BCHUSDT Bullish ChannelBCH is currently testing the upper resistance of a long-term descending channel on the weekly timeframe, a level that has historically acted as strong resistance. After months of consolidation and a healthy recovery structure, BCH is once again knocking on the door of a major trendline breakout.

The price has steadily recovered from the lows near $250 and is now hovering around $590. A confirmed breakout above this descending trendline could trigger a larger bullish continuation, potentially propelling BCH toward the $1,600–$1,700 zone.

Cheers

Hexa🧘♀️

BCHUSD

Is #BCH About to Fall or Will it Continue to Rise? Key LevelsYello Paradisers! Have you seen what’s cooking on #BCHUSDT lately? Let’s dive into the latest structure on #BitcoinCash and what may unfold next:

💎#BCH has been trading within a well-respected ascending channel since early April, consistently bouncing between dynamic ascending support and resistance levels. However, the current move into the $500–$505 resistance zone is showing clear signs of momentum exhaustion, as price stalls and volume fades.

💎The strong resistance area between $500 and $505 has rejected price multiple times, and this recent rejection aligns with both the channel resistance and a bearish momentum divergence in volume. Unless #BCHUSD can break and hold above this zone, bulls are fighting a losing battle.

💎The invalidation of the bearish setup lies above $555. Only a confirmed breakout and sustained hold above this level would negate the current bearish structure and open room for a larger bullish expansion. Until then, the risk of a deeper retracement is very real.

💎Currently trading around $490, #BCH looks vulnerable to a drop toward the moderate support zone near $393, with the strong demand zone between $335 and $340 being the high-probability area for a smart-money reaccumulation—if the market flushes weak hands first. This zone also lines up with previous high-volume nodes on the VRVP.

Trade smart, Paradisers. This setup will reward only the disciplined.

MyCryptoParadise

iFeel the success🌴

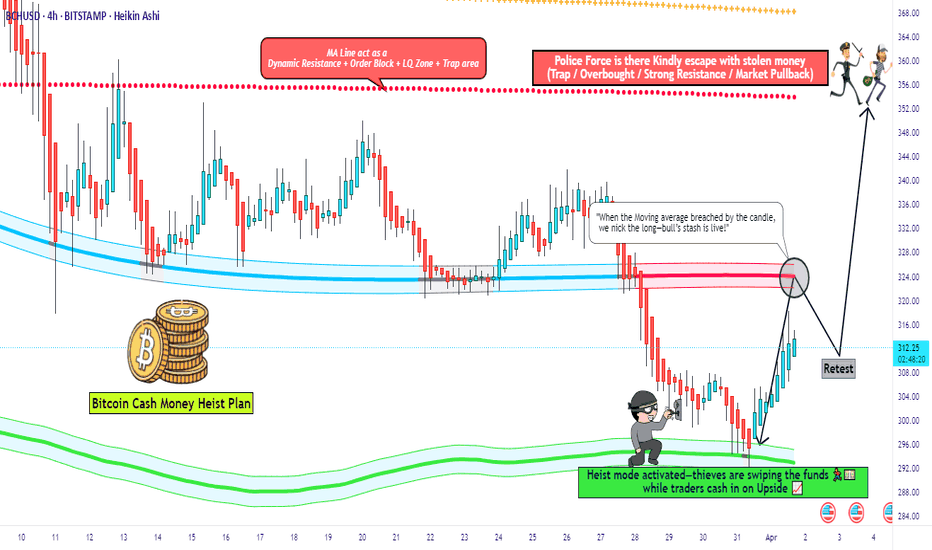

BCH/USDT Robbery Blueprint | Bullish Breakout Swing Trade Setup🚨 BCH/USDT Robbery Blueprint: The "Breakout Bandits" Bullish Heist Plan! 🚨

(Thief Trading Style – Swing Trade Setup)

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Market Robbers, 🤑💰💸✈️

We're about to pull off a high-stakes breakout heist on the BCH/USDT “BitcoinCash vs Tether” crypto market using the legendary 🔥Thief Trading Style🔥 — powered by technical + fundamental recon.

🎯 Mission Objective: Long Entry

"The vault is cracking open... our move starts above the 455.00 MA breakout level. Set your traps smart!"

✅ Buy Stop: Above MA @ 455.00 – The breakout point to initiate the heist.

✅ Buy Limit: Look for pullbacks on 15m or 30m swings for a sneaky entry at key levels.

📌 Set an alarm – don’t blink or you’ll miss the breach!

🛑 Escape Plan – Stop Loss

🔊 Yo crew, hear this:

If you're rolling with a buy stop, don’t drop your stop loss too early – wait till we’re inside!

📍 Ideal SL @ 425.00 on 4H swing lows — keep it smart, based on risk + lot sizing.

You’re the captain of this getaway — protect the loot!

🏴☠️ Target Zone

💰Profit Point: 500.00

(or escape earlier if heat increases 🔥)

Get out before the cops (bearish robbers) regroup!

📊 Heist Intelligence:

Market’s flashing bullish vibes, driven by:

🧠 Fundamentals | 📈 Macros | 🧾 COT Report | 🔗 On-chain Data | 🌀 Sentiment | 🔄 Intermarket Forces

👉 Check our bi0 link for the full briefcase of intel 🔍🧠

⚠️ Trading Alert – News & Volatility Risk

📢 Avoid entries during high-impact news

🔒 Use trailing SLs to protect profits + survive crossfire

💖 Show love to the crew! 💥 Hit that Boost Button 💥

Support our robbery squad – grow stronger, smarter, richer!

