Barr

Short Breakdown of Cardano (ADAUSDT) weekly/daily technicalsLooked over this for a friend. Rowland I would love your feedback in the comments 🫡

I will see my biggest expectation is for this to make it's way into the weekly imbalance range below the weekly Mother Candle we are existing within. The entire crypto market seems to want to revisit some key lows to correct some inefficiently delivered rally ranges (meaning too many pending orders left behind due to price not coming back to grab them, happens when HUGE money places--attempts to place/fill--bulk orders).

We are getting what I think is a temporary bullish correction due to taking of profits at key lows. It is my belief/observation that after correcting the newly minted bearish range (grabbing pending shorts above daily highs--turtle soup I think they call it), we will be able to drive down into the bullish imbalance weekly candle's range.

Let's see how we go! 😈

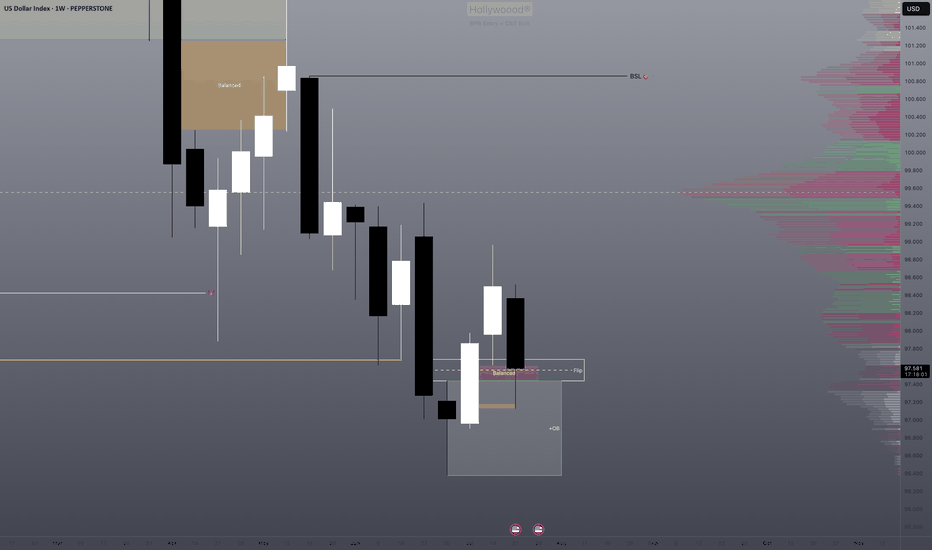

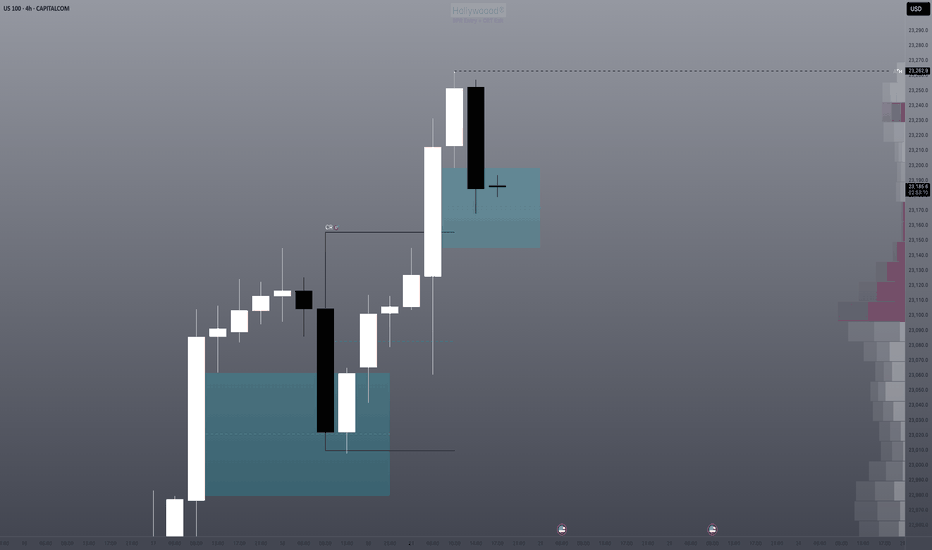

Eur, Gbp & DXY Dynamics: We have reached fair valueWith equilibrium being established we are stuck in an internal liquidity range. We do expect the trending targets to be hit although we are seeing a preliminary shift in structure.

If there was anything I missed in this analysis please let me know. Share this with anyone who may be interested 🙏🏾

PROSBUSD - Bump and Run Reversal Bottom PatternThe bump-and-run reversal bottom is a chart pattern that is a surprisingly good performer in both bull (ranking best for performance) and bear markets (ranking second best). It has a low break even failure rate and high average rise after the breakout. Discovered by Thomas Bulkowski in 1999.

