Was the Price of Avoiding a Bailout Worth More Than Just Money?In the wake of the 2008 financial crisis, Barclays faced a pivotal decision that would echo through the halls of financial history for more than a decade. The bank's recent £40 million settlement with the Financial Conduct Authority (FCA) brings to light a fascinating intersection of survival strategies, regulatory compliance, and the true cost of maintaining independence during a financial storm.

The saga revolves around Barclays' £11.8 billion capital raise in 2008, which successfully helped the bank avoid a government bailout – a feat that distinguished it from many of its peers. However, the intricate web of arrangements with Qatari investors, including alleged preferential fee structures and undisclosed payments totaling £322 million, raises profound questions about the delicate balance between institutional survival and market transparency. The case became a landmark in British financial history, marking the first time a major bank's CEO faced a jury over financial crisis-related events.

What makes this case particularly compelling is its broader implications for corporate governance and regulatory oversight. Despite the FCA's findings of "reckless" conduct and lack of integrity, Barclays has emerged as what the regulator acknowledges is "a very different organization today." This transformation, coupled with the complete acquittal of all individuals involved, including former CEO John Varley and three other executives, presents a complex narrative about institutional evolution and the challenges of judging crisis-era decisions through a post-crisis lens. The resolution not only closes a chapter in Barclays' history but also serves as a powerful reminder that in the world of high finance, the line between innovative survival strategies and regulatory compliance can often become precariously thin.

Barclays

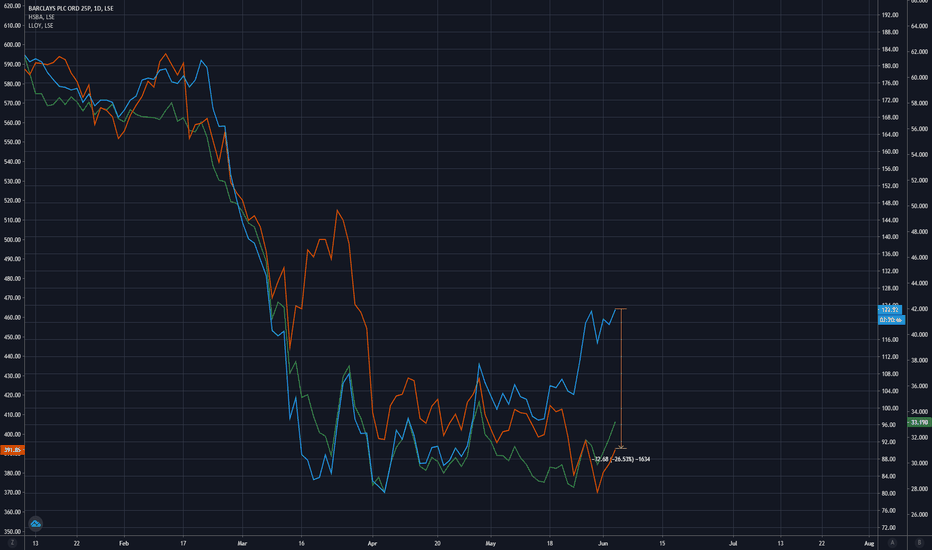

The worst is over for Barclays Bank?One of the Uk's 'big four' banks, Barclays bank is looking to make a comeback after being in a corrective phase(or downtrend) for more than a year and a half.

The stock made an impulsive up move from the march 2020 bottom and the same went on till Jan 2022.Since then however the stock entered the 'wave 2' correction and has remained in it for more a year and a half.

At the most recent Oct 2023 low however, the corrective wave counts for the stock seem to have come an end and it should be expected to now start a fresh 'wave 3'.

The stock held its 61.8% retracement on three different occasions and managed to reverse from it almost immediately every time it visited it.

On the way up the stock faces its first hurdle from the falling trendline at 155 and then at previous 'x' wave top at 166.44 respectively.

On the downside the low of 128.12 is crucial for the stock.

The stock is expected to gain momentum upon closing above the falling trendline.