Trade like a thief. Rob the markets daily. 🎯💪🏆🚀💸

I'll be back soon with another crypto vault raid – stay tuned, legends! 🐱👤🤑🤩

Bitcoin Cash BCH price analysisMore than 3 months have passed since the publication of the previous idea for #BCH, and the price itself has shown an increase of +40%

◆ Slowly but surely growing

◆ Does not react to the price fall CRYPTOCAP:BTC (for those who don't know, #BCH is the first CRYPTOCAP:BTC fork and probably the only one that survived. Then there were 8-10 more of them in 2017-2018... but hey...)

◆ It has been moving in its own direction for more than a year, when OKX:BCHUSDT is cheaper than $300, it is actively bought back by someone.

We have slightly revised the growth target for #BitcoinCash, but why not consider this asset as a long-term investment from $350-400 to $900 and $1250

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

#BCH/USDT#BCH

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 456.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are heading for stability above the 100 moving average.

Entry price: 471

First target: 480

Second target: 489

Third target: 500

Is the Bitcoin Cash Hype Over? BCH/BTC Ratio Flashes WarningThe Great Divergence: Why the Bitcoin Cash-Bitcoin Ratio Breakdown Signals More Than Just a Price Drop

In the unforgiving arena of the cryptocurrency markets, every chart tells a story. Some whisper of quiet accumulation, others scream of speculative frenzy. But few charts tell a story as profound and historically charged as the Bitcoin Cash to Bitcoin (BCH/BTC) ratio. For years, this ratio has been the ultimate barometer of a digital civil war, a measure of the hopes and failures of a project born from a contentious schism. Recently, that barometer has given its clearest signal in months: a decisive and powerful breakdown from a multi-month triangle pattern.

This technical event is far more than a simple squiggle on a screen for traders. It represents the potential end of a speculative, hype-driven rally and the forceful reassertion of a brutal, long-term trend. It signals that the fundamental chasm between Bitcoin, the undisputed king of digital assets, and Bitcoin Cash, its most famous and ambitious offshoot, may be widening once again. The breakdown suggests that the brief period of optimism for Bitcoin Cash, fueled by its own halving event and a broader market updraft, may be conclusively over. To understand the gravity of this moment, one must dissect not only the technical pattern itself but also the deep-seated historical and fundamental weaknesses that made this breakdown almost inevitable.

The Anatomy of a Technical Collapse: Smashing the Triangle

For much of 2024, the BCH/BTC ratio was trapped in a state of compression. On the chart, this appeared as a classic symmetrical triangle pattern. This pattern is defined by a series of lower highs and higher lows, creating two converging trendlines that form the shape of a triangle. In market terms, it represents a period of intense equilibrium and indecision. Buyers and sellers are locked in a fierce battle, with neither side able to gain a definitive edge. The price coils tighter and tighter, like a compressed spring, building up energy for an explosive move. The only question is which direction it will break.

In the case of the BCH/BTC ratio, that question has been answered with a resounding crash. The price has decisively broken below the lower trendline of the triangle. This is known as a "breakdown," and it is a powerfully bearish signal. It signifies that the sellers have overwhelmed the buyers, the equilibrium has been shattered, and the path of least resistance is now firmly downwards.

Traders often measure the potential target of such a breakdown by taking the height of the triangle at its widest point and projecting that distance downwards from the point of the breakdown. Given the scale of this particular pattern, this technical measurement points to a significant further decline in the ratio, potentially revisiting and even surpassing its all-time lows. This isn't just a minor dip; it's a structural failure on the chart that suggests a new, sustained leg down in Bitcoin Cash's performance relative to Bitcoin. The "hype rally" that saw the ratio climb in the lead-up to the Bitcoin Cash halving has been effectively erased, and the market is signaling that the fundamental gravity of the long-term downtrend is taking hold once more.

A Ghost in the Machine: The Lingering Shadow of the 2017 Fork

This technical breakdown did not occur in a vacuum. It is a single chapter in a long and bitter saga that began in 2017. To grasp its significance, we must revisit the great "Block Size War" that tore the Bitcoin community apart. At its heart was a philosophical disagreement about how to scale Bitcoin to accommodate more users.

One camp, which included many of the earliest adopters and evangelists, argued for a simple solution: increase the block size. By allowing more transactions to fit into each block, the network could process more volume and keep fees low, preserving what they saw as Bitcoin's original vision of a "peer-to-peer electronic cash system."

The other camp, which ultimately retained control of the Bitcoin protocol, argued for a more cautious approach. They feared that large blocks would lead to centralization, making it too expensive for ordinary users to run a full node and validate the blockchain. Their solution was to keep the base layer small and secure, and to build scaling solutions on top of it, such as the Lightning Network.

This ideological impasse led to a "hard fork" in August 2017, creating Bitcoin Cash. For a brief, euphoric period, BCH was seen as a legitimate contender. Fueled by a powerful narrative and influential backers, its price soared, and the BCH/BTC ratio hit an all-time high of over 0.5 in late 2017, sparking serious talk of a "flippening"—the moment BCH would overtake BTC in market capitalization.

That moment never came. Since that peak, the BCH/BTC ratio has been locked in a devastating, multi-year downtrend. The recent triangle pattern was merely a pause, a brief consolidation within this much larger waterfall decline. The breakdown from the triangle is therefore not a new event, but a continuation of a historical trend. It is the market's brutal verdict on the outcome of that civil war.

