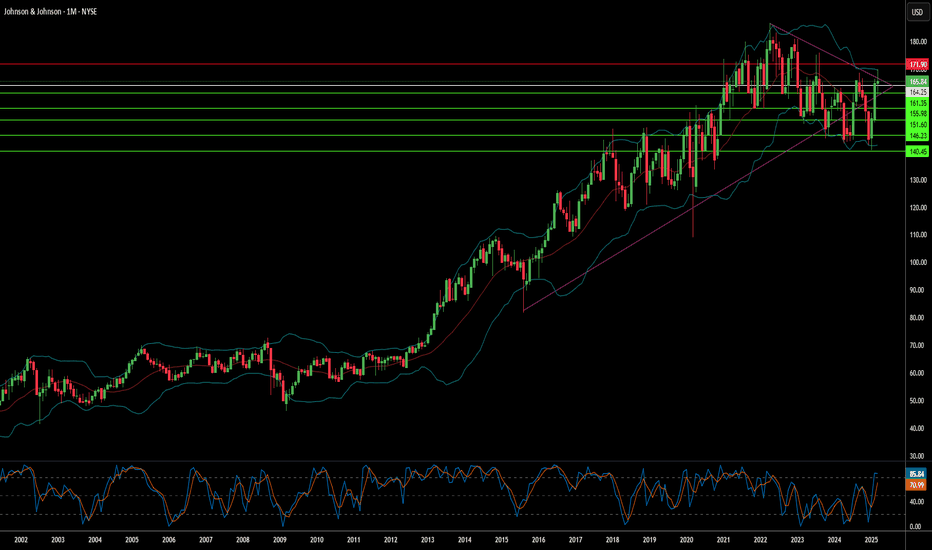

Cracks Appearing in J&J's Armor?Johnson & Johnson, a long-established leader in the global healthcare sector, confronts substantial challenges that raise significant questions about its future trajectory and stock valuation. Foremost among these is the persistent and massive litigation surrounding its talc-based baby powder. With tens of thousands of lawsuits alleging links to cancer, the company's strategy to manage this liability via bankruptcy has been repeatedly struck down by courts, most recently rejecting a $10 billion settlement proposal. This forces J&J to potentially face over 60,000 individual claims in court, introducing immense financial uncertainty and the prospect of staggering legal costs and damages.

Compounding these concerns is mounting scrutiny over the company's historical and recent marketing practices. A federal judge recently imposed a $1.64 billion penalty against J&J's pharmaceutical arm for misleading marketing of HIV medications, citing a "deliberate and calculated scheme." This follows earlier multi-million dollar settlements related to alleged improper financial inducements paid to surgeons for orthopaedic implants by its DePuy subsidiary, and tax disputes in India over questionable "professional sponsorship" expenses tied to similar activities. These incidents depict recurring legal and ethical entanglements with significant financial penalties and reputational harm.

Taken together, the unresolved talc litigation, substantial financial penalties from marketing violations, and persistent questions regarding ethical conduct create considerable headwinds for Johnson & Johnson. The cumulative impact of ongoing legal battles, potential future liabilities, and damage to its corporate image threatens to drain resources, divert management focus from core operations, and erode investor confidence. These converging factors present tangible risks that could exert significant downward pressure on the company's stock price moving forward.

Bankruptcy

Is iRobot's Bankruptcy the End or a New Start?iRobot, the renowned maker of the Roomba robotic vacuum cleaners, now finds itself in a precarious financial situation marked by significant debt and dwindling liquidity. Once a symbol of innovation, the company has been battling mounting losses and a challenging cash crunch, raising serious concerns about its ability to continue as a going concern.

The collapse of a high-profile acquisition deal with Amazon—derailed by European antitrust authorities—has compounded iRobot’s woes. The termination of this deal led to a dramatic plunge in share value and market capitalization and intensified investor skepticism, leaving the company with a heavier debt load and forcing it to consider strategic alternatives such as refinancing or selling assets.

