Will the Canada-US Trade Tension Continue to Impair CAD?Fundamental approach:

- USDCAD advanced this week, supported by broad US dollar strength and renewed trade tensions as the US announced higher tariffs on Canadian imports.

- The pair was further buoyed after the BoC left rates unchanged and signaled caution amid persistent core inflation and ongoing trade negotiations.

- Meanwhile, US labor data indicated that job openings were moderating growth while tariff-related uncertainty weighed on risk sentiment.

- The BoC’s decision to keep its policy rate at 2.75% cited domestic economic resilience and the unpredictable US trade policy outlook.

- At the same time, negotiations between Canada and the US over trade terms remained in an “intense” phase, with additional tariffs entering effect 1 Aug, adding to downside risks for the Canadian economy.

- USDCAD may remain elevated next week as markets monitor follow-through from new tariffs and assess further data on US jobs and Canadian trade. Potential progress or setbacks in Canada-US trade talks and upcoming economic releases could influence direction, while central bank policy signals and risk appetite will remain key catalysts.

Technical approach:

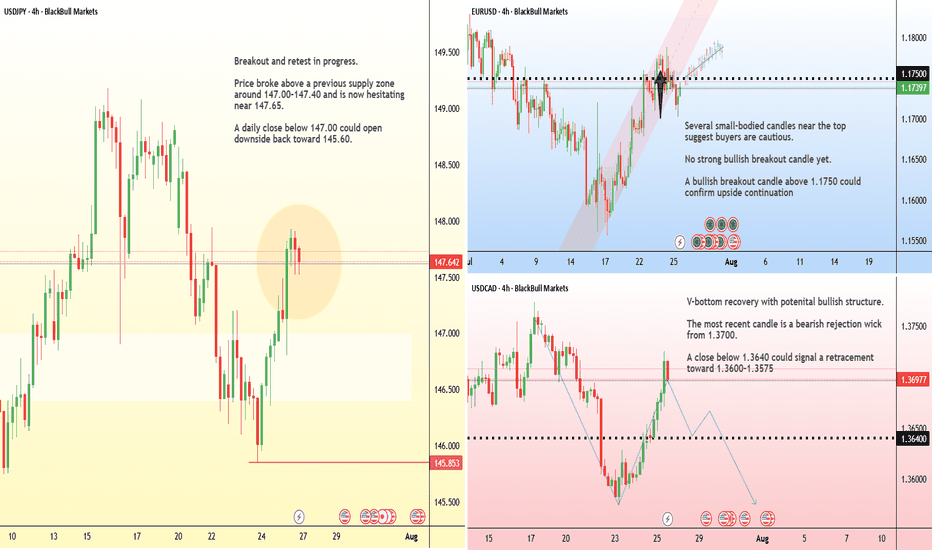

- USDCAD formed a Triple-bottom pattern at around 1.3567 and bounced up to break the neckline at 1.3755. The price also broke the descending trendline and closed higher than both EMAs, indicating a potential trend reversal.

- If USDCAD remains above the support at 1.3755 and both EMAs, the price may retest the resistance at 1.3980.

- On the contrary, closing below the support at 1.3755 and both EMAs may lead USDCAD to retest the key support at 1.3567.

Analysis by: Dat Tong, Senior Financial Markets Strategist at Exness

Bankofcanada

Markets face a PACKED schedule this weekThe tariff truce between the U.S. and several major trading partners is set to expire on August 1 . A deal with Japan has already been reached, but talks with the EU, Canada, and Mexico remain active.

In monetary policy, the Federal Reserve is widely expected to hold rates steady at 4.5% during its midweek meeting .

Across the border, the Bank of Canada is also expected to leave its interest rate unchanged at 2.75% . After cutting rates twice earlier this year, the BoC is seen as entering a wait-and-see phase.

In Asia, the Bank of Japan will announce its decision on Wednesday . While the BoJ isn’t expected to hike this month, recent U.S.–Japan trade progress has opened the door for policy tightening later this year.

Finally, the week concludes with the U.S. Non-Farm Payrolls report on Friday. Economists expect job gains of around 110,000 in July, down from 147,000 in June.