The Fundamental Chasm: Why Bitcoin Cash Keeps Losing Ground

A chart pattern is ultimately a reflection of underlying fundamentals. The relentless decline of the BCH/BTC ratio is a direct consequence of the widening gap between the two networks across every meaningful metric.

1. Narrative and Brand Identity: Bitcoin has successfully cultivated a simple, powerful, and globally understood narrative: it is digital gold. It is a store of value, a hedge against inflation, and a pristine, unconfiscatable asset. This narrative has attracted institutions, nation-states, and trillions of dollars in potential capital. Bitcoin Cash, meanwhile, has struggled to define itself. Its narrative as "peer-to-peer electronic cash" is less compelling in a world with countless low-fee payment options, including stablecoins and Bitcoin's own Lightning Network. Without a clear and unique value proposition, it has failed to capture the market's imagination.

2. Security and Hash Rate: The most critical measure of a proof-of-work blockchain's health is its hash rate—the total computational power dedicated to securing the network. Here, the difference is staggering. Bitcoin's hash rate is orders of magnitude higher than Bitcoin Cash's. This makes Bitcoin exponentially more secure and resistant to a 51% attack, where a malicious actor could gain control of the network. Bitcoin Cash, with its comparatively minuscule hash rate, remains theoretically vulnerable, a fundamental flaw that deters serious institutional capital.

3. Developer Activity and Innovation: The heart of any technology is its developer community. The most innovative and exciting developments in the Bitcoin ecosystem are happening on the main chain. The activation of Taproot, the explosion of Ordinals and Inscriptions, and the continued growth of the Lightning Network all demonstrate a vibrant and evolving protocol. In contrast, the developer ecosystem for Bitcoin Cash has been far less dynamic. While it has its dedicated builders, it has not produced the kind of groundbreaking innovation needed to attract new users and capital.

3. Adoption and Network Effects: Bitcoin's network effect is its ultimate moat. It has spot ETFs trading on major stock exchanges, granting it unparalleled access to traditional finance. It is held on the balance sheets of public companies and is recognized as legal tender in some countries. Bitcoin Cash has none of these things. Merchant adoption has stalled, and institutional interest is virtually non-existent. In the world of networks, winners tend to take all, and Bitcoin's lead has become seemingly insurmountable.

The Aftermath: What Comes Next for the BCH/BTC Ratio?

With the triangle pattern now shattered, the path forward for the BCH/BTC ratio looks precarious. The most likely scenario is a continuation of the bearish trend that has been in place for over six years. The breakdown has released the coiled energy to the downside, and the ratio will likely seek out lower levels of support, potentially bleeding towards its all-time lows. For investors, this serves as a stark reminder of the risks of holding assets that are fundamentally and technically weaker than the market leader.

Is there any hope for a reversal? A bull case for Bitcoin Cash would require a monumental shift. It would need to carve out a sustainable niche that Bitcoin cannot serve, perhaps in ultra-low-fee microtransactions. It would require a renaissance in developer activity, producing a "killer app" that draws in millions of users. More likely, any significant bounce in the BCH/BTC ratio would probably be a result of a massive, indiscriminate altcoin rally that lifts all boats, rather than a specific vote of confidence in Bitcoin Cash itself. Even then, history suggests such bounces are temporary and ultimately present better opportunities to sell than to buy for the long term.

Conclusion: The Market Has Spoken

The breakdown of the BCH/BTC ratio from its multi-month triangle is a technically significant event with profound fundamental implications. It is the market's latest verdict in the long-running war for the "real Bitcoin" title. The verdict is clear: the hype is over. The dream of a "flippening" is a distant memory, a ghost from 2017.

The story of the BCH/BTC chart is a powerful lesson in market dynamics. It shows that in the brutal competition of open-source protocols, a superior narrative, impenetrable security, and a powerful network effect are the ultimate weapons. Bitcoin Cash began its life as a legitimate contender with a compelling vision. But over time, it has been outmaneuvered, out-developed, and out-adopted. The chart does not lie. It simply reflects this divergent reality, and its latest signal suggests that the great divergence between Bitcoin and its most famous offspring is set to continue.

Bitcoin Cash Nears $485—Will BCH Hold Its Gains? FenzoFx—Bitcoin Cash remains bullish, nearing the previous monthly high at $485.0, though overbought conditions signal possible consolidation.

BCH/USD may stabilize around $431.0 before resuming its uptrend toward $485.0. A break above this level could pave the way for $568.0.

The bullish outlook holds as long as BCH stays above $349.0.

BCH/USD Consolidates Eying $461.9FenzoFx—BCH (Bitcoin Cash) paused its uptrend near $448.1, a low-volume zone, suggesting the rally may resume after consolidation.

Technical indicators show overbought conditions, increasing the likelihood of a short-term dip. BCH/USD may consolidate near $430.0 before aiming for the next target at $461.0.

BCH Analysis for Scalpers (1H)Bitcoin Cash (BCH) is currently showing multiple technical signals that support a potential bullish continuation.

A reversed Head and Shoulders pattern is in the process of forming, and it aligns well with several key confluences — including the Ichimoku Cloud and volume profile support zones.

A breakout above the $430 level would not only confirm the pattern but also activate a bullish flag formation, adding further momentum to the setup. In that case, the next immediate target would be around $452.4.

