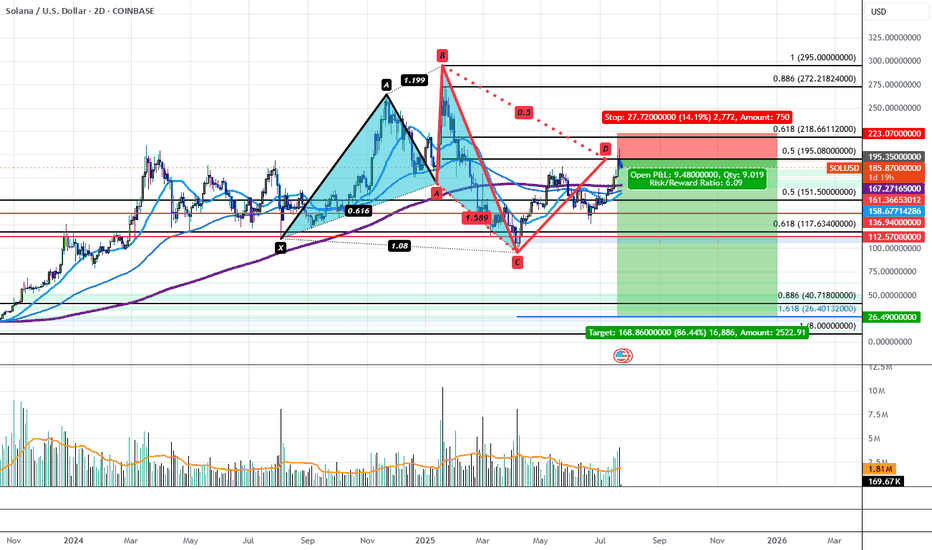

Solana's Bearish 5-0 is Locking in a Bearish Reversal to $26.40Solana has recently run up to Horizontal Resistance Zone of $195-$210 aligning with the PCZ of a Bearish 5-0 and has begun to impulse downwards with volume to back it. This could be the start of a greater move down that would take SOL back to the low of the distributive range at $95.16. If the level breaks, we would then target a drop down to the $40.72-$26.40 confluence area aligning with the all-time 0.886 retrace as well as the 1.618 extension from previous swing low to high. Only at these levels could we even possibly begin to consider Bullish Entries on Solana.

Bearish 5-0

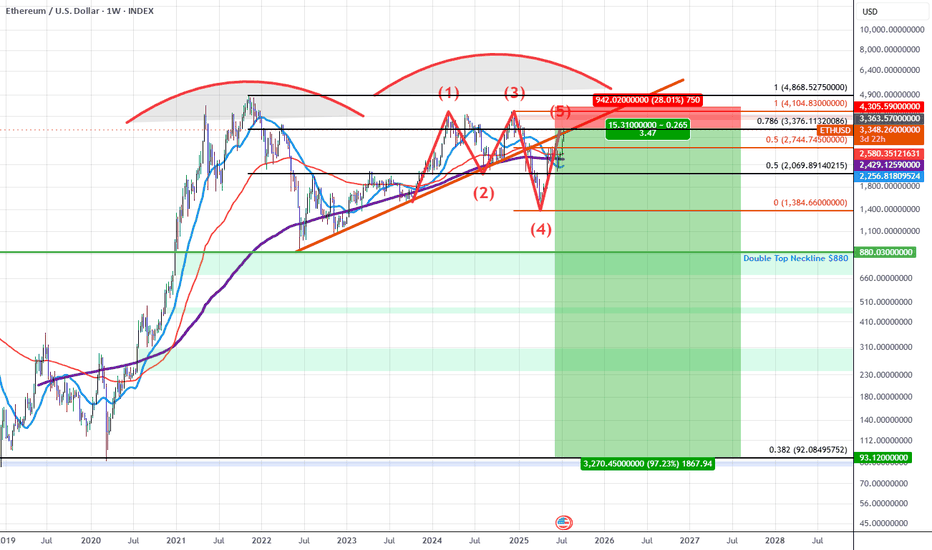

ETHUSD: Double Top into A Bearish 5-0 Breakdown (Extended)Updated Commentary: ETH has extended a bit further than projected as the Pattern Completed at the 0.618 but ETH gapped into the 0.786 instead. The gap up aligned with an upside gap fill on the CME futures as well as a gap fill on the grayscale ETH futures ETF $ETHE. The easier move from here to simply add to the ETH shorts and adjust the stop to be above the previous highs while sizing up at the 0.786 and playing off this gap higher as an anomaly. Beyond this, my view on ETH at the current 0.786 retrace remains the same as the original Idea posted as ETH rose into the initial 0.618 PCZ the details of which I will also include once again below as it still remains relevant.

ETH for the last 5 years has been developing a Double Topping pattern which has put in a series of lower highs during the most recent 2nd run up. As we've confirmed these lower highs we've broken down below trendline and are finding resistance at the trendline which happens to have confluence with the PCZ of a Bearish 5-0 wave formation near a 0.786 retrace.

