Bartpattern

New Bart PatternA meme develop in the crypto community around this unusual price pattern seen almost extensively in crypto currencies, characterized by its sudden rise in price, sideways movement, then sudden drop which had been widely popular in the entire duration of bear market 2018.

It has become so popular that trader @JamesRkaye made a trending post about it. Check his post by clicking the next image.

Just recently I've been hearing bears here and there for the past two weeks taunting another bart pattern will emerge.

Well times have change, the bart pattern we saw now look like these.

It would be fun to see double barts in the upcoming bull.

Short-term ETH Bart moveWe can see that the upmoves on 4H chart are getting pushed down and the volume is low. This most likely means that the institutions/professional traders are setting up short positions from the bounces, using the liquidity from the retail traders who lose money with FOMO longs and triggered stop-losses.

So from this short-term prediction, ETH will retest $112-$114 area.

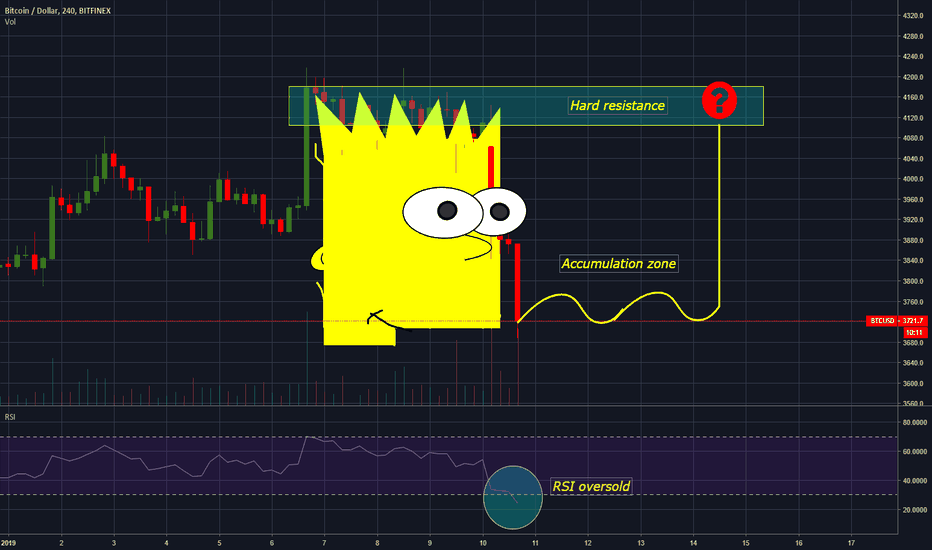

Bitcoin (BTC) Bart Head pattern, it will reverse?Classic crypto Bart's Head pattern

"The reason for these sudden pumps and dumps is likely to burn margin traders, whether short or long, by manipulating the market. While some believe that this is done by the exchanges themselves — which is entirely possible due to the lack of regulations — this might be related to large crypto traders"

Where from here? we will see a revers head after some accumulations?

Or it will go even lower?

RSI is oversold

Volume is only in pumps or dumps

But the history did not taught us anything, cuz everything is possible in crypto world...

Cheers!

@Zekis

BTC Falling wedge in a downtrendHi guys,

I am back after a short winter holiday break with new ideas for your. What's going on with BITSTAMP:BTCEUR at the moment? Up, down, up, down, down... and so on.

Come on guys, let's push this chart a little bit.

What I can see now is a falling wedge in this downtrend. And perhaps we will see a nice breakout on Sunday or Monday morning.

Another idea is that it it a simple Bart formation!? Let's see what the wales will do.

What do you think? Is it going up or down next? Please support me with a thumb up and a comment. I would appreciate this :)

I will try to update this post frequently.

See you guys, trade on, Muckrah

Bart Attracting Volume - Pulling In Short Entry ZoneLooks like the Bart dump out stopped out a lot of bulls which means it will probably be harder for price to get up as far as I was thinking.

I'm moving my region of interest to start shorting back to where I first projected it previously. The lower region is mainly a fib projection of the current bart.

This bart hasn't finished so it may expand lower which would change the fib projection.

I am not even going to attempt to predict the path it will take to get up to the shorting zone. It will probably be a tortuous path of barts and widening patterns.

All that matters is that it get outside the range to produce some kind of good RRR.

As long as it's stuck in this range any trade is probably throwing away money because it's very hard to define your risk with any degree of certainty.

Bart, Head and ShouldersGood day Traders,

As expected, Bitcoin's short-lived rally had short-lived volume to follow through after its big jump on 6 Jan. The bullish inverted head and shoulders has been invalidated, and the bear flag has ultimately failed. It looks like we have a head and shoulders pattern playing out with the right shoulder currently printing as we speak. If we break the neckline support at around $3880, then I'm expecting a +- $160 drop with the target from the neckline being the height of the head from the neckline, which takes us to a short term target close to our $3730 horizontal support to form yet another bart pattern and will bring us back below our SMA50 on the 1D, as has happened on quite a few occasions in the past 6 months where we briefly breach our SMA50 on the 1D then reverse shortly after.