This setup remains valid only upon confirmation of the breakout. Until then, caution is advised — a clean break and retest would offer the most favorable entry.

— Thanks for reading.

BCH/USD Crypto Profit Raid: Steal Gains with This Blueprint!🔥 Chart Heist Blueprint: Snag Profits in BCH/USD "Bitcoin Cash vs U.S Dollar"! 🚀💰

Crafted for sharp traders ready to raid the BCH/USD "Bitcoin Cash vs U.S Dollar" market, this sleek strategy fuses razor-sharp technicals with savvy fundamentals to maximize your gains. 📊🕵️♂️ Surf the bullish surge, but watch for traps in the Overbought Resistance Zone where bears could strike! 🐻 Lock in your loot before the tide turns. 🌊

- 🎯 **Entry Tactics: Hit the Sweet Spot**

- Long on pullbacks near 440.00 (or) the Silent entry : Institutional Buy Zone at 380.00 (or) above price level. 🏹

- Set alerts for breakouts or pullbacks to strike in real-time. 🔔

- 🛡️ **Stop Loss Hacks: Guard Your Gains**

- Place stops below the nearest 4-hour swing low or candle wick. 🔧

- Tailor stops to your risk and lot size—precision over recklessness! ⚡

- 💸 **Profit Goals: Cash In Big**

- Bullish traders aim for 510.00 or exit early if momentum dips. 📈

- Scalpers focus on long-side quick wins, trailing stops behind big players. 🚀

- 📡 **Market Edge: Why This Plan Wins**

- BCH/USD "Bitcoin Cash vs U.S Dollar" is charging bullish, driven by COT data, macro shifts, sentiment outlook, and intermarket flows. 🔍

- Check the linkss for deeper insights. 🌐

- ⚠️ **News Alert: Dodge the Chaos**

- Skip new trades during major news releases. 📰

- Use trailing stops to secure profits on active trades. 🔒

- 🤝 **Join the Profit Crew**

- Boost this plan, share the vibe, and let’s raid the markets together! 🤑

- Stay sharp for the next big score in the XPD/Palladium heist! 💥

Happy trading, chart bandits! 🎭📉

BCH/USDT Bullish Heist: Crack the Vault & Grab the Loot!🔥 **BCH/USDT Bullish Heist Plan** 🔥

Hey Profit Pirates & Chart Chasers! 🤑 Ready to pull off a slick move on the Bitcoin Cash vs. Tether (BCH/USDT) crypto market? 📈 This *Thief Trading Style* blends sharp technicals with market vibes to hunt a bullish breakout. Stick to this plan, ride the surge, and slip out before the Red Zone danger hits. Let’s stack those gains as a crew! 💪🎯

📊 Heist Blueprint: BCH/USDT

- Market: BCH/USDT (Crypto) 🌐

- Bias: Bullish Breakout 🌟

- Timeframe: 1D (Swing Trade) ⏰

Entry Points 📈

- **Breakout Entry (Entry 1)**: "Crack the vault! Spot the MA breakout at 430.0 and jump in—bullish riches are calling!"

*Pro Move*: Set buy stop orders above the Moving Average or buy limit orders at the latest 15/30-min swing low/high for pullback entries. 📣 Add a chart alert to snag the breakout!

- **Pullback Entry (Entry 2)**: "The job’s on! Wait for the MA pullback in the Market Makers Trap/Heist Zone at 350.0, then strike—guts win big!" 📍

*Trader Hack*: Set a TradingView alert for the 430.0 breakout to stay one step ahead! 🔔

Stop Loss 🛑

- **Breakout Traders**: Once the breakout confirms, place Stop Loss below the recent 1D swing low at (Entry 1) 380.0 & (Entry 2) 310.0 to shield against reversals. ⚠️

- **Pullback Traders**: Customize Stop Loss to your risk tolerance (e.g., 1-2% of account). Tweak based on lot size and multiple orders. 📏

- **Risk Warning**: This heist’s high-octane! Keep position sizing tight to protect your stash. 🔥

Target 🎯

- Aim for 500.0, close to the Red Zone (overbought territory ripe for consolidation or reversal). 🏴☠️

- **Exit Play**: Cash out early if bearish clues (e.g., high volume, reversal candles) pop up near 500.0. 💸

Scalpers 👀

- Focus on Long-side scalps with tight trailing stops. Team up with swing traders for the full heist or grab quick profits if your funds allow. 💰

📡 Why This Trade’s Got Juice (May 17, 2025)

BCH/USDT is primed for action with a neutral trend and bullish sparks, fueled by:

- **Technicals**: A breakout above the 50-day MA (not 108000, correcting to ~430.0), paired with higher lows on the 1D chart, screams momentum. 📊

- **Sentiment Analysis (May 17, 2025)**: Social media buzz on platforms like X shows 68% positive sentiment for BCH, with traders hyping altcoin season. Fear & Greed Index at 72 (Greed), signaling bullish vibes but caution near overbought levels. 😎

- **Fundamentals**: The latest COT report (May 16, 2025) from CFTC shows institutional long positions in crypto futures up 12% WoW, hinting at big-player confidence. 📰

- **Seasonal Edge**: Q2 historically favors Bitcoin and altcoins, aligning with our setup. 📅

- **Market Flow**: USD softness (DXY down 0.8% this week) and altcoin strength boost BCH’s upside. 🌎

