US Banks on Fire | Revenues Soar, and So Do the ProfitsWho Needs a Recession? Banks Are Swimming in Cash!

The largest U.S. banks have reported some of their best quarterly performances in recent years, with surging trading revenues, a resurgence in dealmaking, and an overall renewal of corporate confidence playing pivotal roles. Let’s break down the key details of the results.

Market Recovery

Across the major banks, investment banking and trading activities recorded impressive performances. Goldman Sachs saw investment banking revenue increase by 24%, while Bank of America (BofA) experienced a massive 44% jump, marking its strongest quarter in three years.

The market volatility stemming from factors like the U.S. election and changing expectations around interest rates continued to fuel robust trading revenues. Morgan Stanley’s equities division, for example, reached an all-time high, while JPMorgan and Goldman Sachs enjoyed notable gains in fixed-income trading.

A surge in CEO optimism has led to an uptick in mergers and acquisitions (M&A), initial public offerings (IPOs), and private credit demand. Morgan Stanley, in particular, is seeing the largest M&A pipeline in seven years, signaling a sustained wave of dealmaking.

Mixed Results for NII

Net interest income showed varying results across the banks, but forward guidance indicates that NII will likely see moderate growth in 2025, spurred by continued loan demand and higher asset yields.

Credit Risks on the Rise

Consumer lending pressures have persisted, with JPMorgan’s charge-offs rising by 9%. Many banks are preparing for a further increase in delinquencies, particularly in credit cards.

Commercial Real Estate Challenges

While the office sector remains under stress, banks are managing their exposures cautiously and have yet to face significant shocks in this area.

Regulatory Scrutiny Continues

Citigroup lowered its 2026 profitability target as it undergoes a transformation, while Bank of America faced increased scrutiny over its anti-money laundering compliance.

Resilient U.S. Economy

Banks are reporting strong consumer spending, loan growth, and corporate profitability, which supports an optimistic outlook for earnings growth heading into 2025.

Performance Breakdown for Each Bank

JPMorgan Chase

- JPMorgan posted a record annual net income of $58.5 billion, marking an 18% increase from the previous year.

- Investment banking saw a 46% surge in revenue, driven by strong advisory and equity underwriting.

- Trading revenue climbed by 21%, led by a 20% increase in fixed-income trading.

- Despite the impressive results, JPMorgan is still facing challenges such as rising charge-offs and pressures on loan margins. CEO Jamie Dimon emphasized concerns about persistent inflation and growing geopolitical risks.

Bank of America

- BofA experienced an 11% year over year growth in revenue, reaching $25.3 billion, with net income up 112% from the previous year.

- The investment banking division saw a dramatic 44% rise in revenue, the highest in three years, thanks to strong debt and equity underwriting.

- Trading revenue grew by 10%, driven by solid performance in fixed income (up 13%) and equities (up 6%) as market volatility spurred client activity.

- BofA also reported growth in its consumer and wealth management divisions, with credit card fees and asset management showing strength. Client balances grew to $4.3 trillion, a 12% increase from the previous year.

- After several quarters of decline, BofA’s NII grew by 3%, exceeding expectations and signaling stability. The bank expects NII to continue rising through 2025, with projections of $15.7 billion per quarter by the end of the year.

Wells Fargo

- Wells Fargo’s revenue remained flat at $20.4 billion, but net income surged by 50%.

- NII declined by 8% year-over-year but is expected to rise slightly in 2025 due to higher reinvestment rates on maturing assets.

- The bank made significant progress in cost-cutting efforts, reducing non-interest expenses by 12%, thanks to workforce reductions and efficiency initiatives.

- Investment banking fees rose by 59%, benefiting from the broader market recovery and the bank’s renewed focus on its Wall Street presence.

- Wells Fargo returned $25 billion to shareholders in 2024, including a 15% dividend increase and $20 billion in stock buybacks. However, the bank continues to face regulatory constraints, notably the asset cap imposed by the Federal Reserve.

