BDL

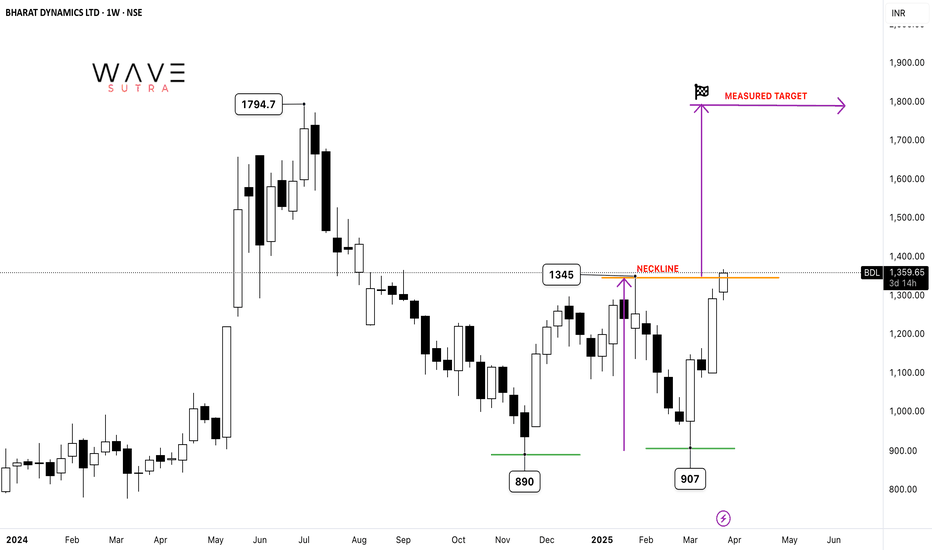

BDL: DOUBLE BOTTOM BREAKOUTThe Double Bottom pattern is a bullish reversal chart pattern that signals the potential end of a downtrend and the beginning of an uptrend. It consists of two consecutive troughs (lows) at roughly the same level, separated by a peak. The pattern resembles the letter "W."

Key Features:

Two Lows: Nearly equal in price, indicating strong support.

Neckline: The peak between the two lows acts as a resistance level.

Breakout: A bullish signal is confirmed when the price breaks above the neckline with strong volume.

Price Target: The expected upward movement is typically equal to the distance between the lows and the neckline.

Double Bottom pattern in Bharat Dynamics Ltd. (BDL) is confirmed, with both lows near ₹888 and a breakout above the ₹1,345 neckline, the price projection suggests a potential upside. The expected price target can be estimated by measuring the distance between the neckline and the lows, which is ₹1,345 - ₹888 = ₹457. Adding this to the breakout point, the projected price target would be ₹1,345 + ₹457 = ₹1,802. If the stock sustains above ₹1,345 with strong volume, it could gain further bullish momentum, potentially reaching ₹1,800 or higher in the medium term.

BDL Short-Term Long Trade on 15m Time Frame: TP4 ReachedWe initiated a short-term long trade setup in Bharat Dynamics LTD (BDL) on the 8th of October at 9:45 am, entering at 1114.45 based on the bullish signal from the Risological Swing Trader. The price action was strong, and we successfully reached TP4 (1225.90) by the 11th of October at 9:15 am.

Target Points Achieved:

TP 1: 1135.70

TP 2: 1170.15

TP 3: 1204.60

TP 4: 1225.90

Stop Loss (SL): 1097.20

This trade exemplifies the power of the Risological Swing Trader in identifying profitable setups and executing with precision. We’ll continue leveraging this strategy for future market moves.

Potential Buying zone in BDLBDL is nearing it's support around 1100-1200.

One's missed the rally can add at these levels.

There's a strong supporting trend line. Could be the Next Best Opportunity to Invest or Swing.

Let the price become Bullish around support, then consider for Swing.

KEEP AN EYE OUT AND DON'T MISS THE OPPORTUNITY

Bharat Dynamics BDL Short Setup on 1D Daily TF on RisologialBharat Dynamics BDL Short Setup on 1D Daily TF on Risologial

After 125% upside rally, BDL has given signs of a possible SHORT trade.

The BDL price is crossing under the Risological trend line, and if we see a red candle today, it is a sign of a good short trade.

Once the trade is confirmed, the Risological swing trading indicator will set the Entry, stoploss and profit targets for this trade.

I will update on this trade post 3:30 closing.

Take care.

Namaste!

Bharat Dynamics Ltd (BDL) Breakout TradeBharat Dynamics Ltd (BDL) has shown a strong breakout above a significant resistance level. The bullish momentum is supported by increased volume and a well-defined trend line, indicating a potential continuation towards higher levels.

Trade Setup:

SL: 1630

TP: 1900

Bharat Dynamics (BDL): Cup & Handle or VCPBharat Dynamics which was already in nice uptrend has currently taken a pause.

When it was move up, it formed big range candle with big volume (in May month), then when it halted, its first pulled back with lower volume.

Whenever there is green candle, there is big volume and where there is red candle there is low volume.

Volume completely dried at second pullback, it means less and less supply is coming, supply is getting absorbed.

So could be the short term trading good opportunity.

BDL / Bharat Dynamics 35%+ in 1 week! Crazy ReturnsEverybody loves momentum.

Why not?

Momentum is the best friend of every trader. I always wanted to find and catch the beginning of a confirmed trend. It's unbelievable it is happening in real life.

Education and skills acquisition is the key to continued growth in any field. This especially holds true in the highly risky terrain called Trading.

A lot of stocks are in superb momentum and I am ready to catch them.

