NewtekOne | NEWT | Long at $10.92NewtekOne NASDAQ:NEWT is a financial holding company providing business and financial solutions to small- and medium-sized businesses across the U.S. Services include Newtek Bank, business lending, SBA loans, electronic payment processing, payroll and benefits, insurance, and technology solutions. While the stock has taken a major hit recently, insiders have scooped up over $1 million in shares with an average price of $11.70. Currently trading at a P/E of 5.6x, forward P/E of 6.6x, and near book value, the stock may be poised for a move up soon with the anticipation of interest rates dropping. Revenue is up 24.93% from $271.15M (2023) to $338.73M (2024) and earnings are forecast to grow 11.63% per year, but the company does have a high debt-to-equity ratio (over 5x).

Tariffs could indirectly impact NASDAQ:NEWT by increasing costs for its small- and medium-sized business clients, particularly in industries reliant on imports (e.g., manufacturing, retail). Higher costs may reduce client profitability, increasing loan default risks or reducing demand for Newtek’s lending and payment processing services. But an interest rate reversal may greatly limit the impact (longer-term).

So, at $10.92, NASDAQ:NEWT is in a personal buy zone.

Targets into 2027:

$12.00 (+9.9%)

$14.00 (+28.2%)

Bankingstocks

FHN: Bearish retest after channel break – more downside ahead?First Horizon Corporation is a regional U.S. banking company offering commercial, mortgage, and investment services. It operates mainly across the southern United States and is among the largest regional banks in its sector.

Technical Analysis:

FHN recently broke down from a long-term ascending channel and is now retesting the lower boundary as resistance. Price stalled near 18.65 with weakening bullish momentum. RSI is trending lower and volume on retest is soft. Key downside levels: 15.00, 13.50, and possibly 10.24 if weakness continues.

Fundamentals:

FHN faces headwinds from tightening monetary policy, rising credit costs, and profitability pressures. Regional banks are under investor scrutiny following sector instability. Latest earnings report showed declining margins and weaker guidance.

Scenarios:

Bearish bias – rejection at 18.65 → drop toward 15.00 → 13.50 → 10.24

Bullish reversal – break back above 18.65 → re-entry into channel toward 21.00+

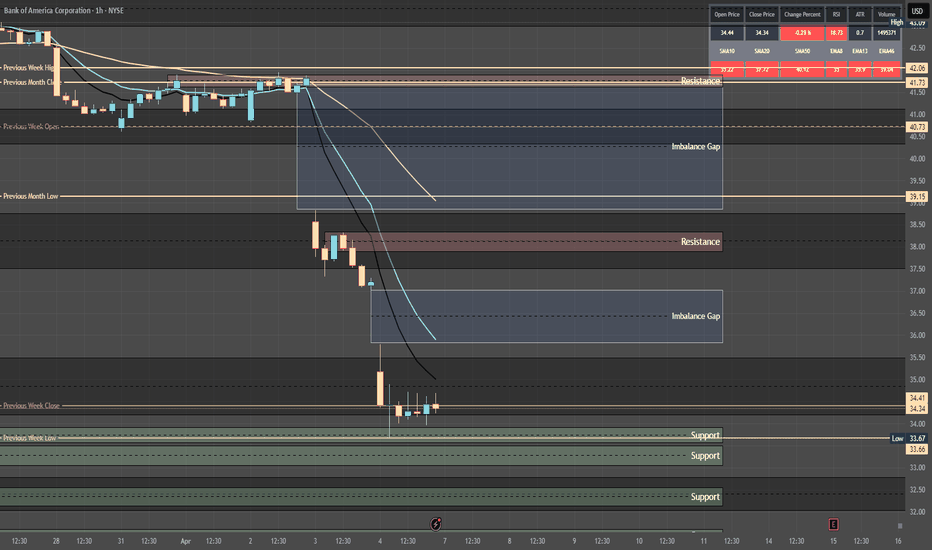

Quantum's BAC Trading Guide 4/8/25BAC (Bank of America Corporation) - Sector: Financials (Banking)

Sentiment:

--Neutral (slight bullish tilt). Pre-market options lean call-heavy, RSI likely ~48 (up from ~45 with +1.8% from $35.58 to $36.23), X posts overnight mixed—rate fears vs. recovery hopes—suggesting a bounce from $34.19 (April 4).

