BTC - A gameplan to try and trick Murphy!!!Shorts from 12.3K have to be closed carefully now. If we close above 11.9K today we might go as far as 12.8K which would be bad. But if we close around 11.7K or lower, 10.8K would be the target to close the shorts. If 10.8K breaks, it means a bear flag is in play and we can buy at 8.8K (X times leveraged based on how good your risk management is). Or to be safe just cascade buys at 9.8K, 9.2K and 8.8K as KRAKEN:XBTUSD might decide to break out of the bear flag and charge towards 14350. All this should happen in the next 14 to 18 hours. If not we go back to the drawing board again.

May the grace of Hades shine on you!!!

Disclaimer: Do your own research and don't play with your money if you don't understand what I'm talking about!

PS: The idea is SHORT because, I personally believe we hit the top channel of the correction from ATH and we are still in downtrend and personally look forward to buy KRAKEN:XBTUSD when it's value reaches 3 digit numbers ;)

Bearflags

Aion crash or Aion moon from Bitcoin sell off?Is Aion going to fall into the Abyss or Moon because of BTC sell-off...

At the moment it looks like we are in a Bear Flag but with Bitcoin in a Descending Triangle are we in for some profits?

What's your opinion?

BTCUSD on the hour, you're in for a rideQuick TA on the Bitcoin Hourly!

It's been a rollercoaster ride these past weeks, especially in the last few days as massive price volatility has gotten everyone in frenzy.

After a breakdown from 13.7k, down to almost 10k, we observe the failed support of the trend line, testing the 200MA (in red). It seems to be consolidating around the 50% fib retracement. The current structure is rather bearish, and the breakdown from the bear flag suggests further downward price action. I would be expecting price action to retest the 200MA at around the 78% fib retracement - failing at this point would likely bring us back to revisiting 10k as the next strong support level.

It is clear that 10k is forming a critical support level for Bitcoin - Falling under 10k would spell disaster unless it's drawn out wicks for sniping those limit orders. For the bulls out there, look out for buying volume to re-enter the market - volume is starting to restabilize right now.

Do note, that on a larger time scale, we are still in a bullmarket, so be careful shorting, as it is not wise to trade against the market.

Technical Bear: Gann Square, Triple Top and Bear Flag on ETH/USDWe are bearish on ETH/USD because Ethereum is trading within the up flag as a type of consolidation following the initiation of a downtrend following a triple top pattern. The downtrend from the triple top is the flagpole of the bearish flag pattern. Following the sharp down movement after the triple top, ETH has been trading within a bearish flag. Once there is a breakout we suggest a high likelihood of a strong down movement, to the low 280s.

This strategy incorporates the Gann Fan trend retracement which serves as the upper resistance within the current channel. Three technical analysis patterns - Gann Square, triple top and bearish flag - come together to buttress the strong bearish sentiment we hold.

Attempt for a recovery - Early Reversal?Nasdaq is up more than 2% after several days in the red, coinciding with the fed's will to lower the interest rates to calm the trade war. Although it is a counter-move to buy now, the analysis of a bull run or a pullback is supported by the double-bottom formed with the low of March the 8th. We experienced a sharp decline of bear volume since the 11% correction from the year's high.

Setup to be watched closely :

- Buy @now

- SL @7000.00 (Institutional Level near the current strong support)

- TP @7643.00 (Close to 7700.00 which is 2018's high)

Basic Market Structure and Pattern BehaviorBasic Market Structure and Pattern Behavior applied on every timeframe and any markets (stocks, crypto, fx, futures, indices etc).

Common Patterns I showed on the chart:

Double Bottom / Triple Bottom

Bull Flag / Bear Flag

Ascending Wedge / Descending Wedge / Expanding Wedge

Head and Shoulders / Inverted Head and Shoulders

Cup and Handle / Inverted Cup and Handle

All of given patterns generates good trading signals, and if you combining them with indicators you can have a good trading system.