God bless you and happy trading.

BDL gave Break-Out and Retested the Trend-LineBharat Dynamics Ltd. engages in the manufacture of defenses equipment. It specializes in surface-to-air missiles, air defense systems, heavy weight torpedoes, air-to-air missiles, and other allied equipment. The company was founded on July 16, 1970 and is headquartered in Hyderabad, India.

Stop-Loss - 1740

Target 1 - 2230

Target 2 - 2400

Bharat Dynamics looking like it's about to launch into new orbitBharat Dynamics Ltd. is one of the leading defence PSUs in India engaged in the manufacture of Surface to Air missiles (SAMs), Anti-Tank Guided Missiles (ATGMs), Underwater weapons, Launchers, Counter Measures Dispensing System (CMOS) and Test Equipment. The Company is engaged in the business of refurbishment and life extension of stored and deployed missiles. It is the sole manufacturer in India for SAMs, torpedoes, ATGMs.

Bharat Dynamics Ltd. CMP is 1729.40. The Negative aspects of the company are High Valuation (P.E. = 66.5), Declining annual net profit. The positive aspects of the company are No debt, Zero promoter pledge, MFs are increasing stake, Improving cash from operations annual.

Entry can be taken after closing above 1730. Targets in the stock will be 1834 and 1926. The long-term target in the stock will be 1995. Stop loss in the stock should be maintained at Closing below 1600.

The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock. We do not guarantee any success in highly volatile market or otherwise. Stock market investment is subject to market risks which include global and regional risks. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message.

Bharat Dynamics Positional Entry LevelsAs per my analysis NSE:BDL has given a breakout for some upside levels. Best level to take positional buy entry will be 990 with stop loss of 890 (-100 Risk). My expected upside target would be 1087 (+97) & 1145 (+155). This could be low risk and reward idea.

Note: This is my personal analysis, only to learn stock market behavior.

Thanks.

Muhurat Trading picks - 2022What's your Diwali picks ?🤔 comment down below.

1. TATAMOTORS

C.M.P - 398.2

TARGET - 447

Potential Upside % +12.26 %

2. M_M

C.M.P - 1257

TARGET - 1425

Potential Upside % +13.37 %

3. FEDERALBNK

C.M.P - 132.85

TARGET - 150

Potential Upside % +12.91 %

4. SBIN

C.M.P - 561.65

TARGET - 640

Potential Upside % +13.95 %

5. BDL

C.M.P - 954.85

TARGET - 1078

Potential Upside % +12.90 %

6. PARAS

C.M.P - 643.45

TARGET - 740

Potential Upside % +15.01 %

7. ONGC

C.M.P - 131.45

TARGET - 148

Potential Upside % +12.59 %

8. POWERGRID

C.M.P - 216.6

TARGET - 248

Potential Upside % +14.50 %

9. RECLTD

C.M.P - 93.55

TARGET - 105

Potential Upside % +12.24 %

10. BAJAJFINSV

C.M.P - 1681.95

TARGET - 1932

Potential Upside % +14.87 %

11. ITC

C.M.P - 344.85

TARGET - 389

Potential Upside % +12.80 %

12. VBL

C.M.P - 1011.25

TARGET - 1145

Potential Upside % +13.23 %

13. LEMONTREE

C.M.P - 84

TARGET - 96

Potential Upside % +14.29 %

14. INDHOTEL

C.M.P - 313.55

TARGET - 360

Potential Upside % +14.81 %

15. KPITTECH

C.M.P - 711.8

TARGET - 801

Potential Upside % +12.53 %

16. HCLTECH

C.M.P - 1025

TARGET - 1175

Potential Upside % +14.63 %

17. VEDL

C.M.P - 279.95

TARGET - 323

Potential Upside % +15.38 %

18. HINDALCO

C.M.P - 392.1

TARGET - 433

Potential Upside % +10.43 %

19. LAURUSLABS

C.M.P - 477

TARGET - 540

Potential Upside % +13.21 %

20. SUNPHARMA

C.M.P - 978.95

TARGET - 1144

Potential Upside % +16.86 %

21. IOC

C.M.P - 67.5

TARGET - 77

Potential Upside % +14.07 %

⚠️ Important: Always maintain your Risk & Reward Ratio.

⚠️ Purely technical based pick.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat🔁

Happy Diwali 🪔🎉✨

Happy learning with trading. Cheers!🥂

BDL , ready for UPTREND Hey guys ,

BDL stock is ready for uptrend ......

this stock is moving in a straight uptrend

Now this stock was following a traingle pattern

This stock has crossed it's resistance

and has given a big green candle

so , this is a perfect stock to buy presently.

also. the 200 day ema is above the 50 day ema

which show's that the stock is in a great uptrend

therefore, try to buy this stock and earn high returns.

😊😊

BUT FIRST CONSIDER THE GLOBAL MARKET SITUATIONS

1. INFLATION

2. WAR

3. RISING BANK RATES

after considering these situations

you can buy this stock

😀

Bharat Dynamics Trend AnalysisPrice pattern shows a potential reverse Adam & Eve pattern formation.

Price is heading towards support around 570 level which is also at golden FIB zone.

If this support breaks, then the price will fall to 375-400 levels.

Broader view shows price is moving inside the ascending channel and it should touch the bottom of the channel in confluence with the support zone highlighted.

Better to accumulate around 400 levels for a positional target of 1230 (207.50% ROI with 16.6 R:R)

Mandatory stoploss @ 350 due to cyclical nature and inconsistent cashflow which is a matter of concern.

Do your own due diligence before taking any action.

Peace!!