EURAUD – Bearish Flag Breakdown OpportunityThe EURAUD pair is showing signs of trend continuation via a classic bearish flag pattern formation. After a sharp decline, the market has entered into a tight consolidation channel, climbing steadily inside a sloped flag structure. Price is now testing a critical resistance area near 1.7830–1.7840 while hovering just below the 200 EMA.

This setup offers a high-probability sell opportunity — but only after confirmation.

1. Structure Overview

The initial sharp downtrend is followed by a consolidation channel — a textbook bearish flag.

Price is approaching major resistance (1.7830–1.7840) and 200 EMA, acting as a ceiling.

A breakdown from the rising support of the flag is expected to trigger a continuation toward the downside.

2. Trade Plan – Bearish Flag Breakdown

✅ Entry Plan:

Wait for a breakdown of the green support trendline (flag support).

Then, wait for a re-test of the broken support (now resistance).

Enter short only after a bearish candlestick confirmation (e.g., bearish engulfing or rejection wick) on the 15-min or 1-hour chart.

🛡️ Stop Loss:

Place the stop loss just above the major resistance zone, around 1.7835–1.7840.

🎯 Target Zones:

Target 1 (TG1): 1.7755

Target 2 (TG2): 1.7718

Final Target: 1.7632

Risk/Reward Ratio: 1:2, 1:4, 1:9.4+

3. Why This Trade Makes Sense

Bearish Flag is a reliable continuation pattern in strong downtrends.

Price is failing to break above key resistance and 200 EMA.

The flag offers a tight SL and large downside potential — ideal conditions for R:R setups.

Confluence of structure, pattern, and trend all align for short bias.

4. Trade Management Tips

Scale out partial profits at TG1 and TG2, and trail stop for final target.

If breakdown fails, avoid chasing price — re-evaluate bias if price breaks above 1.7840.

5. Final Thoughts

This EURAUD chart is a textbook case of pattern + price action + resistance confluence. The flag structure is well-defined, and the reward-to-risk ratio is significantly favorable if the breakdown confirms.

📌 Watch for:

Breakdown of rising support

Retest and bearish candle

Entry only on confirmation

High-probability setups don’t require prediction — they require preparation.

=================================================================

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

=================================================================

Bearish Flag

USD-CHF Bearish Flag! Sell!

Hello,Traders!

USD-CHF is trading in a

Downtrend and the pair broke

Out of the bearish flag so

We are bearish biased

And we will be expecting

A further bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

$XAU Showing Bearish Flag Pattearn & Dropped $3K Support area...TVC:XAU Showing Bearish Flag Pattearn & Dropped $3K Support area. Price dropping now and back to $3K price level area. price FVG touch and Strong support $3K Price Level area. Here is many support Holder.

Stoploss: $3,536

Entry: $3,377

1st Target point $3,377

2nd Target point $3,249

3rd Target point $3,028

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions. Digital asset prices are subject to high market risk and price volatility. The value of your investment may go down or up, and you may not get back the amount invested. You are solely responsible for your investment decisions and Binance is not available for any losses you may incur. Past performance is not a reliable predictor of future performance. You should only invest in products you are familiar with and where you understand the risks. You should carefully consider your investment experience, financial situation, investment objectives and risk tolerance and consult an independent financial adviser prior to making any investment.

$Btc Bearish Flat Pattern Forming?Bitcoin Bearish Flat Pattern Forming? Potential Short Setup to $97K-$98K if Rejected at $106K

📉 BTC recently hit a new all-time high around $112K, followed by a series of higher lows near $110K, $108K, and potentially $106K. If price gets rejected at $106K, a bearish flat pattern may play out—triggering a high-probability short opportunity toward the $97K–$98K support zone. However, a clean breakout above $107K will invalidate this setup.

EURCAD no3 view, bearish continuation still to expect

OANDA:EURCAD last two analysis on EURCAD doing, going good, will be attached, having now one more update and new view.