Tariff Impact:

--Moderate. 10% tariffs could hit loan demand (trade-sensitive clients), but BAC’s diversified revenue softens impact. Sentiment drives here.

News/Catalysts:

--Consumer Credit (April 8) key—strong data could lift BAC; X posts on banking resilience or tariff delays might boost today.

Technical Setup:

-Weekly Chart:

---HVN near $37 as resistance, weekly low ~$34 as support (April 4: $34.19).

---Sideways (8-week EMA ≈ 13-week ≈ 48-week, reflecting $35–$40 range).

---RSI ~48 (neutral),

---MACD near signal (histogram flat),

---Bollinger Bands near midline,

---Donchian Channels at midline,

---Williams %R -50 (neutral).

-One-Hour Chart:

---Support at $35.58 (prev. close), resistance at $36.68 (day high), weekly alignment.

---RSI ~50, MACD near signal (histogram flat),

---Bollinger Bands near midline,

---Donchian Channels at midline,

---Williams %R -48 (neutral).

-10-Minute Chart:

---Pre-market uptick to $36.23, 8/13/48 EMAs flat-to-up, RSI ~52,

---MACD flat near zero.

Options Data:

--GEX: Neutral (slight bullish tilt)—pinning shifts mildly upward.

--DEX: Neutral (slight bullish tilt)—call delta edges out puts.

--IV: Low—~20–25% vs. norm 25–30%, steady post-drop.

--OI: Balanced (slight call tilt)—OI leans above $36.

--Directional Bias: Neutral (slight bullish tilt). GEX’s mild upward pinning, DEX’s call delta hint at buying, low IV limits big swings, and slight call-heavy OI nudges up—neutral with a bullish edge.

Sympathy Plays:

--JPM (JPMorgan Chase): Rises if BAC gains, falls if BAC fades.

--WFC (Wells Fargo): Gains with BAC upside, drops if BAC weakens.

--Opposite Mover: BAC rallies → cyclicals like ALK fade; BAC dumps → JPM/WFC soften.

Sector Positioning with RRG: --- Financials (Banking).

--RRG Position: Improving Quadrant. BAC’s bounce from $34.19 lifts it vs. XLF.

Targets: Bullish +2% ($36.95, hourly resistance); Bearish -2% ($35.50, hourly support).

Quantum's BAC Ultimate Weekly OutlookBAC (Bank of America Corporation) - Sector: Financials (Banking)

Sentiment: Bearish. Put volume rises, RSI 45 weakens, X posts note banking fears from tariffs/economic uncertainty.

Tariff Impact: Moderate. Tariffs may slow growth, impacting loans, but domestic focus softens the blow. Sentiment drives more than fundamentals.

News/Catalysts: Banking sentiment shifts on X. Consumer Credit (April 8) could signal credit trends.

Technical Setup:

Weekly Chart: HVN above as resistance, weekly low as support. Downtrend (8-week EMA < 13-week < 48-week). RSI 45 (neutral, fading), MACD below signal (negative histogram widening), Bollinger Bands near lower band, Donchian Channels below midline, Williams %R -68 (nearing oversold).

One-Hour Chart: Support below, resistance near highs, weekly alignment. RSI 42, MACD below signal (negative histogram growing), Bollinger Bands at lower band, Donchian Channels below midline, Williams %R -74 (close to oversold).

10-Minute Chart: Bearish breakdown, 8/13/48 EMAs down, RSI 42 weakening, MACD flat near zero.

Options Data:

GEX: Bearish—pinning below close, dealers hedge puts to resist upside.

DEX: Bearish—put delta leads, selling bias.

