Bear flag with scary target of 20K We have this scary bear flag on the 4 hourly that nobady is looking at. Bear flag break-outs are usually the most accurate break-outs from all patterns.Thats why i entered short position at 29.9k but we have so much support under my entery price so i am going to take my profits at 27.3k,25.5k, 24k and possibly at 20k.

Be smart, trade safe and i wish you good luck.

What do you think about this scary bear flag ?

Feel free to leave a comment.

If you like my ideas please follow me and like because you can always find something interesting on my profile, i am new to Treadingview but i have 6 years expirience in trading.

DON'T SELL YOUR CRYPTO

BTC TO THE MOON!!!

Bearflags

EURO-HORIZ trading range.last bearflag?Hello everyone

As we see New York markets struggle in the past couple of days,many down fall of prices in the different markets are noticeable,however in EURUSD we can't see that much change.

Now the price is in a horizontal trading range with long shadowed bars ,after a trend line break, late in a bear market;I don't know about you but this screams final bear flag to me.In situations of such,I expect to see a reasonable down trend in lower time frames after a retest of a moving average ( 20 maybe) and a lower low major trend reversal which can create good reasonable buy setup for swing trades.

For now. the price might stay in trading range for the rest of this week ( good for scalpers) so our support level of 1.05$ will stay unbroken until next week and the price will stay in this channel.

Wait and see at this levelHello Friends!

I entered a trade at $38K and exited at $48K. Now I’m waiting for a confirmed breakout above $48,300 (200 day moving average). It must breakout and hold above that level (prefer above $49K to $50K) for a few days for me to trade the next potential levels up. Maybe wait until the weekly candle closes and watch the volume to support the price action.

Here are the next levels up if it breaks above the 200 day:

-$57K

-$65K

-$70K

Break below the 200 day might push it down a few levels to the bottom of the channel.

-$42K

-$37K

As always thanks for your follows, likes, and comments. Let’s learn and grow together. Cheers!

*This information and publication is not meant to be, and do not constitute, financial, investment, trading, or other types of advice. Do your own research.

BTC is putting up a fightHello Friends!

BTC broke below a bear flag but the break wasn’t strong to push it firmly into the $30,000s. Currently it’s fighting to find strength to break above A1 resistance line. A failed attempt might push BTC to break below A2 resistance and $30,000s might be in play.

As always thanks for your follows, likes, and comments. Let’s learn and grow together. Cheers!

*This information and publication is not meant to be, and do not constitute, financial, investment, trading, or other types of advice. Do your own research.

EURO - Continuation as bear flag!!Hello everyone

As we have seen a great loss of support level 1.078$ and 1.06$ on EURUSD, now we have the support level 1.05$ which leave us with possible outcomes of:

- Continuation of the wedge that can be seen in 4 hours chart as bear flag which is more likely because of the last daily bar with the shadow almost as long as the body and the context of bear market on daily chart. This will lead to fall of the EURUSD to lower channel with the support level of 1.035$ which the price last seen on Dec 2016 & Jan 2017.

- Or we can have the price continues in the channel between 1.06$ and 1.05$ for the whole week and wait for a reversal pattern.

The war in Europe also can be a factor in our bear trend.

TOL - Bear Flag in the makingBear Flag is a continuation pattern. The current trend is down and is now consolidating in a bear flag. Short if and as it breaks at least $0.50 below the bear flag.

trail stops down diligently as bear markets are prone to sharp bear rallies.

Disclaimer: Just my 2 cents and not a trade advice. Kindly do your own due diligence and trade according to your own risk tolerance and don't forget that money management is important! Cheers.

NEAR-Stay in the channel for a while!!Hello everyone

In the past week we had almost 28% fall of the price which brought the market a lot of liquidity and insured a healthy market.

I think we may see lower prices for NEARUSDT which can be the continuation of bear channel in 4 hours time frame ,but if we look at it with positively we may get an IOI (inside, outside, inside) pattern or a pinbar (set of 3 bars)and have a reversal in the next couple of days.

For now , we have support level of 12.5$( it's more likely to break)and 12$ and we have the resistance level of 13.55$.

DOT- Going back up may not be an option!!hello everyone

Yesterday's bar been closed with a lot of selling pressure and a shadow the same size of the bar on top, which is not a good sign for the market.if this price behavior continues we may have a bear flag formation right here (can be seen better on lower time frames).

For DOTUSDT ,we have the resistance level of 17$ and support level of 16$ and the weekly trend line which held the price so far.

I believe we may see the market a pinbar pattern here but it may have the same behavior as we seen on 11th of April.