⚠️ Risk Management: Lock Your Loot

- **News Alert**: Dodge new trades during high-impact events (e.g., CPI, FOMC) to sidestep volatility traps. 🗞️

- **Trailing Stops**: Activate trailing Stop Loss as price nears 500.0 to secure profits. 🔒

- **Position Sizing**: Cap risk at 1-2% per trade for a smooth heist. 🚨

💥 Ignite the Heist! 💥

Join the *Thief Trading Style* squad—like, comment, and follow for more electrifying trade setups! 🚀 Your support powers our market raids, paving the way for precise wins. Let’s dominate BCH/USDT together! 🤝🏆🎉

**Stay Locked In**: Another heist plan’s brewing. Keep your charts ready, traders! 🐱👤😎

---

🔥 **Real-Time Data (May 17, 2025, UTC+1)** 🔥

- **BCH/USDT Price**: ~425.0 (based on aggregated exchange data).

- **COT Report (May 16, 2025)**: Institutional long positions in crypto futures up 12% WoW, per CFTC.

- **Sentiment**: 68% positive, Fear & Greed Index at 72 (Greed).

- **USD Index (DXY)**: Down 0.8% WoW, supporting altcoin strength.

TA on BCHUSD - 2025.05.14This is a quick technical analysis piece on Bitcoin Cash ( MARKETSCOM:BCHUSD ).

Let's dig in!

CRYPTO:BCHUSD

Let us know what you think in the comments below.

Thank you.

77.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

BCHUSD getting ready for gainsHello traders,

this is a monthly chart - to keep things really simple.

For the last 2 years BCH price has been "climbing stairs". These "stairs" are based on important levels dating 6 years back (green lines). Price action from Q2 of 2021 up until now has been creating a 'cup and handle' pattern. Handle has beatifully reversed from support level, RSI has found support at 50 level (also important level).

This seems a good entry point to me, with target price for profit taking at 1000-1100 USD. Trade is invalidated, if price dips below 265 USD (one step lower).

It will take some time for this to play out - remember, it is a monthly chart.

This is not a financial advice, trade at your own risk.

Mid-term uptrend starts: 333.5-348.2 or higher

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

(BCHUSDT 1D chart)

The M-Signal indicators on the 1M, 1W, and 1D charts are showing an upward trend in a convergent state.

Accordingly, if the price is maintained above 333.5-348.2, it is expected to continue the uptrend in the mid- to long-term.

If the uptrend continues,

1st: 473.4-480.4

2nd: 590.6

You should respond depending on whether there is support near the 1st and 2nd above.

If it falls below 333.5, you should check if it is supported around 294.6.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- Here is an explanation of the big picture.

I used TradingView's INDEX chart to check the entire range of BTC.

I rewrote it to update the previous chart while touching the Fibonacci ratio range of 1.902 (101875.70) ~ 2 (106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems to have been maintaining an upward trend following a pattern since 2015.

In other words, it is a pattern that maintains a 3-year bull market and faces a 1-year bear market.

Accordingly, the bull market is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it is displayed up to 3.618 (178910.15).

It is expected that it will not fall again below the Fibonacci ratio of 0.618 (44234.54).

(BTCUSDT 12M chart)

Based on the BTCUSDT chart, I think it is around 42283.58.

-

I will explain it again with the BTCUSD chart.

The Fibonacci ratio ranges marked in the green boxes, 1.902 (101875.70) ~ 2 (106275.10) and 3 (151166.97) ~ 3.14 (157451.83), are expected to be important support and resistance ranges.

In other words, it seems likely that they will act as volume profile ranges.

Therefore, in order to break through these ranges upward, I think the point to watch is whether they can receive support and rise near the Fibonacci ratios of 1.618 (89126.41) and 2.618 (134018.28).

Therefore, the maximum rising range in 2025 is expected to be the 3 (151166.97) ~ 3.14 (157451.83) range.

In order to do that, we need to see if it is supported and rises near 2.618 (134018.28).

If it falls after the bull market in 2025, we don't know how far it will fall, but based on the previous decline, we expect it to fall by about -60% to -70%.

Therefore, if it starts to fall near the Fibonacci ratio 3.14 (157451.83), it seems likely that it will fall to around Fibonacci 0.618 (44234.54).

I will explain more details when the bear market starts.

------------------------------------------------------

BCH/USD "Bitcoin Cash vs U.S.Dollar" Crypto Heist (Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the BCH/USD "Bitcoin Cash vs U.S.Dollar" Crypto market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red MA Level. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout then make your move at (328.00) - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) after the MA breakout Place buy limit orders within a 15 or 30 minute timeframe most NEAREST or SWING low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📌Thief SL placed at the nearest/swing low or high level Using the 4H timeframe (304.00) Day trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 355.00 (or) Escape Before the Target

LTC/USD "Litecoin vs U.S.Dollar" Crypto Market Heist Plan (Day / Scalping Trade) is currently experiencing a bullishness,., driven by several key factors.👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, On Chain Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

BCH/USDT "Bitcoin Cash vs Tether" Crypto Heist (Swing / Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the BCH/USDT "Bitcoin Cash vs Tether" Crypto Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk Yellow ATR Line. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe nearest or swing low or high level for pullback entries.