Price at end is break RAISING WEDGE and BEARISH FLAG, pushing strong bearish, strong volumem and momentum is gathered and still here having strong bearish expectations.

SUP zone: 1.57200

RES zone: 1.53000, 1.51600

EURUSD update and new bearish view

FX:EURUSD one more view on EU, we can see long zone and break of same how currently looks, two bounce on sup zone 1.13500, price now pushing till crucial zone 1.12700, if we see break here we will have confirm.

Currently how everything looks, its expected to see stronger fall here.

SUP zone: 1.14000

RES zone: 1.11700, 1.11200

$TOTAL Crypto Market Cap BULL TRAP AlertBULL TRAP 🚨

New money has been coming into the market as shown on the Crypto CRYPTOCAP:TOTAL Market Cap, hence why you haven’t seen “rotations” in coins, but it appears to be drying up.

There’s been major resistance at the 200DMA, which is just below the previous ATH at $3T, and PA is being squeezed between the 9DMA.

Combine this with a heated RSI, it appears to be a bear flag in the making.

The trendline from Oct. ’23 gives confluence with the 50DMA as support.

*The only savior I see at this point is price smashing through the 200DMA and flipping support into the green accumulation box.

Regardless, this move is coming to an end later this week to test support or breakout.

Again, I’ll reconfirm my stance that this is the most obvious bull trap I’ve seen all cycle. Although I hope to be wrong 🥲

Having said that, after support is confirmed on the move, we are going to VALHALLA 🚀

Bookmark this 🤓

GBPCAD bearish view

OANDA:GBPCAD whats next?, we are have two times bounce on trend line,

currently on D is visible DESCENDING TRIANGL,

in triangl we have RECTANGLE PATTERN 4h which is breaked,

below rectangle pattern we have on lower TF better visible BEARISH FLAG pattern 1h (violet doted), which currently looks breaked,

here expecting bearish push now till next trend zone.

SUP zone: 1.85000

RES zone: 1.82250, 1.81600

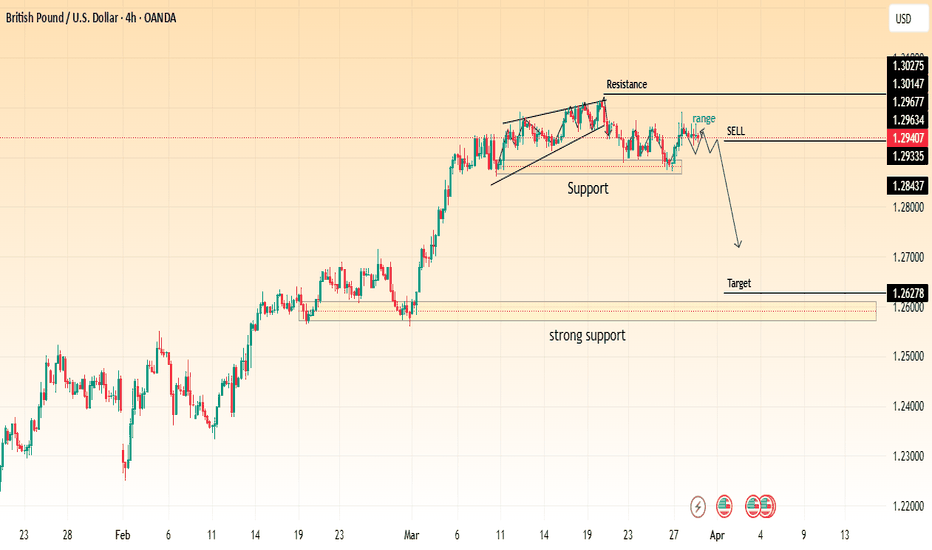

GBP/USD Breakdown: Bearish Setup with Sell Opportunity!"Key Observations:

Rising Wedge Breakdown:

The price initially formed a rising wedge near resistance.

The wedge broke down, indicating bearish momentum.

