US500 - Long-Term Long!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

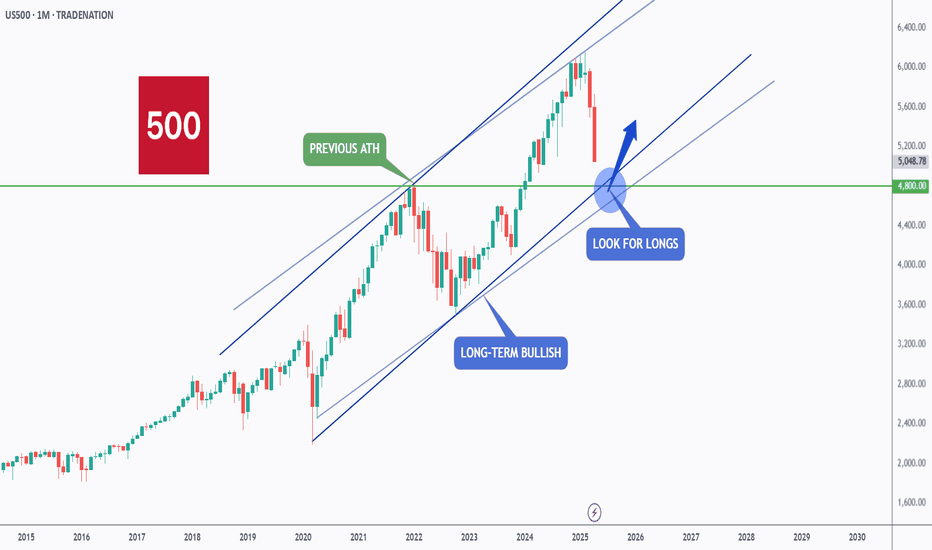

📈US500 has been overall bullish trading within the rising channel marked in blue.

Moreover, it is retesting its previous all-time high at $4,800 and round number $5,000.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of previous ATH and lower blue trendline acting as a non-horizontal support.

📚 As per my trading style:

As #US500 approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Basket

New Crypto Millionaires are almost ready to be bornA finfluencer said today on his Instagram reels: 'On the topic of Bitcoin dominance ( CRYPTOCAP:BTC.D ) I really dislike this metric. I don't think that is very relevant any more. The reason why I say is that because 1. it includes stable coins, which stable coins have an enourmous market cap and continue to grow as market matures. The issue with including all altcoins is that is very easy to create new ones that don't necessarily have any true value but they get included in the CRYPTOCAP:BTC.D calculation thus lowering it despite not actually making any major difference'.

I was curious and felt challenged. What I have found out was similar to Einstein's Eureka moment. The claim is that USDT market cap ( CRYPTOCAP:USDT ) plays a significant part in CRYPTOCAP:BTC.D but it gives an distorted image. I distracted CRYPTOCAP:USDT from CRYPTOCAP:BTC.D to see till what extent there is a relation by using their relative strengthness.

There is not much data and because it probably happens in every Bitcoin cycle only, next conclusions I can draw:

1. if CRYPTOCAP:USDT crosses up CRYPTOCAP:BTC.D and maybe as 2. condition at the same time BTC price crosses up EMA 21, you can start hodling;

2. as long as the CRYPTOCAP:USDT remain above CRYPTOCAP:BTC.D no need to panic as long as you are a day trader: every time BTC price close below EMA 21 you can take profit on your spot position and/or consider short and every time price close above EMA 21 you can buy spot and/or consider long position;

3. if CRYPTOCAP:USDT crosses down CRYPTOCAP:BTC.D you stop/continue hodling and/or consider a short position;

4. as long as the CRYPTOCAP:USDT remain below CRYPTOCAP:BTC.D and the BTC price hits EMA 21, consider this as to open short position;

5. if the CRYPTOCAP:BTC.D is decreasing below 50% level and the BTC price is increasing and remains above EMA 21 (see arrows): the best moments to create altcoin baskets.

Hopefully the history will repeat!