IV: Moderate—slightly above norm (e.g., 25–30% vs. 20–25%), uncertainty raising prices. Supports GEX pinning, boosts DEX bearish bias.

OI: Put-heavy—high OI at lower strikes, capping downside.

Sympathy Plays:

JPM (JPMorgan Chase): Moves in sync—rises if BAC takes off, falls if BAC dumps.

C (Citigroup): Correlates via banking—gains with BAC rallies, drops with sell-offs.

Opposite Mover: BAC dumps → defensive stocks like JNJ may rally; BAC rallies → JPM/C surge.

Sector Positioning with RRG:

Sector: Financials (Banking).

RRG Position: Weakening Quadrant. BAC’s economic sensitivity fades vs. XLF as tariffs/rates weigh.

Targets: Bullish +3% (hourly resistance); Bearish -5.1% (weekly support).

Trade Idea: Weekly put (exp. April 11) on 10-min breakdown, target support, stop above close.

BBNI: A potential tripple bottom, with theoretical target 5,225

Price rebound after a retracement from strong resistance through 4,880-4,750-4,700.

If breaks above 4,700, pattern since Jan2025 may become triple bottom.

MACD and Stochastic shows a divergence on this pattern, gives indication a possible bullish in progress.

This pattern theoretical target price if confirmed is around 5,250.

Prepare your risk management if price breaks below 4,350.

M. Alfatih, CFTe, CTA, CTAD, CSA, CIB

Trade for Indonesian Stocks with:

Samuel Sekuritas Indonesia

Technical Trading Course -batch9: April 2025 (daftar di star.id/go/ttc2025)

M. A

Deutsche Bank: Unlocking New Heights!Deutsche Bank AG ( NYSE:DB is currently trading at $17.48 , reflecting a slight decrease of 0.11% from the previous close.

Our proprietary quantum probability indicator signals a strong buy, suggesting a favorable outlook for the stock.

The technical chart reveals a bullish flag formation, characterized by an initial surge to the $17.20 resistance level, followed by a consolidation phase.

A decisive breakout from this pattern indicates potential for continued upward movement, with a mid-term target of $24.31 .

From a broader perspective, the development of a cup and handle pattern is evident.

This bullish continuation pattern suggests a long-term projection above the major resistance at $27.28.

Recent developments further support this positive outlook.

Deutsche Bank has shifted its stance to "overweight" on European equities, citing lower interest rates and expectations of a strong corporate earnings season amid an improving political landscape.

Analysts highlight that Europe offers the most attractive equity risk premium among developed markets, with the European benchmark index projected to rise by 15% by the end of 2025 .

Additionally, Deutsche Bank's CEO, Christian Sewing , has emphasized the need for structural reforms and reduced regulations to enhance Germany's economic competitiveness, which could positively impact the bank's performance.

In summary, the technical indicators and recent strategic positions of Deutsche Bank point to a positive trajectory, with significant upside potential in both mid-term and long-term projections.

JP MORGAN Expect a 1D MA50 correction before it turns into a buyJP Morgan Chase (JPM) posted a strong bullish leg on our last analysis (September 17, see chart below) that easily hit our $229 Target:

From a wider perspective on the 1D time-frame, the price is now right at the top of the 13-month Channel Up on an overbought 1D RSI and a 1D MACD that is about to form a Bearish Cross.

All previous Higher Highs of the pattern formed MACD Bearish Crosses and pulled back to the 1D MA50 (blue trend-line) on a minimum of -7.35% correction. Note that the 1D MA200 (orange trend-line) never broke, so as long as it holds, the long-term bullish trend is intact.

As a result, we now expect a pull-back to the 1D MA50 and a minimum of -7.35% decline puts the Target a $236.00.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

UJJIVAN SFB LONGUJJIVAN SFB looks to be taking a support and might revert back to 60 levels where it used to trade, this would probably be done when interest rates are reduced which are not far now as we know. Once the stock reaches back to 60 levels, it would have completed a cup and handle pattern which upon breakout could possibly lead to larger targets!!

