GOLD FULL UPDATE – July 15, 2025 | Post-CPI TrapPost-CPI Flip Zone Battle

Hello dear traders 💛

Today has been one of those heavy CPI days — full of volatility, sweeps, and doubt. But if we read it structurally and stop chasing candles, everything makes sense. Let’s break it all down step by step, clearly and human-like.

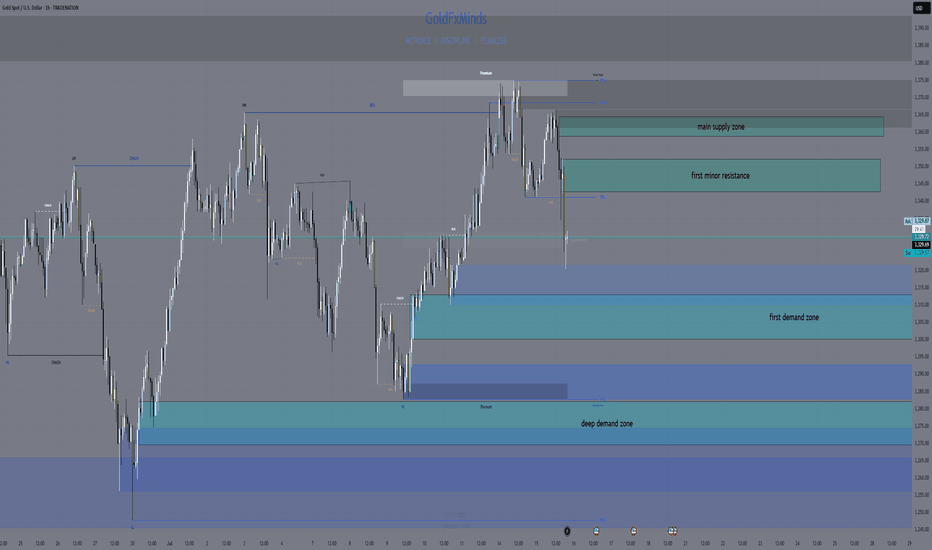

Current Price: 3330

Bias: Short-term bearish, reactive bounce underway

Focus Zone: 3319–3320 liquidity sweep + key decision structure unfolding

🔹 Macro Context:

CPI came in slightly hot year-over-year (2.7% vs 2.6%) while monthly stayed in-line at 0.3%. That gave the dollar a short-lived boost, and gold reacted exactly how institutions love to play it — sweeping liquidity under 3320, then pausing. Not falling, not flying. Just... thinking.

That reaction matters. Why? Because it shows us indecision. It tells us that gold isn’t ready to break down fully yet, and every aggressive move today was part of a calculated shakeout.

🔹 Daily Structure:

Gold is still stuck below the premium supply zone of 3356–3380. Every attempt to rally there for the past few weeks has failed — including today.

The discount demand area between 3280–3240 is still intact and untouched. So what does this mean?

We are in a macro-range, and price is simply rotating between key structural edges.

🔹 H4 View:

The rejection from CPI at 3355–3365 created a micro CHoCH, signaling the bullish leg is now broken.

After the 3345 fail, price dropped to 3320 — but it hasn’t tapped the full H4 demand at 3310–3300.

H4 EMAs are tilting down, showing pressure. This isn’t a breakout. It’s a correction inside a larger range.

🔸 Key H4 Supply Zones:

3345–3355: liquidity reaction during CPI

3365–3375: untested OB + remaining buy-side liquidity

🔸 Key H4 Demand Zones:

3310–3300: mitigation zone from the CHoCH

3282–3270: deep discount and bullish continuation zone if current fails

Structure-wise: We are in a correction, not a clean uptrend. That’s why every bullish attempt fails unless confirmed.

🔹 H1 Real Structure

This is where things got tricky today.

Price formed a bullish BOS back on July 14, when we first pushed into 3370. That was the start of the bullish leg.

But today, we revisited the origin of that BOS, right near 3320. This is a sensitive zone.

If it holds → it’s still a retracement.

If it breaks → we lose the bullish structure and shift full bearish.