Basket trading for max gains and min losses 🧺 🤑 Many of you probably aren't familiar with a trading strategy called basket trading. I got first introduced to it from my Forex trading days and immediately saw its value. I apply that to Crypto trading to minimize my losses and keep my trades stable and less volatile. It also allows me to harvest profits as targets are reached.

Here are the facts about the market. Market comes across looking random because many cannot quantify the factors that contribute to price movement, and therefore it appears random. We can take that assumption as a fact. Due to various timing factors, the market appears random within a certain time range. We can use this randomness to our benefit. This means if we trade a basket of cryptos that exhibit various timing and trend attributes, then we end up with a single "currency" or asset that tends to move in more of a sinusoidal pattern with a bias towards a direction. Price tends to cross the 0% gain line, often giving us many opportunities to adjust that basket. These adjustments involve taking out profit and breaking even from other coins. If the basket trend is bullish or bearish, that's all you need to make a profit from the basket.

You can use the amazing TradingView feature of combing cryptos quickly to create your basket. More about the feature is here:

Here is a quick tutorial on how to perform this exercise of creating a basket. The more coins you have, the smoother the movement will be, and more often, it will reach the 0% gain level. The advantage here is that this acts as a "stop-loss" without taking a loss, and you can harvest profits with TP limit orders.

Determine the series of coins that you think are bullish or bearish. Stick to only one direction. Let's say for this example; you went with bullish.

Determine the volatility of each coin: meaning, the general % movement of the price that is expected typically.

Use that volatility to determine the % of the investment that should go towards each coin.

Now, create the chart formula based on that percentage, and you got yourself what the basket of currencies looks like.

Here is an example:

BTCUSD, ETHUSD, JASMYUSD, AVAXUSD

BTCUSD->2%, ETHUSD->5%, JASMYUSD->15%, AVAXUSD->9% (not real values)

If I have $1000, I will invest most into BETC and least into JASMYUSD to make my overall basket constant in volatility. This yields about BTCUSDx4, ETHUSDx1.8, JASMYUSDx0.1, AVAXUSDx0.7. If you put $100 in each coin, multiply it by the multiplier, $400 on BTCUSD, $180 on ETH, etc. You can play however you like. You can maximize for higher risk as well.

Now on the TradeView chart, enter the formula for the coin to see the single basket currency made up of your combination: BTCUSD*4+ETHUSD*1.8+JASMYUSD*0.1+AVAXUSD*0.7

I also add each coin, so I see how the coin itself moves relative to the others. You can apply indicators and whatever you like to it and trade it just likes how you would trade anything. All the math that applies to a single chart applies to this basket. I'm yet to see a platform that lets us easily trade complex strategies like this, so I'm making my own for trading purposes. If you know of one, please let me know in the comments so that I can try it out.

If you have any questions, please ask, and I will try my best to answer. If you found this interesting or helpful, please like it! Thank you!

Please keep in mind that this is not a guaranteed way to make profits. There are still risks like the entire crypto market going against you. This happens when there are fundamental changes that affect the market. Please trade at your own risk and play it safe.

EMBASKET are on bearish momentum! 10th March 2022Prices are on bearish momentum. We see the potential for a dip from our sell entry at 8388 in line with 78.6% Fibonacci Projection towards our Take Profit at 8305 in line with 78.6% Fibonacci retracement. Prices sre trading below our ichimoku clouds, further supporting our bearish bias.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.

JPYBASKET is on bearish momentum! | 14th Feb 2022Prices are on bearish momentum and abiding to our descending trendline. We see the potential for a dip from our sell entry at 9064 in line with 23.6% Fibonacci retracement towards our Take Profit at 8992 in line with 23.6% Fibonacci retracement and 61.8% Fibonacci retracement. Prices are trading below our Ichimoku cloud resistance and also RSI are at levels at dips previously occurred.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.

AUDCAD - LONG TERM CONTINUATION - SHORT TRADEAUDCAD Multi timeframe analysis.

This is a short trade taking the WEEKLY downtrend as my bias using the Daily all the way down to the One Minute to pinpoint my entry.

