Bearish Shark Pattern with a Massive Profit FactorThis is how trading should be done . I've just spotted a Bearish Shark Pattern on the Weekly Chart and while it's not perfect, it's still a great trade worth keeping on the radar. The market has been hovering around the entry price for weeks, which tells me something is brewing.

The Smart Approach:

Now, I’m not entering based on the Weekly Chart alone , that would require a stop-loss that’s way too wide. Instead, I look for an execution timeframe within three levels down. That means the lowest timeframe I’d engage from this setup is the 4-hourly chart .

But here’s the twist...

The Trade Setup:

I spotted another Bearish Shark Pattern on the 15-minute chart.

What did I do?

> I traded what I saw. Simple as that.

It’s not always about having the "perfect" timeframe. It’s about:

Seeing a valid setup

Knowing your structure

And having a clear trade management plan.

Key Rule:

Once the market reaches a certain level, I’ll shift my stop to entry, securing a risk-free trade. That’s always the goal.

Golden Rule in Trading: “Don’t lose your capital.”

The Reward:

If this trade hits my final target, I’ll walk away with a Profit Factor of 27.45 .

That means for every dollar I risk, the projected return is $27.45. Let that sink in.

So now the question is - how much of your equity would you be risking on a trade like this? Would you go big, or stick to your usual risk percentage?

Let me know in the comments, how would you manage this kind of high-reward setup?

Stay sharp and happy trading, everyone! 🚀

Bearish Shark

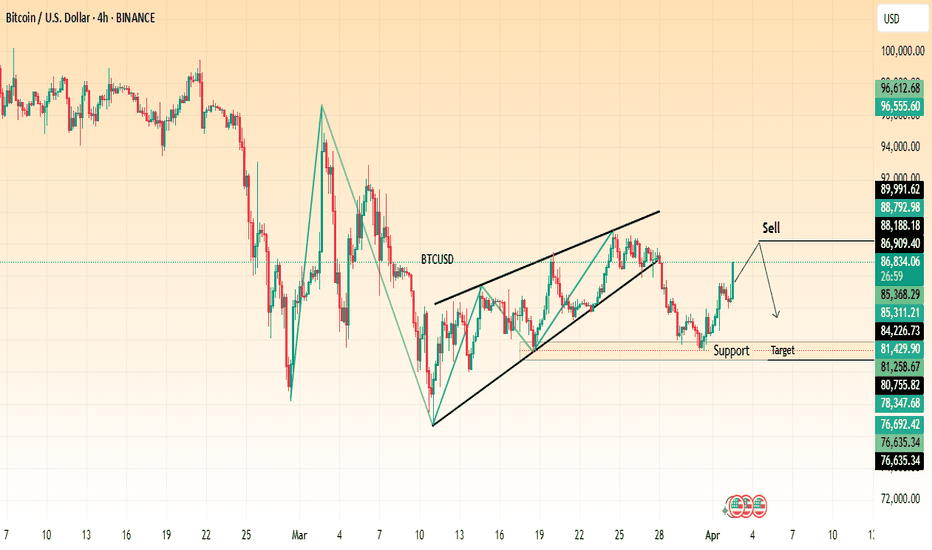

Bitcoin (BTC/USD) Reversal? Rising Wedge Breakdown Signals Sell! The chart suggests a potential bearish move after a rising wedge pattern breakdown.

Key Observations:

Rising Wedge Breakdown:

BTC formed a rising wedge, which is a bearish reversal pattern.

The price has broken down from this wedge, indicating a potential downtrend.

Support and Resistance Levels:

Resistance Zone: Around $88,188 – $88,792, marked as a key level where selling pressure may increase.

Support Zone: Around $85,368 – $84,226, where buyers may step in.

Target: $81,429 – $81,258, a strong support level where price could drop.

Bearish Setup:

The chart suggests a sell opportunity near resistance, expecting a downward move toward the target zone.

Trading Idea:

Entry: Sell near $88,000 after confirmation.

Target: $81,429 – $81,258 (support zone).

Stop-Loss: Above $89,991 (resistance zone).

This setup suggests Bitcoin could decline further, making it a potential short trade opportunity. However, traders should watch for confirmation and overall market sentiment before executing trades.

GBP/USD Breakdown – Bearish Momentum Ahead?This 4-hour chart of GBP/USD shows a clear bearish setup:

🔹 Rising Wedge Breakdown – The pair has broken below a rising wedge pattern, signaling potential downside pressure.