Deutsche Bank AG (DB): Potential Sell-Off Ahead?Analyzing the Deutsche Bank AG on the German Stock Exchance XETR, we observe a repeating pattern involving two trend channels. In both instances, the trend channels were respected and behaved as expected.

In the first case, the price exited the trend channel and then retested it almost perfectly. In the second instance, the price overshot the trend channel briefly with a wick above but quickly retraced back below it. This overshoot indicates significant weakness, suggesting a potential stronger sell-off in the near future.

Zooming into the volume since 2020, we notice that the current range has seen low volume, indicating minimal buying interest at these levels. The buying interest appears to be much lower.

Zooming into the Deutsche Bank AG 12h chart, we see that the level of the larger Wave (1) at €14.64 is being respected and held for now. However, we anticipate a sell-off down to the range between €13.50 and €12.50. Falling below this range is not expected, but if it occurs, the next likely support would be between €10.50 and €9.30.

From an Elliott Wave perspective, it would be unfavorable if Wave 4 were to fall into the territory of Wave 1. While brief wicks below are acceptable, a prolonged stay in this range would not be ideal and is not our primary expectation. We also observe that the RSI is showing signs of being overbought.

There is a bearish divergence forming, with a lower high on the RSI and a higher high on the price chart. This divergence suggests that the recent price movements might lead to further declines.

In summary, while the €14.64 level is currently holding, we expect a potential sell-off to the €13.50 to €12.50 range. A further decline into the €10.50 to €9.30 range could occur but is less likely. The bearish RSI divergence supports this outlook, indicating potential downward pressure in the near term.

UNION BANK LOOKING GOOD TO BUY - LONG TERM INVESTMENT CUP PATTERN

Entry Price - 100

SL - 80

Targets - 120,140,170

In this channel, I share my expertise in trading strategies, technical analysis, and market trends to help you make informed decisions in your trading ventures.

Stay tuned for daily updates, in-depth market analyses, and real-time trading scenarios to witness firsthand how we transform from Zero to Hero in the trading world. My Only aim is to empower you with the knowledge and skills necessary to navigate the complexities of the financial markets successfully.

Disclaimer - All information on this page is for educational purposes only,

we are not SEBI Registered, Please consult a SEBI registered financial advisor for your financial matters before investing And taking any decision. We are not responsible for any profit/loss you made.

Request your support and engagement by liking and commenting & follow to provide encouragement

HAPPY TRADING 👍

#Sofi $SofiAfter trading in a range from $4-$8 for the last 14 months, we find ourselves now with the possibility of turning the box marked with bulls into a support/buy zone. If we can get confirmation and continuation on this into next week or even just the markets hold up Monday i would expect at the LEAST to revisit the recent high. Making for a nice quick play. However in the BIGGER picture i think you could see a LOT more upside targets getting hit.

DPST Long as the banking sector stabilizesDPST was down in April, consolidated in May and is now parabolically rising and had a price split

in recent days.On the one hour chart, price is rising along the quickly after a pivot on June 1.

Price is well above the POC line of the intermediate term volume profile showing buyer strength

The relative strength on the RSI indicator is flat over 80. I will take a long trade with a stop

loss at 5% and a take profit at 20%. I will end the trade early if the RSI drops below 75 as a risk

management maneuver. I will be viligent for a correction / retracement because the price is

up more than 10% in one day.

Bank Nifty Bullish Breakout | New All Time High | Banking StocksToday on 29 May 2023, Bank Nifty broke its 2 week range and created a new All-Time high.

Until and unless, Bank Nifty does not closes back below 44140, bullish view on Bank Nifty remains intact and we can expect price to continue to go high.

Since, the bullish breakout happened after 2 weeks of consolidation near ATH, the breakout can be considered strong.

Bank Nifty is bullish now, banking stocks will fly high.