1. Weekly Downtrend Continuation

2. Price at the Gartley Pattern with perfect ratios

3. Price has spiked out of every ADR channel at the high from the Daily - One Minute

4. A VSA entry on any timeframe is triggered at either a Weekly Pivot OR has spiked through a Weekly Pivot and pulled back closing below it in this case

5. Enter Trade

PT1/T1: Potential Target 1 is the lower ADR channel band on the Daily timeframe (Exact price level will change over time depending on how fast price reaches it)

T1/PT2: Potential Target 2 is the lower ADR channel band on the Weekly timeframe, used to build a basket of trend positions (Exact price level will change over time depending on how fast price reaches it)

If AUDCAD pushes lower like my analysis STRONGLY suggests and how Friday closing suggests; AUDCAD will could provide a good move of over 200 Pips.

Forex basket Trade the NEWS : 10:34 06-Sep-19.LOG

Forex basket Trade the NEWS : 10:34 06-Sep-19

For most new traders, the biggest challenge is getting a profitable strategy that works

for the long term. Usually, trend-following systems are favored because they tend to have

a very good risk-to-reward ratio. Trading the currency market is essentially a numbers

game, basically traders look for strategies or systems that have a positive overall

yield. The profit factor of any strategy is also very essential, because a profitable

strategy should make more money or pips, than it loses. After some extensive research,

I have discovered one of such systems. This strategy is built on one of the oldest

trading adages around; “cut your losses early and let your profits run”

and “the trend is your friend”.

Basket trading involves opening a series of correlated or uncorrelated trades, and after

an adequate amount of time, closing the trades when the overall sum of the trades

is positive i.e. when the net value of all open trades is positive or close to our

targeted profit-value.

It is not 100% guarantee.

The Trading setup

The truth behind the Forex market is that currencies trend. This means that currencies have a tendency to keep gaining or diminishing over a long period of time. There are a lot of concepts about trading cycles and swings, but in reality if we were to zoom out of our charts we would notice a very obvious and unmistakable trend direction. Basket trading involves gauging the potential strength or weakness of a pair, and placing several trades that align with that analysis.

Key Reports/Factors that Move FX Markets

Any world events /news

Financial crises and elections create financial uncertainty and, in turn, impact value

of a country’s currency

Central Bank monetary policy announcements Will affect size/growth rate of a

nation’s money supply and, in turn, interest rates; can include key interest rate

changes, buying/selling government bonds, reserve requirements changes

FOMC (Federal Open Markets Committee)

Meets 8 times a year to set U.S. monetary policy and key interest rate changes;

impacts value of U.S. dollar, world’s reserve currency

U.S. Dollar Index

Measures the value of U.S. dollar relative to a basket of currencies for the

U.S.’s most significant trading partners

Forex basket Trade the NEWS : 10:01 05-Sep-19.LOG

Forex basket Trade the NEWS : 10:01 05-Sep-19

For most new traders, the biggest challenge is getting a profitable strategy that works

for the long term. Usually, trend-following systems are favored because they tend to have

a very good risk-to-reward ratio. Trading the currency market is essentially a numbers

game, basically traders look for strategies or systems that have a positive overall

yield. The profit factor of any strategy is also very essential, because a profitable

strategy should make more money or pips, than it loses. After some extensive research,

I have discovered one of such systems. This strategy is built on one of the oldest

trading adages around; “cut your losses early and let your profits run”

and “the trend is your friend”.

Basket trading involves opening a series of correlated or uncorrelated trades, and after

an adequate amount of time, closing the trades when the overall sum of the trades

is positive i.e. when the net value of all open trades is positive or close to our

targeted profit-value.

It is not 100% guarantee.

The Trading setup

The truth behind the Forex market is that currencies trend. This means that currencies have a tendency to keep gaining or diminishing over a long period of time. There are a lot of concepts about trading cycles and swings, but in reality if we were to zoom out of our charts we would notice a very obvious and unmistakable trend direction. Basket trading involves gauging the potential strength or weakness of a pair, and placing several trades that align with that analysis.

