BCHEUR

BCH - Falling Wedge/IHS SetupBCH looks to have a bullish reversal forming on the daily. You can see the price action has been moving within this pink falling wedge since beginning of last year. BCH broke through resistance just the other day only to get pushed back under. However, the price is sitting on strong support as it rounds out that right shoulder. Unlike most alts which have had some bull runs of their own this year, BCH has not. So if this breaks to the upside, we could see a very strong move even beyond my IHS target.

BCH / LINK / ADA / DOT Buy Opportunities If Market PermitsI'll keep it short. Unless each takes no break and just continues to climb,

Possible buy opportunities for each at their 0.236 and 0.382 fib retracements.

Make sure to set your stop loss orders not to lose any money or sit there being forced to HODL.

BCH/USD (Retest Weekly Major Support?)COINBASE: BCHUSD

-Bitcoin Cash weekly chart view is still sideways

-It is trading inside a potential ascending triangle

-A clear flat area of resistance at 500 dollars

-And new upward trendline of support at 175 dollars

-BCH is likely to retest major support again

-Can we expect another strong upside movement after retest?

-There is a big chance because of good risk to reward ratio

-Buyers will be interested if the price get this low

-Please don't take this as financial advice

-Technical analysis is only a guide for future scenarios

-Exercise proper risk management

BCH/BTC (Accumulation Phase?)BCH/BTC

-Bitcoin Cash is on an accumulation phase

-Trading at key support area or pivot zone last Dec 2018 history

-BCH is also forming a potential Descending triangle pattern

-Which is a bullish reversal sign if confirmed

-If you are a long term trader

-This crypto is perfect for your taste

-Because you are buying a demand zone

-But always remember to buy only you are willing to lose

-This asset can be dead for many months or even years

-Patience is the key here

BCH/BTC (Accumulation Phase?)BCH/BTC

-Bitcoin Cash is back at previous 2 years Swing Low support late 2018 history

-Base from the bigger picture, it looks to be in the accumulation stage

-But it is gonna take more weeks or even months to confirm a true reversal

-If you are a long term holder, the market is good to add position

-While swing traders will wait for the trendline breakout to confirm the reversal

-There is always a risk in every environment so please use proper trade size management

Nice move!Hello everyone, this is our view on bcheur, enjoy!

Analysis:

Technicals don't lie: huge volume spike detected on small timeframes, signal the pump is not over yet. If whales keep pushing it this way (following the Elliott impulse waves) those are price targets. Brokeout of an ascending channel just to make another one higher which we probably won't break this term. If reaches the major falling wedge then buy at retracement. Golden cross formed by ma9-ma25 on last candle, maybe marking this breakout or, more probably, completing this small uptrend. Wma25 supporting the price very well, an eventual breakdown would bring us to second trendline, but not to my stoploss. Bullish engulfing marked on chart. Overbought on bollinger, wait for a retracement, don't fomo. Very big ichimoku cloud and keeps super bullish. Big bullish divergence and smaller bearish divergences on fisher, i believe we'll retrace and then go up once again. Bull divergences on many laggings (chaikin, moneyflow, rsi, stoch (14,3,3), uo). Stoch also looking good on smooth 50. Very good momentum marked on ao and macd, which is also forming a golden cross. Greed accumulation.

Strategy:

Wait for daily closure or follow our entries and targets

Entry: 218.35-215.19-197.07

Target (short-term): 238.77

Sell (mid-term): 246.46-258.14-277.73-300+

Stoploss: 188 (8% from average)

High risk for big gains!

Trade safe. Anlvis.

Bitcoin Cash to hit $153 - $143. Good chance to go Short. This looks like a very strong TA.

There's alot of pressure on the daily chart and the bulls are working to hold it from going lower but as seen on 4H chart it's now battling on resistance level.

I see this getting rejected at current price level and stomp back to close around the opening.

For the rest of the following weeks it will stay in this downtrend.

Also 13 EMA on daily chart is acting as a resistance upon the bulls. Volume is not quite enough on this level.

RSI looks also waterproof proof that this will reject. I'm waiting for a break in the RSI and seeing the bears take over and push it to the lower supply zones as shown on my chart.

Love to hear your comments.

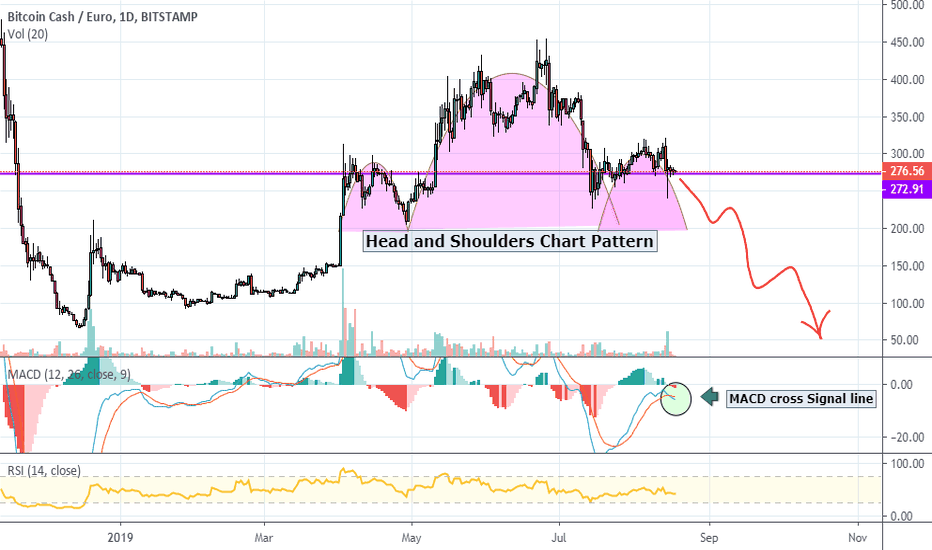

Head and Shoulder Chart Pattern on BCH EURDear Reader,

As I was reading charts, I came across this head and shoulders pattern. This pattern is highly respected and valued among traders.

As addition to the Pattern the MACD is crossing the signal line, giving an indication of bearish momentum. The Price seems in an stable (as the RSI indicator shows)position and has room to move. I am excited to see if my prediction will be a successful one.

Warm regards,

Morning Light,

The altseason coming? Nice bitcoin cash trade opportunity.BCHBTC chart here is showing a classic falling wedge pattern

Judging by historical support/resistance, the bottom is very clear here.

We can simply put our stop loss under 0.1 key support and a get a very nice trade with risk reward ratio greater than 8

***TRADE WITH YOUR OWN RESPONSIBILITY, THIS IS NOT AN ADVICE.***

Bitcoin Cash | Cup and Handle + What is a 'Cup and Handle' ?

A cup and handle pattern on bar charts resembles its namesake, a cup with a handle. The cup is shaped as a "U" and the handle has a slight downward drift.

Place a stop buy order slightly above the upper trend line of the handle. Order execution only occurs if the price breaks the pattern’s resistance. Traders may experience excess slippage and entering a false breakout using an aggressive entry. Alternatively, wait for the price to close above the upper trend line of the handle, subsequently place a limit order slightly below the pattern’s breakout level, attempting to get an execution if the price retraces. There is a risk of missing the trade if the price continues to advance and does not pullback.