It should also be noted that Barclays is a significant component of the FTSE 100.

The 'wave 3' projection is expected to take the stock from current levels to around 250-260 mark.

Note*- This chart is for educational purpose only.

PSNY Giant Falling Wedge (reversal) Weekly & DailyFalling Wedge Pattern for PSNY chart, Polestar

In this chart analysis, it's evident that there's a potential buying opportunity if we manage to reclaim the indicated level (previous gap after Earnings). This could take 30 to 45 days, as institutional investors are not very interested in buying this stock.

However, it's crucial to exercise caution and patience, especially considering the need for a CMF (Chaikin Money Flow) reversal within the green zone.

While there's a possibility of a lower buy-in, it's important to remember that there are no guarantees of a bounce at this stage.

Traders should keep a close eye on CMF indicators to confirm a favorable entry point before taking action.

In addition, is there a potential positive divergence in the PPO (in formation)

Barclays Bank: Descending Triangle Visible on Quarterly ChartBarclays is currently trading within a Descending triangle that is visible on the Multi-Month Timeframes. It has had some wicks below the Demand Line already, but has yet to truly break down.

Whenever it decides to truly break down, there are really no supports below it, so I think it will go and make new all time lows and reach one of the Fibonacci Extensions below; which would take it below a dollar.

Barclays gains to be capped.Barclays - 30d expiry - We look to Sell at 172.38 (stop at 178.52)

175 continues to hold back the bulls.

Broken out of the Head and Shoulders formation to the upside.

The primary trend remains bearish.

Bespoke resistance is located at 173.

Early optimism is likely to lead to gains although extended attempts higher are expected to fail.

Resistance could prove difficult to breakdown.

Our profit targets will be 157.12 and 152.12

Resistance: 162.50 / 167.00 / 173.00

Support: 155.60 / 150.00 / 145.00

Disclaimer – Saxo Bank Group.

Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis , like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis , as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

BARC to break from IH&S.Barclays - 30d expiry - We look to Buy a break of 152.62 (stop at 145.44)

We are trading at oversold extremes.

A bullish reverse Head and Shoulders has formed.

Short term bias has turned positive.

Prices have reacted from 132.06.

A break of the recent high at 152.22 should result in a further move higher.

Our outlook is bullish.

Our profit targets will be 170.78 and 175.78

Resistance: 151.00 / 160.00 / 170.00

Support: 143.00 / 140.00 / 132.00

Disclaimer – Saxo Bank Group.

Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis , like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis , as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

Barclays has no bulls at all. Yet.Barclays - 30d expiry - We look to Buy at 140.42 (stop at 134.98)

Price action continued to range between key support & resistance (140.00 - 175.00) and we expect this to continue.

We are trading at oversold extremes.

Short term momentum is bearish.

Early pessimism is likely to lead to losses although extended attempts lower are expected to fail.

Support is located at 140.00 and should stem dips to this area.

Support could prove difficult to breakdown.

With signals for sentiment at oversold extremes, the dip could not be extended.

Our profit targets will be 154.48 and 159.48

Resistance: 150.00 / 155.00 / 160.00

Support: 144.00 / 140.00 / 135.00

Daily perspective

Disclaimer – Saxo Bank Group. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis , like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis , as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

Barclays: Money not in the bank Barclays

Short Term

We look to Sell at 171.28 (stop at 176.42)

Previous resistance located at 170.00. Although the bulls are in control, the stalling positive momentum indicates a turnaround is possible. We look for a temporary move lower. We therefore, prefer to fade into the rally with a tight stop in anticipation of a move back lower.

Our profit targets will be 160.82 and 151.60

Resistance: 170.00 / 175.00 / 195.00

Support: 160.00 / 151.00 / 143.00

Disclaimer – Saxo Bank Group. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis, like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis, as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

Barclays (USA: $BCS) Showing Bullish Divergence On The Daily! 🌅Barclays PLC, through its subsidiaries, provides various financial products and services in the United Kingdom, Europe, the Americas, Africa, the Middle East, and Asia. The company operates through Barclays UK and Barclays International divisions. It offers financial services, such as retail banking, credit cards, wholesale banking, investment banking, wealth management, and investment management services. The company also engages in securities dealing activities; and issues credit cards. The company was formerly known as Barclays Bank Limited and changed its name to Barclays PLC in January 1985. Barclays PLC was founded in 1690 and is headquartered in London, the United Kingdom.

