KOTAK BANK & BANK NIFTYHello

Welcome to this analysis on Bank Nifty and Kotak Bank

On the hourly chart Bank Nifty appears to be ending its 5 waves up from Aug 23rd lows (this can stretch to 38000)

Kotak Bank in daily time frame is at a Bearish Harmonic AB=CD Pattern along with 1.27x its Fibonacci extension of the IHS breakout. (this can stretch till 1925)

Both can cool off a bit from these levels - approx 38% of its recent run up could be a retracement level

Bankingsector

Banknifty - Important levelsBanknifty opens lower today and saw selling only to close near its low.

The immediate support I see on the index is around 33300 levels.

If the prices hold these levels, they might move towards the recent highs.

Any opening below 33300, would trigger selling in the index and prices may move instantly towards 32980 and maybe towards the lower end of the range in the coming trading sessions.

BANKNIFTY, DAILY CHARTBANKNIFTY, Daily Chart

Three consecutive close above 33100 will take it to 36960 & 38000+++ levels in days to come.

Stop loss below 31500 on a closing basis. Any fall downside will be buying opportunity.

Disclaimer

I am not SEBI REGISTERED Analyst

My Studies are Educational purpose only

Consult with your financial advisor before trading or investing

WIRECARD AG 2020 was a hard time for everyone because of Corona , but one of the biggest shock of stock market was Wirecard scandal.

I believe even after all this chaos around Wirecard, it would rise again in future. Of course the time could not be predicted.

Wirecard was a BlueChip stock, they have billions of Euro worth business running still now.

The share fell down because of scandal and closing operations in different countries, but in longer term if there comes the long waited news of selling Wirecard to a new company could push the price upwards. As, it could bring relief and trust among investors once again.

*** Do your own research. This is only my own analysis, not an investment advice.

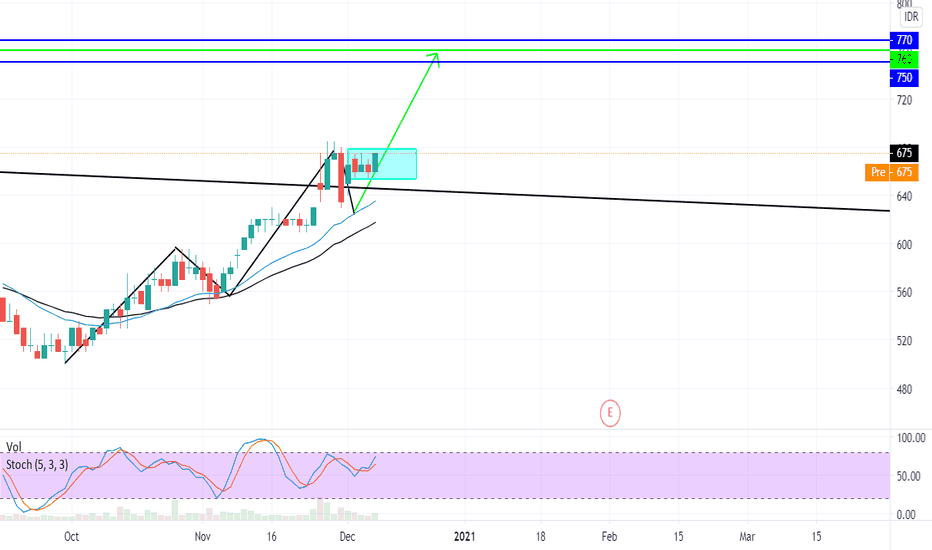

BJTM 13%+ INDONESIA STOCKS EXCHANGEWE KNOW THAT DOW THEORY IS PRIMARY SECONDARY AND PRIMARY AGAIN

THE MARKET ALREADY SECONDARY REACTION AND NOW BJTM IS MAKING A BASE, A BASE IS LIKE A CAGE WHICH THE PRICE TRAP INSIDE THE CAGE, WE HAVE TO WAIT THE CONFIRMATION OF THE BREAKOUT OF THE CAGE, IF BREAKOUT THAN THE PRICE WILL RALLY MAKING HIS PRIMARY REACTION AGAIN,

THE TARGET PRICE AREA WILL BE 750 - 770

AND WHY A GREEN LINE AT 720? WHY THE TARGET PRICCE 750 - 770?

THE REASON IS SIMPLE,

THE GREEN LINE PRICE PROFIT AREA IS BY USING FIBONACCI PRICE PROJECTION (AB = CD) AND IT STOP AT 720, SO IS THE GAP AREA, WE CAN SEE 750 - 770 IS AN OPEN AND CLOSING GAP AREA WHICH CLUSTER TO FIBONACCI AB = CD

STOPLOSS AREA

630

WHY? BECAUSE IF WE BUY AT BREAK OUT AREA, AND THE PRICE ISNT CAPABLE TO RISE, AND DROP TO THE BASE (CAGE) AGAIN AND ALSO BREK THE BOTTOM OF THE BASE WE CAN ASSUME THAT SUPPLY IS MUCH HIGHER THAN THE DEMAND

DISCLAIMER ON!