- Looking ahead to 2025, Wells Fargo anticipates modest growth in fee-based revenue, with cost discipline and efficiency gains driving improvements.

Morgan Stanley

- Morgan Stanley saw a 26% increase in revenue, reaching $16.2 billion, while net income soared by 142%.

- Equity trading revenue jumped by 51%, setting a new all-time high as market volatility sparked increased client activity, particularly in prime brokerage and risk-repositioning trades.

- Investment banking revenue grew by 25%, fueled by strong demand for debt underwriting, stock sales, and M&A activity. CEO Ted Pick noted that the M&A pipeline is the strongest in seven years, signaling a potential multi-year recovery in dealmaking.

- Morgan Stanley’s wealth management division saw $56.5 billion in net new assets, increasing total client assets to $7.9 trillion. The firm is pushing toward its goal of $10 trillion in assets under management.

- In response to growing business complexities, the firm launched a new Integrated Firm Management division to streamline services across investment banking, trading, and wealth management.

Goldman Sachs

- Goldman Sachs experienced a 23% increase in revenue, reaching $13.9 billion, while net income more than doubled, up 105%.

- Record performance in equity trading contributed to a 32% increase in revenue from this segment, as market volatility drove greater client activity.

- Investment banking revenue grew by 24%, boosted by significant gains in equity and debt underwriting.

- The firm’s asset management division saw an 8% rise in assets under management, reaching $3.1 trillion, while management fees exceeded $10 billion for the year.

- Goldman is winding down legacy balance-sheet investments but also saw a gain of $472 million from these investments in Q4. The firm’s recent launch of its Capital Solutions Group is aimed at capturing growth opportunities in private credit and alternative financing.

Citigroup

- Citigroup posted a 12% increase in revenue, reaching $19.6 billion, with non-interest revenue surging 62%.

- Fixed-income and equity markets were key drivers, growing 37% and 34%, respectively, as market volatility tied to the U.S. election boosted performance.

- Investment banking revenue climbed by 35%, supported by strong corporate debt issuance and a pickup in dealmaking activity.

- The bank unveiled a $20 billion stock repurchase program, signaling confidence in future earnings.

- Citigroup also made strides in controlling operating expenses, which declined by 2% quarter-over-quarter. However, the bank lowered its 2026 return on tangible common equity (RoTCE) guidance to 10%-11% due to the costs of its ongoing transformation.

- CEO Jane Fraser emphasized Citigroup’s long-term growth trajectory, noting improvements in credit quality and continued progress with the strategic overhaul, including the postponed IPO of Banamex, the bank’s Mexican retail unit, now expected in 2026.

Long story short

Heading into 2025, the major U.S. banks are in strong positions, buoyed by a favorable economic backdrop, continued growth in trading, and a rebound in corporate dealmaking. Despite challenges such as rising credit risks, regulatory hurdles, and potential macroeconomic uncertainties, the outlook remains positive. With a recovering IPO market, continued wealth management growth, and strong trading revenue, the banks are poised to capitalize on the renewed corporate optimism. The key question will be whether the dealmaking frenzy continues or whether uncertainties in the global economy and market dynamics could temper the rally.