CAUTION: VXX Is Broken!The pricing of the VIX futures tracking ETN VXX no longer reflects reality.

Barclays has halted new issuance of both the VXX and OIL ETNs.

Existing shares of VXX are being bid up far beyond the movement in the underlying futures market.

As I mentioned in a previous post, (linked below), I believe the VIX is setting up for a breakout to the upside.

I strongly caution against trying to trade VXX right now. For one, trading has been halted repeatedly, which may happen again, and you NEVER want to get stuck in a position that you can't trade out of. For another, VXX pricing is no longer tracking the VIX futures, so it's impossible to predict how VXX will respond to a significant move in the VIX futures.

When the price action in a market is irrational, technical levels become irrelevant, fundamentals become irrelevant, and you can't expect logical price movements from the market. For example: See the recent price action in crude oil futures (CL1!).

One of the most valuable skills in trading is recognizing when not to trade.

VXX right now is like a crate of 100 year old dynamite sweating nitroglycerine in the desert heat. DON'T TOUCH IT!

Stay safe out there traders!

Barclays Banking on a Move Higher? Barclays - Short Term - We look to Buy at 187.74 (stop at 177.66)

Preferred trade is to buy on dips. Previous support located at 190.00. Prices expected to stall near trend line support. Levels close to the 50% pullback level of 187.16 found buyers. The primary trend remains bullish.

Our profit targets will be 219.38 and 227.80

Resistance: 200.00 / 210.00 / 220.00

Support: 190.00 / 175.00 / 160.00

Disclaimer – Saxo Bank Group. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis, like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis, as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

DNN bet into the futureDNN had an sucessful breakout after an triangle pattern and the trend will continue.

Also check latest news from Barclays:

Barclays believes investors are overlooking a key source in the push to decarbonization: nuclear energy.

Barclays notes that nuclear output is not influenced by weather conditions and seasonality; nuclear waste is less than the waste from retired solar panels, wind turbine blades and lithium ion batteries; and nuclear power does not need the storage solutions required by renewable energy.

In the big safety issue, all nuclear accidents have occurred in earlier-generation plants, Barclays says.

"Advanced nuclear reactors and proposed small modular reactors do not rely on power to drive safety systems. Instead, they depend on the laws of physics (gravity, convection, heat transfer) to protect the core in the event of an accident. These designs should provide even better safety statistics than the historical comparables," Barclays says.

In nuclear news today, Bill Gates' advanced nuclear reactor company TerraPower LLC and PacifiCorp, owned by Warren Buffet's Berkshire Hathaway (BRK.A, BRK.B), have selected Wyoming to launch the first Natrium reactor project on the site of a retiring coal plant.

Price target 2$!

USDCHF D1 - Short SetupUSDCHF D1 - Bit late to the part posting this, apologies. Very similar structure and paced moving pair here, DXY is at a key level to monitor, retesting after breaking upside of a trading zone, we covered all of this in the rundown, but take a look here too if you haven't got a chance to watch the video.

BARCLAYS CLOSED +1.7% GAIN! SELLS NOW VALID TO ENTER!!JUMP IN THEM SELLS TEAM! BARCALYS NOW VALID TO ENTER FOR A SELL!

Stocks strategy file now released! below youll see our list of stocks we have found optimal settings for!

Amazon

Apple

Tesla

Cineworld

Facebook

Netflix

BABA

US30

DAX - DE30EUR

US500

NAS100

SPX500USD

Google

ROKU

UK100

BA - Boeing

Zoom ZM

Barclays

What is our strategy?