As we begin to find weakness and Bearish price action begins I suspect price will make it's way towards the neckline of the double top aligning with the $880 price level if ETH breaks below that level there will be no significant support until it reaches the all-time 0.382 retrace down at around $92.10.

In short it seems ETH is in the early stages of a macro breakdown which could result in value declines greater than 80%.

I also suspect that we will see many of the assets that ran up significantly going into this week to sharply reverse those run-ups as this week comes to a close and the new week begins mainly due to the effects of OpEx, this includes: Bitcoin, MSTR, SOL, XLC, META, and BTBT. Long-dated Put accumulation on these assets at these levels is far easier to manage than naked short positions and that's how I will go about positioning here.

ATOMUSD: Holding 21-week SMA After Completion of Bullish SharkATOMUSD has Double Bottomed on the weekly timeframe at the PCZ of a Bullish Shark and is now holding above the 21-week SMA. If it holds, we could see ATOM breakout of the range and rise all the way up to a 61.8% retrace. From there it may then turn into a Bearish 5-0 but for now I'm just focused on the potential Bullish move upwards.

The Shark pattern here is admittedly controversial given the fact the C leg is an equal high to the A leg rather than being a higher high, but I think it is something that this pattern could maybe get away with.

ZARJPY: Massive Head and Shoulders with Bearish DivergenceIn addition to the Bearish 5-0 I pointed out before on a previous chart, the ZARJPY has also formed a Potential Bearish Head and Shoulders that is visible on timeframes even as high as the monthly with Bearish Divergence on the MACD and RSI. If The Carry Trade truly is to be dissolved, the ZARJPY should be among the currency pairs that are most severely affected, as it has the highest interest rate differential and therefore generates the highest yield for the time being.

A Promising Trading StrategyThe star trade of the week. I'm currently waiting for a shorting opportunity on the bearish shark pattern off the weekly chart.

Trading off the weekly chart directly would send my initial risk through the roof. While we could always reduce our trading size when trading off the higher timeframe, it doesn't make sense to me.

I'll be waiting for a bearish 5-0 pattern to complete at 110.56. My initial stop-loss is at 110.96, which is approximate -40pips or -400USD/lot.

My first target is at 109.96, which is approximately 1,000USD/lot.

However, there's also a bullish shark pattern that has completed at 109.96, so there's no reason why you can't engage on that as well.

Remember, it's important to plan your trade and trade your plan. Never follow any trader blindly.

ADBE: Bearish 5-0 Bearish Entry Anticipating PPO ConfirmationBack in December 2021, ADBE gave us a Bearish ABCD entry that led us into a Shark BAMM Pattern. Once it made it to the BAMM target, it bounced back up to where it is now. The interesting thing is that the PPO is looking like it's ready to roll over, and it happens to be at what would be a Potential Bearish 5-0 entry. If the PPO crosses below the upper extremes, we could see this go for a lower low, and if we are to judge how far it can go harmonically, I'd say it could go all the way to the 1.414, which would be the PCZ of a Potential Bullish ABCD.

For additional context, I have left the Bearish Entry setup from 2021 in the Related Ideas Section below.

Great Wins on WTI💰 Celebrating two great wins on WTI in June! But let me clarify, I'm not chasing streaks—I focus on proper setups. Let's dive into the current situation for WTI, aka US Oil.

📈 The market is testing the support line on the weekly chart. While some traders see it as strong support and anticipate buying opportunities, multiple retests increase the likelihood of a break. That's why my highest priority is shorting WTI and monitoring key levels.

⏰ On the 4-hourly chart, I'm cautious about shorting at the Bearish 5-0 pattern. If I spot an RSI divergence, my perspective may change.

⬇️ Instead, I'm patiently waiting for the Bearish Shark Pattern at 72.03 for a shorting opportunity.

⏱️ On the 1-hourly chart, if you're seeking a buying opportunity, watch for a confirmed candlestick pattern on the Bullish Bat setup at 69.61.

📊 Share your trade plan for WTI! What's your top investment product?

Luna Classic: Bearish 5-0 on the Daily LUNC if Breaking Below the 89 Day EMA while showing MACD Bearish Divergence on the Daily after Two very weak Attempted Rallies towards the PCZ of a Potential Bearish 5-0 and now it looks to recover the gaps below the sub one-ten-thousandths level.

I thimnk it Could go as low as 47 Millionths but i will mostly be targetting the zone between 72-55-millionths

$ANY: Momentum Shifting Spring and Bullish SharkANY looks to be springging off an also support level that aligns with the 1.618 Fibonacci Extension of a Log Scale Bullish Shark while at the same time the RSI seems to be shifting it's momentum into the Bullish Control Zone; Hold these levels long Enough and it could rise up to the 50% Retrace up at around 2 dollars.

RBOB Gasoline Future Macro Bearish 5-0Gasoline Futures is very near the PCZ of a Bearish 5-0 but is actually showing a very notable amount of weakness at the 0.382 and is Bearishly Diverging if this keeps up we will see Gasoline Breakdown out of the Bearish Consolidation and probably go back to pre-2020 Levels.