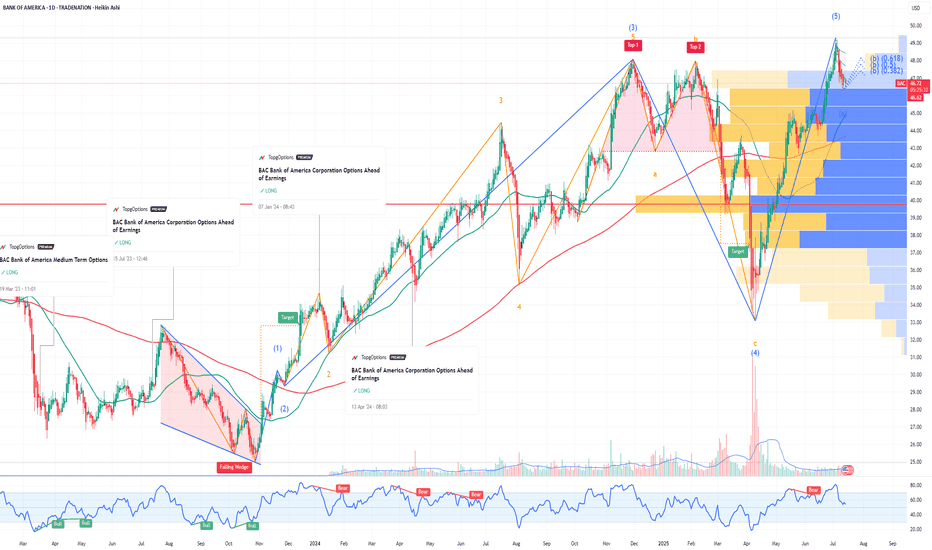

Bankofamerica

BAC Bank of America Corporation Options Ahead of EarningsIf you haven`t bought BAC before the rally:

Now analyzing the options chain and the chart patterns of BAC Bank of America Corporation prior to the earnings report this week,

I would consider purchasing the 48usd strike price Calls with

an expiration date of 2025-7-18,

for a premium of approximately $0.34.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

BAC – Building the Base for a Breakout?Bank of America (BAC) has been consolidating quietly, attracting attention as it sits near a key mid-range level. With a 52-week low of $33.06 and a 52-week high of $48.08, the stock currently trades around $36.92 – roughly 11% above its low and 23% below its high.

This setup could be the calm before the move.

💥 Technical Outlook & Strategy

With financials holding steady and macro headwinds softening, BAC might offer a solid swing trade or medium-term positioning opportunity.

📌 Entry Points to Watch

$36.90 – Market price, if volume picks up near support

$33.30 – Prior breakout area and potential pullback support

$30.50 – Strong support and near the 52-week low for aggressive buyers

🎯 Target Levels

$39.80 – Short-term resistance; previous rejection zone

$43.50 – Fib retracement from the high, medium-term target

$47.50–48.00 – 52-week high retest, bullish scenario

🧠 Narrative to Watch

With potential Fed pauses on rate hikes, improving margins, and relative stability in U.S. banks, BAC could be positioning for a slow grind higher. Watch for earnings momentum and bond yield trends.

⚠️ Disclaimer

This analysis is for informational and educational purposes only and does not constitute financial advice. Always do your own research or consult with a licensed financial advisor before making trading decisions.

Nato and EU meetings could lift EUR/USD further Despite believing the euro is currently overvalued, Bank of America prefers it to the US dollar, Swiss franc and Japanese yen.

Bank of America thinks the EUR could be supported leading up to the NATO and EU summits (June 24-27) especially if defense spending is confirmed. German infrastructure spending might also be expected to support the euro.

The EUR/USD holds above the 20- and 50-period EMAs at 1.1380–1.1360 and is comfortably above the 200-period EMA. The recent pull-back from 1.14930 has eased momentum slightly.

A close above 1.1420 could target 1.1470, then 1.1520. A sustained break below 1.1280 could neutralise the bullish bias.

BANK OF AMERICA: Strongest rebound since 2023 eyes $65.Bank of America is heavily bullish on its 1D technical outlook (RSI = 68.687, MACD = 1.120, ADX = 62.779) as it's on an impressive rebound since the April low, which was priced on the 0.236 Fibonacci level of the long term Channel Up that begun in December 2011. Every rally on the 0.236 Fib always hit the 0.786 Fib. Long until the end of the year, TP = 65.00.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Bank of America (BAC) Shares Drop Over 6%Bank of America (BAC) Shares Drop Over 6%

On 18 February, we reported that Warren Buffett was selling bank stocks, including Bank of America (BAC) and Citigroup (C). This proved to be a sharp decision, as yesterday:

→ Bank of America (BAC) shares fell by 6.34%

→ Citigroup (C) shares fell by 6.25%

As a result, BAC stock hit its lowest level of 2025.

