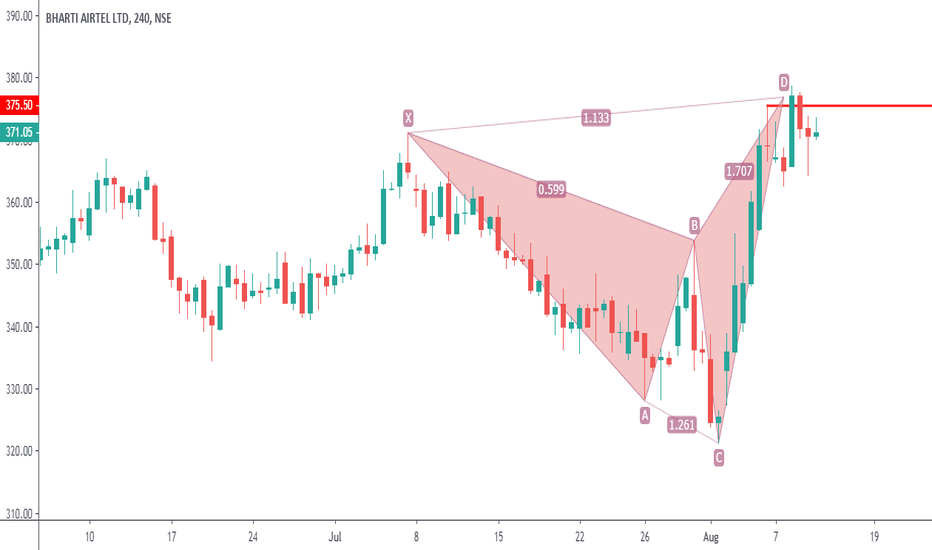

Bearish Shark

Trade Ideas Educator: EURJPY SharkOh wow if you have missed the bullish bat trading opportunity on the weekly chart, there's potentially another opportunity, a 5-0 pattern can set you up for a buying opportunity.

Do you know how to spot that though?

I've engaged a trend trading opportunity as the market has set up for a shorting opportunity, a bearish shark on the 4-hourly chart(left).

Let's see how this trade roll out.

Trade Ideas Educator: NZDUSD SharkBearish Shark setup at the extreme, I've already shorted the market is because of 3 reasons.

1) RSI Divergence on this setup

2) My Harmonic Pattern Assistance Software spotted this and deem this as valid.

3) Sell Arrow in my system showed up

4) A Pin Bar/ Long shadow candle shows up with a bearish engulfing candle

5) A perfect Rewards: Risk even when the market only touches 1st Target.

Trade Ideas Educator : AUDCAD SharkA bearish shark setup that I deliberately didn't take the trade because on last Wednesday 4Sep19 there is a Canada Rate decision marked by the red eclipse. Such an event can swing the trade both way and I'm not going to gamble again.

Heard of that phrase, there's always another chance, so here it goes, 2nd chance entry I didn't take again as its Friday and market are about to close. Will wait for either market open, observe the movement before engaging the trade or to wait for the retracement to happen.

GBPUSD-Weekly Market Analysis-Sep19,Wk2A bearish shark looking to complete at 1.2528 on the 4-hourly chart as a trend trading opportunity and within the sell zone, I would say is a pretty good trading idea.

Looking at the 1-hourly chart, there is a buy-zone and the width of the buy zone is a good 80pips movement(don't judge the pips potential by the chart, chart are fit to screen).

My trade plan is simple, within the buy zone on the 1-hourly look for a buying opportunity of cause with my trading rules for a long opportunity, 1st target will be recent high closing price candle and extended target will be at the 4-hourly chart entry price.

What's your plan?

Trade Ideas Educator: AUDCAD SharkA bearish shark on the 1-hourly chart will be the 1st level of resistance for a shorting opportunity.

On the 4-hourly chart a bearish bat setup for another trend trading opportunity. Let's see how the market reverse and head towards the trading opportunity.