Support and Resistance Levels:

Resistance Zone: Around 1.3014 – 1.3027, marking a strong rejection area.

Support Zone: Around 1.2933 – 1.2843, where price previously bounced.

Strong Support: Around 1.2627, marked as the target area for a bearish move.

Bearish Setup:

A range-bound consolidation occurred after the breakdown.

The chart marks a sell signal, suggesting a move toward the 1.2627 target zone.

Trading Idea:

Entry: Sell after confirmation below 1.2933.

Target: 1.2627 (major support level).

Stop-Loss: Above 1.3014 (resistance level).

This setup suggests a potential bearish continuation, with price expected to decline further if support breaks. Always confirm with volume and market conditions before entering a trade.

Bitcoin - This bear flag will send BTC to 72,000! (sell now)The whole crypto market and Bitcoin are crashing, and it looks like 2025 will be a very red year! From a bitcoin cycle's perspective, bitcoin has entered a bear market. Let's look at the latest technical analysis on the 6H chart. Bitcoin hit a new all-time high on January 20, exactly the same day as Trump's first day in office. Thereafter, Bitcoin has been crashing.

Currently, the price prints a bearish flag on the 1H chart and a descending channel on the 6H chart. As long as Bitcoin is inside this descending channel, we have to stay bearish and trade with the trend until the end. This bear flag is also a problem because you would rather not see such patterns in a bull market in general. My next target is 72k, from here we could expect a bounce. Why 72k? Because it's the Fibonacci retracement of the previous major wave from 49k to 110k.

Write a comment with your altcoin + hit the like button, and I will make an analysis for you in response. Trading is not hard if you have a good coach! This is not a trade setup, as there is no stop-loss or profit target. I share my trades privately. Thank you, and I wish you successful trades!

US100 BEARISH FLAG|SHORT|

✅US100 is trading in a

Strong downtrend and

The price has formed a

Bearish flag pattern so

And on top of that the

Horizontal resistance

Of 20,000 is ahead so

We are super bearish

Biased and IF we see a

Bearish breakout we

Will be expecting

A further move down

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURGBP Bearish Continuation Setup Potential Drop to Key Support📌 Overview:

The EUR/GBP pair is showing signs of bearish continuation after failing to break above key resistance levels. Price action indicates a potential downward move towards a major support zone, aligning with the overall market structure.

🔎 Technical Analysis:

The pair has formed a lower high, indicating weakness in bullish momentum.

A breakdown from the recent consolidation zone suggests sellers are in control.

Price has breached a key support level, turning it into a resistance zone.

The market structure indicates a potential drop towards 0.82773, which aligns with a previous support area.

📊 Key Price Levels:

✔ Resistance: 0.84000 - 0.84200 (previous support turned resistance)

✔ Current Price: 0.83876

✔ Target: 0.82773 (major support and liquidity zone)

✔ Stop Loss: Above 0.84000, invalidating the bearish setup

📉 Trade Plan & Execution:

🔹 Entry Strategy:

Traders can look for a retest of broken support (now resistance) near 0.84000 to confirm selling pressure.

A bearish rejection candle (such as a shooting star, bearish engulfing, or pin bar) could confirm the continuation of the downward trend.

🔹 Profit Target:

The primary target is 0.82773, which acts as a strong demand zone from previous price action.

🔹 Risk Management:

A stop loss should be placed above 0.84000, as a break above this level would invalidate the bearish setup.

Maintaining a favorable risk-to-reward ratio (1:2 or better) is advisable for optimal trade execution.

📢 Market Outlook & Considerations:

✅ Bearish Confirmation: Sustained rejection from resistance and lower highs strengthen the bearish outlook towards 0.82773.

🚨 Bullish Reversal Risk: A break above 0.84000 could invalidate the setup, signaling a potential return to bullish momentum.

📊 Fundamental Factors: Keep an eye on GBP and EUR-related economic data, central bank policies, and risk sentiment, which could impact price movements.

