to break yet.

With a slightly high RSI at 70 I'm getting in.

The target is where I drew the support on the chart.

Thanks for reading!

Wesley

DXY to the UPside??If there is a minor continuation on the Dollar,

We can see levels as high as 98.00 - 99.00

there has to be big trader sponsorship in these candles to

define if we have a bullish Dollar...

Say we do? that 70.5% would be our price entry? NO we are just

guaging the big trader sponsor ship on grabbing up all the dollar.

Seems like they were looking for levels to buy up in my honest opinon.

take this bias as you wish and utilize it to your advantage.