First dip into Institutional TradingI did personally did not take this trade. After watching videos on learning how banks and institutions trade, I decided to try and mark out liquidity zones on Gold and drew my analysis. In this process, I realized that these moves happen all the time in the market and everything started to click. I intend to become more well-versed with institutional trading concepts and eventually take action on potential trades I see in the market. I haven't made one yet but I feel like a well thought-out, solid trading plan would help me immensely and get me where I want to be. This style of trading is super eye-opening and only convinces me to improve.

- Who wouldn't want minimal draw-down and and high reward??

- Sniper entries all day.

- I'll always be a student the market. Cheers ya'll.

Banks

Deutsche Bank LongNYSE:DB

Entry - $7.60

Target 1 - $8.30

Target 2 - $9.65

Target 3 - $12

Stop loss - $6.79

DB is at an important Fib level as well as showing Bullish Divergence.

Be aware that this is a contrarian play and a countertrend trade. However, this area has a good chance of being a medium term bottom and we might be catching a trend reversal here which can be very powerful.

I plan on taking a 100 share position and selling calls against it on the way up as we hit important fib levels/moving averages.

Trade at your own risk and remember, this is not financial advice and I am not a financial advisor. Do your own research and due diligence.

AUD/CAD - DON'T DO IT!!... Don't go long!... YET!!4 Previous touches on that trend line, and now some bullish candles appearing. I bet a lot of people are wanting to join in right about now. And if you are tempted would your stop loss not be where I have put the trade prediction?

Well if I can see that, big banks and institutional traders who get paid a lot more than me can see it.

Apples for the taking (I think that is the quote).

Don't feed the banks pockets, feed your own!

SA BANKS falling wedge?Banks selloff lately has been big. Is this a potential falling wedge on the banks?

GBP/NZD - LONG... Did you just get stopped out? Here's whyDid you just hand back over some money to the market after what you thought was a great entry? But why, that "support" looks fantastic? You might have thought;

Multiple touches in the past, strong zone.

Price created some nice bullish Price Action, it must be bouncing off the support.

We had a huge strong move up not too long ago.

This is accumulation within that strong move now is a good entry.

Lets enter and place our stops underneath that strong zone, surely price will fly!

All the banks and the big investors see is a nice zone full of stop losses, great liquidity for the taking. Why would the banks try and fill their massive orders at a worse price, when they can manipulate it downwards and gain a much much better entry.

Trade smarter not harder. Follow the big money in the markets. Wait until the liquidity (stops) have been cleared out, then enter!

Barclays - Heading higherBuy Barclays (BARC.L)

Barclays PLC is a global financial service holding company. The Company is engaged in credit cards, wholesale banking, investment banking, wealth management and investment management services.

Market Cap: £29.60Billion

Barclays appears to have completed an inverse head and shoulders bottom pattern back on the 11th of October 2019. The shares continue to hold up well as a Conservative win at the upcoming election remains the most likely outcome. the medium-term target is up at 200p.

Stop: 163.65p

Target 1: 181p

Target 2: 193p

Target 3: 200p

Interested in UK Stocks?

Join our free Telegram channel for up to date analysis on the best main market opportunities in the UK right now - t.me

XAU LONG IDEAPotential reaction off of an institutional play with the yellow zone highlighted, we may see this move happen for multiple reasons such as also being in my kill zone area which is between 62%-88%.

This trade may happen before market closes however most likely next week let keep close eyes on it and if you see an opening take it.

This is a nice 3:1 ratio trade that can pay more than it can hurt, always take partials out of your trade along the way, especially if you are new to the market and get into moments where you question yourself if you should close your trade or not,.. thats when you know you SHOULD be taking partials and most certainly moving your stop loss into profit accordingly .

The link in my bio i explain more about how i view the market for its opportunities.

Learn-Interact-Trade

Lit Capital

EurAud Sell Opportunity I believe EurAud will drop simply because it’s formed a lower low and a lower high on the daily timeframe, hence a bearish structure.

The reasoning behind my entry, is because there was a liquidity capture with that institutional candle (highlighted yellow candle), clearing equal highs (highlighted red ish).

The specific entries are at the body and 50% of that institutional daily candle where the banks will mitigate their positions, which also aligns within my Fibonacci kill zone.