Facing regulatory pressures, shifting market dynamics, and the human cost of necessary layoffs, iRobot’s future now hangs in the balance. This unfolding crisis invites investors and industry observers to reflect deeply on broader questions: Could a strategic overhaul pave the way for recovery, or does this signal the end of an era for the iconic brand?

Is the End of an Era for Tupperware?The iconic Tupperware brand, once a household staple, has recently faced a significant setback with its declaration of bankruptcy. This unexpected turn of events has sparked a deep dive into the factors contributing to its financial decline and the potential avenues for its revival.

A closer examination reveals that the changing consumer landscape, rising costs, and the shift toward digital commerce have played pivotal roles in Tupperware's struggles. However, amidst these challenges, there also lie opportunities for innovation and reinvention.

To navigate this critical juncture, Tupperware must prioritize product innovation, brand revitalization, and digital transformation. By developing sustainable alternatives, reconnecting with its heritage, and embracing emerging technologies, the company can potentially overcome its current challenges and secure a prosperous future.

The bankruptcy of Tupperware serves as a poignant reminder of the ever-evolving business landscape and the importance of adaptability in the face of adversity. As the company grapples with its future, the question remains: Can Tupperware reinvent itself and reclaim its position as a leading brand in the food storage industry?

Intel - Is this for real?NASDAQ:INTC created a top formation and is dropping hashly ever since - be careful!

Click image above to see detailed analysis

Catching falling knifes will go wrong 9 out of 10 times and you will cut yourself very badly. Just in a couple of months, Intel is down about -65% and is not slowing down at all. This honestly seems like the possibility of bankruptcy is not that far away and investors and trader should be extra careful. We have support coming soon, but the question is: will it stabilize price?

Levels to watch: $18

Keep your long term vision,

Philip - BasicTrading

Celsius looks like it wants to reclaim a Dollar! :0Nothing really dies in crypto lol

Theres always one more pump left lol

Sad state of affairs to all the people who got their coins stuck in celsius

But the the FTX fallout could give credence that people will actually made whole.

Technically the chart points to good news down the road .....

or could be traders wanting to pump something that hasn't moved much already

The two breakout levels are clear for all to be seen let's see what it can do.

Bankruptcy is a new beginning? Aerwins. I am thinking maybe? I am currently bullish on both NASDAQ:AWIN and NASDAQ:AWINW stocks, as I strongly

believe we are approaching a pivotal turning point in their charts. The

recent market volatility has caused these stocks to experience significant

downward pressure; however, I remain optimistic that this represents the

bottom of their price action. I am particularly excited about the

potential for an "Aerwins moment of truth," where these companies

demonstrate their resilience and growth potential to investors. With solid

fundamentals, innovative technologies, and a promising outlook for the

industry, I am confident that NASDAQ:AWIN and NASDAQ:AWINW are poised for a strong

rebound in the near future.

Dont worry FTT moves like this First it drops

then ( Green Phase ): Move higher and higher to cover some last candles of drop (But this high will not touch halfway of dip)

Then ( RED phase ): those high are now going to become lows with same resistance and support levels

And when price action reaches the same level that we bottom of previous drop; another Drop starts 😉

PRA Group: Bullish Shark at a Weekly Support Congestion ZonePRA Group is currently trading above a Support/Resistance Congestion Zone visible on the Weekly Timeframe, and at this zone it has formed a decently sized Bullish Shark pattern with a Bullish PPO Arrow as confirmation, and this all happens to align with the all-time 0.786 retrace. If this plays out, I think it could come back up to make around a 0.886 retrace, which would put it at around $60.

For further context, PRA Group is a Debt Buyer/ Collector, which is something that furthers my interests in the stock.

OZK Bank Options Ahead of EarningsAnalyzing the options chain of OZK Bank prior to the earnings report this week,

I would consider purchasing the 40usd strike price Puts with

an expiration date of 1/19/2024,

for a premium of approximately $2.72.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

Levels Of Resistance And Support On Possible Auction DateOTC:BBBYQ

This is the daily candle chart.

