Bank Nifty: Multi time frame analysis1) NSE:BANKNIFTY : Daily time frame - Consolidation going on at at the same area where previous consolidation happened. On the first occasion this led 3600 points break down and on the second occasion led to 2400 points up move. One positive aspect is that there are long wicks in candles which are signs of demand. All positional bet to be avoided unless price clearly moves above 41700 or below 41100. Until then stick to Intraday.

2) NSE:BANKNIFTY : Hourly time frame - Clear volatility contraction visible at this TF. With nice drop in volumes. Usually these are signs of break out. But wait until it happens. No pre-emptive trade.

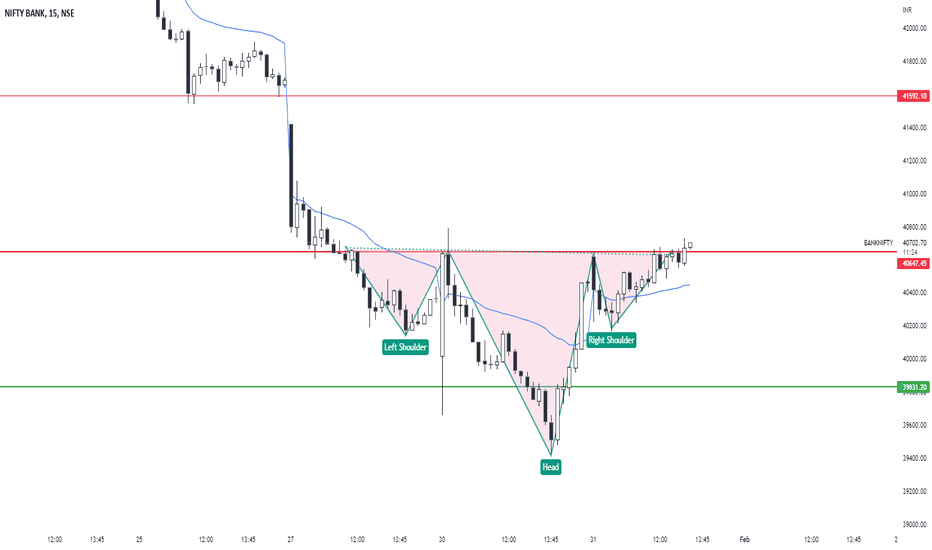

3) NSE:BANKNIFTY : 15 minutes time frame - Price is in range. All signs of breakout/breakdown to be first spotted from this time frame. Should watch closely.

4) NSE:BANKNIFTY : 5 minutes time frame - From 6th onwards price is trading below VWAP, actually this is a sign of bearishness. But price closely following VWAP and sticking to it whenever there is trend to move away

Bankniftylevels

08/02/2023 BANKNIFTY SUPPORT AND RESISTANCE ZONE

Hello Guys,

Good Morning everyone,

According to the data today market Gap-Up is going to open

After A Gap-Up opening if Banknifty sustain Above last day high 41700 and taking Support from 41700 then open target for T1-41900,T2-42000,T3-42200

If the Banknifty after a Gap-Up opening sustain Below last day low 41500 and and taking resistance below 41500 then the open Targets for T1-41300,T2-40100,T3-40000

Major Levels 41600,41500,41400

7/02/2023 BANKNIFTY SUPPORT AND RESISTANCE ZONEHello Guys,

Good Morning everyone,

According to the data today market Gap-Up is going to open

After A Gap-Up opening if Banknifty sustain Above last day high 41700 and taking Support from 41700 then open target for T1-42000,T2-42200,T3-42400

If the Banknifty after a Gap-Up opening sustain Below last day low 41250 and and taking resistance below 41250 then the open Targets for T1-41000,T2-40800,T3-40600

Major Levels 41600,41800,42000

BANK NIFTY 07.02.2023NSE:BANKNIFTY Refer yesterday mentioned levels. Given that, from 41690 onwards could face stiff resistance and today made a high of 41725 and reversed. Also given that 41200 and blow could lend support and got support at 41260.