BOC decision - trading the uncertaintyMarkets are narrowly leaning toward no rate cut from the Bank of Canada this Wednesday. Markets were pricing a 58% chance of a pause as of Friday last week. With traders nearly evenly split, short-term volatility in USD/CAD is possible.

While the Bank had previously signaled it would "proceed carefully" on future rate cuts, that guidance came before the heightened risks tied to the U.S. “Liberation Day” tariff announcements.

From a technical standpoint, there are early signs the pair may be forming a near-term bottom. If the BOC holds rates steady, USD/CAD could retake its 200-day moving average, opening the door for a move toward resistance near 1.4100.

After CAN CPIs, it's time to prepare for BoC rate decisionLooking at the CPI numbers that came out, we are noticing some weakness in the CAD right now. This weakness may spill over into tomorrow's trading, as the BoC is expected to keep the rates unchaged.

Let's dig in!

FX_IDC:USDCAD

MARKETSCOM:USDCAD

Let us know what you think in the comments below.

Thank you.

77.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

Why is the Canadian Dollar Outperforming Expectations?A Deep Dive into the Unexpected Resilience of the CAD

In a landscape marked by economic uncertainty, the Canadian dollar has defied the odds, exhibiting remarkable resilience. This unexpected strength is a result of a complex interplay of factors, including the Federal Reserve's monetary policy, market dynamics, and global commodity trends.

The Federal Reserve's Pivotal Role

The Federal Reserve's shift towards a more accommodative monetary policy has been a key driver of the CAD's rally. The Fed's hints at potential rate cuts, especially in response to a weakening labor market, have weakened the U.S. dollar, boosting the appeal of other G10 currencies, including the CAD. This has created a favorable environment for the Canadian dollar, as investors seek higher-yielding alternatives to the U.S. dollar.

Short Covering and Positioning Dynamics

Another significant factor contributing to the CAD's strength is a wave of short covering. Traders had previously bet against the CAD, anticipating a divergence between the easing cycles of the Federal Reserve and the Bank of Canada. However, as the U.S. dollar weakened and the CAD began to rise, these short positions became increasingly unsustainable. Traders were forced to unwind their bets, adding momentum to the CAD's rally.

The Impact of Rising Oil Prices

Canada's significant oil exports make it particularly sensitive to fluctuations in oil prices. The recent increase in crude oil prices, driven by geopolitical tensions and potential supply disruptions, has provided a further boost to the CAD. As a major oil producer, Canada benefits from higher oil prices, which can lead to increased exports and a stronger currency.

Assessing the Risks and Challenges

While the CAD's rally has been impressive, it is important to acknowledge the potential risks and challenges that could undermine its momentum. The Bank of Canada's rate cuts, although expected, could narrow yield differentials and put pressure on the CAD. Additionally, ongoing global uncertainties and subdued risk appetite could limit the loonie's upside potential.

Key Data to Watch

Several key data releases will be closely monitored in the coming weeks. Canada's GDP data will provide insights into the health of the Canadian economy and could influence the Bank of Canada's policy trajectory. Meanwhile, U.S. economic reports, such as PCE, will be watched for potential shifts that could affect the USD/CAD exchange rate.

Conclusion

The Canadian dollar's unexpected resilience is a testament to its strength in a challenging economic environment. While the current momentum is positive, investors should remain cautious and closely monitor key economic indicators. By understanding the underlying factors driving the CAD's rally and assessing the potential risks, investors can make informed decisions about their currency exposure.

USD/CAD Pressured but Policy Divergence Still FavorableUSD/CAD has entered its third straight losing week and faces renewed pressures today after the upside surprise in Canadian inflation. Crucially, Core CPI accelerated 1.6% y/y in May, snapping its five-months declining streak. The Bank of Canada had slashed rates earlier this month, for the first time four years and had hinted at further easing if inflation continued to decelerate. But today’s hot CPI report, casts some doubt over the disinflation process and the policy path. The pair remains is risk of bigger decline below the 38.2% Fibonacci of the December-April advance. Sustained weakness towards and beyond 1.3419 has a higher degree of difficulty though.