This builds on DannyBrenards curve idea, with the possible date of June 9th being the announcement of a possible winner of a sale auction (news that might drive price action). The bankruptcy documents (provided by Kroll) have two possible dates of announcing a winner of a sale auction on June 2nd or June 9th. If the price on either of these two dates crosses the yellow curved line, then a possible move upward could occur by Danny's hypothesis (note: my curve is slightly different in position than Danny's). The yellow vertical line and horizontal line indicate the June 9th date and a stock price of .8622 would be the target to cross the yellow curved line. The first level of resistance and support is at .3173 (the long horizontal red line on the peak volume bar that does not seem to show in chart). The second level of resistance and support is the green block at .56. The curved yellow line is the next important price point to cross. The next level of resistance and support is the green block at at 7.031. The rainbow lines of the Fibonacci Retracement are the next levels of resistance and support. The final level of resistance and support is the green block at 30.06.

Other important levels of resistance and support from the 4 hour chart are 1.49 and 2.83 (these are not shown on the daily chart above). The 8 hour chart shows levels of resistance and support at 3.15, 4.18, and 5.87 (these are not shown on the daily chart above).

Other important dates that may drive price action are the two dates that the bankruptcy documents (provided by Kroll) say that a possible Stalking Horse Bidder (opening minimum bid) might be announced. They are either May 22nd or May 31st.

There is only a possibility of these auction announcements. There has to be bidders for an auction to occur.

Indicators used are the Support Resistance - Dynamic and the Visible Range Volume Profile.

It is important to have entrance and exit plans when trading stocks.

This is not financial advice. I am not a professional financial expert. You are responsible for you own financial decisions.

SPCE ? Consolidation ? Short Squeeze ?SPCE is at a line in the sand of the chaos of the market.

On the 4H chart, price has bottomed and might be making a reversal pivot

as supported by a rising line segment on the RSI out of the oversold zone.

The though of a reversal is also supported by price crossing over the POC

line of the volume profile. Price above the POC line shows buyers are dominating

although some of the buyers are buying to cover shorts. Below the POC line,

sellers are dominating. If SPCE can get a trajectory upward, a short squeeze

could ignite a launch.

( Fundamentally, SPCE is dying and waiting for Eton Musk to make a good offer.)

This could be worth watching with an alert set 10% above the current price and

a volume alert at 50% above the moving average 20-day volume.

Banking crisis + War Provocation = Haiiyaaa! More money printing. More banks facing liquidity shortage. More bank runs as panic and fear kicks in. As mentioned before, Q2 will be bank run galore.

Entire 2 year's QT effort by Jerome Powell, is now being reversed in less than a month.

Did Credit Suisse got bailout by SNB and UBS recently for almost $105B Swiss Francs? Hmm today $CS is trading at less than $1.

Did SVB got liquidity injection by several banks and the government to avoid collapse? Hmm a week ago, SVB just filed chapter 11 for bankruptcy protection.

Good read here: lnkd.in

Early this week Deutsche Bank is knee weak and now the latest one, Schwab is flying a kite outside during a monsoon storm. Awesome read here:

lnkd.in

Yo, at the end of the day, I am forecasting that only a handful of banks, like less than 5, will be standing in the coming years.

To usher in CBDC, you must herd the sheeps into a smaller ranch to make control and compliance, easier.

To usher in CBDC, competition is BAD. Very bad. Competition is antithesis of monopoly. Therefore, Bitcorn? Ethereum? And the other cryptos? Hmm

And US is getting more aggressive in provoking war with China and Russia.

What has the world got to now....

I remember an old saying, "When all else fail, go to war"

By Sifu Steve @ XeroAcademy

CS Credit Suisse Group to $0.27 on Monday??UBS Group AG has made an offer to acquire Credit Suisse for as much as $1 billion.