Our strategy is a trend following strategy - that is coded in pine script to use with the trading view platform - the entries are shown automatically! NOTHING is done manually, it can be used on any instrument and time frame. However, we have hard coded specific parameters for when trading the H1 time frame, so we can back up over 4200 previous trades to confirm our edge from previous data. This gives us confidence in execution and belief in our trading strategy for the long term.

The strategy simply sits in your trading view, so you will see exactly what we see - the trade, entry price, SL and multiple TPs (although we hold until opposite trade as this is the most profitable longer term plan), lot size, etc.

This could be on your phone trading view app, or laptop of course.

The hard work is done, so we have zero chart work time, no analysis, no time front of the chart doing technical analysis - technical analysis is very subjective - you may see different things at different times - how do you have a rigid trading plan on a H&S shoulder pattern? Your daily routine, diet, sleep, exercise can affect what you 'see' and your decision making, this doesn't happen when a strategy is coded like this; what we do have is a mechanical trading strategy...

What does this mean?

It means, we are very clear on our entry and our exit and use strict risk management (this is built in - put in your account size, set your risk in % or fixed amount and it will tell you what lot size to trade!) so we have no ego with our position and we are comfortable with all outcomes - its simply just another trade. This free's our mindset from worry and anxiety as we take confidence from knowing our edge is there and also that we have used sensible risk management.

The strategy itself can be used as a live trading journal too!

BARCLAYS PLC and huge chance to choose BUY position right nowHello, here is my analysis, where you can see some interesting points of detail about BARCLAYS PLC. There is some explanation, about COVID-19 impacts and bullish position, where you can choose a long term trading position.

Please, don't hesitate to #share your opinion and #LIKE my idea. Thanks and GL

BARCLAYS 2.0 - STILL STRONGBy popular demand, here are my revised predictions for Barclays over the next month or so.

I will mark this chart as long, but READ THIS DESCRIPTION . I am not indicating that you long from the get go. Please read my thesis to see when and how you should enter these positions.

Barclays hit the initial target I set almost instantly. From there, it's been consolidating, choosing where to go from that area. To me, it seems as if it'll be down, and then up. Stocks don't tend to go up, then fall slightly, and then boost right back up. Tying in with the COVID-19 pandemic, I don't think it's likely that Barclays has the heart to fight through the terrors as of yet.

We can see how well Barclays followed the trendline that I set out. It hit is almost perfectly, but then proceeded to push back upwards from there on.This leaves us in a tricky position.

I can only post one thesis on a chart, although I actually have two.

Number one is one NOT on the chart. The thesis for this is that Barclays continue their run upwards off of the trendline and touch it one again, but then print a divergence and get out of the hole that they are in. I think this is more unlikely because of the traction needed to get out of the area that they're in. Their chart looks similar to HSBC, in that it's not unlikely that they will fall back into the bottom range. However, if Barclays manage to hold the consolidation period they're in, and print a nice push upwards, then it's safe to say we will hit the first (and potentially second) target with little to no effort.

Now for my second thesis. This is the one that's on the chart. As you can see, I have planted two buying zones on the chart. The reasoning for this is due to the difference between CFD and Stock trading. If you trade CFD's, it's more worth it to wait until the 75% zone. If you buy and hold stocks, it's safer to buy into the 25% zone AND the 75% zone should it hit. Use both zones at your own discretion. My prediction is that Barclays will lose the trendline, get trapped underneath it, and then proceed to fall under the line to the buying zones plotted. From here, it will try and reclaim its previous trend by pushing through the resistance; to which it should partially falter and then succeed, I have not included the resistance on here because if you enter in the two zones plotted, it should be rather irrelevant.

Hopefully this thesis gives some of you a clearer idea on what to do in this scenario. A recovery in imminent, but not immediate.

- 𝙇𝙄𝙉𝘿𝙀𝙇𝙇

Barclays Earnings go LONGBarclays earnings will push the price upwards tomorrow, they will still pay dividends even if their earnings report is weaker than expected. Expect either a straight push to the first target, or a follow along the trend line until the consolidation period is over and the big push out of the range occurs. Great long term hold especially with bullish divergence!