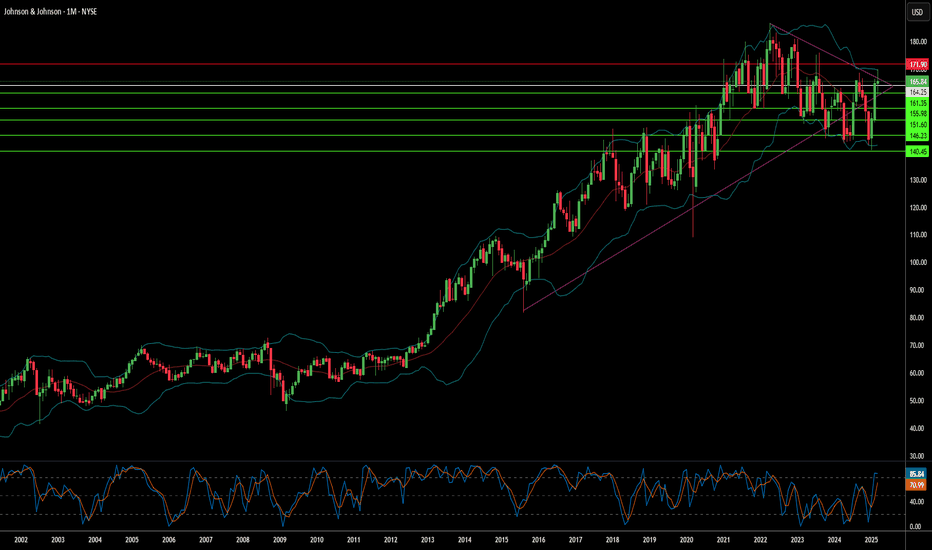

Cracks Appearing in J&J's Armor?Johnson & Johnson, a long-established leader in the global healthcare sector, confronts substantial challenges that raise significant questions about its future trajectory and stock valuation. Foremost among these is the persistent and massive litigation surrounding its talc-based baby powder. With tens of thousands of lawsuits alleging links to cancer, the company's strategy to manage this liability via bankruptcy has been repeatedly struck down by courts, most recently rejecting a $10 billion settlement proposal. This forces J&J to potentially face over 60,000 individual claims in court, introducing immense financial uncertainty and the prospect of staggering legal costs and damages.

Compounding these concerns is mounting scrutiny over the company's historical and recent marketing practices. A federal judge recently imposed a $1.64 billion penalty against J&J's pharmaceutical arm for misleading marketing of HIV medications, citing a "deliberate and calculated scheme." This follows earlier multi-million dollar settlements related to alleged improper financial inducements paid to surgeons for orthopaedic implants by its DePuy subsidiary, and tax disputes in India over questionable "professional sponsorship" expenses tied to similar activities. These incidents depict recurring legal and ethical entanglements with significant financial penalties and reputational harm.

Taken together, the unresolved talc litigation, substantial financial penalties from marketing violations, and persistent questions regarding ethical conduct create considerable headwinds for Johnson & Johnson. The cumulative impact of ongoing legal battles, potential future liabilities, and damage to its corporate image threatens to drain resources, divert management focus from core operations, and erode investor confidence. These converging factors present tangible risks that could exert significant downward pressure on the company's stock price moving forward.

Bankruptcyrisk

Is iRobot's Bankruptcy the End or a New Start?iRobot, the renowned maker of the Roomba robotic vacuum cleaners, now finds itself in a precarious financial situation marked by significant debt and dwindling liquidity. Once a symbol of innovation, the company has been battling mounting losses and a challenging cash crunch, raising serious concerns about its ability to continue as a going concern.

The collapse of a high-profile acquisition deal with Amazon—derailed by European antitrust authorities—has compounded iRobot’s woes. The termination of this deal led to a dramatic plunge in share value and market capitalization and intensified investor skepticism, leaving the company with a heavier debt load and forcing it to consider strategic alternatives such as refinancing or selling assets.

Facing regulatory pressures, shifting market dynamics, and the human cost of necessary layoffs, iRobot’s future now hangs in the balance. This unfolding crisis invites investors and industry observers to reflect deeply on broader questions: Could a strategic overhaul pave the way for recovery, or does this signal the end of an era for the iconic brand?

RAD - Is there such a thing as a safe SHORT?If there was ever a thing such as a safe short- I think it would be Rite Aid (RAD)

As shown on a monthly chart, RAD triple topped in 2015=2017 and has been in a decline

every since. It has shed 90% of its market cap in the intervening 6-8 years. Now, it is

fundamentally fighting for survival. This is because as a weaker drugstore retailer and

the rise of Walgreens, CVS and others as well as RAD's role in the opioid epidemic

( I have insider knowledge) RAD is now filing for bankruptcy protection against

claims and litigation which will vastly outstrip its liability protections. All confirmations

on the monthly chart ( high validity given the time frame) considered in context, RAD

is near to its death bed. The judge will be ing the rights of shareholders against the rights

of litigants ( which include Medicare, Medicaid and state governments). The shareholders will

loose and loose very badly. I will go short in a stock trade and take a large put option position.

There is no need to buy call options here for backside protection. The writing is on the wall.

Gold TradingGold mid-term swing idea we are currently looking at.

The Two setups provided are to account for the recent fundamental activity which caused havoc on the global markets as risk on mode ushered investors into buying #Gold (#XAU ), and other assets like #JPY as an example.

Markets have priced in a possible risk scenario where $CS (Credit Suisse) one of the G-Sibs files for bankruptcy.

This event has a high impact on the markets due to the significance of Credit Suisse.

Today 15th March 2023 the Saudi National Bank have announced that they won't be able to support Credit Suisse further. As the bank itself has low deposits due to depositors rushing to withdraw their money the bank is on the brink of bankruptcy.

At the time of writing this post, the Swiss Government is in talks with Credit Suisse discussing a possible bail-out.

The current interest rate hikes have pushed many banks close to or over bankruptcy and due to the Fractional Reserve banking the banks have very low liquidity if any at all on their hands to cover a liquidity crunch. For example depositors en-masse run to the bank to withdraw their funds.

To learn more and keep informed about Global Economics, follow our TradingView, and don't hesitate to message us!

Join Us today to stay ahead!

Any questions?

Don't hesitate to reach out to us! We are here for you!

If you'd like to reach out to the Founder personally you can! By finding him on TradingView: im_MrTony_

Thank you for your time and contribution to this post! If you'd like to see more don't forget to leave your ideas in the comment section and boost/like our post!