Why Did Bank of America (BAC) and Citigroup (C) Shares Decline?

Investor bearish sentiment may have been driven by concerns over:

→ New US tariffs on imports from Mexico and Canada

→ The risk of renewed inflation growth amid an economic slowdown

This led to a broader decline in financial sector stocks yesterday.

Technical Analysis of Bank of America (BAC)

The chart shows that in 2024, the price was in an upward trend (illustrated by the blue channel), but the $48 level proved too strong for bulls to break. Key observations:

→ In mid-February, a bearish breakout occurred below the channel, and in early March, the same level acted as resistance

→ The $44 level has influenced the trend in the past and could now act as resistance again

→ A drop below the late-December low may indicate a Change of Character (ChoCh) pattern, signalling a potential market shift

BAC Stock Price Forecasts

Analysts remain optimistic. According to TipRanks:

→ 17 out of 19 analysts recommend buying BAC stock

→ The average 12-month price target for BAC is $53

Trade on TradingView with FXOpen. Consider opening an account and access over 700 markets with tight spreads from 0.0 pips and low commissions from $1.50 per lot.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

XRP | BIG NEWS | How XRP Gets to $10A few weeks ago I made an update about rumors of Bank of America using XRP for its internal transactions.

The United States is the world’s largest economy, with a GDP of about $27 trillion. If a major like Bank of America were to adopt the use of XRP, consider how it processes trillions of dollars every day. Imagine what this can do for the market cap. Currently, these transactions are run through traditional payment systems like SWIFT and FedWire. But if Ripple can come in with a real cost saving advantage, it's very likely that other banks may follow.

Apart from internal transactions. these banks play a key role in global financial transactions, which means that any shift towards the XRP could lead to massive liquidity inflows and increased daily trading volume for the currency.

In case of limited adoption within US banks, the price may rise to $2-5 in the medium term.

In the event of widespread adoption within the United States, if XRP becomes a core part of the operations of major banks, the price could reach $10-20, but this would require fundamental changes in the financial infrastructure.

In the event of global adoption led by the United States, the price could range between $20 and $50, but this requires years of development and legal regulation.

__________________________

BINANCE:XRPUSDT

BAC Bank of America Corporation Options Ahead of EarningsIf you haven`t bought BAC before the recent rally:

Now analyzing the options chain and the chart patterns of BAC Bank of America Corporation prior to the earnings report this week,

I would consider purchasing the 47usd strike price Calls with

an expiration date of 2025-2-7,

for a premium of approximately $0.89.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

XRP | Bank of America Uses XRP InternallyXRP is making international headlines once again - this time, news of a collaboration with Bank of America is going around.

XRP gained against the trend on Wednesday, as other cryptocurrencies faced losses. The surge followed a photo shared by Ripple CEO Brad Garlinghouse, showing him dining with Chief Legal Officer Stuart Alderoty and President-elect Donald Trump.

But have we seen this before? In the past, Ripple has been known to make dodgy deals with news outlets and participate in unsolicited and unethical advertising - who remembers all the celebs they paid to speak out about XRP, and then the string of YouTube influencers? The SEC case cracked down on this "market manipulation" particularly hard, but it merely cost Ripple a few million dollars in fines.

Recently, David Stryzewski, CEO of Sound Planning Group, appeared on FOX Business to assert that Bank of America (BoA) is now utilizing XRP for 100% of its internal transactions. If verified , this would mark a groundbreaking step toward mainstream adoption of blockchain technology within major financial institutions. (This is a little worrisome - a validation from Bank of America would really be the only believable confirmation).

As per a recent article by The Crypto Times, a move of this magnitude could position XRP as a pivotal component in global banking systems. Notably, Bank of America’s relationship with Ripple is not new. The bank has been a member of RippleNet, Ripple’s blockchain-based global payments network, which facilitates secure and fast international money transfers. Bank of America's interest in blockchain technology dates back to at least 2017, when it filed a patent for a real-time settlement system referencing a "ripple" distributed ledger. Although the patent did not explicitly mention XRP , it signaled the bank’s intent to explore the integration of Ripple’s technology into its operations. According to Stryzewski, BoA has since filed 83 patents related to Ripple’s blockchain technology, underscoring its commitment to incorporating this transformative technology into its infrastructure.

