Is BigBear.ai the Next Titan of Defense AI?BigBear.ai (NYSE: BBAI) is emerging as a significant player in the artificial intelligence landscape, particularly within the critical national security and defense sectors. While often compared to industry giant Palantir, BigBear.ai carves its niche by intensely focusing on modern warfare applications, including guiding unmanned vehicles and optimizing missions. The company has recently garnered considerable investor attention, evidenced by its impressive 287% rally over the past year and a notable surge in public interest. This enthusiasm stems from several key factors, including a substantial 2.5x increase in backlog orders to $385 million by March 2025 and a significant ramp-up in research and development spending, signaling robust foundational growth.

BigBear.ai's technological prowess underpins its rising profile. The company develops sophisticated AI and machine learning models for diverse applications, from facial recognition systems deployed at major international airports like JFK and LAX to AI-augmented shipbuilding software for the U.S. Navy. Its Pangiam® Threat Detection and Decision Support Platform enhances airport security by integrating with advanced CT scanner technology, while its ConductorOS platform facilitates secure communication and coordination for drone swarm operations under the U.S. Army's Project Linchpin. These cutting-edge solutions position BigBear.ai at the forefront of AI-driven advancements crucial for evolving geopolitical landscapes and increasing defense AI investments.

Strategic collaborations and a favorable market environment further fuel BigBear.ai's ascent. The company recently formed a significant partnership in the UAE with Easy Lease and Vigilix Technology Investment to accelerate AI adoption across key industries like mobility and logistics, marking a major step in its international expansion. Additionally, multiple contracts with the U.S. Department of Defense, including those for J-35 fleet management and geopolitical risk assessment, underscore its vital role in government initiatives. While BigBear.ai faces challenges, including revenue stagnation, escalating losses, and stock volatility, its strategic market position, growing backlog, and continuous innovation in mission-critical AI solutions present a compelling high-risk, high-reward investment opportunity in the burgeoning defense AI sector.

BBAI

BBAI Breakout Continuation Pattern ConfirmedWe enter BBAI at $5.11 look for confirmation above the $5.20 which we expect to confirm support after consolidation of this morning's breakout (if it even recedes from this point), with a price target of $8.35 which would provide the potential for a ~65% Gain on the potential trade and continuation. We have a stop set for $4.06 on the trade.

This comes after the company announced deploying their Biometric Software at Major US Airports & Ports of Entry, which helped prop up the company's stock to push back to those potential highs to retest the $10.49 even. No company-specific information has been released in the past week.

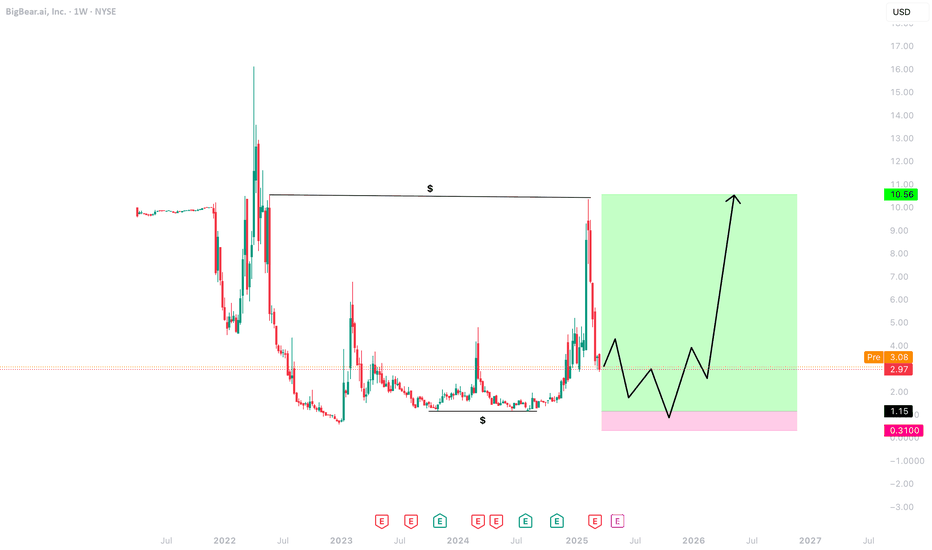

$BBAI upside targets $8-10?NYSE:BBAI looks set to run higher here. As you can see, we've broken out of the bottoming formation and have now retested support.

As long as we're able to stay above support, we should see a large move higher up to the two resistance levels.

Let's see how high we end up going. Think it's very likely that we end up going to the top of the range.

