October 19 BTCUSD BingX Chart Analysis and Today's HeadlineBingX’s Bitcoin Chart

Bitcoin is down 1.81% over the last 24 hours and fell to an intraday low of $19,091.97. The largest cryptocurrency broke below the 20-day exponential moving average ($19,410), suggesting the seller remains active at the higher levels. The RSI is near the midpoint, suggesting a balance between supply and demand. For now, the bulls need to push the price above the 20-day exponential moving average in order to prevent further decline.

Today’s Cryptocurrency Headline

Silvergate Capital Release Q3 Earnings Report

Crypto bank Silvergate Capital released its third-quarter earnings statement Tuesday. The bank reported EPS of $1.28 in its third-quarter earnings presentation, compared with analysts’ consensus estimate of $1.41 via S&P Capital IQ. Silvergate's shares subsequently fell about 20%. Transfers via Silvergate’s real-time settlement network totaled $112.6 billion in the third quarter, which represents a 41% decrease compared with the previous three-month period and a 30% decline from the third quarter of 2021.

Disclaimer: BingX does not endorse and is not responsible for or liable for any content, accuracy, quality, advertising, products, or other materials on this page. Readers should do their own research before taking any actions related to the company. BingX is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods, or services mentioned in the article.

BANK

EUR / CHF LONG - Potential trend changeAfter we have been in a downtrend in the EUR/CHF pair for quite some time, I expect a potential trend change.

- the existing rally in the DXY could come to an end in the near future, which would ease the pressure on the EUR.

I provide the idea with the consideration of rules of "SUPPLY&DEMAND" theory, which focuses on market influence of banks.

The market moves when banks open positions:

- in our case it is a LONG position - of banks / large investors.

- by buying, retail investors were forced to liquidate their SHORT positions = "positions were bought" = "buying cascade".

The banks need more than one run-up to fill their position "100%" due to their position size.

- the next run-up could be into the 0.88 FIBO in my opinion, so that the banks get a similar purchase price. (Level combined with DEMAND.)

- the retail investors will not expect a trend reversal and will open more SHORT positions, allowing the banks to get the liquidity they need.

If the SL level (stop loss) I set is broken, we can expect a further sell-off. (Should it not be a fake-out).

- There are on the time levels 1-4h large "DEMAND" zones at entry, which should bring about a reaction.

- The banks are not interested in the price falling below their EC, so they will defend this level.

If you disagree, feel free to let me know - I am still in the learning process.

Thank you and happy trading!

Bank Nifty levels for 14 Oct 2022Good morning 🌞

Have a profitable day 💰👍🏻

Morning Market Update 14 Oct 2022

SGX NIFTY is indicating a Positive opening

👉 SGX NIFTY is trading at 17252 up by 295 points

👉 US futures are in Green

👉 ASIAN Market is in Green

👉 USDINR at 82.18

In Nifty 17000 PE and 17000 CE have high Open Interest in weekly

In BankNifty 38500 PE and 39000 CE have high Open Interest in weekly

👉 Asia-Pac Stocks Are Higher And Take Impetus From The Gains On Wall St Which Staged An Aggressive Comeback Amid Several Factors Including A Dovish ECB Staff Model View, UK U-Turn Speculation And A Touted Short Squeeze; ASX 200 (+1.5%), Nikkei 225 (+2.3%), KOSPI (+1.5%)

👉 STOCKS TO WATCH:

INFOSYS, ANGEL ONE, POWER MECH, MINDTREE, COAL, HDFC LIFE, CYIENT, ANAND RATHI, DEN NETWORKS, TATA STEEL LONG, RELIANCE, KPI GREEN

👉 Stocks Ban In F&O: Delta Corp, Indiabulls Hsg

My view today 👇

we can see some profit booking in first 1 hour. Nifty above 17280 levels is good for longs and Bank Nifty 39300 levels above is good for longs