INDONESIA BANK BMRI With FALLING WEDGE and DOUBLE BOTTOM PATTERNINDONESIA STOCKS MARKET BMRI (BANKING SECTOR)

En : The red candle on 30 Sept shows us that already hit fibonacci external retracement on 1.272 (False break area) that means Double bottom in on the way, And if we put a trendline it shows us the chart formed a pattern called falling wedge so this 2 strong patterns will lead BMRI to minimum : 5450 the reason is because we use the past (nearest) classic resistance and second target price will be on 5825 this is fibonacci 1.618 external retracement and the third target price will be on 6225 to 6325 area this is Falling wedge pattern target price, and the reason of buying is because on 1st Oct the closing price is Bullish MAROBOZU CANDLE, and 2nd Oct the Closing price is a BULLISH HAMMER .

Thankyou!

SAHAM BANKING BMRI

ID : Candle merah pada 30 September sudah mencapai titik fibonacci 1.272 (area false break itu terjadi) menandakan double bottom akan terjadi, dan jika kita mengaris trendline chart akan menunjukan pembentukan pattern yang disebut falling wedge , jadi 2 pattern yang sangat kuat ini akan mengarahkan BMRI ke min 5450 target dengan alasan classic resistance sebelumnya price ke dua adalah di 5825 target price ini di fibonacci 1.618 external retracement dan target ke 3 pada BMRI ini adalah di 6225 - 6325 area tersebut adalah titik target price fallingwedge pada umumnya, dan alasan pembelian ini dikarenakan pada tanggal 1Oct clossing price nya adalah candle MAROBOZU BULLISH , dan pada 2Oct closing pricenya adalah Bullish hammer .

sekian dan terimakasih

Bitcoin (BTC/USD) Weekly Daily Chart Analysis For October 5,2020Technical Analysis and Outlook

Bitcoin's price broke out of a powerful resistance of $11,000 . As a result, the price is advancing to Mean Res $11,935 and #2 Inner Coin Rally marked at $12,013 - The trifling retest is expected, buy the ''Rinse and Repeat and ''Prevalent'' zones. Phase Two of the rally is very much to follow. To continue the rest story, see 'Weekly Market Review & Analysis For October 5, 2020, page.

#Rescue packages ahead or #Bankruptcy wave #Banks #RevolutionChart technical target already processed.

In my opinion, wave targets should be searched lower.

1. either massive bank failure ahead with bail-ins or

2. massive rescue packages from the ECB.

I bet that ECB will buy bank shares massively and issues uncovered blank checks within the EURO system.

What comes to my mind?

I have to buy more gold and silver shares again.

Greeting from Hannover

Stefan Bode

Are Turkish Banks creating opportunities? (XBANK.IS) In dollar terms, the Turkish Banking Index is in a long-term squeeze.

With the new works that started to arrive, albeit late, after the Lira's compression, we can see that the index can throw itself back to the upper band at the end of 2020 and at the beginning of 2021.

The estimated return on a rise up to horizontal resistance will also be over 200%...

Only personal opinions and ideas. Does not Include Legal Investment advice...

Capital One -- Not in My WalletAlthough Capital One is involved with more than consumer credit cards, it doesn't feel like a great place to be with record unemployment -- while unpopular, I am taking the gamble that the longer term trend is closer to '08 style credit crisis. The indicators line up, as well as the exact price levels. If this sells off (starting with poor earnings next week?) and was to do an exact length match to the bottom as in '08, it would be 17 monthly candles, or in this case roughly December 2021. COF broke through its 200 day moving average, and I don't see the earnings impressing.

HDFC Bank - Is it the right time yet?Considering the upcoming week (from tomorrow, 11 May, 2020), a lot of announcements are expected regarding ending of lockdown, stimulus package, opening up of several businesses in cities; we can hope to see a lot of volatility in the market, yet we can expect a positive movement in a stock like this, swing traders are often seen trading in this script. NSE:HDFCBANK

MONEY ZONES into 2021 ADAA slow conservative approach to technical growth

.20 - .25 = x4 / 2021

If we don't continue with a rising wedge we will have a triple bottom and a very fast impulse up. 3 years of consolidation and build up just means more power over time.

Anything is possible when 2023 comes.

Especially if we are above .25 in 2021

.05 price today @ 100,000 ADA = 5K USD

5K today (could) make you 100,000 dollars within a 10 year span

Hindsight 20/20 just keep swimming and work on more than one avenue in your life.

KRE - time to go Long!AMEX:KRE

KRE, looks good to push higher! CMP : $57.28

We are witnessing a continuous higher high and higher low on the RSI indicator and price has just been pushed lower by the Resistance Line (R1) @ $58.60 levels

Price has already created a support level near $48.87.

Important trading levels

R1 : $58.60

R2 : 65.77

S1 – 50.88

S2 : 45.16

S3 : 36.25

RSI seems to be showing signs of being oversold faster at higher price points suggesting higher price action

Watch out for this space, go long and sit tight

Please share a thumbs up if you like what you read!

Cheers

Good investing opportunity on the U.S. banking sector.The KBE ETF, which tracks an equal-weighted index of U.S. banking stocks, has been rising on a very steady 1M Channel Up since the 2008 financial crisis and has recently rebounded on the latest Higher Low (RSI = 50.776, MACD = 0.640, Highs/Lows = 0.0000). This presents a good buy opportunity on banking stocks, which are expected to outperform the market in the coming years. Our long term target is 52.00 with 60.45 in extension.