OptionsMastery: A potential swing on BBAI!🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

BBAI BigBear ai Holdings Options Ahead of EarningsIf you haven`t bought BBAI before the massive rally:

Now analyzing the options chain and the chart patterns of BBAI BigBear ai Holdings prior to the earnings report this week,

I would consider purchasing the 3usd strike price Calls with

an expiration date of 2025-12-19,

for a premium of approximately $1.35.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

BBAI BigBear ai Holdings Options Ahead of EarningsIf you haven`t bought BBAI before the massive rally:

Now analyzing the options chain and the chart patterns of BBAI BigBear ai Holdings prior to the earnings report this week,

I would consider purchasing the 5.50usd strike price Calls with

an expiration date of 2025-6-20,

for a premium of approximately $1.10.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

$BBAI back on track to break the $10.00 resistanceAfter the crash in sync with PTLR yesterday due to Trump's Defense spending cuts. If you don't cut losses, and still hold tight, even DCA to load more share below $8.00, especially the $6.80 - $7.00 area. Congratulations! Profits are in sight.

Most of the popular indicator is

Option trading ideas:

Buy Call $10, exp 3/21

Buy Call $11 and $12, exp 4/17

Most popular indicators are supporting this bullish momentum. BUT!!! Watch out for profit-taking pressure near the upcoming ER 3/6. BBAI's valuation is already too high compared to its projected earnings, so be careful!

Disclaimer

$BBAI next target $11 - $12 in the last week of Feb 2025Please see the sample chart I shared. The bullish flag pattern appears once again. So if BBAI can hold the support level of $8.00 - $8.50, it is likely to rise to $11 - $12 in the next push. The most ideal entry point is the price zone of $7.80 - $8.00. However, I am not sure that this can happen when the profit-taking pressure is too strong at the $9.xx area. My confidence level is only 66% for the bullish case. And 33% possibility of a decline to the price zone of $7.00 - $7.50. So, Stop Loss must be setup or hold tight up to you. Good luck Bigbear brothers!

Can AI Weather the Storm of Volatility?BigBear.ai has captured the market's attention with its dramatic stock performance, navigating through a sea of volatility with recent gains fueled by significant contract wins and positive AI sector developments. The company's journey reflects a broader narrative in the tech industry: the high stakes of betting on AI innovation. With its stock soaring over 378% in the last year, BigBear.ai demonstrates the potential for rapid growth in an era where AI is increasingly central to strategic sectors like defense, security, and space exploration.

However, the narrative isn't without its twists. Analyst warnings about cyclical business patterns and valuation concerns introduce a layer of complexity to the investment thesis. BigBear.ai's ability to secure pivotal contracts with the U.S. Department of Defense showcases its technological prowess, yet the challenge lies in converting this into sustainable profitability. This scenario invites investors to ponder the delicate balance between innovation, market sentiment, and financial stability in the AI landscape.

The strategic acquisition of Pangiam and partnerships like the one with Virgin Orbit illustrate BigBear.ai's ambition to not only ride the wave of AI hype but also to steer it into new territories. These moves are about expanding market presence and redefining what AI can achieve in practical, real-world applications. As BigBear.ai continues to evolve, it challenges us to consider how far AI can go in reshaping industries and whether the market can keep pace with such rapid technological advancements. This saga of BigBear.ai is a microcosm of the broader AI investment landscape, urging us to look beyond immediate gains to the long-term vision and viability of AI-driven companies.

Ever seen a more beautiful uptrend than this? $BBAIEver seen a more beautiful uptrend than this 15 min gem? 💎📈

And yes I alerted to buy it

And yes still holding and riding it for as long as uptrend continues to support 🤑

Simply doesn't get any better than being in fat profit already and continuing to stay PAYtience for as long as it wants to give more into uptrend

NYSE:BBAI

BANGER $5 to $8+ on steadiest uptrend of 2025 so far!BANGER $5 to $8+ on steadiest uptrend of 2025 so far! 📈

Buy & Hold 💬

Told you about it in chat while it was still in $6's

Doesn't get any easier than this, just waiting for the money to pile as it keeps uptrending NYSE:BBAI

Everyone that listened got paid, it was the only stock bought and held yesterdy 1/1 for a fat win.

BBAI BigBear ai Holdings Options Ahead of EarningsAnalyzing the options chain and the chart patterns of BBAI BigBear ai Holdings prior to the earnings report this week,

I would consider purchasing the 2usd strike price Calls with

an expiration date of 2025-1-17,

for a premium of approximately $0.40.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

BigBear.ai's Big Win: FAA Contract Award Leads to 35% SurgeBigBear.ai Holdings, Inc. (NYSE: NYSE:BBAI ) saw its shares skyrocket by 35% to $1.80 after the company announced it had been awarded a significant subcontract under the U.S. Federal Aviation Administration's (FAA) Information Technology Innovative Procurement Strategic Sourcing (ITIPSS) program. This announcement, made Wednesday, sent waves through the stock market, drawing the attention of investors and analysts alike.