Stop Loss 🛑:

📍 Thief SL placed at the recent/swing low level Using the 4H timeframe (300.00) Day/Swing trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 390.00 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸BCH/USDT "Bitcoin Cash vs Tether" Crypto Market Heist Plan (Day / Swing Trade) is currently experiencing a bullishness,., driven by several key factors.☝☝☝

📰🗞️Get & Read the Fundamental, Macro, COT Report, On Chain Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Crypto update 2025.04.14The current market moves due to tariffs are pushing away the interest from cryptos, as those are stuck somewhere between potentially being a safe-haven and still classed as a risky asset.

Let's dig in.

CRYPTO:BTCUSD

CRYPTO:BCHUSD

CRYPTO:ETHUSD

CRYPTO:LTCUSD

Let us know what you think in the comments below.

Thank you.

77.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

BCH/USD "Bitcoin Cash vs U.S Dollar" Crypto Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

⚔Dear Money Makers & Thieves, 🤑 💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the BCH/USD "Bitcoin Cash vs U.S Dollar" Crypto Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (320) then make your move - Bearish profits await!" however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or Swing high or low level should be in retest.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: Thief SL placed at (360) swing Trade Basis Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 270 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

BCH/USD "Bitcoin Cash vs U.S Dollar" Crypto Market is currently experiencing a Neutral trend to Bearish., driven by several key factors.

📰🗞️Read the Fundamental, Macro Economics, COT Report, Seasonal Factors, Intermarket Analysis, Sentimental Outlook, Future trend predict.

Before start the heist plan read it.👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

BCH/USDT "Bitcoin Cash vs Tether" Crypto Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the BCH/USDT "Bitcoin Cash vs Tether" Crypto market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (360.00) then make your move - Bullish profits await!"

however I advise placing Place Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 4H timeframe (320.00) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

1st Target - 420.00 (or) Escape Before the target

Final Target - 500.00 (or) Escape Before the target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

BCH/USDT "Bitcoin Cash vs Tether" Crypto Market is currently experiencing a bullish trend,., driven by several key factors.

🟤Fundamental Analysis

Bitcoin Cash Adoption: Growing adoption of Bitcoin Cash as a payment method, with increasing transaction volumes

Block Reward Halving: The upcoming block reward halving in April 2025 is expected to reduce Bitcoin Cash's block reward, potentially increasing demand and prices

Competition from Other Cryptocurrencies: Increasing competition from other cryptocurrencies, such as Bitcoin and Ethereum, may impact Bitcoin Cash's market share

🔴Macro Economics

Global Economic Trends: The ongoing global economic recovery is expected to drive up demand for cryptocurrencies, including Bitcoin Cash

Inflation Rate: Global inflation is expected to rise to 3.8% in 2025, potentially increasing demand for cryptocurrencies as a hedge against inflation

Interest Rates: Central banks are expected to maintain low interest rates in 2025, supporting cryptocurrency markets

🟠COT Data

Net Long Positions: Institutional traders have increased their net long positions in Bitcoin Cash to 55%

COT Ratio: The COT ratio has risen to 2.2, indicating a bullish trend

Open Interest: Open interest in Bitcoin Cash futures has increased by 15% over the past month, indicating growing investor interest

🟣Sentimental Outlook

Institutional Sentiment: 60% bullish, 40% bearish

Retail Sentiment: 55% bullish, 45% bearish

Market Mood: The overall market mood is bullish, with a sentiment score of +35

🟡Technical Analysis

Moving Averages: 50-period SMA: 320.00, 200-period SMA: 300.00.

Relative Strength Index (RSI): 4-hour chart: 64.21, daily chart: 60.14.

Bollinger Bands: 4-hour chart: 343.00 (upper band), 320.00 (lower band).

🟢Market Overview

Current Price: 343.00

Daily Change: 3.1%

Weekly Change: 12.5%

🔵Overall Outlook

The overall outlook for BCH/USDT is bullish, driven by a combination of fundamental, technical, and sentimental factors. The expected increase in Bitcoin Cash adoption, upcoming block reward halving, and bullish market sentiment are all supporting the bullish trend. However, investors should remain cautious of potential downside risks, including changes in global economic trends and unexpected regulatory developments.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

BCH: Current SituationYou asked, and we delivered.

Bitcoin Cash (BCH) is trading at $331, a pivotal level that’s acting as a battleground between buyers and sellers. This price sits near a critical support zone, and recent price action shows BCH struggling to push higher amid broader crypto market weakness. The total crypto market cap has dropped by 4.4% in the last 24 hours, putting pressure on altcoins like BCH and fostering a cautious sentiment. Social media buzz, especially on platforms like X, has flagged $330 as a make-or-break level, holding here could spark optimism, while a breakdown might fuel bearish momentum. That said, take these posts with a grain of salt; they’re often speculative and lack the full technical or fundamental picture.

Technical Breakdown: What the Charts Are Saying

Short-Term (1-Hour and Daily Charts)

Support Levels:

Immediate: $330 – A close below this could signal trouble.

Next: $315.58 – A deeper drop might test this level if selling picks up.

Resistance Levels:

Immediate: $339 – A hurdle to watch for any upside push.

Next: $350 – A tougher ceiling that’s rejected recent rallies.

Indicators:

MACD: Bearish crossover, suggesting short-term weakness.

RSI: At 46.40, it’s neutral but leaning bearish, room to fall or bounce.

Moving Averages: Price is below the 20-period MA on the 1-hour chart, a sign of near-term softness.

Pattern: A falling wedge is forming, a setup that could hint at a bullish reversal if BCH breaks above the upper trendline with solid volume.