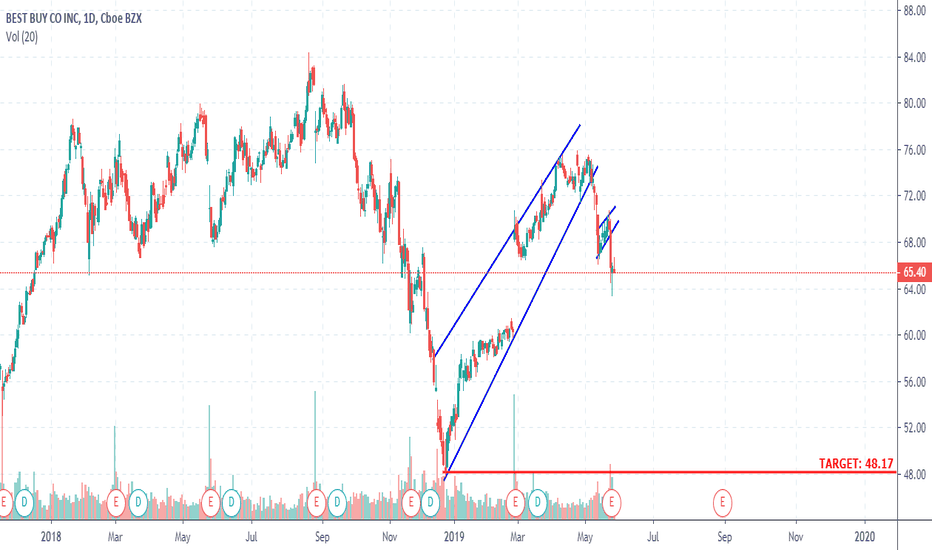

BEST BUY DAILY TIMEFRAME SHORTPrices dropped sharply before forming an ascending wedge, which topped out at the 76 price level. Now, price has already broken out of this corrective structure to the downside and is making a continuation move, with two opportunities to scale in already gone. But you can still jump in with proper risk management and target the bottom of the corrective structure, at the 48.17 price level. May the bears pounce on unsuspecting buyers lol!!

NVIDIA DAILY TIMEFRAME SHORTPrices have been tumbling down recently, having broken out of a corrective structure in the form of a bear flag pattern. This pattern was a good way for prices to blow off some steam, after the massive sell-off. Now we expect the prices to go towards the bottom of the corrective structure (bear flag pattern). This is a classic setup and there is no need to say much because price says it all. May the bears take over the world!!!

Target: 125.33

WE CAUGHT 295 PIPS ON GBP/NZD!!! LET'S DO IT AGAINIf price should move below the 1.9350, i will be entering a short position again. Well this trade was obviously epic, as i entered it on a Thursday, on the daily timeframe, and Friday i spent half the morning in a gruesome Financial Reporting exam. Let it be known that i normally enter my trades using the 4-hour and the hourly timeframes. This was almost a first, if not a second. Can't say i wasn't pleased when i came back and the trade started moving in my favor. It was as if it was waiting for me to come back from the exam center. This trade has taught me a few things:

1. Don't focus on pips, focus on the strategy. If you want pips that bad, go on a higher timeframe. Otherwise focus on the process.

2. Set your stop loss and take profit levels and go meet some girls. I set my stops and had to go for an exam for three hours and i trusted that even if i was wrong, i would be taken out at a fairly reasonable level. There is more to life than trading.

3. The higher the timeframe, the more your patience is tested. I held this trade for close to a day before i could see some feasible profits. Don't just enter a trade on a higher timeframe (daily, weekly) and expect miracles immediately. An exception would be when there is a market crash (like the oil crash of 2018).

4. Trust the process. This is self explanatory. If you have a working trading system, why try and modify it? No system will give you 100% success. As long as it makes you profitable, it is a good system. So be content and scan for set-ups.

GBP/CAD 4-HOUR TIMEFRAME SHORTGBP/CAD recently broke out of the daily corrective structure that started out in early September 2018. This was in the form of an 800 pip move. We are expecting this drop to continue, as price is currently making a smaller corrective structure, and therefore we can expect a continuation to the downside after this bear flag is complete. It will also be interesting to note how the sterling will react to the resignation of the second woman-prime minister of the UK, Theresa May, thirteen days from now on the 7th of June. I hope there will be more selling. In bears we sell!!!