So far, price touched 3320, bounced weakly, but has not printed a bullish BOS again.

🔸 H1 Zones of Interest:

Supply above:

3340–3345: micro reaction zone

3355–3365: CPI origin rejection

3370–3375: final inducement

Demand below:

3310–3300: current flip test

3282–3270: if this breaks, bias flips bearish

Right now, we are between zones. Price is undecided. RSI is oversold, yes — but that alone is never a reason to buy. We need structure. We need BOS.

🔻 So… What’s the Truth Right Now?

✅ If 3310–3300 holds and price builds BOS on M15 → a clean long opportunity develops

❌ If 3310 breaks, and we lose 3300, structure fully shifts and opens downside to 3280–3270

On the upside:

Only look for rejections from 3355–3365 and 3370–3375

Anything inside 3325–3340 is noise. No structure, no clean RR.

Final Thoughts:

Today’s move was not random. It was a classic CPI trap: induce longs early, trap shorts late, and leave everyone confused in the middle.

But we don’t trade confusion — we wait for structure to align with the zone.

If M15 or H1 prints a BOS from demand, that’s your green light.

If price collapses under 3300, flip your bias. The chart already told you it wants lower.

No predictions. Just real reaction.

—

📣 If you like clear and simple plans, please like, comment, and follow.

Stay focused. Structure always wins.

📢 Disclosure: This analysis was created using TradingView charts through my Trade Nation broker integration. As part of Trade Nation’s partner program, I may receive compensation for educational content shared using their tools.

— With clarity,

GoldFxMinds

Battleplan

XAUUSD BATTLE PLAN — 16 JUNE 2025GoldFxMinds — Sniper Liquidity Execution

👋 Hello traders — we’re entering a highly tactical week where liquidity rotation dominates both sides of the board. This is no longer trend-following — this is liquidity chess.

🔎 Market Narrative

Gold remains structurally bullish after a clean sequence of higher lows: 3120 → 3246 → 3448.

Last week’s sweep above 3447 cleared weak hands, activated premium liquidity traps, and left price fully positioned inside extended premium expansion. Smart money continues rotating liquidity aggressively as markets prepare for this week’s heavy catalysts.

With FOMC, Powell’s press conference, Fed projections, and Middle East tensions all unfolding, institutional positioning is building quietly beneath surface price moves.

For us, this is not a moment to guess or force trades — this is the phase where patience and structure offer the only real edge.

🎯 GoldFxMinds Bias for 16 June 2025

🔼 Short-term:

Price remains inside premium expansion, with open liquidity layers above 3450 → 3480 → 3505 still uncollected. We allow price to finish hunting late buyers before considering any premium exhaustion reactions. No blind shorting inside premium unless exhaustion signals confirm.

🔽 Medium-term positioning:

Controlled pullbacks into 3368 and deeper recalibration zones offer the cleanest tactical long opportunities, aligned with higher timeframe bullish structure for potential future premium expansions.

❌ No aggressive directional conviction intraday:

The current structure demands discipline, patience, and reactive execution — not early bias.

🔼 Premium Supply Zones (Sniper Calibrated)

Price Zone Explanation

3450 – 3462 🔸 Premium inducement zone — early liquidity pocket where price may react mildly before sweeping deeper premium levels.

3480 – 3495 🔸 Liquidity collection extension — gap zone drawing in late buyers and liquidity build-up above recent highs.

3505 – 3515 🔸 Premium exhaustion — final sweep level for late liquidity grabs before potential higher timeframe recalibrations.

🔽 Demand Defense Zones (Sniper Calibrated)

Price Zone Explanation

3410 – 3400 🔸 Micro pullback — short-term liquidity refill zone valid for scalps, not for strong swing positioning.

3368 – 3352 🔸 Tactical bullish recalibration — strong HTF OB + FVG combo, valid for tactical swing positioning with structure confirmation.

3308 – 3292 🔸 Institutional re-accumulation base — deeper liquidity recalibration where larger players likely step in for new expansions.