The Swiss government is planning to change the country's laws to bypass the need for a shareholder vote on the deal, as they seek to restore confidence in the banking sector following Credit Suisse's outflow of 10 billion Swiss francs in just one week.

The proposed agreement, which is an all-share deal between Switzerland's two largest banks, is expected to be signed as early as Sunday evening.

The deal is priced at a fraction of Credit Suisse's closing price on Friday.

According to insiders, the offer was made on Sunday morning at a price of 0.25 Swiss francs ($0.27) per share, payable in UBS stock.

On Friday, Credit Suisse's shares closed at $2.01 Swiss francs.

I think we are about to see more bidders and the price go up from $0.27.

Looking forward to read your opinion about it.

COIN Coinbase Crypto Winter in SpringIf you haven`t sold COIN here, ahead of earnings:

Then you should know that following a string of investigations and lawsuits against it, Silvergate Bank, a prominent lender to cryptocurrency firms, lost five key partners on March 2.

Coinbase, Paxos, Gemini, BitStamp, and Galaxy Digital were among the notable crypto firms that previously relied on Silvergate as their banking partner.

As a result, Coinbase ended its relationship with SI Silvergate and turned to SBNY Signature Bank, which i also believe it can drop significantly in price.

In my opinion, we are about to witness a Crypto Winter in full Spring.

COIN Coinbase could easily reach $53 by the end of this month, according to the Fibonacci retracement tool.

Looking forward to read your opinion about it.

SBNY Signature Bank exposure to FTXOn December 21 Fitch Ratings revised Signature Bank's (SBNY) 'BBB+' Long-Term Issuer Default Rating (IDR) Rating Outlook to Negative from Stable.

On Jan 10, a team of analysts led by Ken Usdin downgraded SBNY Signature Bank to Hold from Buy, and slashed their target price to $124 from $185.

SBNY Signature Bank said that it had an exposure to FTX of less than 0.1%.

They also announced a reduction is crypto exposure, of which Jefferies analysts said:

“Signature Bank’s decision to shrink its crypto deposits by $8 billion to $10 billion and replacing with wholesale borrowings at 4.25% will drive a significant net interest margin reset in the coming quarters,”, which is a key profitability metric for banks.

Looking at the SBNY Signature Bank options chain ahead of earnings , I would buy the $75 strike price Puts with

2023-6-16 expiration date for about

$4.45 premium.

If the options turn out to be profitable Before the earnings release, i would sell at least 50%.

Looking forward to read your opinion about it.

Huobi Token HT could be the next exchange to fall?Huobi had experienced a lot of withdrawals recently.

This week I predict another selloff in the stock and crypto market after the CPI report on January 12.

My price targets for Huobi Token HT are:

HT/USDT short

Entry Range: $4.50 - 5.00

Price Target 1: $4.30

Price Target 2: $3.80

Price Target 3: $3.00

Stop Loss: $5.90

Tron TRX chances of a sell-offTRX is a collateral in the stablecoin USDD, that keeps depegging!!!

This week I predict another selloff in the stock and crypto market after the CPI report on January 12.

My price targets for Tron TRX are:

TRX/USDT short

Entry Range: $0.052 - 0.055

Price Target 1: $0.049

Price Target 2: $0.045

Price Target 3: $0.030

Stop Loss: $0.062

DLO"our research leads us to believe that DLO is likely a fraud"November 16, 2022, Muddy Waters Research: "our research leads us to believe that DLO is likely a fraud. We also have concerns over its disclosures about, and controls of, client funds."

DLO DLocal Limited is a technology-first payments platform enabling global enterprise merchants to connect with billions of consumers in emerging markets headquartered in Montevideo, Uruguay.

Muddy Waters Research: "we found a series of lies that the company has told, along with accounts it has altered to corroborate the lies. This series of lies had to do with disguising the timing of an option exercise and the source of funding for that insider option exercise. Absent the most glaring level of incompetence, these account alterations should point to fraud."