I have a few banking stocks in my watchlist which can be excellent picks for swing trading which can fetch decent returns in coming few days.

Let me know in the comments section if you are interested in these banking stocks and i will post detailed analysis.

DBS to Gain as Funds Rain in SingaporeDBS is positioned uniquely at the intersection of both India and China to gain from growth in both countries. Facilitating capital flows out of China, continued rising footprint in India, digital asset presence, a trusted bank in Singapore which is emerging as the Swiss of Asia, DBS has more than one source of tailwind powering its upward flight.

Specifically, this paper identifies five key drivers powering DBS shares. Against the backdrop of sharp recession ahead, this paper posits a case study delivering 2.8x reward to risk ratio through a spread comprising of long DBS shares and short MSCI Singapore Index futures to gain from expected outperformance.

The DBS Story

Launched >50 years ago, DBS is the largest bank in South-East Asia and rubbing shoulders among global banks with S$743B in assets as of December 2022. Its diverse services cover consumer banking, asset management, brokerage, and digital assets. DBS' robust capital position, strong governance, and solid operational practices, with MAS as the regulator, makes it a bank with the highest credit ratings in APAC.

“Live More, Bank Less” defines the essence of the bank's strategy. DBS aspiration goes beyond being the best bank but aspires to deliver experience that's world class and on par with GANDALF firms. GANDALF stands for Google, Amazon, Netflix, Apple, LinkedIn, and Facebook. And D? DBS, of course.

A key figure in the transformation has been its CEO Piyush Gupta who has helmed its leadership since 2009 and is seen as instrumental in the bank's meteoric rise as a global banking player.

Last year, DBS delivered stunning record profits of S$8.2B driven by surging rates. 2022 was not entirely hunky dory as fees and commissions declined 12% YoY.

DBS expects 2023 to be better with a forecast of double-digit fee income growth plus rising income from cards business. While loan growth slowed with rising rates, DBS continued to gain market share across both corporate and consumer loans.

Key growth driver for DBS in 2023 and for the rest of the decade is the wealth migration from China. Singapore is a key destination for capital taking flight out of China. DBS is strongly positioned to take advantage of this as a trusted and customer-focused banking partner.

Five factors to propel DBS shares ahead:

1. Chinese Wealth Migration

Ultra rich Chinese have been emigrating with Singapore as the preferred destination. China’s crackdown on its business and entrepreneur class with a focus on “common prosperity”.

China faced capital flight of about $150B annually from its citizens migrating. Capital flight in 2023 is expected to be far higher, with some estimates suggesting it could top $100-$200B.

About 10,800 rich Chinese migrated in 2022, the highest since 2019, according to Henley & Partners. China has the world’s second-largest number of ultra-rich with more than 32,000 people holding wealth more than $50M.

DBS holds a key position to capitalize on this trend as the leading and trusted bank in Singapore. It is not just the Chinese but also the wealthy from India, Indonesia and Thailand finding Singapore as a convenient home for them and their wealth.

2. Regional Expansion via Digital First Strategy

DBS’s digitization dovetails nicely into their regional expansion as digitised infrastructure easily transcends geography.

Case in point is DBS' expansion into India. It had its presence in India since 1994. However, it was with the launch of Digibank India in 2016 that propelled its footprint in the country.

Digibank India was the first mobile-only, paperless, signatureless, and branchless bank in India. This allowed them to expand rapidly in the country while India was going through its own financial digitization following demonetization exercise in 2016. This provided DBS with a strong launchpad while keeping operational costs at bay.

DBS India has seen its deposits grow consistently since launch with a huge jump following the acquisition of Laxmi Vilas Bank (LVB). Over the past 3 years, DBS India has doubled its revenue. DBS has been profitable since launch, except for a tiny loss in 2017-18. LVB acquisition enabled DBS to expand its branch presence nearly 18x from mere 30 to >500.

3. Bold Forays into Digital Assets

In 2020, DBS launched DBS Digital Exchange (DDEx) enabling institutional and accredited investors to access digital assets.