Another recent publication by Binance expressed confidence in XRP’s long-term significance, praising the technology and Ripple's partnerships through RippleNet. Ripple’s official website lists Bank of America as a member of RippleNet, reinforcing the likelihood of ongoing collaboration.

If Stryzewski's claim proves accurate, it would represent a historic milestone for cryptocurrency adoption in traditional banking, potentially leading to a massive short-term pump. It is good to remember though, as with any news relating to Ripple and XRP, there are always many "if's" and "buts".

__________________________

CRYPTO:XRPUSD COINBASE:XRPUSD BINANCE:XRPUSDT

BAC | SHORTNYSE:BAC

Technical Analysis of Bank of America Corporation (BAC)

Key Observations:

Current Price Action:

Price: $37.58

Recent Drop: -1.92 (-4.86%)

Support and Resistance Levels:

Immediate Support: $37.18 (Bearish Line)

Further Supports: $36.00 (Target Price 1), $35.22 (Target Price 2), $33.39 (Target Price 3), and $30.98 (Target Price 4)

Resistance: The price recently broke below a support level at around $41.78.

Trendlines:

The price has broken below a key upward trendline, indicating a potential shift from a bullish to a bearish trend.

Relative Strength Index (RSI):

Current RSI: 48.91

The RSI shows a decline, indicating increasing selling pressure but still in a neutral zone.

Target Prices:

Target Price 1: $36.00

This level is the immediate support and a potential first target for any continued downward movement.

Target Price 2: $35.22

If the price breaks below the immediate support, the next target is around $35.22, a previous support level.

Target Price 3: $33.39

Further downside could see the price reaching $33.39, another key support level.

Target Price 4: $30.98

In a more bearish scenario, the price could fall to $30.98, a significant support level.

Summary:

Bank of America Corporation (BAC) has experienced a significant drop, breaking below a key support level and its upward trendline. The next levels to watch are $37.18, $36.00, $35.22, $33.39, and $30.98. The RSI indicates potential for further declines if market conditions remain negative.

BofA's Triumphant Return: Stock Surges to New Heights● Following a significant rejection around the 46.5 level, the stock price dropped nearly 50%.

● However, it found support near the 24.3 level and staged a comeback.

● After nearly three years, it has now broken through its previous major resistance and is currently trading at an all-time high.

● There are expectations that this upward momentum will continue, pushing the price even further.

Bank of America (daily - log )Hello community,

Following the publication of Warren Buffet's results, I looked at the Bank of America stock.

Since the beginning of the year, performance 28%

Why did you sell the stock, there must be a reason that I don't know.

Upward trend, I put the 3 accumulation zones on the chart.

Make your opinion, before placing an order.

► Thank you for boosting, commenting, subscribing!

BANK OF AMERICA Short-term buy signal.Last time we gave a signal on the Bank of America Corporation (BAC), was exactly a year ago (October 11 2023, see chart below), with the stock giving us a highly profitable buy trade, hitting the $44.00 long-term Target:

This time our focus is on the shorter term 1D time-frame where the stock is forming a Bullish Megaphone similar to the one in January - March 2024. Currently the price is pulling back (blue circle) and the symmetric pattern of mid March 2024 suggests that it should now rebound towards the 2.0 Fibonacci extension.

As a result, we are turning bullish mid-session, targeting $44.00 (above Fib 2.0 and below Resistance 1).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Bank of America Stock Surge on Q3 Earnings BeatBank of America (NYSE: NYSE:BAC ) delivered impressive third-quarter results, showcasing its resilience amid a challenging economic landscape. The bank reported $25.34 billion in revenue, slightly up from $25.17 billion a year earlier and above the analysts' consensus projection of $25.28 billion. Although profit fell to $6.90 billion ($0.81 per share) from $7.8 billion ($0.90 per share) last year, this was still better than the expected drop to $6.45 billion** or $0.75 per share.