If todays high is taken out on tomorrow, good chance to reach up to 42000 - 42300 which is also budget day high. Reason Low volume zone all the way. 41100 to 41200 area can offer some support. Refer the chart.

Meanwhile at 15 minute timeframe one beautiful VCP pattern is getting printed the break out of which will push the price up to above mentioned levels. refer the chart below.

Please keep in mind following charts NSE:BANKNIFTY Daily time frame. If you remove the negative noise from the market for the moment there is nothing wrong with BNF charts. Daily time frame shows a consolidation. Refer chart below.

NSE:BANKNIFTY weekly time frame looks like a shakeout. Refer chart below.

06/02/2023 BANKNIFTY SUPPORT AND RESISTANCE ZONEHello Guys,

Good Morning everyone,

According to the data today market Gap-Up is going to open

After A Gap-Up opening if Banknifty sustain Above last day high 41500 and taking Support from 41500 then open target for T1-41700,T2-41700,T3-42000

If the Banknifty after a Gap-Up opening sustain Below 41400 and and taking resistance below 41400 then the open Targets for T1-41200,T2-41000,T3-40800

Major Levels 41500,41400,41700

CE Buyers Activate Zone 06/02/2023NSE:BANKNIFTY

Monday 06/02/2023 Trading condition -

---------------------------------------------

Bankninfty Open and Breakout their resistance level 41550and are holding in the upside , We expected banknifty Kiss💋 42050 next Resistance level /Target.

Stoploss swing low.

Thankyou and keep learning.💚

03/02/2023 BANKNIFTY SUPPORT AND RESISTANCE ZONEHello Guys,

Good Morning everyone,

According to the data today market Gap-Up is going to open

After A Gap-Up opening if Banknifty sustain Above last day high 41000 and taking Support from 41000 then open target for T1-41200,T2-41400,T3-41600

If the Banknifty after a Gap-Up opening sustain Below 40000 and and taking resistance below 40000 then the open Targets for T1-39800,T2-39600,T3-39500

Major Levels 40500,41000,40800

CE Buying Condition / Friday 03/02/2023NSE:BANKNIFTY

Expiry day is over, I hope everyone must have made a lot of profit.

Friday 03/02/2023 Trading condition -

---------------------------------------------

Bankninfty have Breakout their resistance level 40600 and are holding in the upside , We expected banknifty try to touch 41109 next Resistance level/Target.

Stoploss swing low.

Thankyou and keep learning.💚

01/02/2023 BANKNIFTY SUPPORT AND RESISTANCE ZONEHello Guys,

Good Morning everyone,

According to the data today market Gap-Up is going to open

After A Gap-Up opening if Banknifty sustain Above last day high 41000 and taking Support from 41000 then open target for T1-41250,T2-41400,T3-41590

If the Banknifty after a Gap-Up opening sustain Below 40200 and and taking resistance below 40200 then the open Targets for T1-40000,T2-39700,T3-37500

Major Levels 40200,40500,40800

31/01/2023 BANKNIFTY SUPPORT AND RESISTANCE ZONEHello Guys,

Good Morning everyone,

According to the data today market Gap-Up is going to open

After A Gap-Up opening if Banknifty sustain Above last day high 40800 and taking Support from 40800 then open target for T1-41000,T2-41100,T3-413000

If the Banknifty after a Gap-Up opening sustain Below 40400 and and taking resistance below 40500 then the open Targets for T1-40300,T2-40200,T3-40000

Major Levels 40500,40400,40800

30/01/2023 BANKNIFTY SUPPORT AND RESISTANCE ZONEHello Guys,

Good Morning everyone,

According to the data today market Gap Down is going to open

After A Gap Down opening if Banknifty sustain Below las day low 40147 and taking Resistance from 419000 then open target for T1-39800,T2-39600,T3-39200

If the Banknifty after a Gap Down opening sustain Above 40454 and and taking support above 40454 then the open Targets for T1-40600,T2-40800,T3-41000

Major Levels 40200,40000,40400