Key Reports/Factors that Move FX Markets

Any world events /news

Financial crises and elections create financial uncertainty and, in turn, impact value

of a country’s currency

Central Bank monetary policy announcements Will affect size/growth rate of a

nation’s money supply and, in turn, interest rates; can include key interest rate

changes, buying/selling government bonds, reserve requirements changes

FOMC (Federal Open Markets Committee)

Meets 8 times a year to set U.S. monetary policy and key interest rate changes;

impacts value of U.S. dollar, world’s reserve currency

U.S. Dollar Index

Measures the value of U.S. dollar relative to a basket of currencies for the

U.S.’s most significant trading partners

09:57 04-Sep-19

Forex basket : 10:15 04-Sep-19.LOG

Forex basket : 10:15 04-Sep-19

For most new traders, the biggest challenge is getting a profitable strategy that works

for the long term. Usually, trend-following systems are favored because they tend to have

a very good risk-to-reward ratio. Trading the currency market is essentially a numbers

game, basically traders look for strategies or systems that have a positive overall

yield. The profit factor of any strategy is also very essential, because a profitable

strategy should make more money or pips, than it loses. After some extensive research,

I have discovered one of such systems. This strategy is built on one of the oldest

trading adages around; “cut your losses early and let your profits run”

and “the trend is your friend”.

Basket trading involves opening a series of correlated or uncorrelated trades, and after

an adequate amount of time, closing the trades when the overall sum of the trades

is positive i.e. when the net value of all open trades is positive or close to our

targeted profit-value.

It is not 100% guarantee.

The Trading setup

The truth behind the Forex market is that currencies trend. This means that currencies have a tendency to keep gaining or diminishing over a long period of time. There are a lot of concepts about trading cycles and swings, but in reality if we were to zoom out of our charts we would notice a very obvious and unmistakable trend direction. Basket trading involves gauging the potential strength or weakness of a pair, and placing several trades that align with that analysis.

Key Reports/Factors that Move FX Markets

Any world events /news

Financial crises and elections create financial uncertainty and, in turn, impact value

of a country’s currency

Central Bank monetary policy announcements Will affect size/growth rate of a

nation’s money supply and, in turn, interest rates; can include key interest rate

changes, buying/selling government bonds, reserve requirements changes

FOMC (Federal Open Markets Committee)

Meets 8 times a year to set U.S. monetary policy and key interest rate changes;

impacts value of U.S. dollar, world’s reserve currency

U.S. Dollar Index

Measures the value of U.S. dollar relative to a basket of currencies for the

U.S.’s most significant trading partners

09:57 04-Sep-19

Forex basket : 09:36 04-Sep-19 CAD Interest Rate Decision 10.30.LOG

Forex basket : 09:36 04-Sep-19

For most new traders, the biggest challenge is getting a profitable strategy that works

for the long term. Usually, trend-following systems are favored because they tend to have

a very good risk-to-reward ratio. Trading the currency market is essentially a numbers

game, basically traders look for strategies or systems that have a positive overall

yield. The profit factor of any strategy is also very essential, because a profitable

strategy should make more money or pips, than it loses. After some extensive research,

I have discovered one of such systems. This strategy is built on one of the oldest

trading adages around; “cut your losses early and let your profits run”

and “the trend is your friend”.

Basket trading involves opening a series of correlated or uncorrelated trades, and after

an adequate amount of time, closing the trades when the overall sum of the trades

is positive i.e. when the net value of all open trades is positive or close to our

targeted profit-value.

It is not 100% guarantee.

The Trading setup

The truth behind the Forex market is that currencies trend. This means that currencies have a tendency to keep gaining or diminishing over a long period of time. There are a lot of concepts about trading cycles and swings, but in reality if we were to zoom out of our charts we would notice a very obvious and unmistakable trend direction. Basket trading involves gauging the potential strength or weakness of a pair, and placing several trades that align with that analysis.