For the mid term, my trade target covered by my previous 2 posts is still active, with a bottom target of $2640.

Previous posts:

BTC/USD BART SIMPSON'S HEAD AGAIN?!!Following the last tendency and taking into account the fact that we have touched the trendline for the third time I will place couple LONG orders with TP around $3950.

There is also a possibility of FLAG formation, so make sure that one of the patterns is confirmed.

WARNING: Ensure that you follow your risk and money management rules!

Bart PatternI know this is very unlikely, we have ema 200 as support at 4.2k, ema 50 on monthly at 3.9k and rsi lower 10 on daily.

But, because there is akways a BUT, this year we have experienced Bart patterns, and I feel like this could be a Weekly Bart (could get us around $1.5k and $1k)..

Don't mind, i know we are already down a lot, but this is a possibility, and everything is possible around here, so just keep that in mind.

Reminder, it's always good to be wrong ;)

Ps : This might be the bottom call idea, just trade safely ^^

Quick breakdown of the "bart" BTC market capturing wave. For those of you who are not familiar with this recurring structure here is a quick breakdown of often how the alts are effected by BTC.

As of late the alts have been trying to decouple from BTC movements however the recent bullish injection that came from BCC over the last few days has had it's chance to permeate through the market.

It's a good opportunity to get a clear breakdown of these small week long time frame market cycles.

You can see from the chart above a break down with arrows of the general process of the market.

We start from a position of low influence of BTC price on the alts... which is usually brought about by steady trend motion for BTC...

From this point if we see movement in the big top coins then usually there is a readjustment of sentiment... People start to go into the top coins...

Soon enough, when the top coins are pumping, then the alts start to pump and take positions...... After which the top coins start going sideways and looking spent...

The altcoins that pumped while the top coins were running up are now in a dangerous position where the sentiment within their price action is more coupled to the top coins motions... and we know what happens next!

The "bart" or square wave type shape of BTC and other top coins...

Effectively these serve to capture portions of the market back to top coin dominance.

It's a battlefield out there!

Is This The End Of The Bitcoin Bull Run?Bitcoin and most of the crypto market has had a pretty decent run over the last couple of weeks, but we've reached a fork in the road: Are we finally exiting the downtrend or are bear'bears taking the 'wheel' once again?

Looking at Bitcoin from a Daily perspective there's a pretty clear triangle pattern that's formed and we're butting up right against the downtrend of the triangle. Taking a look at a four-hour chart, you'll see there is a Squeeze that has been coiling for a couple of days now. This coupled with the bull flag pattern, make me think we'll actually see this play out long. With that said, there's one pattern I've seen crush more bulls dreams than any other in crypto...the infamous "Bart Pattern" lol.

I'd never heard of this until the crypto market which is likely where it originated. In short, the pattern is a busted flag pattern like the one we have here. I made a short video you can watch here to see how it gets its name: www.instagram.com

This would be the one thing I would guard against here. Remember, like in most things price will take the path of least resistance and right now the longer trend is still down. If Bitcoin can clear the downtrend (around 7600) it will need to clear and close above the zone coming in between 7872.5 - 8059.60.

In my mind, this is basically a coin toss and I'm not ready to step in front of this freight train just yet. Remember, you can make money without catching the bottom or top, you're just trying to catch the "meat of the move."

Continuing Bull Trend; But First a BART Correction?I’ve noticed a lot of BART moves in the charts lately. These are moves where whales pump the price, then consolidate/distribute, and after a short time dump. The result is a price chart that looks a little like the head silouhette of Bart Simpson, thus the name.

If we are due for such a dump, it should still follow the general rules of EW theory and correct to appropriate levels. But what’s disconcerting is the “suddenness” of these moves. Until market cap is considerably larger than currently, this is what we have to work with in these comparatively small, easily manipulated markets.

We are in the midst of a correction, but what’s not clear is whether or not we’ve finished the correction or we are still in the middle of it. In this post, I take the view that we are still in the middle of the correction, and that we have a little further to drop before resuming the upward trend.

The reasons I think this are several:

1. The wave counts show that we have completed the 3rd wave. A fib. retracement of 0.382 is very common for 4th waves, and this puts us at around a $7k region.

2. The correction thus far has exhibted some of the classic behaviour of an ABC correction, where we would appear to have finished the A leg, and are nearly finished the bull-trap B leg, now ready to commence the C leg. The target of this C leg would also put us somewhere around $7k.

3. This correction would appear to coincide with the right shoulder of an inverse H&S pattern which is not visible in this chart, but if you zoom out a bit, you will see that this right shoulder would be fully formed once it reaches the $7k region.

For these reasons, I believe we are headed to the $7k region before beginning the 5th wave of a broader trend reversal bull run.

Target 1: $7,000 (wave 4)

Target 2: $8,500 (wave 5)