However, today’s hot report is not the end of the disinflation process and is likely not enough to bar further rate cuts by the BoC. Its US counterpart meanwhile is reluctant to pivot due to inflation persistence and Fed officials see just one cut this year, despite more optimistic market pricing for two moves. This monetary policy divergence remains a tailwind for USD/CAD. On the technical front, the pair has already defended the critical 38.2% Fibonacci and another bounce off would reaffirm the upside bias and allow the bulls to push for new 2024 highs (1.3846).

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading CFDs with this provider . You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (trading as “FXCM” or “FXCM EU”), previously FXCM EU Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading CFDs with this provider . You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763). Please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this video are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed via FXCM`s website:

Stratos Markets Limited clients please see: www.fxcm.com

Stratos Europe Ltd clients please see: www.fxcm.com

Stratos Trading Pty. Limited clients please see: www.fxcm.com

Stratos Global LLC clients please see: www.fxcm.com

Past Performance is not an indicator of future results.

USDCAD Triangle PatternHi Traders!

There is a triangle pattern on the USDCAD 4H chart ahead of the Bank of Canada (BoC) Monetary Policy Report, Rate Decision, and press conference.

Here are the details:

The price action looks bullish due to US dollar strength, and the market is currently in a consolidation phase in the triangle.

Depending on what we get later from the Bank of Canada, we may get a re-test of the monthly high at 1.35420 if the triangle resistance breaks.

It is expected that the BoC will hold rates at 5%.

Preferred Direction: Buy

Resistance: 1.34797 (TRENDLINE RESISTANCE)

Resistance: 1.35420 (MONTHLY HIGH)

Support: 1.34401 (TRENDLINE SUPPORT)

Technical Indicators: 20 EMA

Please make sure to click on the like/boost button 🚀 as your support greatly helps.

Trade safely and responsibly.

BluetonaFX

Watching for GBPCAD to follow EURCADWe saw a huge sell off when EURCAD broke it's uptrend last week so I'm watching GBPCAD to see if we get a similar flush. Price has been holding the trend now for several days with price barely able to escape and push higher, leading to further tightening.

Entry signal would be a non ambiguous break of the Daily trend with stop above high of day if possible.

Target is somewhere around the mid Nov break out as shown on the Daily TF, just over 100 pips away.

Daily SWAP is -1.58% so a multi day is possible, but I wouldn't want to go over 3.

Volatility around the CAD rate decision has the biggest downside effect on the idea if we get a break prior to the news. Not much we can do about this, if we get a sell signal before the release I still think it is worth taking.

Double CPI Day for the EUR & CADCertain weeks stand out in importance, and the week ahead is shaping up to be one of them.

On the economic calendar we have the Eurozone & Canada CPI as standouts for Tuesday, UK CPI & FOMC on Wednesday. Such action-packed weeks often provide the catalyst for the next move in the markets.

Our attention is currently drawn to the EURCAD for multiple reasons. Firstly, from a technical perspective, we see the EURCAD completing a head and shoulder pattern on a daily timeframe, which is generally associated with a trend reversal. This is further supported by the 200-day simple moving average, which has consistently marked out the trend for the currency pair. With prices recently crossing below the moving average, this could mark a change in the overall trend, potentially heading lower.

Further, when looking at the long-term chart, the 1.440 level has been a critical point of support & resistance across its history, with prices often either breaking through with momentum or stopping and bouncing off this level.

Looking at each leg of the EURCAD against the USD also reveals an intriguing setup, with the USDCAD trading near the resistance of a descending channel and the EURUSD breaking sharply below its trend support. Both indicate a potentially lower EURCAD.

Another interesting comparison we can make is the currency pair with its related markets. Both the Euro and Canadian dollar are deeply tied to the USD; thus, the broad dollar proxy should have some relationship with the pair. By overlaying the inverse dollar index (DXY) and the EURCAD, we see both are closely related with the Inverse DXY pointing towards a slightly lower EURCAD. The same observation applies when we overlay the EURCAD and the Inverse Crude Oil prices, given the correlation of the Canadian dollar with crude prices due to its oil-exporting nature.

With CPI numbers out for both economies next week, it is also worth looking at the economic data from both countries. From an unemployment rate perspective, the Eurozone is faring worse than Canada, a trend echoed when we look at YOY GDP. Both indicators suggest a frail Eurozone economy, likely making the central bank more cautious as it tries not to overdo policy tightening and risk sending the Eurozone into a deep recession.