Long-Term (Weekly and Monthly Charts)

Support Levels:

Key: $300 – A major floor to hold for bulls.

Next: $263 – A deeper correction could target this if $300 fails.

Resistance Levels:

Key: $536 – A 50% Fibonacci retracement level and a big hurdle.

Next: $800 – A long-term target if momentum flips bullish.

Indicators:

200-Day MA: Trending down, reflecting prolonged bearish pressure.

RSI/MACD: Neutral on weekly, with no extreme signals yet.

Pattern: A double-bottom around $300 is worth watching, confirmation could spark a reversal, while a drop below $263 would sour the outlook.

Potential Scenarios: What Could Happen Next?

Short-Term Scenarios

Bullish Case:

If BCH holds $330 and punches through $339 with strong volume, it could climb to $350. A break above $350 might target $380, especially if MACD flips bullish. Look for a volume surge to confirm this move.

Bearish Case:

A close below $330 could trigger a slide to $315.58, or even $300 if selling accelerates. High volume on the drop would lock in bearish control, watch this closely.

Long-Term Scenarios

Bullish Case:

Holding $300 and breaking $536 could kick off a new uptrend, with $800 or higher in sight by 2026. This depends on a crypto market rebound and growing BCH adoption for payments.

Bearish Case:

A sustained fall below $300 might drag BCH to $263 or lower, especially if altcoins stay weak. This would kill the double-bottom setup and point to a longer downtrend.

Broader Context: What’s Driving BCH?

Market Sentiment: BCH’s identity as a scalable, low-fee payment option (thanks to bigger block sizes) keeps it in the game, but it faces stiff competition from other coins and regulatory uncertainty. Adoption is key, more real-world use could lift its value.

Tech Developments: Network upgrades enhancing scalability could boost BCH’s appeal. Watch for news on this front.

External Factors: Crypto prices often dance to macro tunes, think regulatory shifts, US economic data (like inflation), or Bitcoin’s moves. These could sway BCH in either direction.

Practical Tips for Traders and Investors

Risk Management: Crypto’s wild, set tight stop-losses and don’t over-leverage. A stop below $330 for shorts or $315 for longs could save your bacon.

Volume is King: Breakouts or breakdowns without volume are suspect. Wait for confirmation.

Stay Flexible: Markets shift fast, keep an eye on news and adjust your plan as needed.

BCH/USD "Bitcoin Cash vs U.S Dollar" Crypto Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the BCH/USD "Bitcoin Cash vs U.S Dollar" market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (380.00) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low or high level Using the 4H timeframe (330.00) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 500.00 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT Report, On Chain analysis, Sentimental Outlook etc....

BCH/USD "Bitcoin Cash vs U.S Dollar" market is currently experiencing a Bullish 🐃 trend,., driven by several key factors.

1. Fundamental Analysis

Fundamental analysis evaluates Bitcoin Cash's intrinsic value based on its technology, adoption, and market position. Here are the key factors:

Technology and Network Upgrades:

Bitcoin Cash (BCH), created from a 2017 Bitcoin hard fork, aims to be a peer-to-peer electronic cash system with faster transactions and lower fees. Recent network upgrades have enhanced scalability and security, making it more efficient for everyday use.

Adoption and Transaction Volume:

BCH boasts a large, active community and high transaction volumes, signaling robust adoption. Its design supports practical use cases, such as micropayments, which strengthens its utility.

Market Position:

Ranked 15th by market capitalization (approximately 7.13 billion USD), BCH holds a solid position among cryptocurrencies. Its established presence and community support contribute to its value.

Key Insight:

BCH’s fundamentals are strong, driven by technological improvements and growing adoption. However, it faces competition from newer cryptocurrencies and potential challenges in maintaining its niche compared to Bitcoin.

2. Macroeconomic Factors

Macroeconomic conditions influence BCH as a global asset. Here’s a breakdown:

Global Economic Growth:

The global economy is experiencing moderate growth, with GDP forecasted at 3.0% for 2025. This supports risk assets like cryptocurrencies but doesn’t strongly favor inflation hedges.

Inflation Rates:

Inflation is stable at around 3%, reducing the urgency for investors to seek cryptocurrencies as an inflation hedge, though it keeps them viable as alternative investments.

Interest Rates:

Interest rates remain steady, with central banks maintaining current policies. Stable rates provide a neutral environment for crypto investments, neither strongly encouraging nor discouraging capital flows.

Geopolitical Events:

No major geopolitical crises are currently affecting markets, limiting BCH’s appeal as a safe-haven asset in the short term.

Key Insight:

The macroeconomic backdrop is stable and neutral for BCH. While moderate growth supports risk assets, the absence of significant inflation or instability means BCH’s price is more tied to crypto-specific factors than macro drivers.

3. Global Market Analysis

This section compares BCH’s performance to other cryptocurrencies and traditional assets:

Market Capitalization:

BCH’s market cap is approximately 7.13 billion USD, placing it 15th among cryptocurrencies. This reflects its established status but also its distance from top-tier coins like Bitcoin and Ethereum.

Trading Volume:

A 24-hour trading volume of 618.85 million USD indicates strong liquidity and active trading, supporting price stability and market interest.

Correlation with Other Assets:

BCH exhibits a positive correlation with Bitcoin (BTC), which often sets the tone for altcoins. If BTC sustains bullish momentum, BCH is likely to follow, though with potentially higher volatility.