BTC/USD 8-hour Shots at the BARR. Get Down with the Pattern.BTC/USD 8-hour: BARR pattern still on point 💪🏌 and price moving as predicted. Orders should be placed between 23500 and 25k to catch the bottom of the bump in accordance with the 2 descending trendline start points and the conclusion of it at 23500... to catch the reversal.

Carnival Cruise Line: Bump and Run Reversal BottomCCL is Double Bottoming with some very distinct Bullish Divergence on the Monthly Timeframe on both the MACD and RSI and it also has a Lead-In trendline that goes all the way back to 2018. If it breaks above this trend line then it will begin the BARR Breakout which could then take it above the Neckline of the Double Bottom and BAMM us up to the 0.886 Retrace up at $59.65. I personally am trading this via the 2025 LEAPs at the strike price of 10 dollars though i may also get other long dated calls at different strikes later on.

Bitcoin | Bump & Run Reversal Bottom Pattern..!!

#Bitcoin Bump & Run Reversal Bottom Pattern in Daily timeframe Chart..!!

What is Bump & Run Reversal Pattern?

Bump and Run Reversal Bottom (BARR) is a technical analysis chart pattern that is used to identify potential reversal points in an asset's price trend.

It consists of three phases: the lead-in phase, the bump phase, and the run phase.

During the lead-in phase, the asset's price trend is relatively flat and stable. Then, during the bump phase, the price experiences a sharp increase in value, followed by a brief period of consolidation. Finally, during the run phase, the asset's price experiences a sharp decline, which usually marks the bottom of the trend.

The key characteristic of the Bump and Run Reversal Bottom pattern is the presence of a gap between the lead-in phase and the bump phase. This gap represents a period of excessive speculation and creates an overbought condition, which is ultimately corrected during the run phase.

Traders use the Bump and Run Reversal Bottom pattern to identify potential buying opportunities, as the price may be poised to reverse its downward trend. However, like any technical analysis pattern, the Bump and Run Reversal Bottom should be used in conjunction with other indicators to confirm the potential reversal.

Please like the idea for Support & Subscribe for More ideas like this and share your ideas and charts in Comments Section..!!

Thanks for Your Love & Support..!!

PROSBUSD - Bump and Run Reversal Bottom Pattern?Bump and Run Reversal Bottom Pattern

The bump-and-run reversal bottom is a chart pattern that is a surprisingly good performer in both bull (ranking best for performance) and bear markets (ranking second best). It has a low break even failure rate and high average rise after the breakout. Discovered by Thomas Bulkowski in 1999.

Celsius Token Future Potential Bump and Run Price ProjectionIf Cel can get back above the .236 Retrace and then the trendline i think it will make a dash towards the .886 Retrace then the 1.618 Fib Extension.

*This is a Repost of an existing setup on this coin but the chart i used was an FTX chart and ssiunce FTX's chart no longer exists i felt it necessary to repost the same setup but on a different exchange*

BTC BARR FORMATION BTC at the 4H After a month of sideways support broke down in early January. and support has been found around $41250.

what struck me was the BARR (Bump & Run Reversal) formation and is therefore the pattern that continues for now.

I expect that the lead-in line will be a target where the bulls will have to prove themselves to gain ground there to be able to continue up with 2 price targets one based on the start of the Lead-in and the other on the RUN or the outbreak based on the reflection of the longest distance. If the bulls get rejected, it could just be that the bears will prepare another attack to test the $41250.

Keep calm, trade safe and manage your risk.

*(Disclaimer: This is not financial advice)*

BTCUSDT CRAB PRZ Supply to neckline retestHi everyone. I'm watching a probably PRZ in some confluences after a bearish Scott Carney's CRAB pattern figured out. The volume decreasing along the consolidation so-called Bart Simpson indicates institutional price support. In the next two days at least we can expect a distribution phase in the 100-88.6% range of Fibonacci retracement. The 61.8% pivot level can be a TP1 in a reversal breakout of 88.6%. The actual price action reinforces an ideal pullback to touch Head and Shoulders' neckline which can be spiked at this supply sector, as predicted in my past overview "potential pullback...". An expected overbought condition in the next daily coincides with a key level for institutionals to liquidates high leveraged longs by sardines that came in the BARR impulsive breakout.

RDN/BTC IHS/BARR bottom accumulationRDN looks ready to break out of this BARR bottom setup into a bigger inverse head and shoulders pattern on the weekly, then into an even bigger IHS on the daily. Nice bullish patterns!

Both IHS targets and both BARR targets are marked on the chart.

Potential return: ~1200%

COS/BTC Long term Accumulation break out COS has broken out of 504 day accumulation pattern. Similar play to the BARR setups.

Forgot to publish until now but there is a chance it will come back for a retest which could give you a safer entry.