Key Financial Highlights:

- Net Interest Income (NII) was reported at $13.97 billion, down from $14.38 billion a year ago but exceeding the expectation of $13.85 billion.

- The bank's trading revenue saw a significant uptick, with fixed income trading revenue rising 8% to $2.9 billion and equities trading jumping 18% to $2 billion.

These results come on the heels of similar positive reports from rivals like JPMorgan Chase and Wells Fargo, highlighting a robust start to the big bank earnings season. This broader positive sentiment in the banking sector is likely contributing to a favorable outlook for Bank of America.

Technical Analysis

As of the time of writing, NYSE:BAC shares are up 1.62%, signaling a bullish trend. The stock has recently rebounded from a consolidation zone, gathering momentum for further upward movement. A key indicator of this bullish sentiment is the Relative Strength Index (RSI), currently hovering around 71, indicating that the stock is entering overbought territory.

The stock's performance is further supported by its trading above key moving averages, which traditionally signals a strong bullish trend. Analysts note that this upward momentum, combined with the bank's robust earnings, positions Bank of America (NYSE: NYSE:BAC ) favorably for potential further gains, especially as NII shows signs of recovery.

Investment Implications:

The current trajectory suggests that Bank of America (NYSE: NYSE:BAC ) is turning a corner in terms of NII, as indicated by analysts like Wells Fargo's Mike Mayo. With the Federal Reserve having recently cut interest rates, analysts believe this should help improve bank earnings moving forward, as lower deposit costs may enhance profitability.

Additionally, with a provision for credit losses reported at $1.5 billion, slightly under the estimated $1.57 billion, the bank appears to be managing its risks effectively, further instilling confidence in investors.

Conclusion

Bank of America's latest earnings report reflects a strong performance amid a dynamic banking environment. The combination of better-than-expected trading results, a recovery in NII, and robust investor sentiment positions NYSE:BAC as a compelling investment opportunity. As the bank continues to navigate the evolving landscape of interest rates and economic conditions, investors may want to keep a close watch on its performance in the upcoming quarters.

EUR/USD in Trouble? BofA May Think So Bank of America (BofA) anticipates that the European Central Bank (ECB) will reduce interest rates more aggressively than what is currently reflected in the EUR/USD.

This expectation is driven by doubts surrounding the ECB's estimate of the neutral rate and shifting savings and investment patterns within the Euro Area.

Even so, the EUR/USD has dropped to a new weekly low of 1.0950. With the U.S. dollar maintaining a bullish trend across the FX market, the pair may decline further, potentially testing the next support level at 1.0910.

If BofA’s forecast holds true, EUR/USD could revisit the lower highs seen in August and July, signaling a deeper pullback.

Is Warren Buffett Losing Faith in Bank of America?A Strategic Shift with Far-Reaching Implications

Warren Buffett, the legendary investor and CEO of Berkshire Hathaway, has taken a significant step that has sent ripples through the financial world. Berkshire, a long-time major shareholder of Bank of America (BofA), has been steadily selling its stake in the bank. This strategic move, totaling over $3.8 billion in sales, has raised eyebrows and sparked speculation about the future of BofA.

Buffett's decision to reduce Berkshire's holdings in BofA is a departure from his typical investment strategy, which often involves long-term, unwavering commitments. This shift raises questions about his perception of the bank's prospects and the broader financial landscape.

The implications of this move extend beyond Berkshire and BofA. As one of the most closely watched investors in the world, Buffett's actions can influence market sentiment and investor behavior. His decision to sell BofA shares could signal a potential shift in his outlook on the banking sector or broader economic conditions.

To learn more about the reasons behind Buffett's decision, the potential impact on Bank of America, and the broader implications for the financial sector, please visit our website.