The easiest 100pips profits to captureAs early as 8 Feb 23, I've been shouting LONG the Shark, LONG the Shark(at this to my community). The trading analysis report was written on TradingView.

The Bullish Shark Pattern has been bouncing off the Bearish 5-0 patterns, and this combo, it produces more than 100pips of profit potential.

It has bounced up and down 5 times; that's not too bad. 5x100pips = 500pips.

I'm excited to wait for the next confirmation to get involved in this trade.

USOIL: Remaining Stubborn within the RangeUSOIL has managed to stay slightly above the PCZ of a Bearish Butterfly as well as to not break down any trendlines and avoid the bottom of the Range; However, Despite how strong it may look it still has dailed to break structure and it has been showing lots of Bearish Divergence. So long as the range holds i suspect that we will trade back below the 1.618 and eventually go for the Bearish Break Down Targets that could lead to a Bearish 5-0 to take us down to Atleast $56.27.

NZDJPY - Combo TradeWe could be a bit early for this 5-0 Pattern trading setup. That is because the daily chart has not confirmed; the candlestick pattern confirmation is required.

I pull the trading confirmation of the 1-hourly chart. This is a trading management I've been using and refining for the past 5years.

There are 2 kinds of trading management for the such combo.

ComboTrade - Valid trading setup off the higher timeframe, but we engaged the trade on the smaller timeframe

UpsizeTrade - Valid trading setup on the smaller timeframe and final target stretch to complete the higher timeframe.

Both are high-risk trade management, which means the chances of stop-loss being hit are higher, but the profit factor(reward) is amazing.

Of the two selections, upsize trade has the higher risk.

NASDAQ100: Hidden Bearish Divergence at PCZ of Bearish 5-0The Nasdaq has made a 50% Retrace to the PCZ of a Bearissh 5-0 while showing Hidden Bearish Divergence just below the Supply Line of the Equidistant Channel; I think it will continue down from here. I don't however have a strong bearish opinion on the other Indexes, just the Nasdaq because the Nasdaq in particular has not presented us with Potentially Bullish Arguments like the other indexes have.

AUDUSD: Bearish 5-0 on Quarterly Timeframe Seaking 50% DeclineAUDUSD has this strange Inverse Cup with Handle / Bearish Head And Shoulders sorta look to it, but more clearly, it has formed a very real Massive Bearish 5-0 that has been in the making for many years and it has recently tested the PCZ as resistance at the 50% retrace and confirmed it with huge amounts of MACD Hidden Bearish Divergence. If this plays out fully, then we can expect that the Australian Dollar to lose well over 50% of its value from here out.

BTC/BVOL Bullish Continuation, VIX Bearish BAMM, DXY Bearish 5-0BTC looks to be continuing the move it started yesterday after hunting for the stops below the POC and then defending the EU Brinks Box During the US Brinks session.

BVOL is Bullishly Diverging at the lows Signaling a rise in BTC Volatility is imminent.

The SPX is Bouncing off of a Liquidity Zone and off of the 1.618 Extension PCZ of a Bullish Shark that may now take it back to the supply line and confirm a Partial-Decline for the second time.

The VIX S&P Volatility Index seems to be struggling at the Moving Averages and setting up for a Deep Crab Bearish BAMM that will take it down to $14

The DXY is showing weakness at the PCZ of a potential Bearish 5-0 that will probably take it down to equal or lower lows than the previous low.

BTCUSD: Bullish Cypher at Weekly Support Congestion ZoneBTC leading to the Fed SPeaking in the 21st may see a rally from the Support Zone it's been trading within. It formed this Bullish Cypher/Shark on the Daily and rallied about 61.8% of the way before failing and pulling back down again. This sorta action is very dangerous as it makes me think it could be a Bearish 5-0 that could lead to us making a lower low and if we do that we will likely come back down to atleast the 786 retrace below at 17.8k. But as of right now the move down to PCZ of this Harmonic has been fast and on above average volume with a wide spread so i believe that we have a high chance of recovering the bearish price action and trading back to the top of the range as the new trading week begins, and if we break above the range we could see a secondary target of $26.5k

Bullish Shark on the 1hr BTCHello, we got a bullish shark forming on the 1hr bitcoin chart. A shark harmonic pattern has the XC .886 to the 1.13 buy area zone. However, you'll know the entry zone if the BC extension is of at least a 1.618. There it lines up with the .886 so we know that the entry for the price reversal zone is with the combination of the .886 and 1.618 BC extension and not at the 1.13 for this one.

According to Scott Carney, harmonic trader, from harmonictrader.com, he states we should take at least 50% position off at the 50% retracement up from the whole bullish pattern. This is because the shark pattern, if it hits the 50% retrace profit target, that is where a bearish 5-0 pattern completes.

Bullish Shark at Support Line with MACD Bullish DivergenceFrom the looks of it AXS would like to see one more bounce before it resumes it's Bearish Trend. I suspect close to a 50% Retrace of the Prior Highs before an Ultimate Reversal back to the downside.

For now the trade is Bullish and Profit Taking Targets range from 80 dollars to just over 100 dollars.