IOTA- another bear flag or reversal?!Hello everyone

As we have seen a red bar on almost all of the assets yesterday, the candle left a big scar on the market.A red bar with a big body might be the indication of a bear market continuation.

We have a resistance level of 0.625$ and the support level of 0.58$.If our support level fails,our next support level is 0.5$.

I believe it's most likely to have a bear flag pattern here as yesterday for the pole.But we aware ,with a red market like this anything is possible.

CARDANO- Can it get worst than this??Hello everyone

As most of the analysts were wrong ( including me of course)the candle from yesterday didn't create a successful reversal pattern and instead we may get to see either a bear flag pattern( on the good side) or we may face another red bar for tomorrow.

For now, for ADAUSDT,we have the support levels of 0.82$ and 0.78$ and as for the resistance level we have 0.85$.

Honestly, I expect to see an IOI (the day before yesterday inside, yesterday outside,today inside) pattern for the bars on Cardano.

Fantom - bear flag or wedge??!Hello everyone

In past couple of days, in FTMUSDT ,the price been in a range between support level of 1.08$ and resistance level of 1.20$, which shows a bear flag structure but in my opinion with a less likelihood of going lower; because we have a wedge formation on weekly time frame( what you see on higher time frame IS more reliable).

With that been said,I presume we will be able to witness the price breakout from this level and reaches 1.31$ ( more likely),or on the bad,side we will see the price breakout of 1.08$ and touches the 0.97$ level (less likely)

DOW on a potential H&S pattern 🦐DJI on the 4h chart is trading near to a daily support.

The price after the recent top creates a right shoulder and is testing the neckline area with a possible bear flag formation.

How can i approach this scenario?

I will wait fro the EU market open and if the price will break below the support area i will check for a nice short order according to the Plancton's strategy rules.

––––

Follow the Shrimp 🦐

Keep in mind.

• 🟣 Purple structure -> Monthly structure.

• 🔴 Red structure -> Weekly structure.

• 🔵 Blue structure -> Daily structure.

• 🟡 Yellow structure -> 4h structure.

• ⚫️ Black structure -> >4h structure.

Here is the Plancton0618 technical analysis , please comment below if you have any question.

The ENTRY in the market will be taken only if the condition of the Plancton0618 strategy will trigger.

BTCUSD Weekly Bear Flag!Looking at BTCUSD on the Weekly TF (LOG) It was apparent that LT Trend touch attempts were made by the Bears after ATH levels had been locked in.

With the current Weekly Bear Flag formed within the current Ascending Range, I am questioning whether another LT Trend retrace is in play.

Noted there is some strong Support to break and hold BUT as former ATH (20k region) has yet to be retested since it broke in DEC 2020 and LT trend has been untested since MAR 2020 I feel it is a great target if Range & Former Support is broken.

RSI is rallying off Short Term uptrend but if this breaks then the last sign of momentum support is off the 42.00 region as this has proved pivotal in years past.

If the current range holds and the Bear Flag is to fail then I am looking for another rally within Weekly Range back towards ATH and Upper Range Resistance. RSI will break above the 50.00 Midway and break its LT Downtrend.

Descision time is close IMO. What are your thoughts on the LOG Scale?

"DISCLAIMER: NO ADVICE. The information presented here is general in nature and is for education purposes only. Nothing should be considered to be advice. You should consult with an appropriate professional for specific advice tailored to your situation."

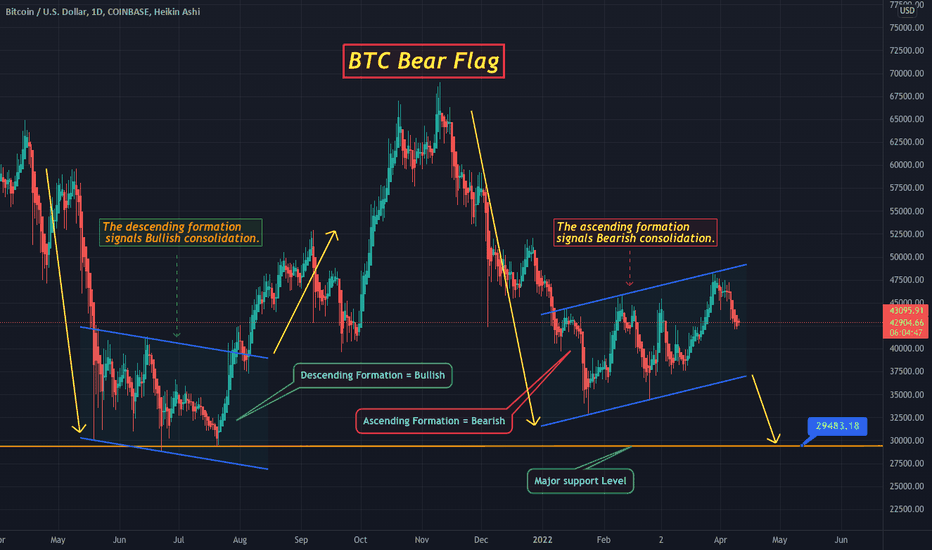

Bitcoin Bear Flag - What this means for Bitcoin's Future...Hello Traders,

Today I will be discussing the formation of a Bear Flag and what this means for Bitcoin.