Performance Comparison:

Over the past year, BCH has risen 25.85%, outperforming many traditional assets like fiat currencies and commodities, reinforcing its appeal as a growth asset.

Key Insight:

BCH’s solid market position and correlation with BTC suggest potential upside, especially if the broader crypto market trends upward. Its liquidity supports active trading, though it remains a secondary player compared to top coins.

4. Commitment of Traders (COT) Data

COT data reveals the positions of large traders and institutions:

Speculative Positions:

Large traders are net long on BCH, reflecting bullish sentiment and confidence in future price increases.

Commercial Traders:

Commercial traders are net short, indicating a cautious or bearish stance, possibly due to hedging against price declines.

Market Sentiment Implications:

The split between speculative bullishness and commercial caution suggests mixed sentiment. Speculators anticipate growth, while commercial shorts may reflect risk management.

Key Insight:

The net long speculative positions lean bullish, but the net short commercial stance introduces uncertainty. This divergence could signal choppy price action ahead.

5. On-Chain Analysis

On-chain data reflects BCH’s blockchain activity and holder behavior:

Active Addresses:

The number of active addresses is rising, indicating growing network usage and interest from users.

Transaction Counts:

Transaction counts are increasing, reinforcing adoption and utility as a payment system.

Holder Distribution:

A balanced mix of long-term holders and short-term traders suggests stability. Long-term holders provide a price floor, while short-term activity adds liquidity.

Key Levels:

On-chain metrics identify support at 334.08 USD and resistance at 395.00 USD, critical for predicting price movements.

Key Insight:

Positive on-chain trends, like rising activity and balanced ownership, indicate a healthy network. This supports price stability and potential growth if adoption continues.

6. Market Sentiment Analysis

Market sentiment gauges the mood of traders and investors:

Social Media Sentiment:

Sentiment on Internet is slightly positive, with a score of 0.721360266209. Discussions highlight both bullish (breakout to 395.00 USD) and bearish (drop to 334.08 USD) scenarios.

Fear & Greed Index:

At 15 (Extreme Fear), the index suggests widespread caution or panic, potentially signaling a contrarian buying opportunity if sentiment shifts.

Trading Patterns:

Mixed trading activity reflects uncertainty, with some traders shorting BCH and others accumulating at current levels.

Key Insight:

Sentiment is mixed but leans slightly positive on social media, contrasted by extreme fear in broader markets. This could indicate an oversold condition ripe for a reversal.

7. Positioning

Positioning shows how traders are aligned in the market:

Trader Positioning:

Traders are net short on BCH, suggesting a bearish short-term outlook and potential downward pressure.

Institutional Interest:

Institutional investors are increasing exposure via ETFs, signaling long-term confidence in BCH’s value.

Market Impact:

Short-term bearish positioning contrasts with long-term institutional bullishness, creating a tug-of-war dynamic.

Key Insight:

The bearish trader stance may cap upside in the near term, but growing institutional interest could provide a foundation for recovery or growth.

8. Next Trend Move

Technical analysis predicts the next likely price movement:

Current Trend:

BCH is in a downtrend, testing support at 334.08 USD. Resistance looms at 395.00 USD.

Key Levels:

Support: 334.08 USD – A break below could lead to further declines toward 325.00 USD.

Resistance: 395.00 USD – A breakout above could trigger a bullish reversal targeting 500.00 USD.

Triggers:

A surge in volume or positive news could push BCH above resistance, while sustained selling pressure might breach support.

Key Insight:

The next move hinges on support at 334.08 USD. Holding this level keeps bullish hopes alive; breaking it confirms bearish momentum.

9. Other Data

Additional factors influencing BCH/USD:

Partnerships:

A new partnership with a major payment processor could boost adoption, enhancing BCH’s real-world utility and long-term value.

Regulatory Risks:

Rumors of a potential regulatory crackdown on cryptocurrencies introduce uncertainty, potentially pressuring prices if confirmed.

Technological Developments:

Ongoing network improvements strengthen BCH’s fundamentals, though they must translate to broader adoption to impact price significantly.

Key Insight:

Positive developments like partnerships are bullish catalysts, but regulatory risks pose a wildcard that could overshadow gains.

10. Overall Summary Outlook

Overview:

On March 5, 2025, BCH/USD at 360.00 USD presents a cautiously bullish outlook. Strong fundamentals, rising on-chain activity, and institutional interest support long-term potential. However, bearish trader positioning, mixed sentiment, and regulatory uncertainty introduce short-term risks. The market is at a pivotal point, with price action near key levels determining the next direction.

Future Prediction

Trend: Cautiously Bullish (Long-Term), Short-Term Uncertainty

Scenarios:

Bullish Case: If BCH holds above 334.08 USD and breaks 390.00 USD, it could rally to 500.00 USD, fueled by adoption and institutional buying.

Bearish Case: A drop below 334.08 USD might push prices to 240.00 USD or lower, driven by regulatory fears and bearish positioning.

Conclusion:

The long-term trend leans bullish due to robust fundamentals and growth potential. However, short-term risks warrant caution. Traders should monitor support/resistance levels and sentiment shifts closely.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Bitcoin Cash shows signs of resilienceBitcoin Cash MARKETSCOM:BCHUSD is currently resisting to go for lower lows. Instead, the crypto is forming higher lows. If this remains like this, there might see some buying interest coming through. Let's dig in.

CRYPTO:BCHUSD

Let us know what you think in the comments below.

Thank you.

74.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.