🔹 Support and Resistance Levels –

Resistance at 1.29206 - 1.30275

Support at 1.28000 - 1.28437

Strong support at 1.27539

🔹 Sell Confirmation – A sell signal is indicated, suggesting further downside movement towards the target zone.

📉 Trading Plan:

✅ Possible short entries below the 1.28956 level.

✅ Target price: 1.27539

✅ Stop-loss above 1.29206 for risk management.

⚠️ Risk Note: Always manage risk properly and watch for any trend reversals before entering trades.

What are your thoughts? Are you bearish or bullish on GBP/USD? 🤔💬

USD/JPY 4H Analysis – Potential Bearish RetestThe USD/JPY pair has been in a clear downtrend, trading within a descending channel for an extended period. Recently, price action has broken above the channel, but it is now facing resistance around the 150.35 level.

Retest Zone: The pair is currently retesting the broken trendline, and if it fails to sustain above this level, a rejection could lead to further downside.

Bearish Expectation: If the price fails to reclaim 150.35, a move towards the 147.00 support zone is likely.

Confirmation: A strong bearish candle from this level could indicate a reversal, confirming the downward move.

Traders should watch for price action signals at the retest level before making decisions.

This is a 4-hour chart of Bitcoin (BTC/USD)This is a 4-hour chart of Bitcoin (BTC/USD) showing a key resistance level around $86,527 and a potential bearish move towards lower support zones.

Analysis:

Price is currently trading near the resistance zone, struggling to break above it.

A sell setup is suggested, expecting rejection from resistance.

The first target is around $78,500, with an extended downside target at $75,869 and possibly $71,580 if momentum continues.

A stop-loss level is placed above resistance at $86,527, indicating a risk management strategy.

The overall structure suggests bearish sentiment unless price breaks above resistance.

Potential Trading Plan:

📉 Bearish Scenario:

Short below resistance confirmation.

Targets at $78,500, $75,869, and $71,580.

Stop-loss above $86,527.

📈 Bullish Scenario:

A break and close above $86,527 could invalidate the bearish setup.

HARROW 16% INTRADAY DROP CAUGHT!Technical Analysis: HARROW (15-Minute Timeframe)

This chart demonstrates a highly profitable short trade executed with precision using the Risological Indicator. A stellar 16% profit was captured in this intraday trade, showcasing the power of momentum trading.

Trade Details

Stock: HARROW

Timeframe : 15-Minute

Entry Price : $52

Exit Price : $43

Profit : $9 per share (16% intraday return)

Key Technical Observations

Perfect Entry Point:

The entry at $52 aligns with the beginning of a sharp bearish breakout, as identified by the Risological Indicator. The indicator’s red resistance bands provided clear confirmation of a strong downward trend.

Momentum Confirmation:

A steep decline immediately followed the entry, with heavy bearish candles confirming the strength of sellers in the market.

The gap and acceleration downwards signify a likely reaction to negative news or market-wide pressure.

Dynamic Resistance:

The price consistently respected the downward-sloping resistance bands, highlighting the dominance of sellers and a clear absence of bullish recovery attempts.

Exit at $43:

The exit near the $43 level demonstrates disciplined profit-taking, as the stock begins to consolidate and show signs of slowing bearish momentum.

Analysis of Results

This short trade captured the entirety of a massive 16% intraday move, leveraging the indicator’s precise trend-following signals. The sharp entry and timely exit reflect the strength of the Risological Indicator in identifying and capitalizing on market momentum.

Key Takeaways

Trend Confirmation is Critical: The trade capitalized on the established bearish trend, ensuring high probability of success.

Indicator Precision: The Risological Indicator’s dynamic resistance bands provided clear visual cues for both entry and exit, removing guesswork.

Risk Management: By exiting as momentum slowed, the trader avoided potential losses from a reversal or consolidation phase.

This trade underscores the importance of using robust tools like the Risological Indicator to stay ahead in volatile markets, transforming short-term opportunities into substantial profits.

BLUEDART SHORT CAUGHT!Today was a one side, short market!

I always believe in following the money - the smart money!

Coupled with the options Weekly contracts termination like BANKNIFTY, MIDCPNIFTY, FINNIFTY, etc, we are going to see more sell off in this week, as per my observation.

Dont go LONG in the market blindly tomorrow ( 14, Nov, 2024).

