CNO to continue in its selloff?CNO FINANCIAL GROUP - 30d expiry - We look to Sell a break of 20.29 (stop at 21.31)

There is no indication that the selloff is coming to an end.

The move lower is mixed and volatile, common in corrective sequences.

A break of the recent low at 20.36 should result in a further move lower.

Daily signals are bearish.

News events could adversley affect the short term technical picture.

Our profit targets will be 17.81 and 17.31

Resistance: 22.00 / 22.61 / 23.00

Support: 21.20 / 20.36 / 20.00

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre.

BANK

GBPJPY Technical Analysis 29.03.2023 1h chart– Previous Daily candle closed weak Bearish forming weak Daily Resistance around 161.540.

– Buys on close above 161.770 targeting 30min previous Support formed on 22nd March 2023 at 162.240, Leaving Runners to the next 30min previous Support formed on 22nd March 2023 at 162.600.

– Sells on close below 161.180 targeting 4h Support at 160.850, Leaving Runners to the next 4h Support formed at 160.170

– Buy targets remained the same as the Analysis posted yesterday (Tuesday) as price have respected the level of Resistance marked on the chart.

Will Morgan Stanley Bank continue in selloff?Morgan Stanley - 30d expiry - We look to Sell a break of 83.18 (stop at 86.32)

Short term bias has turned negative.

There is no indication that the selloff is coming to an end.

This stock fell 6.5 % last week.

A break of the recent low at 83.28 should result in a further move lower.

Short term MACD has turned negative.

Our profit targets will be 75.33 and 73.33

Resistance: 89.18 / 92.00 / 93.50

Support: 87.00 / 83.28 / 81.00

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre.

FRC First Republic Bank Price TargetFRC First Republic Bank received uninsured deposits of $30 billion on Mar 16, 2023, from 11 banks of the country: Bank of America Corporation BAC, Citigroup Inc. C, JPMorgan Chase & Co. JPM, PNC Bank, Wells Fargo, Goldman Sachs, Morgan Stanley, Bank of New York Mellon, State Street, Truist, and U.S. Bank.

I know it`s a risky trade, but i believe this recue package puts it in a lot better situation that CS Credit Suisse Group.

My price target for FRC First Republic Bank is at least $30.30 and maybe $52.20.

Looking forward to read your opinion about it.

XAUUSD Market ViewThe price movement approaching the resistance area with decreasing liquidity indicates a reduced enthusiasm of market participants to buy. This is also supported by the decreased concerns caused by the Silicon Valley Bank & Signature Bank incident. Therefore, it can be concluded to prepare for a selling position.

SBNY Signature Bank next to Collapse? If you haven`t bought those 5X puts:

Then you should know that Signature Bank's stock experienced its worst day on record following the collapse of SIVB Silicon Valley Bank and SI Silvergate.

Due to high volatility, trading was suspended earlier in Friday's session, and the stock has continued to decline for five consecutive sessions.

This downturn was triggered by the closure of Silvergate, the second major bank serving digital assets companies, as well as the regulatory shutdown of Silicon Valley Bank, the 18th largest bank in the United States.

It has been reported that Signature Bank had exposure to FTX.

I am still bearish on the company and i believe it will reach the $34 - $63 area soon!

Looking forward to read your opinion about it!

Guide to adjusting your brain to a bank run, short everything?

We're entering the phase where potential bank runs will occur, meaning "experts" will start shorting everything heavily including Bitcoin.

But the question is if Bank deposits aren't safe? can't withdraw funds? where do you go?

Gold? possibly if you trust paper gold, Bitcoin? decent choice, stocks? well at least you own the certificate of ownership that can be protected.

17,610 bn of bank deposits yes that is 17.6 trillion currency in "oh no my money mode" people want to know how gold can hit $5,000? how Bitcoin can hit $500,000? gamma squeeze.

Let the games begin!

www.youtube.com

SBNY Signature Bank exposure to FTXOn December 21 Fitch Ratings revised Signature Bank's (SBNY) 'BBB+' Long-Term Issuer Default Rating (IDR) Rating Outlook to Negative from Stable.

On Jan 10, a team of analysts led by Ken Usdin downgraded SBNY Signature Bank to Hold from Buy, and slashed their target price to $124 from $185.

SBNY Signature Bank said that it had an exposure to FTX of less than 0.1%.