Key Reports/Factors that Move FX Markets

Any world events /news

Financial crises and elections create financial uncertainty and, in turn, impact value

of a country’s currency

Central Bank monetary policy announcements Will affect size/growth rate of a

nation’s money supply and, in turn, interest rates; can include key interest rate

changes, buying/selling government bonds, reserve requirements changes

FOMC (Federal Open Markets Committee)

Meets 8 times a year to set U.S. monetary policy and key interest rate changes;

impacts value of U.S. dollar, world’s reserve currency

U.S. Dollar Index

Measures the value of U.S. dollar relative to a basket of currencies for the

U.S.’s most significant trading partners

Forex basket : 08:36 04-Sep-19.LOG

For most new traders, the biggest challenge is getting a profitable strategy that works

for the long term. Usually, trend-following systems are favored because they tend to have

a very good risk-to-reward ratio. Trading the currency market is essentially a numbers

game, basically traders look for strategies or systems that have a positive overall

yield. The profit factor of any strategy is also very essential, because a profitable

strategy should make more money or pips, than it loses. After some extensive research,

I have discovered one of such systems. This strategy is built on one of the oldest

trading adages around; “cut your losses early and let your profits run”

and “the trend is your friend”.

Basket trading involves opening a series of correlated or uncorrelated trades, and after

an adequate amount of time, closing the trades when the overall sum of the trades

is positive i.e. when the net value of all open trades is positive or close to our

targeted profit-value.

It is not 100% guarantee.

The Trading setup

The truth behind the Forex market is that currencies trend. This means that currencies have a tendency to keep gaining or diminishing over a long period of time. There are a lot of concepts about trading cycles and swings, but in reality if we were to zoom out of our charts we would notice a very obvious and unmistakable trend direction. Basket trading involves gauging the potential strength or weakness of a pair, and placing several trades that align with that analysis.

Key Reports/Factors that Move FX Markets

Any world events /news

Financial crises and elections create financial uncertainty and, in turn, impact value

of a country’s currency

Central Bank monetary policy announcements Will affect size/growth rate of a

nation’s money supply and, in turn, interest rates; can include key interest rate

changes, buying/selling government bonds, reserve requirements changes

FOMC (Federal Open Markets Committee)

Meets 8 times a year to set U.S. monetary policy and key interest rate changes;

impacts value of U.S. dollar, world’s reserve currency

U.S. Dollar Index

Measures the value of U.S. dollar relative to a basket of currencies for the

U.S.’s most significant trading partners

Forex basket : 08:20 04-Sep-19.LOG

For most new traders, the biggest challenge is getting a profitable strategy that works

for the long term. Usually, trend-following systems are favored because they tend to have

a very good risk-to-reward ratio. Trading the currency market is essentially a numbers

game, basically traders look for strategies or systems that have a positive overall

yield. The profit factor of any strategy is also very essential, because a profitable

strategy should make more money or pips, than it loses. After some extensive research,

I have discovered one of such systems. This strategy is built on one of the oldest

trading adages around; “cut your losses early and let your profits run”

and “the trend is your friend”.

Basket trading involves opening a series of correlated or uncorrelated trades, and after

an adequate amount of time, closing the trades when the overall sum of the trades

is positive i.e. when the net value of all open trades is positive or close to our

targeted profit-value.

It is not 100% guarantee.

The Trading setup

The truth behind the Forex market is that currencies trend. This means that currencies have a tendency to keep gaining or diminishing over a long period of time. There are a lot of concepts about trading cycles and swings, but in reality if we were to zoom out of our charts we would notice a very obvious and unmistakable trend direction. Basket trading involves gauging the potential strength or weakness of a pair, and placing several trades that align with that analysis.