Good luck and Namaste!

DXY (US Dollar Index) Analysis Daily TimeframeDXY is currently sitting at a daily resistance level after a bullish run since last week.

we anticipate a potential move to the downside as the index shows signs of weakening, by creating a Doji candlestick, which indicates market indecision.

Remember: If the US Dollar Index turns bearish, EUR/USD and GBP/USD are likely to show bullish momentum.

Let's take a closer look at these pairs for potential buy setups.

EURUSD sellEur vs Us dollar we expecting a pull back to Daily Resistance trendline and as we are putting our idea EUR vs US dollar having a bull run over to its trendline we are expecting a rejection from there and a Drop to its Support under lying Suppot level remember its a Bearish trend and following its technical data

XAU/USD Poised for Potential Gains Amid Market UncertaintyFor today, the technical outlook for XAU/USD (gold vs. USD) indicates a possible upward movement, with gold continuing its bullish trend due to various macroeconomic factors. Analysts suggest that if gold remains above key support levels, there could be further gains. Some expect it to test resistance around $2685, while if prices fall below $2668, a short-term decline to $2635 may follow

This is influenced by ongoing geopolitical risks and market speculation on future Federal Reserve policy, which tends to drive safe-haven assets like gold higher

Bitcoin 20k

**Bitcoin Shark**

(Tune: Baby Shark)

Bitcoin, doo doo doo doo doo doo

Bitcoin, doo doo doo doo doo doo

Bitcoin, doo doo doo doo doo doo

Bitcoin Shark!

Buy the dip, doo doo doo doo doo doo

Buy the dip, doo doo doo doo doo doo

Buy the dip, doo doo doo doo doo doo

Bitcoin Shark!

To the moon, doo doo doo doo doo doo

To the moon, doo doo doo doo doo doo

To the moon, doo doo doo doo doo doo

Bitcoin Shark!

HODL strong, doo doo doo doo doo doo

HODL strong, doo doo doo doo doo doo

HODL strong, doo doo doo doo doo doo

Bitcoin Shark!

Decentralized, doo doo doo doo doo doo

Decentralized, doo doo doo doo doo doo

Decentralized, doo doo doo doo doo doo

Bitcoin Shark!

Major Top Forming on SPXHello Everyone, a simple analysis of the RSI and current price action appear eerily similar to the 2022 peak. During the 2022 top we had financial experts and the media claiming victory stating that this bull market will continue, however we crashed soon after. Now the SPX is currently forming a topping process, this could be done or we could go a little higher before the bear market continues. It's clear that the SPX is making new highs while NDX and IWM fail to make a new high suggesting that this is the top.

If this economy is doing so good, then why does the FED need to cut interest rates? The fed is cutting interest rates because we are either in a recession or we are very close to one. There is no such thing as a soft landing. The truth is we may already be in a recession and it wouldn't be declared until we are deep into one.

If anything we are no longer going into a recession, we are going into a depression. Do not get lulled into a false sense of security like many others during the 2000 and 2008 top.

Second Chance Shorting Opportunity on EURUSDIf you’re looking for a second chance to short EURUSD, there’s a promising setup involving a Type 2 Bearish Shark Pattern with RSI Divergence. Let’s break it down.

Current Overview:

- Type 2 Bearish Shark Pattern:

- What It Means: The first target has already been achieved. This provides clarity on the first target but might reduce participation since the initial group of traders who profited may not re-engage.

- RSI Divergence:

- Signal: This divergence adds another layer of confirmation, especially for traders who rely on resistance and RSI divergence as their entry signals.

Strategy:

- Second Chance Entry: This setup offers a second opportunity to short EURUSD, with the RSI divergence potentially attracting a new wave of traders.

- Profit Factor: The strong profit factor in this trade is what drew me in, despite the potential for reduced participation from the initial group of sellers.

Final Thoughts:

While there might be fewer sellers this time around, the RSI divergence could bring in new participants, making this a solid second chance trade. Always keep an eye on your signals and manage your risk effectively.

What’s your take on this setup? Are you planning to jump in, or do you see other opportunities? Share your thoughts and strategies below!

Happy trading, everyone! 🚀

Second Attempt at Shorting NZDUSDI’m back at it with a second attempt to short NZDUSD, and here’s why this setup caught my attention.