🎯 Execution Flow & Tactical Outlook

We let liquidity fully expose itself before positioning:

Above 3450: Expect continued liquidity sweeps. Monitor sharp reactions above 3480 for exhaustion setups — only trade short-side if clear rejection signals emerge.

Into pullbacks: Minor dips toward 3410 offer quick reactive scalps only. The real positioning opportunities open inside 3368 and deeper zones, where recalibration offers cleaner entries aligned with HTF bullish structure.

Discipline is key: No chasing. No prediction. Only reaction to clean liquidity behavior.

🧠 Trader’s Mindset for This Week

We're facing one of the heaviest institutional risk weeks:

🏛 FOMC Interest Rate Decision → Major market-moving catalyst.

🏛 Powell’s Press Conference → Immediate tone-shifting potential.

📊 Fed Projections → Will influence short-term USD positioning.

📊 Retail Sales & Housing Data → Potential intraday volatility triggers.

🌍 Middle East Tensions → Underlying risk bid remains supportive for gold.

Each event is fuel for liquidity displacement. We don't react emotionally — we position where liquidity delivers.

🚀 If this battle plan helps you stay fully locked — drop a 🚀, share your views, and follow GoldFxMinds for sniper liquidity updates throughout the week.

Stay sharp — liquidity always moves first.

— GoldFxMinds

UPDATE 2: Battle planning on Solana looking at EthereumSolana has finally reached the target I identified back in July by looking at Ethereum's structure from 2016 to 2019 and using a simple Elliot Wave ABC correction. This bottom is at the lower end of the green box like I suspected it would be and we also have the RSI for Solana dipping below 30 by a fingernail to hit 29.8. This is the lowest the RSI has been for Solana. A look at when ETH bottomed in December 2018 shows that the RSI was also below 30 by reaching 28.5.

After hitting a bottom in December 2017 Eth would create an ascending triangle formation for about 3 months. While it was in that formation adding to your position at the base of the Bollinger band was a winning strategy. There is no real need to rush into a trade and YOLO your whole stack 10x. I do have a margin position on that I hope will play out nicely.

If this is similar to ETH we should see SOL create a reversal pattern over the next couple of months and then a pump to around point A. Based off some other charts I have looked at price could die anywhere within AB and the chart is still valid.

Last cycle there were some alt coins that didn't form long term continuation patters, they just thrashed around. If Sol does such then its future isn't that promising. Whatever formation develops we can't expect the rally to have to much over-performance. For example, if an ascending triangle develops on SOL but it is so shallow that a fib extension 2 line is no where close to point A then A is a target to far.

So, if things go well, I will be snagging a 430% move over the next six months and with a wee bit of margin and some good entries. There is a chance that SOL could go a bit lower and if it does, I will be looking for the chart to have some bullish divergence and I will reenter lower down. I'll look for a long-term pattern and add at bollinger band support. Easy peasy.

I have linked my other Solana battle plans as well as a dydx trade I entered a few days a go that has treated me very well so far. I see one more consolidation and bull market for crypto.

UPDATE 1: Battle planning on Solana looking at EthereumTLDR: I waited over 4 months for the trade to get to the point I would put a short on. The next move is to short to the buybox. See the linked idea for more context

Introduction

I have spent a lot of time looking at blow off tops and parabolic moves over the last 450 ideas and 5 years with the goal of being able to benefit from these natual phenomenon of mass psychology. One thing I greatly desire for my trades now is what I call "chart clarity" where the better a asset looks to be following a pattern I know the more I want to trade it.

I plan on following this fractal for the next couple of year so long as each step gets confirmed. I hope to make a lot of money doing this and hopefully others can benefit.

Analysis and battle plan

ETH was prety volatile during the last bull run and bear market but once we zoom back it was just a simple ABC correction with a final consolidation at the Fib Extension 1 level before a final quick move to target. In that case the C wave was a 1.618 extension of the A wave.

As I chart it, Solana's C wave will be a 2x extension of the A wave. Ethereum had a symmetrical triangle that it broke out of when it was done consolidating at the 1 line but Solana has an even more bearish continuation pattern, a bearish rising wedge on a flag pole.