They also announced a reduction is crypto exposure, of which Jefferies analysts said:

“Signature Bank’s decision to shrink its crypto deposits by $8 billion to $10 billion and replacing with wholesale borrowings at 4.25% will drive a significant net interest margin reset in the coming quarters,”, which is a key profitability metric for banks.

Looking at the SBNY Signature Bank options chain ahead of earnings , I would buy the $75 strike price Puts with

2023-6-16 expiration date for about

$4.45 premium.

If the options turn out to be profitable Before the earnings release, i would sell at least 50%.

Looking forward to read your opinion about it.

Long opportunity in ICICI BANKPositional Long Opportunity in ICICIBANK.

1. Positive RSI

2. MFI Breakout

3. 200 EMA Support Level

4. Will retest psychological level of 900 before exiting the 800 range on the downside

5. Price trying to make a HUGE HEAD AND SHOULDER pattern. Currently developing the right shoulder.

Nifty bankHello Everyone,

Today Nifty Bank was trading in a very tight range in the morning session. After than it breaks its support of 41350 and fall unto 41100 after that it tried to rise and breaks its support line of 41350 and move 200++ pts up and hence, ended the market in green.

In this whole fluctuation of today's market over view is set to be bullish for next day. We expect it to touch 42000-42300 range which will show a good market condition in the banking and allied stocks. The impact of budget on the market are seeming lightly today as volatility has decreased quiet comparing to past 4-6 trading session.

So our trading range for upcoming days is between 41000-42000 (+/- 200pts as per India VIX).

Thanks

AXISBANK Potential for Bearish Drop | 6th February 2023Looking at the H4 chart, my overall bias for AXISBANK is bearish due to the current price being below the Ichimoku cloud, indicating a bearish market.

Looking for a pullback sell entry at 908.00, where the overlap resistance and 50% Fibonacci line is. Stop loss will be at 970.00, where the recent swing high is. Take profit will be at 702.30, where the overlap support is.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.

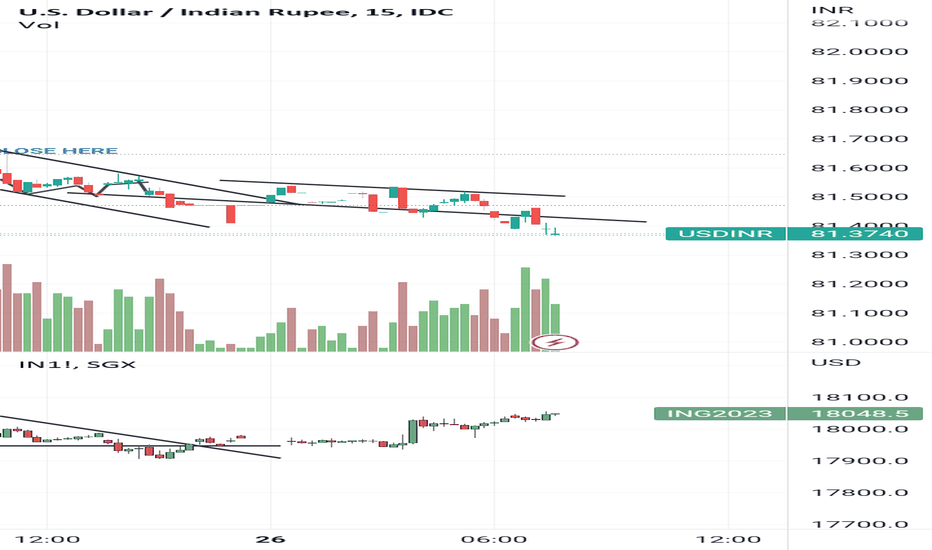

Compare to indaxHi this Vijay Shrivastava and

This is thinking 💭 🤔

I try to compare SGX NIFTY WITH USDINR for catch Nifty 50 next moment..

(1) I think Nifty will go up upro 100 point because sgx have a strong support zone from here and currency make resistance..

In my opinion I currency move to 81.3500 so sgx nifty also cross 18100 level and in Indian market Nifty will come to 18150 again....

And one more thing if currency go 81.3500 so I am also bullish in bank Nifty..

(2) if currency move up to 81.4500 to 81.5500 may be in that case we see Nifty in sideways zone..

(3) this is very important Nifty try to make support from here it's also like aresistance level if currency move up from here so definitely in next trading day Nifty will more down from here aprox 85 to 130 point...

So be raddy next day what ever market decide to go we raddy catch our luck 🤞 from here

..