4 Political Tensions Fueling Gold Prices As gold aims to test record high again, let's look at some of the political issues possibly driving the price action.

Iran Tensions Escalate:

The Pentagon has dispatched a guided missile submarine and a carrier strike group, to the Middle East. This move follows Iran's vow of retaliation against Israel after a senior Hamas leader was killed in Tehran last month. With nearly two weeks passing without a retaliation, the atmosphere remains tense.

US Political Landscape:

A recent New York Times/Siena poll places Vice President Kamala Harris, who is on a swing state tour, ahead of former President Donald Trump by four points in key battleground states, including Michigan, Wisconsin, and Pennsylvania. However, with nearly three months left until the election, the race remains fluid. Trump is set to appear in an interview with Elon Musk on the X platform, looking for a shift in momentum.

US Economic Concerns:

Bank of America CEO Brian Moynihan warned that U.S. consumers might become “dispirited” if the Federal Reserve delays interest rate cuts. He emphasized that once consumer sentiment turns negative, recovery becomes challenging. However, Moynihan acknowledged that Bank of America no longer anticipates a recession.

Ukraine’s Military Advance:

Ukraine’s top military commander reported control over 1,000 square kilometers of Russia’s neighboring Kursk region, with Russia evacuating over 76,000 residents from western Kursk. Russia is now evacuating residents from a second border region as Ukraine's surprise week-long offensive within Russian territory intensifies.

BAC Bank of America Corporation Options Ahead of EarningsIf you haven`t bought AAPL before the previous earnings:

Then analyzing the options chain and the chart patterns of BAC Bank of America Corporation prior to the earnings report this week,

I would consider purchasing the 35usd strike price Calls with

an expiration date of 2024-8-16,

for a premium of approximately $2.82.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

BAC Bank of America Corporation Options Ahead of EarningsIf you haven`t bought the dip on BAC here:

Then analyzing the options chain and the chart patterns of BAC Bank of America Corporation prior to the earnings report this week,

I would consider purchasing the 34usd strike price at the money Calls with

an expiration date of 2024-2-16,

for a premium of approximately $1.54.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Bank of America (BAC) Stock: Breaking Out, Fibonacci DynamicsAnalyzing BAC Stock: Navigating Breakouts and Fibonacci Dynamics

Introduction:

Bank of America Corporation (BAC) has seized investor attention with its recent breakout from a falling wedge pattern on October 27, 2023. As we delve into the details, this analysis aims to provide insights into the stock's recent performance and chart the potential trajectory based on technical indicators.

Breakout from Falling Wedge:

The breakout from the falling wedge pattern marked a significant turning point for BAC stock on October 27, 2023. This event initiated a gradual yet dominant push, propelling the stock towards the 0.5 Fibonacci retracement level from the bottom wick of the lowest candle in the 9-hour timeframe.

Fibonacci Retracement Analysis:

In the weekly chart analysis, BAC is yet to approach the 0.618 Fibonacci retracement zone. This critical zone is anticipated to be a pivotal level, potentially triggering a significant correction towards the falling wedge resistance around $28.90. The Fibonacci dynamics serve as a roadmap, guiding traders through the intricacies of BAC's price movements.

Short-Term Bearish Outlook:

For the short term, a bearish stance is maintained as we anticipate the completion of a double top pattern. This pattern suggests a potential reversal, aligning with our analysis of the Fibonacci retracement zones. The completion of the double top pattern is considered a crucial phase before the stock advances further, adding a layer of caution to our near-term outlook.

Conclusion:

In conclusion, Bank of America Corporation's recent breakout from the falling wedge pattern has set the stage for an intriguing journey. The Fibonacci retracement analysis reveals key levels, with the 0.618 zone acting as a potential catalyst for a significant correction. As we remain short-term bearish, the completion of the double top pattern becomes a pivotal event, shaping the narrative for BAC stock's future movements. Traders are advised to stay vigilant, closely monitoring these technical indicators to navigate the dynamic landscape of Bank of America Corporation's stock performance.