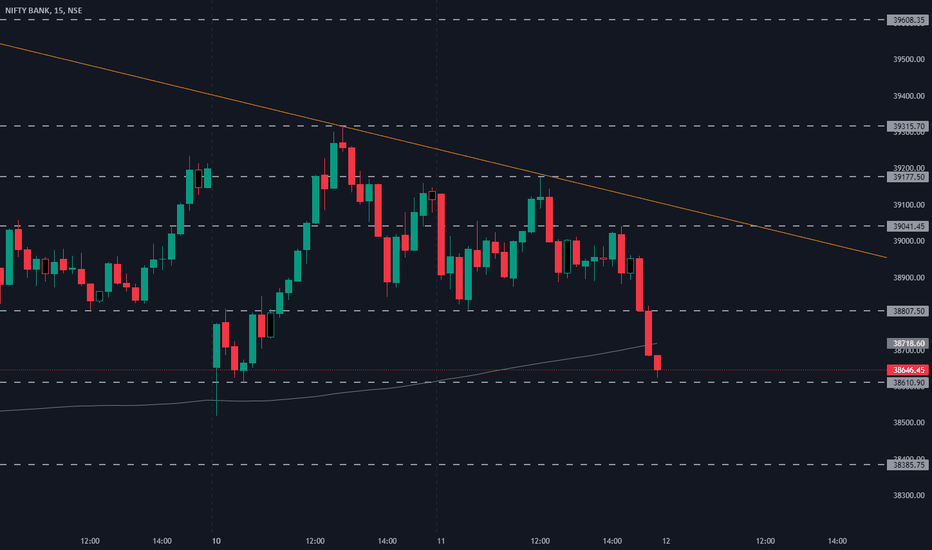

Bank Nifty Levels for 12 oct 2022Good morning 🌞

Have a profitable day 💰👍🏻

Pre-Market Report 12 Oct 2022

SGX NIFTY is indicating a Flat opening

👉 SGX NIFTY is trading at 16964.5 up by 0.14%

👉 US futures are in RED

👉 ASIAN Market is in RED

👉 USDINR at 82.31

In Nifty 17000 PE and 17200 CE have high Open Interest in weekly

In Bank Nifty 38500 PE and 39000 CE have high Open Interest in weekly

👉 Asia-Pac Stocks Begin Subdued Following The Choppy Performance And Late Selling Stateside After BoE Governor Bailey Rejected Calls For An Extension To Gilt Purchases Beyond The Friday Deadline; ASX 200 (-0.1%), Nikkei 225 (-0.2%), KOSPI (-0.1%)

👉 STOCKS TO WATCH:

DELTA CORP, KIRLOSKAR ELECTRIC, L&T FINANCE, GENESYS INTL, SPANDANA SPHOORTY, SUZLON, TCS, RELIANCE, DLF, GUJARAT PIPAVAV

👉 Stocks Ban In F&O: Delta Corp, Indiabulls Hsg, India Cement

My view today 👉 Any gap up will again get correction today, I will look for a selling opportunity.

Trading Idea - #DeutscheBankMy trading idea for Deutsche Bank - Buy / LONG

Target: EUR 12.00 (+40% profit)

The recent valuation of the banking sector in Europe should lead to higher price targets across the industry.

Deutsche Bank should also be among the winners as rising interest rates create favourable business conditions.

From a chart perspective, the price of the Deutsche Bank share has broken the downward trend. The price is currently consolidating above the EUR 8.00 mark with a rising trend.

Tomorrow banknifty levels Today we see Banknifty in range . For us tommorow view was very clear by following today's chart . Buy banknifty only above the level we give to you bcz these level was major resistance in banknifty

Buy banknifty above 40688

Target 40754 40836 40947

Sl 40515...if market open with gap up then buy it according to our level and if it open above our level thn 41040 41243 41383

Sell bank nifty below 40517

Target 40427 40304 40151

Sl 40685

Bank of America Corp.: the instrument trades sidewaysNYSE:BAC

Current trend

The shares of Bank of America Corp., one of the US's largest banks and analytical agencies, are moving sideways around 33.00.

The downward dynamics of the asset are developing against the backdrop of investor pessimism regarding the recent Q2 report, which was one of the worst for the company: net profit fell by 33% and amounted to 6.2B dollars compared to 9.2B dollars a year earlier, EPS is at the level 0.73 dollars, well below 1.03 dollars a year earlier, while the corporation's revenue reached 22.69B dollars, down from 23.23B dollars a quarter earlier. The main disappointment for traders was that the division responsible for capital markets investments suffered a loss of 5.0%, which reduced revenue to 4.5B dollars. The new report, published on October 17, is expected to increase revenue to 23.51B dollars, while EPS could increase to 0.8011 dollars.

The next dividend payout is scheduled for September 30, and shareholders will receive 0.22 dollars per share, reflecting an average quarterly return of 2.66% per annum.

Support and resistance

n the global chart, the price has left the downwards channel and is preparing to continue its local growth. Technical indicators maintain a buy signal: Alligator's EMA oscillation range expands, fast EMAs are above the signal line, and the AO oscillator histogram trades in the positive zone, forming downward bars.

Resistance levels: 33.85, 37.34.

Support levels: 32.40, 30.00.

Trading tips

Long positions may be opened after the price rises and consolidates above 33.85 with the target at 37.34 and stop loss 32.00. Implementation period: 7 days or more.

Short positions may be opened after the price drops and consolidates below 32.40 with the target at 30.00. Stop loss — 33.00.

***All indicator readings and price values are historical data. Past price behavior is not a reliable indicator of future performance.

HDFC BANK LONG TERM ELLIOT WAVE ANALYSISHDFC bank is one of the largest private sector and biggest bank of INDIA and WORLD'S 10 th largest according to market capitalization .

HDFC bank is among top nifty 50 index stocks and one of the largest bank in bank nifty index with 28% weightage . According to ELLIOT WAVE ANALYSIS it has completed one big cycle and moving towards third wave which is considerd biggest waves among ELLIOT 'S 5 WAVES . Price has taken support near 1250 which was earlier a strong support zone.

Weekly candle has also broken channel and looking bullish .It is the best stock to consider for long term investment .

Trading Idea - #DeutscheBankMy trading idea for Deutsche Bank - Sell / SHORT

Target: EUR 5.80

Deutsche Bank with a mixed outlook for the year.

Although DB performed well in investment banking, earnings were lower than in the second quarter of last year due to higher costs.

The sell target is based on last year's support levels.