Price action can be inconsistent depending on the exchanges being looked at but the target is the blue buy box. If price wicks below that into the area of the muave-ish circle then that would be too low for me and would make me think the pattern could be off going forward.

The chart below shows some smaller time frame structure. There is a head and shoulders formation that should facilitate price breaking down out of the wedge in dramatic fashion.

A look at SolBTC shows a black head and shoulders making up the top of a right shoulder in blue heand and shoulders. That SOLBTC sell pressure should create a lot of sell pressure on SOLUSDT.

Further battle planning

If price consolidates in the buy box as predicted the next big move I would want to play would be a long with price action going up to the base of the bull trap, which is the end of corrective wave A and the beginning of wave V. As I study this fractal on smaller altcoins I have seen some rallies move quite a way into wave B but others have died within pennies of the beginning of Wave B. I shan't be greedy.

Battle Planning on Solana by looking at EthereumI have color coded where I see the similarities in Solana's current price action and Ethereum's historic price action from the previous bull run. I think the patterns and seminaries are pretty clear and while I see a lot of upside potential for Solana in the long run and I see lots of coins staged to begin their uptrends now I see one more leg down for solana.

I am going to wait for Solana to come into my buy box and then really drill down on the time frames so I can put on a decent amount of margin on my trade. One price enters the green area there is a chance to grap a x4 move or higher move as price returns to the base of the bull trap. Price may even go into the bull trap quite a bit but for me I don't want to be greedy. I will be taking profits quite quickly on Solana at about $75.

A lot of this is predicated on the black triangle on Solana breaking down as the Ethereum triangle broke down. If the black Solana behaves differently than the Ethereum triangle and breaks up instead of down my trade is negated (for now). The Solana triangle could form a rising wedge and then make it to target but I will be patient. If Solana goes off-scripts I may miss some gains but I really am looking for some chart clarity and due to the similarities I see I won't be taking any longs on Solana until I see how it behaves at the base of the previous bull trap.

But fow now: patience. It is a way a way but I see a lot of potential of Solana to wreck a lot of people over the next 5 years, or make them quite wealthy. I tagged the chart neutral for now as I am still waiting.

Battleplan: 4 Month look at Gold versus the NDX suggest rotationIt is always good to have a plan. Even better if you have a way to stick to it. Nasdaq has taken quite a beating and people who are worried about inflation, stagflation, recession and depression want to know what to do. Well, I can't give financial advice to others, but I can plan for myself. Gold hasn't moved a lot and that has some people concerned. I think the move is just beginning and a look at higher time frames will show that.

Simple candlestick analysis on the Gold/Nasdaq pair shows that we closed the 4 month period with a banger with the candle engulfing two whole periods and almost a third. This is a very strong indicator that the trend has shifted and resembles the trend shift in late 2000. From 2000 to 2008 gold was the clear outperformer with an initial impuse then a multi-year cup and handle formation taking the pair to a high in late 2008/early 2009. From there a few years of sideways topping action and then the price action shows rotation out of gold into the Nasdaq.

Gold/NDX Indicators

The Pair price action has dropped way below the Keltner and Gaussian chanel and I have been waiting for a sign that shows the momentum has shifted and the candle stick analysis suggests. The chart below details the bullishness I see and I won't repeat myself here. I do expect another multi-year consolidation pattern on the pair but it is still much to early to tell what to expect. I do expect a couple of periods of impulse to the bottom of the gaussian channel.

My strategy

A look at this chart suggest that a BTFD strategy will work so long as traders and investors switch the dip they are buying from equities into gold or other miners. I generally expect gold to run first, then silver.

A look back from 2000 to 2010 does seem to show a simple strategy on this weekly chart does seem to be to buy every breakout of multi-month or multi-year resistance or to simply accumulate at the lows of the Keltner channel and certainly buy the Gaussian channel.

Based on that I will be looking for the gold price to get above the resistance charted below. Failure to get above that trendline would be a theory failure, meaning that rather than gold and Nasdaq going separate directions for a while then gold outperforming as they both tend upwards that Gold would merely be going down less than the Nasdaq. In that case I will just wait for cheaper prices.