On top of that, the recent guidance from both central banks reveals slightly different undertones. The Bank of Canada anticipates higher year-over-year inflation readings, while the ECB forecasts declines in headline inflation and harmonised index of consumer prices (HICP) readings. This further supports the idea that the ECB might be more dovish, while the Bank of Canada could lean towards a hawkish stance.

All things considered, the case for a lower EURCAD seems compelling based on the technical charts at key levels, comparisons with other markets, and central bank stances. We could express this view via the CME-listed Euro/Canadian Dollar with a short position at the current level of 1.440, take profit at 1.380 and stop loss at 1.457, offering a risk-reward ratio of 3.5.

Alternatively, the currency pair can be synthetically constructed using the more liquid Euro FX Futures and Canadian Dollar Futures. To establish a short position on the EURCAD, one can sell 2 EURO FX Futures and buy 1 Canadian Dollar Future. This approach approximates the hedge for the position, considering that each EURO FX Futures contract represents 125,000 Euros, and each Canadian Dollar Futures contract corresponds to 100,000 Canadian Dollars. At the current exchange rate of roughly 1.44, 1 Euro FX Futures contract is equivalent to approximately 180,000 Canadian Dollars, resulting in a 2:1 ratio. Each 0.0001 per Euro increment for the Euro/Canadian Dollar Futures is 12.50 Canadian dollars, while each 0.000050 per Euro increment for the Euro FX Futures is $6.25 and each 0.00005 per CAD increment for the Canadian Dollar Futures is $5.00.

The charts above were generated using CME’s Real-Time data available on TradingView. Inspirante Trading Solutions is subscribed to both TradingView Premium and CME Real-time Market Data which allows us to identify trading set-ups in real-time and express our market opinions. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Disclaimer:

The contents in this Idea are intended for information purpose only and do not constitute investment recommendation or advice. Nor are they used to promote any specific products or services. They serve as an integral part of a case study to demonstrate fundamental concepts in risk management under given market scenarios. A full version of the disclaimer is available in our profile description.

Reference:

thoughtleadership.rbc.com

www.ecb.europa.eu

www.cmegroup.com

www.cmegroup.com

www.cmegroup.com

Bullflag resting on band with tight invalidationPretty simple play here. USDCAD tightly coiling up since Sept 2022. Higher lows. Looks like it wants to explode, even a surprise rate hike by the Bank of Canada wasn't enough to sweep the lows. Tight invalidation. US trudging ahead with rate hikes while the market is in disbelief and calling J Powell's bluff. But he's not bluffing. Canada has the bubbliest mortgage market on the planet. They won't be able to follow the US fed lest they ruin a generation of boomers' home equity and retirement.

CAD is clown currency. USD is King.

1.45 first target

Bank of Canada Interest Rate DecisionThe USDCAD traded lower, since the start of June, reversing from the 1.3650 price level, now hovering along the 1.34 price level.

Over the last couple of days, the USDCAD had been in a narrow downward range.

The Bank of Canada (BoC) is due to announce its interest rate decision. With the current rates at 4.50%, there has been speculation that a surprise rate hike could be decided (similar to what happened with the RBA and the AUDUSD).

However, I think that the data might not support such a surprise, with the BoC likely to maintain its current interest rate level.

This is likely to cause the USDCAD to trade higher, from this current area of 1.34 toward the immediate resistance level of 1.35.

Canadian dollar edges lower ahead of Canadian GDPThe Canadian dollar is trading close to a two-month low, as the currency remains under pressure. USD/CAD is trading at 1.3646 in the European session, up 0.34%.

Canada releases GDP later today, and the markets are projecting a modest 0.4% q/q for the first quarter, after flatlining in Q4 2022. On an annualized basis, GDP is expected to jump by 2.5%, after stalling at 0% in Q4.

The GDP report takes on even more significance as it is the last tier-1 release ahead of the Bank of Canada rate meeting on June 7th. A strong GDP release would support the Bank raising rates, while soft growth would give the Bank room to continue pausing rates at 4.25%. The key to the BoC's decision could well depend on the GDP release.