Current Overview:

- 4-Hourly Chart:

i) Rising Channel: The pair is moving within a rising channel.

ii) RSI Divergence: This divergence signals a potential weakening of the uptrend, which adds confidence to the short setup.

Shorting Opportunity:

- 1-Hourly Chart:

i) Type 2 Bearish Shark Pattern: This pattern gave me a solid entry at 0.6029.

Strategy:

- 1st Target:

i) Extended to: 0.5992

ii) Why: The market reversed beyond the original 1st target, allowing me to extend it for better profit potential.

- 2nd Target: Keeping it open to adjust based on how the market moves.

Final Thoughts:

This setup combines a classic RSI divergence with a well-defined Bearish Shark Pattern, making it a compelling opportunity for a second short attempt. If you’re considering a similar trade, keep an eye on the targets and be ready to adapt as the market unfolds.

What’s your take on this setup? Have you noticed similar patterns in your trading? Share your thoughts and strategies below!

Happy trading, everyone! 🚀

Trading Idea: Bearish Shark Setup on NZDUSDI wanted to share an interesting setup on NZDUSD that’s been forming for a while. Let’s dive into the details!

Current Overview:

Bearish Shark Setup:

Potential Reversal Zone (PRZ) : The setup has been hovering at the PRZ, which some traders might misinterpret as a violation.

Key Insights:

Having the Right Knowledge Matters : From my 19 years of trading and nearly 16 years of coaching, I’ve seen even experienced traders make mistakes in reading signals like this. It’s not uncommon for traders with 8 years of experience to misjudge such setups.

Strategy:

Second Chance Entry:

Key Level : 0.5935

What to Do: If you missed the initial signal, wait for the market to retest 0.5935 for a second chance entry opportunity.

Community Alert:

This Trade Alert was triggered at 14:00(SGT)

Final Thoughts:

Patience and proper signal interpretation are crucial in trading. If you’re looking for a second chance, keep an eye on 0.5935. Don’t hesitate to reach out if you need more insights or if you missed this trade.

What’s your take on this setup? Have you seen similar patterns before? Share your thoughts and strategies below!

Happy trading, everyone!

Potential BOJ Intervention and Technical Setups on USDJPYIf you haven't heard the latest news, Japan's Finance Minister and the BOJ have differing views on the intervention of the Japanese Yen. The Finance Minister believes that FX intervention didn't work, while the BOJ has stated they are prepared to intervene at any time and could catch the market by surprise.

Having traded for 18 years, I'm quite familiar with what a market intervention looks like. If you believe the BOJ will intervene, then there are some interesting technical setups to consider.

Analysis:

1-Hourly Chart:

- Potential Head and Shoulders Formation: This pattern could signal a bearish reversal.

15-Minutes Chart:

- Bearish Shark Pattern Checkback: This setup allows us to capture similar targets with lower initial risk.

Strategy:

1. Head and Shoulders Formation:

- Monitor for Pattern Completion: Watch for the right shoulder formation and neckline break.

- Entry: On confirmation of the neckline break.

- Stop-Loss: Above the right shoulder.

- Target: Based on the height of the pattern projected downwards.

2. Bearish Shark Pattern Checkback:

- 15-Minutes Timeframe:

- Entry: Look for entry on the checkback of the Bearish Shark Pattern.

- Stop-Loss: Above the high of the checkback.

- Target: Aligns with the target from the head and shoulders pattern on the 1-hourly chart, allowing for a lower initial risk.

Key Points:

- BOJ Intervention: The potential for surprise intervention by the BOJ adds a fundamental catalyst to these technical setups.

- Risk Management: Ensure proper stop-loss placement to manage risk effectively.

- Confirmation: Always wait for confirmation of the patterns before entering trades.

What’s your take on USDJPY and the potential for BOJ intervention?

Do you see any additional opportunities or setups?

Share your thoughts and strategies below!

Trading Idea: Shorting GBPJPY Amid Conflicting Signals from JapaThe recent statement from Japan's Finance Minister about possibly giving up FX intervention due to its ineffectiveness, which seems to suggest acceptance of the yen's continuous weakness, directly conflicts with recent BOJ communications.

Considering this, shorting GBPJPY becomes a highly volatile decision. Nonetheless, a trade is a trade. If this trade goes well, profits are expected within 2 hours. If not, that's part of the game.