Battle Planing: Basic charting on Total 2 Total2 has been chopping sideways for two months and has gotten a tad boring. Individual coins have done some pump and dumps but the net market cap is sideways. In short order, and by that I mean in the next 2-4 weeks Total two will be at a decision point where it will begin to resolve itself bullishly or bearishly and I hope to be prepared either way.

My main inclination is the black upward sloping trend line will continue to hold except for wicks here and there. If that is to be the case then the price action will have to beat the downward sloping resistance line it is now under. So we are at a IF THEN type situation were we can do some scenarios for both upside and downside. The chart says a lot so I won't repeat myself too much.

Bullish Resolution We see price action act out an ascending triangle. There are potential for throwbacks, under performance, and all that, but the eventual targets are the 1.618 and 2 levels on the drawn fib. And it doens't help that according to Bulkowski, triangles are some of the easiest formations to spot but actually the worst to reach target.

Bearish resolution Price falls to around the 0 fib line. If that were to happen I would see Total2 devolve into a double top type formation. In traditional markets double tops have tops around 5% off in value but for crypto I feel justified in letting that go a little higher. Source? I made it up.

If price resolves bearishly it will be long term very bad news.

Battle Planning: What if Bitcoin Double Tops?The trend has obviously been up and bullish but the chance of a double top remains real until it has passed. There have been many times over my trading career where I did both a bullish and bearish scenario "just in case" and was biased in the wrong direction for my initial position. Sometimes I did a good job switching my trades and some times not. But really, having a plan either way is good and knowing what will trigger deliberate action is very good.

Personally I have closed my margin long positions on link end eth while I watch this develop and I have taken a small ethusd short that should keep my account balance roughly flat no matter which way the market goes. Additionally you see the X I like to use on a lot of price action to see trend lines flipping support and resistance.

Null Hypothesis

The long term trend continues and price action keeps going up. My ETHUSD short keeps my account stable in USD terms and I close the trade and look for margin long entries.

Scenario 1

Price action dips to the black trend line some 20% and support is found with volume. This sets up BTC to go to new all time high and when I close my ETHUSD short and shovel the usd into my prefered alts.

Scenario 2

Price breaks the black trend line. I add to my ETHUSD short and plan to close in the target area around the previous ATH. The target is set by two critera: the hight of the valley between the peaks of the double top as shown by the black line, and the area of activity prior to the break out. That purble zone contains the top of the value area on the VPVR and in intense bull markets the price action retests this area constantly.

Scenario 3

Price goes sideways. Least likely off all scenarios.

Long term Concerns

The chart below is BTCUSD with my long term top indicators. The Bitcoin Log Growth Curves are divided into sub-channels and I find the activity around the midline (76.39 and 38.20%) play a special role as support and resistance as levels and as a zone. A break of this double top would take us very probably to the 23.61% level at about $22.3k

Second concern is the Pi cycle. This is suppose to call the tops on the daily chart and some tinkering shows it does this on several assets besides bitcoin and there are some decent signals for local tops. Below we can see on the 3 day chart it predicted an area of consolidation for BTC and on XPRUSD it nearly predicted the first ATH in 2017 and did call the high in the beginning of 2018. With the signal flashing on the above chart on the weekly this might be tagging a local high. Of course this is not the intended use of the indicator but it is still something scratching at the back of my head.

My final long term concern is the Net Value Transactions with these ribbons to provide easy to read detail. The only time we have enough chart history before to look at on the weekly chart that had the NVT pop out the top of the red ribbon was before the great dump of 2017 with our Christmas and New Years massacre. Being out of the ribbon is concerning enough, but there is a real probability that the NVT turns back to yellow and we dump in a big way.

It sounds cataclysmic but that has to be part of the battle plan because it is a big signal used by the heavy hitters. And the fact remains that on the daily, 3d and weekly every time the NVT has crossed the barrier from red to yellow we have traded lower. Lots of people don't like calls like "it might go up, and it might go down" but trying to forecast how it might go up or down is what we are trying to do.