The BoC has a tough decision to make at next week's meeting. The BoC would like to extend its pause of rate hikes but inflation hasn't cooperated, as it ticked upwards to 4.4% in April, up from 4.3% in March. Inflation has been coming down, but remains well above the Bank's target of 2%.

In the US, the debt ceiling deal between President Biden and House Speaker McCarthy now has to be approved by both houses of Congress. Some Republicans are against the agreement, but the deal is expected to go through. The markets are optimistic, as 10-year Treasury yields dropped sharply on Tuesday in response to the agreement, which was reached on the weekend (US markets were closed on Monday). The 10-year yields are currently at 3.65%, after rising to 3.85% on Friday, their highest level since March.

1.3585 and 1.3515 are providing support

1.3685 and 1.3755 are the next resistance lines

USD/CAD shrugs despite strong Canadian job numbersIt could be a busy day for the US dollar, with the release of nonfarm payrolls later today. Canada posted a strong employment report on Thursday, as employment change and unemployment were better than expected.

In the European session, USD/CAD is trading at 1.3501, up 0.07%.

All eyes are on US nonfarm payrolls, with a consensus estimate of 240,000 for March, following a reading of 311,000 thousand in February. This week's employment releases have been weaker than expected, raising concerns that the robust US labour market is starting to slip. JOLTS Jobs Openings and ADP Employment Change and unemployment claims all missed expectations, and last week's unemployment claims reading was revised sharply upwards.

Will nonfarm payrolls follow the pattern and disappoint? If so, we could see a strong reaction from the markets, and the US dollar could lose ground due to speculation that the Fed might have to take a pause. The Fed has been able to relentlessly raise rates in large part due to the tight labour market, and if job creation shows cracks, it will be difficult for Fed policy makers to justify another rate hike at the May meeting.

Canada released its March employment report on Thursday, and the numbers were solid. The economy added 34,700 jobs, crushing the consensus estimate of 7,500 and above the February reading of 21,800. Unemployment was unchanged at 5.0%, a drop below the forecast of 5.1%. Wage growth eased, however, slowing from 5.4% to 5.2%. The Ivey PMI also pointed to strong growth, climbing to 58.2 in March, up sharply from 51.6 prior and above the consensus estimate of 56.1 points.

The labour market remains surprisingly resilient, even with the Bank of Canada's aggressive rate-tightening cycle. The Bank of Canada paused rates in March, for the first time since the current cycle started in March 2022. Governor Macklem has said that future rate decisions will depend on the data. The BoC meets on April 12th and will have to decide if the economy has cooled enough to warrant another pause.

USD/CAD faces resistance at 1.3590 and 1.3673

1.3436 and 1.3353 are providing support

USD/CAD slides ahead of Canada employment dataThe Canadian dollar usually is calm prior to the North American session, but USD/CAD has posted steady gains in the Asian and European sessions. USD/CAD is trading at 1.2993, down 0.73% on the day.

Canada releases the August employment report later today, with a market consensus of 15.0 thousand. The economy has shed jobs over the past two months, as the labour market appears to be losing momentum. This could affect future rate policy, as a weaker labour market may force the BoC to ease up on rate hikes earlier than it would like.

The BoC delivered a 0.75% hike this week, following the super-size 1.00% increase in July. This brings the benchmark rate to 3.25%, the highest rate among the major central banks. Governor Macklem has said that the BoC is committed to front-loading rate increases now in order to avoid even higher rates down the road, which means that the Bank can relax in October, with a 0.25% hike or possibly no move at all. Inflation in July surprised by dropping to 7.6%, down from 8.1% in June. It's too early to determine if inflation has peaked based on one release, but another decline would signal that tighter policy is bringing down inflation, which would allow the Bank to ease up on rate hikes.

The BoC considers its neutral rate around 2.50%, and with the benchmark rate currently at 3.25%, the Bank's policy is currently restrictive. This should dampen growth as well as inflation. Canada's economy grew by 3.3% in Q2, below the estimate of 4.4%, but still a positive signal that the BoC could succeed in its delicate task of guiding the slowing economy to a soft landing.