Trade Setup:

Short GBPJPY

Entry : 202.97

Stop-Loss : 203.21

Target 1 : 202.60

Target 2 : Open

Strategy:

- Volatility Consideration : Acknowledge the high volatility due to conflicting statements from Japan’s Finance Minister and BOJ.

- Risk Management : Set stop-loss at 203.21 to manage potential losses.

Profit Targets :

Target 1 : 202.60

Target 2 : Keep open

Remember to breathe and prepare for the next trade. What’s your take on this situation? Do you see a different angle or strategy? Share your thoughts and insights below!

Trading Idea: Classic Support and Resistance vs. Harmonic PatterSometimes, the classic Support and Resistance trade is more effective than Harmonic Patterns. It may seem simple, but trust me, it isn't. First, you have to plot it the right way, and even then, different analyses will view the trend differently.

For example, I’ve recently got into shorting USDCAD.

Key Points:

- Support and Resistance: Often more reliable than Harmonic Patterns if plotted correctly.

- Different Perspectives: Proper plotting can lead to varied interpretations of the trend.

- Current Trade: Shorting USDCAD based on my analysis.

Strategy:

- Plan Your Trade: Always plan your trade meticulously and do not follow anyone blindly.

My Entries:

Shorted USDCAD: 1.3692(13)

ISL: 1.3740(-48)

TP1: 1.3666(+26)0.54

TP2: 1.3640(52)1.08

Remember, effective trading requires careful analysis and a well-thought-out strategy. What’s your take on the effectiveness of Support and Resistance trades compared to Harmonic Patterns? Share your thoughts and strategies in the comments!

NZDJPY Trend Reversal OpportunityOn the 1-hourly chart, it looks like a regular shorting opportunity with Key Resistance Level retested at the almost perfect, but potential BOJ Intervention zone, so for traders of all kind to ''try their luck!!''

However, on the Grand Scale of things, and it is a Type2 Bearish Shark Pattern on the Daily Chart.

After I'd include the buffer, I the market hit Price Action Level at 94.00, hence, I'd to push my SL 10pips away, but making it 94.10.

Let see how the market moves before the New York Session ''opens''

Bitcoin (BTC) Price Analysis: Preparing for the Bearish AbyssIn this technical forecast, we delve into the darker recesses of Bitcoin's potential price journey. We observe a concerning configuration on the BTCUSD chart where the currency is currently grappling with critical support levels.

Current Dynamics:

The price has recently retracted from a peak, teasing the possibility of a significant downtrend.

A descending channel formation can be seen, indicating a tightening bearish grip on the market momentum.

Worst Case Trajectory:

Should the price break below the sturdy support zone, indicated by the green rectangle, we may see an accelerated drop.

The price could tumble toward the lower boundary of the channel, a line that has historically acted as a gravitational pull during bearish trends.

Key Levels to Watch:

Immediate support resides within the green rectangle zone. If this fails, the descent could be sharp and unforgiving.

Further support is hypothesized by the extended yellow trend lines, outlining a worst case range that could spell distress for bulls.

Projected Pathways:

The worst case scenario envisions a stark descent, followed by a period of consolidation below the current support.

A relief rally might attempt to reclaim lost ground, but the overarching trajectory remains bleak in this hypothesis.

Conclusion:

While we must tread with caution, preparing for a bearish eventuality is prudent. Investors and traders should brace for volatility and consider the historical behavior of the market during similar patterns. Vigilance is key as we watch for potential support breaches that could confirm this grim forecast.

Counter-Trend for Greater ProfitsThis week, I'm looking at NZDJPY with a bearish perspective, and here's my trade plan:

1. Bearish Shark Pattern Confirmation at 91.74: I'll be patiently waiting for the Bearish Shark Pattern to confirm at the level of 91.74. This level coincides with the formation of a Head & Shoulders pattern, adding confluence to the bearish setup.

2. Extended Trading Targets: If the Bearish Shark Pattern sets up as anticipated, I'll extend my trading targets beyond the traditional Target1 and Target2. By doing so, I aim to capitalize on the potential bearish momentum and maximize profits from the trade.

3. Stop Loss Management: Once the market reaches the traditional Target1 of the Shark Pattern, I'll shift my stops to the entry level to protect profits and minimize risk.

By patiently waiting for the bearish setup to confirm and managing stops effectively, I aim to capitalize on the shorting opportunity presented by NZDJPY this week.

What are your thoughts on NZDJPY? Feel free to share your trade plans and insights below!

Wishing everyone successful trading ahead!