DLO DLocal Limited reminds me of Wirecard WDI in 2020. It was the pride of the German fintech, included in DAX30. a lot of people were buying WDI on its was down, thinking about a reversal, a buyout or a bailout from the authorities. German prosecutors have charged Wirecard's former chief executive Markus Braun and two other high-ranking managers for the colossal commercial fraud that led to the collapse of the payment company.

But financial fraud in payment companies usually ends with bankruptcy.

DLO DLocal Limited`s IPO was on June 2, 2021, at $21. Most of the companies that were listed last year or IPOs are now trading at a huge discount, but not DLO, which today traded at the same IPO price.

Today DLO went from $20.94 to $10.29, but if the accusations turn out to be true, then i am ready to see $1, or even less.

The market cap of DLO is still high in my opinion, $3 Billion!

Even without this report, my price target would be around $8.

Looking forward to read your opinion about it.

Liqudation Problem and SolvingHello, what I am describing here is definitely not an “Investment Advice”. It is at your own risk, remember that you are responsible for your gains and losses!

Eliminating Liquidation Risk…

I do my transactions on the BINANCE exchange, my samples and recipes are according to the menus of this exchange.

Click on the tab in the Upper Right Corner of your Leveraged Trading Order menu.

Activate by clicking Preference – Position Mode – Hedge Mode.

The menu will change to Open - Close in Two Tabs at the Top

Your Margin Mode must be on "Cross"

Adjust your leverage settings (X) to your liking

OPEN

In this mode, you can only open LONG and SHORT positions, do not confuse them with the other menu in One-Way mode, open the position in LONG or SHORT position at the price and amount you want, paying attention to the support and resistance .

CLOSE

In this mode, you can only CLOSE LONG and SHORT positions, do not confuse them with the other menu in One-Way mode, you can close the positions you have opened in OPEN mode in this mode, the button colors are changing, please read above "CLOSE SHORT (GREEN)-CLOSE LONG (RED) carefully.

Watch more videos about HEDGE Usage and do small experiments….

Let's Come To Eliminate Liquidation Risk…

NOTE: Never Deal With Your Entire Cash!!!!

My recommendation is 10-15% of your maximum safe for leverage over 50X

We all open our positions for profit and enjoy our green USDTs rising in the submenu, but sometimes we wait for more without being ambitious and get stuck…

This is where the HEDGE mode comes to the rescue, you opened the POS and you are in profit, the price has increased or vice versa, you are in profit in the SHORT pose, please manage your psychology well in this profitable moment and move forward with the target, the opposite of the position we have opened and please pay attention here You open the reverse transaction “UP TO AMOUNT” as I described above…

You can use this method when you make a wrong transaction and fix your balance in the same way!

No matter where the price goes, the profit or loss you see is always fixed in your pocket… Our problem with being liquid is eliminated, and we can sleep comfortably.

Yes, but will this process continue forever? When do we take a profit or make a loss?

I have made hundreds of experiments without a stop so far, as a result, a price never falls or rises constantly, patience comes into play here, improve your technical analysis knowledge for direction determination, if you cannot draw graphs, trends, etc., follow many well-intentioned people who give support and resistance on social media! (I'm not talking about PHENOS here, most of them give you gas and sell their goods)

While the two-way trade is open, I sell 50% of the position in the profit, whichever direction I am approaching the support or resistance, and I switch to waiting, I realize my profit by gradually buying or selling in the direction of the reaction. Since it is HEDGE mode, of course, the other direction seems to be in loss, right here, again, I am waiting for the right price to come to support or resistance by reducing my loss percentage with gradual purchases.

I saw that there is a DUMP or PUMP risk, I am insuring myself by opening a reverse trade against my open loss trade, and I follow my trades according to the calming market direction.