Bitcoin and battleplanning with Channels.I have said this many times: never draw a trendline when you can draw a channel. Also I have said that symmetrical triangles break down or up into wedges or ascending/descending triangles. Now you might glibly say "This_Guhy said it might go up, or it might to down, wow, so brave"

But it isn't that it goes up or down but how it goes up or down with some targets so you can set some orders to get taken in or stopped out. This is less important for investors because they have less risk of getting squeezed out of their positions but even investors can be interested in buying what they think is the point of no return. Traders can set up straddles or more complexly layered trades.

The macro trend is clearly bullish . We have top coins hitting all time highs or going 10-20X over the last year so the circumstances are very bullish . But that doesn't mean that every symmetrical triangle won't turn into a falling wedge , BTFO'ing the recklessly long or over-margined. It also doesn't mean that the price action won't formed "busted" falling wedges which would have price action dipping below the red channel before blasting to the upside.

This is your launch pad for further battle planning. Falling wedges fit neatly into Elliot waves and fib extensions, as do ascending triangles as continuation patterns. There are retests of trendlines possible all over the place. You will be more prepared for future support and resistance if you battle plan as such. Every symmetrical triangle is best drawn as two possible channels.

Battleplaning: Bitcoin just printed a massive buy signalThe Volatility stop is a very simple way to track areas of support and resistance and when combined with the Multiple Time frame VSTOP we get some indicators taht do some autocharting for us. Throw on some simple moving averages to help with timing trades with retests and I have hopefully developed a system that will help me time my entries on leveraged trades for this next uptrend/bull market.

The pluses on the chart are the normal timeframe VSTOP and they show our basic support and resistance. I have made the green bullish VSTOP just a big bigger than the red bearish VSTOP to highlight support

The MTF is shown in blue or pink lines. When it gets hit by price and the candle closes above it it fades the line. It isn't until a candle is completely above the MTF VSTOP that a bearish VSTOP will flip to bullish. These first touches are shown with the red triangles. The flip in bias is shown the black circle within the VSTOP.

The key point of this post is the weekly VSTOP just turned bullish. The monthly VSTOP flipped in the beginning of the month on the BLX ticker but as we were under the weekly VSTOP breaishly it would be more likely that you would get stopped out of a position. With this alignment BTC is now bullish on the 1D,1W, and 1M timeframe. This makes playing with margin a lot more tenable. It is also comforting to see a potential rising channel coming out of this ascending triangle, which was a very strong right shoulder on a inverse head and shoulders... one bullish formation after another. My linked post is about the a mutli time frame analysis on the VSTOP and BTCUSD and I waited until very recently to put my position on, itching for things to get lined up.

What we are also looking for over the next couple of months is for price action to retest a significant horizontal level. Last time it was a long wick candle that set up long term consolidation and a resistance that we would operate under for over a year. That is $490 set by the black ray and green and red arrows. The level that I suggest we need to retest in a few months, and to steady investors hands, is of course detailed in orange at $13.8K. That is shown on the main chart.

I have entered a position for the breakout of the orange horizontal level at the base of this rising channel. The plan is for me to trail stops up on a lower timeframes. with my gains I'll use the USD to buy the dips around the 20w and trail buystop down on lower timeframes to get taken in with my leveraged XBTUSD trades. I'll look to close any positions against the MFT VSTOP when things flip.

My bias will change from bullish to bearish when the the 20w and the MTF VSTOP are both above price action. If you see me posting about sorting before then slap me. I will probably go long into an altcoins opposed to shorting BTC.

GBPAUD! BIG Battle between the bulls and the bears coming up!Previously, the bulls have won the last couple battles pushing hundreds of pips against the trend. Price is nearing 2 forms of structure, one being the top of the down trending channel and the other being previous resistance. We will have to wait and see how price reacts to these structures to take out next position or close out current longs. Regards of the winner i could see 2 possible scenarios. A break and retest to continue a bullish victories, or reinforcements arrive for the bears and we get a rejection similiar to the one that happened last time price met this trendline.