STOP HUNTING- Institutional trading,beat the banks!. AUD/CAD-1hrAs we can see the black area indicates a potential zone where retail traders are tricked into going long by the illusion of fake support. Large institutions and experienced traders know most novices will have their stop losses just below this level. Institutions and banks manipulate these levels and take out stop losses to gain liquidity in the market. Once a stop hunt has occurred we enter a trade in the direction that we are fundamentally inclined to do so.

LIVE STOP HUNTINGThis could potentially turn into a stop hunt. As we see price created the illusion it was bouncing off support (see the blue arrow), and has now returned and broken below. 95% of retail traders are told to buy at support and sell at resistance.Guess where they are also told to place their stops? Right at the dollar sign. Liquidity the banks need to fill their enormous order. The cycle repeats and 95% of traders continue to fail.

LIVE STOP HUNTING - RESULTHere is the follow up to the previous post and the prediction I made. NZD news helped reach the target faster. Amazing R:R of 6:1 as the stop hunt was very shallow, but that's basically how it is done. All the people who went long earlier and got stopped out must be feeling pretty sad now. I'm happy with this trade.

$JSEFSR Firstrand looking tired?Firstrand is starting to look tired here having reversed off the first big resistance level (R69-R70) as well as trend line connecting the stocks all-time high from MAR 18.

My biggest concern is that the rally from the lows in August has taken place on declining volume which doesn't give me a great deal of confidence in this rally. Secondly we are starting to see divergence develop on the RSI (price making new highs but indicator making new lows) which could be indicating a further correction in price.

We have reversed off the first massive horizontal resistance now at R69-R70, but also keep an eye on the secondary resistance level between R71-R72. Should the stock continue to roll over, important support levels on the downside to keep an eye on are R64.75 (200dma), R62, R60 and R55.

Repo Madness Continues!www.newyorkfed.org

Repo has been the talk of the town lately, and the Federal Reserve has so far downplayed the issue at hand.

Fed chair Jerome Powell did mention this problem in his last FOMC press conference, but again told journalists and viewers that this is not quantitative easing (QE).

Repo and QE both inject money into the system. he difference is really new money vs old money.

In QE, the central bank purchases bonds as a way to inject money into the system as this purchase sends money to the primary dealers (banks). This is done to keep interest rates low. Bonds and yield have an inverse relationship: when bonds go up, the yield drops and vice versa.

With QE you can get to a very crazy environment (one that economic students in post secondary for the last 10 years know nothing about as it was not part of the curriculum) which is negative interest rates. This is what we see in Japan, Europe and Switzerland. Basically the central banks in those countries have killed their debt markets. The central bank is the only one buying bonds at the auctions because no one in the right mind would buy an investment knowing they will collect less money than they invested when the bond matures. Now a days bonds are being traded because you can find a bigger fool who will buy them.

I have outlined this as the problem with real estate and stock markets around the world rising as there is nowhere to go for yield now. Central banks have forced money away from bonds to chase yield to those aforementioned markets.

The second way to inject money into the system is through repo.

Banks have to keep reserves with the central bank. Generally when transactions are done, the reserves held in the central bank changes.

For example Bob banks with Bank A and buys a coffee from Jen who banks with Bank B. When the transaction is through what really happens is that Bank A’s reserves with the central bank is credited (reduced) and Bank B’s reserves are debited (increased). This happens on a daily basis at a time when all balance of payments are settled. Of course if both bank with the same bank, then nothing changes, the mechanism still works the same way.

When banks need to borrow money for the short term, they can borrow from the reserves of other banks at the Fed Funds rate (for the US). When other banks do not have much reserves left over, repo is needed to inject more money to keep the interest rates low.

Interest rates are really the price of money. If there is a lot of money and banks can lend due to the environment, then interest rates can be low.

If you get into a period of time when nobody wants to lend money because of big risks, uncertainty etc and there is not much cash being floated into the system (people want to hoard money) then the price of money (interest rate) has to go up in order to entice people and banks to part with the money.

So when interest rates spiked up to 10% in the US, it was because there was no money left in the reserves. A really scary situation.

When the Federal Reserve injects money through repo, they take collateral from the banks. The Fed says this collateral is US treasuries from the banks. However, I would not be surprised if toxic assets are being passed to the Fed so the banks do not have to take a loss on something they know will lose.

In this way the difference between QE and repo is new bonds (bought up at auction) vs old bonds (collateral that the banks already have and is exchanged).