There is resistance at 1.3102 and 1.3232

USD/CAD is testing support at 1.2996, followed by support at 1.2866

CADJPY:ENERGY CONCERNS BOOSTS CADHigher commodity prices will strengthen the Canadian currency.

Oil prices have increased, and Canadian bond yields have risen further.

In addition, the Bank of Canada stated that it was prepared to act "more firmly if necessary" to return inflation to its target level.

The Bank of Canada has already raised rates by two straight half-points.

According to the Ivey Purchasing Managers Index, economic activity in Canada expanded at a higher rate in May.

Moreover, Governor of the Bank of Japan (BOJ) Haruhiko Kuroda stated on Wednesday that a rapid yen depreciation in a short period of time is undesirable.

Technically, the loony is trading above 102.522 and we expect it to meet resistance at around 106.967 and 109.827

USDCAD Short Expected to fall -Bank of Canada surprisedHello Traders

Here is a new Short Opportunity

💹USD/CAD - SELL STOP

✅ Entry @1.24400 or below

✅TP-1# 1.24200

✅TP-2# 1.24000

✅TP-3# 1.23900

✅SL# 24.900

The Canadian Dollar is coming off of a big week after the Bank of Canada surprised by announcing an end to their QE program. This happened on Wednesday and brought a strong push of CAD-strength into the mix, as USD/CAD dropped down for a test of the 1.2300 handle.

JamdeJam will not accept any liability for loss or damage as a result of

reliance on the information contained within this channel including

data, quotes, charts and buy/sell signals

If you like this idea, do not forget to support with a like and follow.

Don't hesitate to write comments.

Double Hawkish Tone From The BOC (28 October 2021)QE has ended.

During the monetary policy meeting yesterday, the Bank of Canada (BoC) carried out a hawkish move. The initial expectation from the market was for the central bank to taper its quantitative easing (QE) from C$2 billion per week to C$1 billion per week. However, the BoC surprised the market by bringing its QE to a halt.

Rate hike timeline carried forward.

Back in September’s meeting, the BoC mentioned in the rate statement that interest rate will be held at its current level until its 2% inflation target is sustainably achieved. The central bank projected this target to be met during the second half of 2022. However, in the released rate statement yesterday, the BoC revised its projection and is now expecting the target to be met in the middle quarters of 2022. This directly translates to an earlier timeline for the central bank to hike interest rate.

Quarterly economic projections.

The BoC revised its economic growth projections for 2021 and 2022 downwards while revising upwards for 2023. The downwards revision comes as the central bank is expecting global supply chain disruptions and shipping bottlenecks to carry on into next year, having a negative impact on economic growth.

As for inflation, the BoC revised its projections upwards for all three years, explaining that higher energy prices and supply bottlenecks are now “stronger and more persistent then expected”. Hence, the central bank is expecting inflation to be elevated into 2022.

For year 2021,

GDP: 5.1% (6.0%)

CPI Inflation: 3.4% (3.0%)

For year 2022,

GDP: 4.3% (4.6%)

CPI Inflation: 3.4% (2.4%)

For year 2023,

GDP: 3.7% (3.3%)

CPI Inflation: 2.3% (2.2%)

*Figures shown in parentheses refers to projections from July 2021

What’s next for the BoC?

With the conclusion of QE, the BoC is now moving into the reinvestment phase. In this phase, the central bank will offset bonds maturities by purchasing new bonds to replace those that are maturing in order to maintain the overall bond holdings at around the same level. The targeted range of purchase will be from C$4 billion to C$5 billion per month.

With that, the duration of the reinvestment phase has become a future monetary policy decision and will depend on the economic recovery and how inflation plays out in the future.

USDCAD analysis. Important news! Today Bank of Canada will publish their interest rate decision.

We don't expect any changes, but there will be moves in the market! Last time in April,

the interest rate remained unchanged, however there was a 150 pips move in the first hour!

That's why we should expect moves today.

USDCAD is currently trading sideways, which is very likely to end today.

Entry options:

Conservative - wait for the news to come out and once you see a clear breakout, then get involved in the direction of the breakout.

Agressive - look for an entry before the news on a lower timeframe. Proper risk management and using stop loss is mandatory!

Most probably we will see a downside continuation.

Good luck!