If all do well, the bearish shark should hit by Wednesday this week.

Weekly Market Analysis: EURUSDA full streak of a bearish trend on the daily chart, 4-hourly chart, and 1-hourly chart on EURUSD.

A likelihood of a bearish run after a potential retracement from the current price or a wait of double bottom when the market retest on the purple line would be joyous to countertrend trader.

Most likely I'll be waiting for a double bottom to head in the trade by my countertrend trading nature than to shift stops to entry when market approach the next resistance level and prepare for a longer-term shorting opportunity.

Trade Ideas Educator: GBPJPY PennantAt this moment GBPJPY is at the sell zone, having that said on the 1-hourly chart(left) the market has breakout towards the upside of the consolidation pattern, the pennant which happens to be 1 of my favorite setup.

If the market breakout to the upside where is it most likely to go? The tip of the sell zone and the bearish shark entry price.

What's your trade plan on this? Comment down below.

Personally, I'm going to wait for a retracement on the 1-hourly chart(left) back into the buy zone and with for RSI Divergence for a long opportunity.

Trade Ideas Educator - AUDCAD SharkA bearish shark forms on the 1-hourly chart(left) with parallel uptrend channel indeed is not the happiest market movement when you are in the trade. What's great about this is it accompany with RSI Divergence which says otherwise on the market movement.

Right now, if you have not engaged the trade you can wait for the retracement back into the sell zone on the 1-hourly chart to find your 2nd entry opportunity, that being said you have to be in before 5-0 pattern is formed. Most importantly, you should have followed my post closely so you won't miss this fantastic trading opportunity ever again.

On the 4-hourly chart(right) a further uptrend extension the market may meet the bearish bat setup, another trend trading opportunity.

EURUSD-Weekly Market Analysis-Aug19,Wk4A bearish shark trading opportunity on the daily chart(right) as a trend trading setup. If you are not looking at the shark pattern, you can check on the lower timeframe, the 4-hourly chart(left).

The red box sell zone is the same sell zone you are looking at on the daily chart(right), you can definitely look for a retracement into the sell zone or wait for a harmonic patterns setup.

Trade Ideas Position: AUDCAD SharkA bearish shark setup as a trend trading opportunity. Shark pattern is 1 of the most tricky harmonic patterns as there is a possibility of up to 3 different entry zone and by having that you have to have your Fibonacci right.

The next few candles will determine if the setup is valid.

GBPUSD-Weekly Market Analysis-Jul19,Wk4Bullish Shark Pattern complete as a counter-trend trade. A trade that on the day of engagement produced a 114pips of profits has now slid to 70pips of profit without risk at the moment.

On the 4-hourly chart(left) has a selling opportunity form at 1.2739 as a bearish shark pattern. A potential price to see retracement at the level but with that, it does pose a buying opportunity too.

Do you know why so? Comment down below.

Trade Ideas Position: NZDUSD SharkPotential Reversal Zone (PRZ){Red Box} came in important for this trade setup, as the last candle shows a strong candle at this moment.

I will observe if the next candle creates a new high and close above the high of this current candle, if so, trade invalid.

When the next 1-2 candle breaks below and close below the PRZ(red box), I will engage for the short opportunity.

Trade Ideas Educator: NZDUSD SharkA bearish shark setup within the double sell zone gave a great trading opportunity to short this pair. An RSI Divergence has shown, it is possible such setup either gave a great trading opportunity or a potential miss trade as the market may not touch point D.

Let's see how this setup unfold when market opens on Monday.

GBPUSD-Weekly Market Analysis-Jul19,Wk3Daily Chart(right) pose a bullish shark formation as a counter-trend trade To a nearer short-term(left) it does have a head and shoulders setup that present a counter-trend trade and I'm taking as a counter-trend trading approach and I'm going to shift stops to entry when market opens.