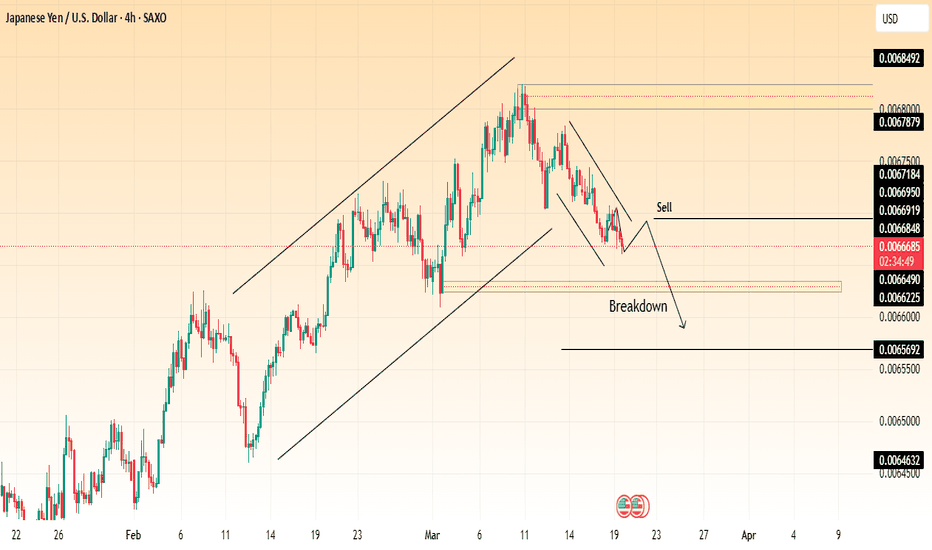

USD/JPY Bearish Continuation📉 Trend Analysis:

The chart shows a breakdown from an ascending channel, indicating a potential bearish reversal after an extended uptrend.

Price has formed a descending channel, reinforcing the short-term bearish structure.

🔍 Key Levels:

Sell Zone: Around 0.0066848 - 0.0066919, acting as resistance.

First Target: Around 0.006490, a strong support area.

Second Target: Around 0.0065692, marking a deeper level of bearish continuation.

Final Target: Around 0.0064632, a critical demand zone.

📌 Trade Plan:

Look for sell entries on a possible pullback to the resistance zone.

Confirmation through rejection candles or continuation patterns could strengthen the bearish case.

⚠ Risk Management:

Stop loss above the previous resistance around 0.0067184.

Take profits gradually at key support zones.

Ascending Triangle pattern for Zcash or Hidden Bear Flag!!!??!?!It appears as though Zcash is forming an ascending triangle pattern, but often this can be confused with a bear flag depending on the Macro Trend of the asset.

The rsi is in a great place for the price to pump.

We have seen the price of Zcash touch the upward sloping support of the pattern over half a dozen times, this is the first time the price have dipped below the upward sloping support.

The price is going to need to rebound immediately if we're going to see a continuation of the pattern.

EURAUD complex structure, high chance for bearish push and break

OANDA:EURAUD analysis, complex structure which i love to see, price is break trend lines, its in ASCENDING CHANNEL, bouncing and on line of BEARISH FLAG pattern, currently moving in zone, AUD with many having strong bullish expectations for next periods.

Here having strong bearish expectations after long time of bullish push.

SUP zone: 1.67200

RES zone: 1.64900, 1.64200, 1.63200

Bear Flag or Bullish Flag for ZcashZcash appears to be consolidating into a bearish flag or a bull flag after breaking to the upside of an ascending triangle.

The horizontal resistance of the macro ascending triangle has turned into the baseline support of a micro bear flag or bull flag.

The RSI is very low on a 1 year chart.

Zcash has made over half a dozen higher lows until recently we have seen a neutral low coinciding with the previous.

The williams alligator has turned downward which is bearish.