Key Reports/Factors that Move FX Markets

Any world events /news

Financial crises and elections create financial uncertainty and, in turn, impact value

of a country’s currency

Central Bank monetary policy announcements Will affect size/growth rate of a

nation’s money supply and, in turn, interest rates; can include key interest rate

changes, buying/selling government bonds, reserve requirements changes

FOMC (Federal Open Markets Committee)

Meets 8 times a year to set U.S. monetary policy and key interest rate changes;

impacts value of U.S. dollar, world’s reserve currency

U.S. Dollar Index

Measures the value of U.S. dollar relative to a basket of currencies for the

U.S.’s most significant trading partners

09:46 03-Sep-19

Forex basket : 09:46 03-Sep-19.LOG

For most new traders, the biggest challenge is getting a profitable strategy that works

for the long term. Usually, trend-following systems are favored because they tend to have

a very good risk-to-reward ratio. Trading the currency market is essentially a numbers

game, basically traders look for strategies or systems that have a positive overall

yield. The profit factor of any strategy is also very essential, because a profitable

strategy should make more money or pips, than it loses. After some extensive research,

I have discovered one of such systems. This strategy is built on one of the oldest

trading adages around; “cut your losses early and let your profits run”

and “the trend is your friend”.

Basket trading involves opening a series of correlated or uncorrelated trades, and after

an adequate amount of time, closing the trades when the overall sum of the trades

is positive i.e. when the net value of all open trades is positive or close to our

targeted profit-value.

It is not 100% guarantee.

The Trading setup

The truth behind the Forex market is that currencies trend. This means that currencies have a tendency to keep gaining or diminishing over a long period of time. There are a lot of concepts about trading cycles and swings, but in reality if we were to zoom out of our charts we would notice a very obvious and unmistakable trend direction. Basket trading involves gauging the potential strength or weakness of a pair, and placing several trades that align with that analysis.

Key Reports/Factors that Move FX Markets

Any world events /news

Financial crises and elections create financial uncertainty and, in turn, impact value

of a country’s currency

Central Bank monetary policy announcements Will affect size/growth rate of a

nation’s money supply and, in turn, interest rates; can include key interest rate

changes, buying/selling government bonds, reserve requirements changes

FOMC (Federal Open Markets Committee)

Meets 8 times a year to set U.S. monetary policy and key interest rate changes;

impacts value of U.S. dollar, world’s reserve currency

U.S. Dollar Index

Measures the value of U.S. dollar relative to a basket of currencies for the

U.S.’s most significant trading partners

09:46 03-Sep-19

Forex basket : 08:58 03-Sep-19.LOG

Forex basket : 08:58 03-Sep-19

For most new traders, the biggest challenge is getting a profitable strategy that works

for the long term. Usually, trend-following systems are favored because they tend to have

a very good risk-to-reward ratio. Trading the currency market is essentially a numbers

game, basically traders look for strategies or systems that have a positive overall

yield. The profit factor of any strategy is also very essential, because a profitable

strategy should make more money or pips, than it loses. After some extensive research,

I have discovered one of such systems. This strategy is built on one of the oldest

trading adages around; “cut your losses early and let your profits run”

and “the trend is your friend”.

Basket trading involves opening a series of correlated or uncorrelated trades, and after

an adequate amount of time, closing the trades when the overall sum of the trades

is positive i.e. when the net value of all open trades is positive or close to our

targeted profit-value.

It is not 100% guarantee.

The Trading setup

The truth behind the Forex market is that currencies trend. This means that currencies have a tendency to keep gaining or diminishing over a long period of time. There are a lot of concepts about trading cycles and swings, but in reality if we were to zoom out of our charts we would notice a very obvious and unmistakable trend direction. Basket trading involves gauging the potential strength or weakness of a pair, and placing several trades that align with that analysis.

Key Reports/Factors that Move FX Markets

Any world events /news

Financial crises and elections create financial uncertainty and, in turn, impact value

of a country’s currency

Central Bank monetary policy announcements Will affect size/growth rate of a

nation’s money supply and, in turn, interest rates; can include key interest rate

changes, buying/selling government bonds, reserve requirements changes

FOMC (Federal Open Markets Committee)

Meets 8 times a year to set U.S. monetary policy and key interest rate changes;

impacts value of U.S. dollar, world’s reserve currency

U.S. Dollar Index

Measures the value of U.S. dollar relative to a basket of currencies for the

U.S.’s most significant trading partners