I am happy if I could be useful, please do not lose your money, as someone who has been liquid many times, I did not get help from anyone, I found this method with my own research, since then my safe has not written off, I have not rushed and closed any of my positions.

Experiment with small amounts as much as you can, applying it correctly and with a little math, you'll be sure to see the benefits.

Your criticism and advice comments will be useful for us to improve each other.

Respects

Possible S&P500 bottom, and wealth redistributionTechnical:

S&p500 holding critical support (yellow ema), a possible bottom will be 503EMA or circle marked in the chart, if Williams AO does its crossover, prepare for vacation.

Fundamental:

Rate hikes are the least of the worries, everything seems bearish. The only hints of hope are the US unemployment rate below 4% (somehow low), and the Ukraine war. NATO and US were in decadence before it and Putin fell in their trap invading an useless country geopolitically speaking. Us is redefining it's status quo by making another war, but this time they're not fighting it directly, will be that cheaper or expensive?

Opinion:

Every TV clown educator has been posting their bearish bias and i won't be the exception, everybody is right when markets are trending (bullish or bearish), the only thing they don't know it's where the bottom (or top) is, they will keep selling useless trading signals, but the thing is there won't be business anymore, the golden era of scamming people is over, at least for now and for the next years, even brokers (market makers) are facing financial issues and we'll see bankruptcy so it would be a great idea cashing out your assets if you don't want to lose it all. It will be a great depression tier freefall, a chud's and a poljack wet dream. But it won't be like that neither. The water they're storing will end mouldy, the ammo dusty they will use just one bullet ;) and the shinny rocks seized or buried somewhere in the dirt. An anarchist dystopia is unrealistic in a country like the US or any west one, worse things happens in third world countries on a daily basis and even so, people manage it to live their lives almost on a normal way but they're too dumb to realize, they are so used to their consumist way of living they think the world ends when they won't find their favorite snacks on a Wal-Mart or any supermarket. Will be a hard time for US citizens, but what's surprising me is how people are realizing now we are in a recession we were already years ago, the signals were pretty obvious: inflation, expensive housing, lots of homeless in top tier cities, r****ds and illiterate people making millions (WSB, Crypto, meme stocks). Will be a healthy recession and a healthy wealth redistribution to the smart hands.

September 2 BTCUSD BingX Chart Analysis and Today's HeadlineBingX’s Bitcoin Chart

According to The Block Research, Bitcoin futures trading volume across exchanges for August came in at $941.5 billion, which is Bitcoin futures' lowest month by trading volume since November 2020. Bitcoin is down 0.42% over the last 24 hours and fell to an intraday low of $19,560.00. The market is anticipating tomorrow’s non-farm payroll report from the U.S. Bureau of Labor Statistics and the figure is expected to show an increase of 300,000 jobs. If the figure is underperforming the expectation, we could see the price decline further. Conversely, if the figure is better than the expectation, the BTC/USDT pair could rally to the 20-day exponential moving average (EMA) ($21,196).

Today’s Cryptocurrency Headline

Celsius Files to Return the Funds of Custody Clients

Crypto lending platform Celsius Network filed to return custody holders' funds to them early Thursday. Celsius said "unlike Celsius customers using its Earn or Borrow products, customers with custodial accounts still maintain ownership of their crypto assets. Celsius is merely acting as the storage provider. Therefore, these funds belong to the customers, not to Celsius' estate." In a separate hearing, it will address ongoing questions about its efforts to restructure and relaunch its operations. The Bankruptcy Court for the Southern District of New York, which is overseeing the case, scheduled a hearing for Oct. 6 to discuss the matter.

Disclaimer: BingX does not endorse and is not responsible for or liable for any content, accuracy, quality, advertising, products, or other materials on this page. Readers should do their own research before taking any actions related to the company. BingX is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods, or services mentioned in the article.

VGX Bankruptcy!VGXusdt , Bankruptcy was announced

It is expected that there will be a heavy fall ahead

We have to wait

If the support lines are broken, a sharp fall is coming