With rising regulations for crypto firms, a fully regulated digital exchange like DDEx from a trusted bank such as DBS is a safe haven for digital asset investors.

Success of DDEx is evident in its performance in 2022 when BTC trading on the exchange increased 80% YoY. BTC’s custodied on the exchange also doubled while ETH custodied on the exchange increased 60%. DDEx also doubled its customer base to nearly 1,200 last year.

4. Deep Digitisation

CEO inspired DBS' purpose driven digital adoption agenda in 2014, with a five-year roadmap and a lofty aim of being named the best bank in the world.

DBS approached the challenge by thinking and operating like a major tech firm instead of a bank. It overhauled its internal tech, 90% of which was developed and managed in-house making it cloud-native enabling rapid scaling and easy deployment.

DBS pioneered “Digibank,” a mobile only bank that allowed it to scale rapidly and with low cost per retail customer. Digital customers have two times higher income per client compared to traditional clients with cost to income ratio of 34% relative to 54% for traditional clients.

5. Startup Mentality

Making Banking Joyful. DBS is deliberate in becoming ever more customer-centric by cleverly tailoring each customer journey to be hassle-free and enjoyable. The bank aims to become “invisible” to its customer while meeting their banking, financial, and investing needs.

In instilling a start-up culture, the leadership team continues to cultivate agility, continuous learning, customer obsession, data-driven experimentation and risk-taking across the organisation.

DBS Outperforms other Singapore Banks

Among top three Singapore Banks:

• DBS has the highest ROE at 14.95%.

• DBS operating margins of 41.5% are far higher than others.

• DBS margins are twice those of OCBC.

• DBS grew its Free Cash Flow at 76.5% YoY, far higher than others.

• DBS has the lowest P/E ratio making the stock relatively undervalued.

• DBS ROIC of 8.2% is marginally lower than OCBC’s 8.75%

• DBS asset growth of 8.3% YoY in 2022, lower than UOB’s 9.8%.

This puts DBS in a far better financial position than the other Singapore banks.

The better performance is also highlighted by DBS stock’s price action. Since Piyush Gupta took over as CEO in 2009, DBS has outperformed OCBC and UOB by an outsized margin and the stock stands nearly 300% higher in the period.

Similarly, since the start of 2020, DBS is up 29% and has outperformed the other two banks vindicating its strategy and execution.

Comparative Analysis with Other Global Banks

DBS shines bright among the global banking majors too as evident below.

• DBS has the highest Return on Equity at 15%

• DBS has the highest Return on Invested Capital at 8.2%

• DBS price to earnings is 6.85 only higher than BNP & Barclays

DBS strong operational efficiency stands out even among the top global bank. Additionally, DBS reported 8.3% annual asset growth in 2022, compared to US banks which have had moderate asset growth or decline.

Since 2009, DBS stock has far outperformed other major global banks and stands second only to JP Morgan.

Notably, DBS has also outperformed the KBW Bank ETF which tracks the performance of US Banks signalling that DBS has been providing stronger growth than the average growth of the US banking industry, particularly during the high-inflation environment of 2022.

The trend is even more apparent when looking at the performance of these stocks since the start of 2020. Among the selected banks, DBS is the only bank that has shown strong gains during the pandemic and stands ~30% higher. Other banks have either posted modest gains or losses.

In addition to providing strong growth, which is reflected in DBS stock’s price action, DBS also has a strong commitment to returning value to shareholders which can be seen from their nearly 4.1% dividend yield.

DBS annual dividend yield has grown by about 100 bps since 2020. Its dividend in 2022 of S$1.5/share exceeded pre-pandemic levels. DBS also announced a special S$0.5/share dividend last quarter reflecting improved earnings profile and strong capital position.

2023 Growth Outlook

Analysts expect DBS to continue its meteoric rise, with an average forecast of 15% growth in 2023. Some analysts expect DBS to be 31% higher while even the lowest forecasts are for -11% decline.