LINK Bear Flag Now- Don't miss out this time!If you've been following, you'll have seen that my calls for LINK have been perfect so far. Here's my next one.

I think some followers have been seeing that they wished they followed me before the pump. I will keep making calls so don't worry about missing the first few.

Anyway, the verdict for me is a big fat SELL on breakout of this flag. Target is exactly where we started. Same lines, just a new pattern to finish it off. If things go really badly, this could turn into a huge head and shoulders with a target below 50c. Otherwise, it could simply bounce of the previous support, and make another attempt.

Chart on the USD pairing looks similar, but not as clear of a flag as this one. BTC however is looking to break upwards in the next few days. Overall, I think 90c- $1 could be a good buy zone for a swing trade or to add to your stack.

Don't forget to leave a like!

NZD/CHF DAILY TIMEFRAME SHORTNZD/CHF currency pair is moving in a gradual downtrend, making lower highs and lower lows. We can expect price to make a corrective structure and creep higher towards the 0.6700 area, before reversing and continuing with the current trend. We will wait for price to blow of some steam and slow down before we consider any shorting opportunities. Prices can also move closer towards the trendline, before resuming the downward trend. Always follow price and don't try to be a wizard. If wizards exist, then i am certainly not one of them.

Bullish Flag or Descending Triangle?Bullish flag formations are found in stocks with strong uptrends. They are called bull flags because the pattern resembles a flag on a pole.

The pole is the result of a vertical rise in a stock and the flag results from a period of consolidation. The flag can be a horizontal rectangle, but is also often angled down away from the prevailing trend.

Another variant is called a bullish pennant, in which the consolidation takes the form of a symmetrical triangle. The shape of the flag is not as important as the underlying psychology behind the pattern.

Basically, despite a strong vertical rally, the stock refuses to drop appreciably, as bulls snap up any shares they can get.

The breakout from a flag often results in a powerful move higher, measuring the length of the prior flag pole.

It is important to note that these patterns work the same in reverse and are known as bear flags and pennants.

This also looks like a descending triangle.

Time will tell per usual.

GBP/NZD DAILY TIMEFRAME SHORTGBP/NZD has just broken out of the corrective structure to the downside, therefore we expect a further continuation to the downside over the next hours/days. Price formed a bearish flag pattern after a big impulsive move to the downside. The technicals of this trade are as follows:

Take Profit 1: 1.87247

Take Profit 2: 1.82568

"The definition of insanity is doing the same thing over and over again and expect different results" - Albert Einstein

CAD/CHF 4-HOUR TIMEFRAME SHORT ENTRYThis trade might/might not have been forecasted on this channel. Price is currently breaking out of a bear flag pattern and creeping to the downside. My take profit is placed at 0.74640, which is the bottom of the flag pattern. Patience is required as usual, as the market is heavily oversold and buyers might "taunt" us. May the bears be with us!!!

Next target $6400 Bear Flag Forming & Rejection at 7600Falling below 7600 caused a massive stop loss hunt and panic in the market , weve had a strong impulsive pattern to 3.1k to 8.3k so far and it makes sense for us to have a correction

My next target is 6400 if this trend line breaks down

If 6400 holds as support we could bounce back above 7000 to form our B corrective wave

SASOL (SOL) 1-HOUR TIMEFRAME SHORTThis stock is moving in a downtrend, and the weekly timeframe shows a possible right shoulder forming. A break of the neckline on this weekly timeframe will signal further bearish momentum. On the 1-hour timeframe, price are trickling down as the momentary uptrend has finished and prices are below that ascending trendline, forming a series of lower highs and lower lows and also forming a series of bear flag patterns. My figures are as follows:

Entry: Now

Stop Loss:44 000

Target Take Profit: 40 000

Is it just a coincidence that the crude oil prices are also falling? We will never know.