A Strategic Partnership with Concept Solutions

BigBear.ai, a prominent player in the AI and emerging technologies sector, secured the subcontract as part of a broader team led by Concept Solutions, LLC (CS). The FAA’s ITIPSS contract, which carries a shared ceiling of $2.4 billion over ten years, is designed to acquire a full spectrum of IT capabilities, solutions, and emerging technologies to support the FAA’s mission of aviation safety and excellence.

BigBear.ai's role under this contract is pivotal. The company will provide critical support for managing information systems across the nation, enhancing operational and facility management capabilities, and assisting in the evolution of existing programs. This includes the implementation of innovative IT solutions that align with the FAA’s strategic goals, particularly in the realm of future technology modernization.

Implications for BigBear.ai

This contract is more than just a win for BigBear.ai (NYSE: NYSE:BBAI ) —it marks a significant milestone in the company’s journey. As a subcontractor, BigBear.ai (NYSE: NYSE:BBAI ) will play an integral role in facilitating the FAA’s IT initiatives, offering comprehensive, multi-disciplinary services that span IT resource management, financial management, and security. The company’s proven track record in supporting U.S. government agencies positions it as a key player in the federal space, particularly in delivering embedded support and facilitating deep integration of bespoke solutions.

Robert Wedertz, Senior Vice President of Federal at BigBear.ai, highlighted the significance of this partnership, stating, “Our proven history of supporting the U.S. Government has enabled us to rapidly modernize myriad bespoke solutions, facilitate deep integration, and provide embedded support. These core tenets of BigBear.ai partnerships distinguish us in the Federal space, and we are privileged to be part of this team.”

Market Reaction

The stock market responded positively to this news, with BigBear.ai’s shares (NYSE: NYSE:BBAI ) spiking 35% during Wednesday’s trading session. This surge reflects investor confidence in the company’s ability to capitalize on this contract and deliver value to its shareholders.

Technical Outlook

BigBear.ai's stock (NYSE: NYSE:BBAI ) has experienced a 27% increase in value as of the time of writing, currently trading near the overbought zone with a Relative Strength Index (RSI) of 64.77, indicating the potential for further growth. The daily price chart exhibits a gap up pattern, which typically fills in subsequent trading sessions. Accordingly, it is advisable for traders to exercise caution regarding a potential trend reversal.

Looking Ahead

The ITIPSS contract opens new doors for BigBear.ai, offering the company a platform to demonstrate its capabilities on a large scale. As the FAA continues to pursue its IT modernization goals, BigBear.ai is well-positioned to be a key contributor, providing innovative solutions that drive efficiency and safety in the aviation sector.

For investors, this contract represents a significant growth opportunity for BigBear.ai. The company’s involvement in such a high-profile federal initiative underscores its potential for long-term success in the AI and emerging technologies space.

As the FAA and its partners move forward with this ambitious IT project, all eyes will be on BigBear.ai to see how it leverages this opportunity to expand its footprint and drive innovation in the federal space.

BBAI may move higher from deeply oversold LONGBBAI fell on an earnings miss on Thursday, March 7th. The downtrend of 30% was a

slow flush. Penny stocks are volatile, to begin with; this one is in the hottest of subsectors.

Price is in the hard oversold area just below the first lower VWAP line on this 15-minute chart

which is acting as resistance. the RSI lines are in the 30s-40s showing the price weakness. A

predictive forecasting algo from Luxalgo suggests move up.

I will buy this weakness on the prospect things will improve. I will take a long trade with tiered

targets on the chart. partial closures of 25% , 50 and 25% respectively with the targets shown on

the chart. The stop loss is 2.00 just below the current price. The entry will be a limit order /

buy stop set for 2.5 It is selected as a POC line crossover on the volume profile.

The trade is to be managed with partial closures directed by alerts and notifications as well as

a trailing stop loss of 5% once the price gain has reached 10-15%. This minimizes effort and

screen time so that they can be spread across a wider variety of trades.

SOUN breaks above falling wedge LONGSOUN has been falling since March 21st and in the past week in a falling wedge pattern.

It broke out above the wedge early in the 4/4 session and I opened my long trade position

soon after in three separate pieces. I have set targets based on pivots or consolidation levels

on the trend down including a standard Fibonacci retracement. The trend up will be

slow perhaps due to the general technology market recovery of the correction made for

the ambiguities of the rate cut. I am projecting a trade profit of 30-40 %.