- As you can see on the chart BTC has been consolidating in an "Ascending" parallel channel since January.

1) An ascending formation is typically a Bearish signal.

2) In conjunction with the downtrend from the highs at $69K in November, this creates a bear flag.

- Now I'm sure some of you may be wondering... Well BTC consolidated last year in a channel before the massive pump to $69K, so won't Bitcoin do the same this time? - The answer is no.

- Last year Bitcoin consolidated in a "Descending" channel which is typically Bullish.

- As expected BTC pumped coming out of that Bullish consolidation.

- This time BTC has created a Bear Flag and has a much higher probability of continuing lower before hitting previous ATH's.

So what does this mean for BTC? Here are the 3 possibilities I see playing out..

1) (Highest Probability) BTC retests the $36K support level

2) (Medium Probability) BTC retests the $29K support level

3) (Lowest Probability) BTC retest the $20K support level.

I want to emphasize... Patterns have a certain probability of playing out. Bear flags have a relatively high probability of playing out and BTC has formed a textbook Bear Flag. This means the probability of BTC breaking down and even hitting $20K are still relatively high. Sometimes you have to zoom out and look at the bigger picture. I'm sure a lot of you will be discouraged by this, but think of how incredible it would be to accumulate BTC back at $20K!?

Good luck everyone and happy trading!

XAU / USD 1948.13 - 0.83 % SHORT IDEA * CONTINUATION & PTTNSHEY EVERYONE

HOPE EVERYONE IS DOING GOOD HAVING A GOOD ONE,

AN IDEA ON THE GOLD METAL THIS WEEK.

* The metal has been Correcting for a couple of weeks now, seems we have entered some slowing down in momentum with the bears as we ranged in a Bear flag possibly signaling continuation.

- Short term the METAL has currently Rallied with a down trend as WE broke below on the 4h chart. hitting ( LH , LL ), looking for a continuation of this trend with the bears.

- Looking for SHORT entries on the METAL this week should all the rules of the formation be met, A break above of the marked structure and close CANCELS the trade should the bear flag / ascending channel come into play again could be just a delay to retest another resistance just above there.

SCALLING DOWN

lets see how it goes

IF THIS IDEA ASSISTS IN ANY OR IF YOU LIKE THIS ONE

SMASH THAT LIKE BUTTON & LEAVE A COMMENT.

ALWAYS APPRECIATED

____________________________________________________________________________________________________________________

* Kindly follow your entry rules on entries & stops. |* Some of The idea's may be predictive yet are not financial advice or signals. | *Trading plans can change at anytime reactive to the market. | * Many stars must align with the plan before executing the trade, kindly follow your rules & RISK MANAGEMENT.

_____________________________________________________________________________________________________________________

| * ENTRY & SL -KINDLY FOLLOW YOUR RULES | * RISK-MANAGEMENT | *PERIOD - SWING TRADE

Bear Flag on the weekly?Hello Friends!

It looks like a bear flag is forming on the weekly. Last time BTC moved up to $69K it was trading above the 50 week. Now it’s below the 50 week and looks like a flag is forming between the 50 and the 100 week. Break below the 100 week can push it down to $20-25K (200 week).

As always thanks for your follows, likes, and comments. Let’s learn and grow together. Cheers!

*This information and publication is not meant to be, and do not constitute, financial, investment, trading, or other types of advice. Do your own research.

TRIPLE TOP;BEARISHBitcoin break out but that isn’t enough to have the bills to get full control. As you see now is triple too and rejection hit from 4HR Chart and rejection bullish breakout from 1HR Chart; will drop test to to 36 or 35K if it breaks then on the way down to 27K.

Let’s see how it plays first and watch any reversal buys hit.

TRIPLE TOP BEARISHIt made a breakout and seemed to be a fake out; technically now we are still in a bearish market.

In order for Bitcoin to be back to bullish then has to break the 48K Resistance but didn’t happen; it’ll go short down to 38 or 35K if the support breaks then will big drop more down about 27K.

Let’s see how the bearish plays and how long will control it looked strong; watch any rejection price reversals for bulls to try to fight and take over.