Key drivers for this growth are expected to be:

• Lean operational strategy and structure leading to lower operational costs.

• Capital outflows from China.

• Regional expansion strategy using their digital banking template.

DBS stock has rallied 86% since March 2020, compared to the Straits Times Index which is only 36% higher in the same period. DBS is the largest constituent of the STI and a major driver of growth for Singapore stocks.

Overall, DBS bucked the overall trend in the banking sector and provided growth in an immensely challenging environment by focusing on sustainable growth and lower costs.

What about the banking crisis?

Investing in bank stocks when uncertainty in the sector is so high can be daunting. The collapse of SVB, shuttering of Signature, and acquisition of Credit Suisse has incited turmoil in markets despite central banks stepping in to ease liquidity concerns and avoid contagion.

Amid the crisis there has been discussion of loose regulatory practices and risky bets. However, in Singapore, MAS keeps a tight check on the risk management of banks in the country.

According to Moody’s, DBS bank still has the highest tier credit ratings and none of its holding are currently under watch. Such stellar ratings suggest that DBS has extremely strong capacity to meet its financial commitments, making it unlikely to be affected by any remaining contagion in the sector.

MAS’s strict stewardship of Singapore banks was underscored by a recent outage in DBS digital services. Though the services were promptly restored on the same day, MAS ordered a thorough investigation into the outage. The outage also affected DBS stock price, driving it 1.5% lower but the stock quickly recovered. Both highlight the resilience in the regulatory, operational, and governance practices at DBS.

Trade Setup

In times of elevated stress, stock betas can spike causing share prices to tank on macroeconomic shocks. To harness pure alpha, this paper posits a spread with long DBS and short MSCI Singapore Index futures.

The spread trade ensures that the position remains hedged against a broader market downturn. DBS has outperformed MSCI Singapore index consistently over the past 10 years.

MSCI Futures on SGX (SGP1!) give exposure to S$100 x index price which translates into a notional value of S$30,905. On SGX, lot sizes for individual stocks are 100 which means that in order to balance the notional on both legs, 9 lots of DBS shares are required which translates into a notional value of S$30,042.

Entry: 10.8%

Target Level: 12.5%

Stop Level: 10.2%

Profit at Target: S$ 4,726

Loss at Stop: S$ 1,671

DISCLAIMER

This case study is for educational purposes only and does not constitute investment recommendations or advice. Nor are they used to promote any specific products, or services.

Trading or investment ideas cited here are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management or trading under the market scenarios being discussed. Please read the FULL DISCLAIMER the link to which is provided in our profile description.

XAUUSD : Gold kill zone for Short OANDA:XAUUSD

Gold , Is trading in immense bullish trend since last 8-10 day's

Market now touching lower trendline , breakout will make it extreme down

3 target's are set as tp's

20,50,200 ema as target's set

❤️ Please, support my work with follow ,share and like, thank you! ❤️

DCB BANK LTDThis stock has been formed like rounding bottom chart pattern and done breakout with good intensity of volume in weekly chart, along with many more positive signs aligned with same bias in Macd, Rsi, Dmi adx, Bollinger band etc. This whole scenario is suggesting that this stock could be an investment pick, all the key levels are mentioned in chart with Stop-loss and Targets.

Breakout with good intensity of volume in daily

Breakout with good intensity of volume in weekly

Dmi adx also positive

RK momentum positive

Macd in daily positive crossover and Uptick and also above zero

Macd in weekly positive crossover and Uptick and also above zero line

Rsi in daily above 60 uptick

Rsi in weekly uptick and above 60

Weekly BBC along with trendline breakout

Daily BBC

Most traders treat trading as a hobby because they have a full-time job doing something else. However, If you treat trading like a business, it will pay you like a business. If you treat like a hobby, hobbies don't pay, they cost you....!

Disclaimer

I am not sebi registered analyst

My studies are for Educational purpose only

Please consult your Financial advisor before trading or investing

I am not responsible for any kind of profit or loss