Both operations inject money into the system. If you follow my work, I have outlined why this operation will not be named QE because it would illicit a confidence crisis.

QE was supposed to be a one time desperate policy initiated by the central banks to prevent another 1920-30’s type depression. There was so much bad debt in the system that it could not be allowed to fail.

Forward to today and there is more debt now. The real economy has not really improved. Financial engineering by keeping interest rates low, have made people go into debt to buy things they really can’t afford. Economic growth is not based on real fundamentals.

If QE is brought up again, then people will realize that QE actually did now work. Central banks were wrong, their monetary policy did not work. Once people understand this, the realization will be that we are stuck in a QE and 0% interest rate environment forever.

Central banks had no plans to raise interest rates and get off of QE. We are now in a managed economy and central banks will morph into the BUYERS of last resort as they cannot allow things to fall. Not only will they have to buy bonds to keep interest rates low, they may need to buy other assets just to keep the system propped.

We are already seeing the Bank of Japan and Swiss National Bank buying stocks and ETF’s.

In other words, central bank balance sheets are expanding.

New York Fed Senior Vice President Lorie Logan posted an article titled “Money Market Developments: Views From the Desk”. It was quite something.

So when repo began, the Fed said they were promising an average about 45 billion dollars a day to provide liquidity to the banks.

They said it was only temporary, but then this number turned to 120 billion a day, with the program being extended from October 24th, until next year.

This article indicated that the average repo daily is now 190 BILLION per day. Take a look at the chart (figure 3) at the top of this post and you can see it is pretty close to this average. This is possible because the US Dollar is the reserve currency so there is an artificial demand for it meaning the US can print as much as they want and do not have to care about deficits…this is why China and Russia are attacking US Dollar demand. Both Europe and Japan can do this type of monetary policy too because they export a lot of goods meaning other nations buy Euro’s and Yen for trade…creating demand for those currencies which warrants printing.

To put this number into perspective, the stock market cap for Goldman Sachs is 79 billion, for JP Morgan it is 407.7 billion and for Wells Fargo it is 228.3 billion.

Once again, I have mentioned how this will be indefinite. It seems like something has broken and the Fed may be losing control of the system. They will throw as much money as they have to in order to keep this propped up. Balance sheets are expanding. They have pretty much erased all the progress from Quantitative Tightening for 3-4 years in less than 3 months with this repo madness.

Central banks are stuck, and it is all about maintaining confidence in the system. They have to appear as if they know what they are doing and everything is okay.

At this blog, I have been warning about this confidence crisis. I believe we are very close.

Right now the market believes the Fed. The Fed is making it appear as if they are pausing on their interest rate cuts. However, I believe they will cut in December/January.

Once this cut happens, people will begin to realize the game. Also, the Fed is running out of excuses. They have to maintain this cutting rates in a strong economy narrative by using geopolitical factors. In the end they are cutting rates mainly for three reasons 1) they know a recession is coming, 2) as a way for government and the public to service their debt loads which are increasing, and 3) perhaps the most important, to attempt to weaken the US Dollar (although I have outlined through my work why the Dollar will likely go higher and how this is what will cause problems for the Fed…perhaps lead to another Plaza accord type deal). The problems in the world get worse as the US Dollar gets stronger.

So again everyone, not a dull time to be alive. Repo madness continues and it shows no sign of stopping.

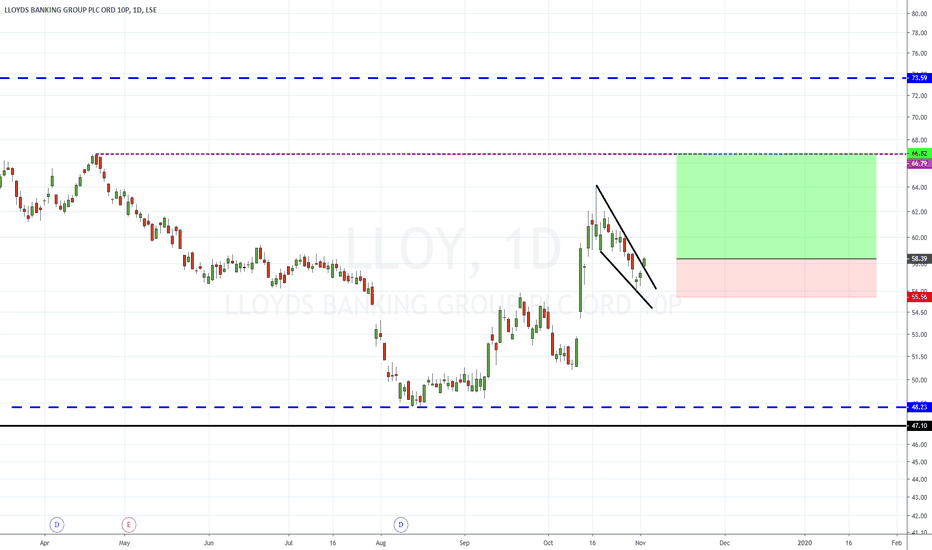

Lloyds - Banking on a move higher.Buy Lloyds Banking Group (LLOY.L)

Lloyds Banking Group plc is a provider of financial services to individual and business customers in the United Kingdom. The Company's main business activities are retail and commercial banking, general insurance, and long-term savings, protection and investment.

Market Cap: £40Billion

Lloyds gapped higher this morning and looks set to close outside of the wedge pattern that has formed on the daily chart. A continuation higher looks possible. The next major resistance to target is 66.8p.

Stop: 55.5p

Target 1: 66.8p

Target 2: 73.50p

Target 3: 80p

Interested in UK Stocks?

Join our free Telegram channel for up to date analysis on the best main market opportunities in the UK right now - t.me

RBS - Set to correct lower?Sell RBS (RBS.L)

The Royal Bank of Scotland Group plc (RBS) is a banking and financial services company. The Company provides a range of products and services to personal, commercial, corporate and institutional customers, through its subsidiaries, The Royal Bank of Scotland plc and National Westminster Bank Plc (NatWest), as well as through other brands, including Ulster Bank and Coutts.

Market Cap: £29.13Billion

RBS appears overdone in the very short term. The shares have benefitted significantly form the rally in GBP over recent weeks with a 30%+ rally from the October lows. The shares have rallied into an unfilled gap at 247.4p, which was created on the 26th April 2019. This also corresponds with a 78.6% Fibonacci retracement level from the highs at 266.1p on the 17th April to the lows at 176.6p on 15th August 2019. The looks to be a reasonable level to take some short-term profit or initiate some speculative selling. The bearish looking candle on the daily chart adds further weight to the bearish argument.

Stop: 250.5p

Target 1: 232p

Target 2: 217p

Target 2: 197p

Interested in UK Stocks?

Join our free Telegram channel for up to date analysis on the best main market opportunities in the UK right now - t.me

BITCOIN COULD REPLACE BANKSIn this video I show a key level of support for BTC. It coincides with a 3-day ATR trendline for the north. I'm not saying Bitcoin can't go south.

I deal with a far bigger issue, where in the heat of a financial crisis banks close. This has happened several times before (and Google is your friend on this point).

There is a lot of chatter out there from very reputable experts about a serious banking crisis approaching. Stop - I don't listen to sensationalist nonsense.

The 'big reset' is now a realistic probability for people in the know. I'm talking about people who understand the global financial system to the core. The reset will mean that not only stock markets meltdown but the money system globally is frozen. What are you gonna do when there is no money? Well, history has shown that people went back to bartering.

At the moment Bitcoin functions as a store of value - even if unstable. The banks can't lock down Bitcoin. When the banks freeze up people will exchange BTC value for goods and services. That's just common sense. Not everybody will have Gold to exchange and physical gold is not available to everybody. But BTC is available to everybody right now.

In the lead up to the banking crisis you will see BTC rocket north. How? Insiders always know and leak what's coming.

Get prepared. I'm not saying that 'you' should put all your money into BTC. I'm saying a reasonable store of BTC is a good back up plan if worse comes to the worst.

Disclaimers: This is not financial advice - even if so construed. It is opinion only. Your losses are your own. Sue yourself if you lose your money.

Look to grab the bounce on Ally FinancialQuite possibly Ally Financial will bounce from its current price after dropping on an earnings beat. However, I am looking for it to bounce from the high-volume node at 30.01 tomorrow, and I've got a buy order set at that price. Ally has an attractive P/E of 8 and has a 95/100 valuation score from S&P Capital IQ. It faces some political risk from a possible third interest rate cut this year, but should perform well in the long term.